The Weekend Edition includes a market update up to the end of trading for the week, and Morningstar adds two stock picking highlights.

***

Anthony Albanese experienced a dream first fortnight as Prime Minister, joking with President Joe Biden in Tokyo, appointing a record number of women to the new Cabinet, gaining a hard-to-elect Leader of the Opposition and even watching South Sydney win from the stands alongside his partner, Jodie Haydon. But he is realistic enough to know that the fun run will not continue, and an early threat is energy.

On the east coast, wholesale energy costs have spiked 600% in a few months, and both businesses and households face large increases in gas and utility costs. The default retail energy prices come into effect from 1 July, rising by up to 18.3% in NSW, 12.6% in south-east Queensland and 9.5% in South Australia. With wages lagging inflation and interest rates increasing, we should expect belt tightening across the economy.

The new Resources Minister is Madeleine King, and one of her first acts was to support WA’s $16.5 billion Scarborough gas project. She said gas has an “important role in the transition to a decarbonised world”. The Government will not support a ban on fossil fuel projects. The energy crisis is intertwined with the climate change debate, including doubts whether new sources such as renewables can be switched on quickly enough to allow an early closure of fossil-fired generators. Mike Cannon-Brookes' successful prevention of the separation of the power assets at AGL is a long-term project, although there is no doubting his tenacity and optimism (he attached a picture of a path through a forest to the following tweet).

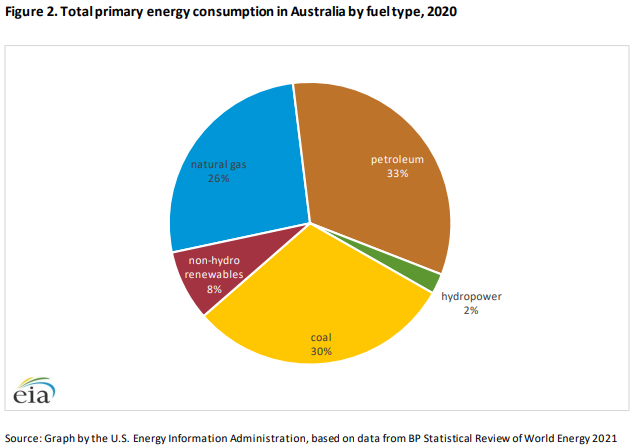

There are conflicting reports on how much of Australia's energy consumption comes from renewables, with some data placing it at about 10%, as shown below. Other sources have it higher, but either way, fossil fuels still dominate.

Although the election result was a clear sign of a rising climate change focus by Australians overall, amid the best ever result for The Greens, the Party's leader, Adam Bandt, issued a qualification:

"We need to get out of coal and gas but do it fairly."

This tempering of the message is important, emphasising the so-called transition. Debby Blakely, Chief Executive of industry super fund, HESTA, a major investor in AGL, said:

"Shareholders are increasingly expecting companies to do more to drive a timely, just and orderly transition to a low carbon future."

Words such as 'fair' and 'just' must be part of the discussion. Fund managers need to allow time for this adjustment, including acknowledging the impact on poorer people and nations. At Firstlinks, articles from fund managers on ESG and divesting from fossil fuels come in every week, and banks now eschew loans to fossil fuel companies. When confronted by a young activist at the recent AFR Banking Summit, NAB CEO, Ross McEwan said his bank no longer finances new coal, oil or gas projects. Some fund managers, such as Blackstone (the world's largest alternative assets manager) have advised clients they will not invest in the exploration and production of oil and gas.

With this background, it is welcome when a leading fund manager, GQG's Rajiv Jain, takes an opposing view, to balance the debate. GQG has not only reweighted portfolios to 'energy' due to favourable valuations, but Jain calls the lack of funding for fossil fuel industries "immoral". It's a view that might upset some people but we need to review both sides during this transition which, in reality, will take decades.

Our interview this week is with Reece Birtles, CIO at Martin Currie Australia. He explains his approach to generating income from shares for retirees, reducing the focus on price volatility and more on the reliability of dividends. It's also notable that Birtles is a major investor in AGL, and his view against the demerger is:

"It will be a stronger company in 10 years' time being a combined business. The significant investment required in renewables is best supported by the customer base and the ability to deliver a more reliable and sustainable energy supply."

And while my employer, Morningstar, takes a strong view on the ESG policies of funds and companies in its ratings, including owning the Sustainalytics business, there is obviously a range of opinions. The Head of Equity Research, Peter Warnes, cautions that we cannot move too quickly, quoting Jeff Currie, the Global Head of Commodities Research at Goldman Sachs, who describes decarbonisation as “replacing the fuels that we use for the way we do manufacturing, the way we create transportation, and the way we heat and cool ourselves for 250 years.” Peter asks:

“How do poor countries, whose energy generation is based on fossil fuels, fund the transition? A successful transition to zero emissions will take decades, not years. Fossil fuels are part of the transition process and will be required to generate reliable and sustainable base load power also for decades.”

