The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

“Australians shouldn’t expect major changes to superannuation if the government changes hands.”

- Dr Jim Chalmers, ABC TV's Insiders, 27 March 2022

“We said that we would not have any major changes in superannuation, and that is certainly our intention. But we’ll receive the review and the report into superannuation, we think that it is important that this continue, and that we do have a debate about the purposing of superannuation."

- Prime Minister Anthony Albanese, National Press Club, 22 February 2023

There was a lot of angst this week about the objective of superannuation but it's not the definition that will really matter. It's the legislated rules that follow. The Prime Minister and Treasurer will claim that capping superannuation is not a "major change" as it affects relatively few people, and in any case, they are wealthy and are taking advantage of the system. Jim Chalmers told Radio 2GB that he was not looking at a higher tax rate on contributions or income, but hinted at a limit on super of $3 million.

“If you think about the average balance in super is about 150 grand, I think, but for less than 1% of people in the system, they’ve got balances higher than $3 million. The average among that group is $5.8 million.”

But a $3 million cap is a major change. Thousands of people with illiquid assets in their SMSFs will be forced into asset sales and a substantial reorganisation of their retirement planning. While the Government wants to believe that, to quote Jim Chalmers, an objective will "end the super wars once and for all", that's about as likely as Anthony Albanese's desire to "end the climate wars". Wishful thinking. The subjective words in the objective confirm that the years of arguments about superannuation are not about to cease, and the rhetoric from Assistant Treasurer and Finance Minister Stephen Jones is not helping.

As if someone saving for 30 years in government-encouraged superannuation makes the system "distorted by a very small number of Australians taking advantage of a system" like it's a dodgy Bottom-of-the Harbour scheme or Cayman Islands tax rort known only to a wealthy few. That argument is the opposite of ending the super wars, and superannuation has done fine since 1992 without a "purpose in life".

Then Labor Party National President and Chairman of Cbus Super, former Treasurer Wayne Swan, weighed in at the $3 million level, telling the Today Show:

“But the truth is if you have $3 million in an account, you're doing pretty well and you don't need tax concessions from every other taxpayer.”

Take a look at the lively debate in Firstlinks last week with 130 comments on the article on the super cap. We had everything from 'Satisfied' who wrote:

"Wake up folks, there is only talk of removing the tax benefits not your hard earned. You can hang on to your wealth! However, why should the tax payer continue to subsidize excessive balances beyond a reasonable 'retirement' limit?"

And from 'Angus':

"It is completely UNFAIR to retrospectively cap the size of a person's funds in Superannuation or force drawdowns on them when people have foregone consumption, saved, taken risks and worked hard at their investments, all the time abiding by the rules of the day including having their Super money locked up for decades until they can access it. Any changes to Superannuation should be grandfathered at the very least."

And everything in between. Anyone who believes the super wars will end should go back and check the comments.

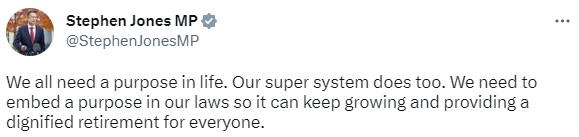

Dignified. Equitable. Sustainable. Security. Wellbeing. They all mean different things to different people, and somewhere along the way in coming years, another government will make another set of changes. While savers in superannuation might set a 40-year retirement plan, governments come and go every few years, circumstances and ideologies change and so do the rules. It's not correct that defining an objective will "make sure that future changes to the system are compatible with its very objective” as Jim Chalmers claims.

Jeremy Cooper responded that a legislated objective would have “little teeth” to limit decisions of future governments.

“Super is always going to change, but for it to be tipped on its head when you're halfway through is destabilising. The proposal is not a universal panacea, things can always be justified by the circumstances.”

And what are all these social projects that superannuation is suddenly supposed to fund? The reforms would enable investment by superannuation funds in projects that: “boost housing supply, manage climate change and spur digital transformation”.

Super funds can do that at the moment if a project meets their investment criteria, but the trustees of a super fund cannot report to their members that returns are 1% lower due to a decision to finance social housing. As the Consultation Paper acknowledges:

"Superannuation trustees have a legal obligation to perform their role in compliance with the best financial interests duty (BFID) under paragraphs 52(2)(c) and 52B(2)(c) of the Superannuation Industry (Supervision) Act 1993. The BFID requires that trustees are guided by the best financial interests of their members when making decisions about the fund and its investments."

And what does 'complement' mean below?

"Legislating an objective of superannuation is intended to complement the long-standing legal and regulatory obligations of trustees of superannuation funds to have in place investment strategies that deliver the best outcomes for their members."