The second major challenge facing the new Albanese Government, especially Treasurer Jim Chalmers and Finance Minister Katy Gallagher, is how to rein in the budget deficit. There are tensions everywhere, from rising interest rates increasing the cost of $1 trillion of debt, greater defence spending and the rapidly rising costs of health, aged care, child care and disability services. It will be extremely difficult, if not politically impossible, to walk away from the legislated tax cuts due to start on 1 July 2024, but they will cost a whopping $137 billion by 2030. The application of a flat 30% tax rate for income earners between $45,000 and $200,000 will put up to $9,000 in the pockets of high income earners. At the same time, the Reserve Bank is trying to slow the economy and inflation. Dare Chalmers renege on a policy promise when many (most?) recipients probably feel the tax cut is no longer inappropriate for the times?

And a quick comment on Albo. Anyone tweeting and hoping to link to him using the tag @Albo better know it belongs to an Italian adult comic artist and our own Albo can be reached on @AlboMP.

Also find time to read these articles in our packed edition ...

Supporting the arguments made by Reece Birtles, David Walsh explains why Value stocks have regained some of the ground gained by Growth stocks over 2020 and 2021, including some revealing charts.

Last week's article on democracy received about 50 comments and many opined on the merit or otherwise of the preferential voting system. Actuary Tony Dillion has looked at the numbers from the election and gives a fascinating explanation of the impact of our voting system on the result. What seems like a simple design feature actually determines who forms government.

Jeremy Cooper is also in a number-checking mood. Who knew 700 people in Australia retire every day? That's a lot of superannuation, but Jeremy says many are missing a smarter way to hold their retirement savings.

Then following a deep read of the messages from the world's most powerful central bank, the US Federal Reserve, Rudi Filapek-Vandyck says the popular mantra, 'Don't Fight the Fed' now has a completely different meaning which investors need to understand.

Finally, Jason Hsu, who as well as his role as a portfolio manager, has held visiting professorships at many Asian universities, gives a quick snapshot of three Investing 101 lessons he feels are often missed. His main message: if everyone knows it, it's already in the price.

This week's White Paper from Vanguard is an update on the numbers and rationale for index investing. While Vanguard is clearly an advocate of passive, it is also a major active manager, so it's not a one-way street.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Mark LaMonica.

Morningstar analysts weigh in on the AGL news. Lewis Jackson writes that the demerger was a way for the energy company to keep its lenders onside. Assets sales or dividend cuts may now be required. Nicola Chand says the economic reopening and exit of rivals leaves analysts hopeful about the future of Mirvac.

Graham Hand

Weekend market update

From AAP Netdesk: The benchmark S&P/ASX200 index closed Friday up 63 points to 7,238.8, a gain of 0.9%. For the week the ASX200 was up 56 points, or 0.8%. It was the market's third week of gains. Every sector was up on Friday except for telecommunications, which was flat, and consumer discretionary shares, which dipped slightly.

Materials was the biggest gainer, up 2.6% with BHP rising 2.5% to $46.76, Rio Tinto up 2.7% to $116.03, and Fortescue gaining 4.1% to $21.46. In the energy sector, Beach Energy and Whitehaven Coal both hit 52-week highs, up 2.5% and 3.2% respectively. Geelong refinery owner Viva Energy rose 2.8% to hit a fresh all-time high. Tech companies were also up on Friday, with Wisetech Global up 5.1% to $42.94 and Altium up 3.9% to $28.89. Lithium miners Pilbara and Alkeem rebounded, rising 7.5% and 3.8%, but both are down around 15 per cent for the week on fears the battery metals boom is over.

The Australian dollar hit a one-month high, buying 72.56 US cents, from 71.84 US cents at Thursday's close.

From Shane Oliver, AMP Capital: Share markets were mixed over the last week. Strong US payrolls for May weighed on US and Eurozone shares on Friday on expectations that they will keep the Fed rate hikes aggressive and this saw US shares down 1.2% for the week and Eurozone shares down 0.8%. By contrast Japanese shares rose 3.7% for the week, Chinese shares rose 2.4% helped by news of a relaxation of Covid restrictions.

The rise in the oil price came despite OPEC agreeing to increase oil production by 648,000 barrels a day for July and August and reflected scepticism that all members will be able to boost production, at the same time that US oil stockpiles fell and the EU announced a partial ban on Russian oil imports.

Share markets have had a nice rebound from oversold lows, but investment markets generally remain in a bit of a no man’s land at present. The critical issue for markets is whether inflation can be brought under control by central banks without generating a recession. We think it can be – at least we can’t see a recession for the next 18 months – but right now the jury remains out.

On Friday in New York, the S&P500 closed 1.6% down and NASDAQ was off 2.5%, driven by a large Tesla drop.

***

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

IAM Capital Markets' Weekly Market Insight

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

LIC Quarterly Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website