For example, John Pearce, the CIO of UniSuper, deals with a vocal membership of university professors and lecturers who often hold strong beliefs about social welfare and equity, but John says UniSuper has not invested in social housing and he has yet to see a model that works:

"However, regardless of how worthy these projects are from a social impact perspective, the financials have to stack up. So, whether or not the conversation actually leads to real investment decisions will very much depend on our assessment as to whether it is in your best financial interests."

The objective will make no difference to Pearce's need to generate the best returns for his members.

With words such as 'equity' and 'sustainable', there were plenty of hints that rules will change in the May 2023 Budget. The Treasury paper says bequests are inappropriate and large super holders should reconsider their retirement planning:

"The focus on delivering income makes clear that the purpose of superannuation is not for minimising tax on wealth accumulation or enabling retirees to leave tax-effective bequests."

I have written more here and here. In summary, despite reassurances from the Treasurer and Prime Minister that no major changes are coming to superannuation, other statements this week suggest otherwise, as does the directness of the Consultation Paper, such as:

“... beyond a certain level of income, additional government support through tax concessions is not necessary or appropriate”.

Treasury and the Government will review feedback to the Consultation Paper but it's strange that the Treasurer seems to have settled on a super cap rather than increasing the super tax rates. Forcing money out of super and driving asset sales and tax on previously-unrealised capital gains will create many unintended consequences.

***

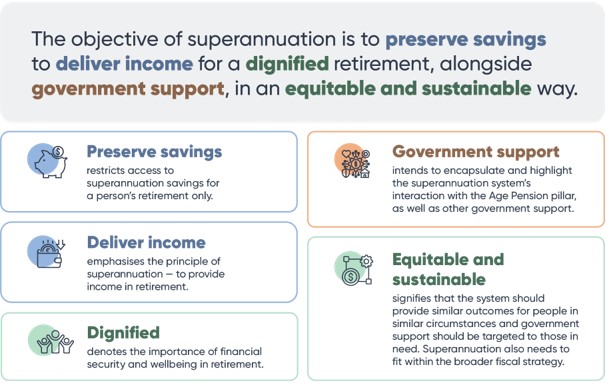

While we're on the importance of words and their definitions, in business, the word 'plunge' means 'to go down in amount or value very quickly and suddenly'. Similarly, 'plummet' means 'to fall or drop straight down at high speed'. So when the headline on the front page of the Weekend AFR of 18 February 2023 under the tag 'Exclusive' uses these words, whatever is affected must be in serious decline. Here is an extract:

"New SMSF accounts plunge as big super fights back

The number of new self-managed superannuation funds has fallen for the first time in four years as improved offerings from professionally managed funds and market volatility combine to take the shine off DIY super.

Two of the nation’s largest brokers, which collectively preside over about a quarter of the $865 billion SMSF market, expect the number of SMSFs established last year to plummet by at least 15 per cent."

The latest data from the ATO shows SMSFs in vibrant health, with record numbers of establishments. What is the evidence that "improved offers from professionally managed funds" are attracting clients at the expense of SMSFs? It's index ETFs that are grabbing market share, also reaching record amounts and often held within SMSFs.

There's not much plunging or plummeting there with SMSFs holding over a quarter of all superannuation. Speaking at this week's SMSF Association Conference, Investment Trends Head of Research, Dr Irene Guiamatsia, said:

“Although the average age of SMSF members remains high at around 60 years of age, SMSFs are being established at a younger age, boding well for long-term growth. The main driver for growth remains the desire for control. Early exposure of Millennials and Gen Z to digitally-delivered financial services reinforces control as an important component of their engagement with service providers. Also, Australians’ well-documented bias towards direct property as an asset class, and their desire to access it, helps stoke SMSF establishments. Supply side factors, such as low-cost initial setup, greater synergies between accountants and adviser practices and a slightly softer regulatory posture also play their role.”

***

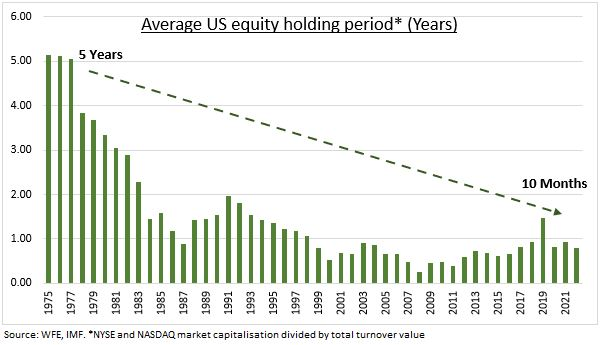

This week, I interview three global fund managers, Orbis, MFS International and Baillie Gifford, who are coming together to make the case for active, long-term investing in a market that can no longer be assured of simply delivering good results through the momentum of passive investing. Each explains their process and the global stocks they like for the long term. Despite the arguments in favour of investing through the cycles and allowing compounding to do its work, the average holding period for equities continues to fall, as shown below.

At an Actuaries Institute event last week, Michelle Levy explained the proposals in her Quality of Advice Review (QAR). Superannuation expert Michael Rice (previously of Rice Warner fame) sees the need to change the advice regime and supports many of the recommendations, but he worries about the safeguards. QAR is a start in updating financial advice rather than the final word. We also include extracts from a submission Michael made to QAR for readers who want more background.

Graham Hand

Also in this week's edition ...

It’s clear the government is preparing the ground for changes to both superannuation and personal taxation. Dr Rodney Brown expects taxes may get a minor tweak in this year’s budget, though it will lay a platform for more comprehensive reform prior to and after the next federal election.

Recently, super funds have copped flak for their valuations of illiquid private assets - is it a form of ‘volatility laundering’ as famously coined by quant expert, Cliff Asness? Perhaps, says Simon Petris, though Petris suggests it's important to distinguish between different segments of private markets to get a complete picture.

In October last year, Annika Bradley wrote of the impending arrival of Vanguard into superannuation in Australia. Today, she assesses how the Vanguard offering stacks up against local juggernaut, Australian Super.

The tech sector was obliterated last year, though it’s made some of that back in 2023. Montaka Global Investments’ Andrew Macken remains an undaunted bull on the sector. He says tech is entering a new phase of growth and dominance, fuelled by innovation and AI, and highlights some compelling ways to play this theme.

David Booth thinks that the past three years are representative of the history of stock returns: two steps forward and one step back. And it provides important lessons about how you should best prepare your investment portfolio for future market outcomes.

In the weekend update by Morningstar, Christine St Anne reports on two ASX stocks with a brighter future, and Susan Dziubinski looks at three Warren Buffett stocks to buy.

In this week's White Paper, MFS says that soaring interest rates have made cash a competitive asset again, prompting an overdue de-rating of risk assets. But just because yields are higher, that doesn’t mean risk is lower.

***

Weekend market update

On Friday in the US, stocks turned lower after a hotter-than-expected personal consumption expenditures data for January, though the S&P 500 managed to finish off its worst levels of the day with a 1.1% decline. Treasurys also came under pressure with the short end getting the worst of it, as the two-year yield leapt 12 basis points to 4.78% and the long bond finished at 3.93% from 3.88% a day prior. WTI crude pushed towards $77/bbl, gold fell again to $1,819/oz ounce and the VIX rose to near 22, settling well below its morning levels.

From AAP Netdesk: On Friday in Australia, the share market snapped a three-day losing streak as reporting season draws to a close. The benchmark S&P/ASX200 index edged higher 21.6 points, or 0.3%, to 7,307 on Friday but finished the week down 0.54%. The broader All Ordinaries closed 20.2 points higher, or 0.27%, at 7,512.7.

All sectors but mining finished up, with tech, property, industrials and consumer discretionaries rising by more than 1%.

The big miners dragged down the index with Rio Tinto the biggest loser, down 3.6% to $118.92. BHP fell 1.6% to $45.94 and Fortescue was 1.7% lower, at $22.44.

Financials finished up, led by Australia's biggest bank, CBA, which climbed 1.3% to $101.22. NAB rose 0.3% to $29.85, ANZ was up 0.1% at $24.79 and Westpac was basically flat.

Aristocrat Leisure rose 2.8% to $36.88 after the world's biggest poker machine manufacturer extended its share buyback by another $500 million. Activist shareholder Stephen Mayne's bid for a board seat was rejected during a fiery AGM, in which he criticised Aristocrat for not embracing cashless gaming measures proposed in NSW.

Fellow gambling giant Star Entertainment also enjoyed a positive trading session, finishing up 8.6% at $1.52 after raising $595 million in equity from investors.

The world's first publicly-listed law firm, Slater & Gordon, is set to end its 15-year dalliance with the ASX after the board agreed to a $150 million takeover bid from private equity firm Allegro Funds.

With most big name companies having already reported earnings, middling players took centre stage on Friday.

Brambles finished up 7.5% to a six-month high of $12.97 after the pallet container company announced its first-half profit after tax had risen 9% to $US331.1 million ($486 million).

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ETF Quarterly Report from Vanguard

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Funds Report from Cboe Australia

Plus updates and announcements on the Sponsor Noticeboard on our website