The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

We were preparing to publish a special edition of Firstlinks on Tuesday afternoon, after the Treasurer announced the new superannuation policy, but there was uncertainty in the reporting and we needed to ensure the explanation was correct. Media coverage was ambiguous at least, wrong at worst.

For example, ABC News said:

"Australians with more than $3 million in their super will have their earnings taxed at double the current rate."

And David Crowe in the SMH wrote:

"People with more than $3 million in super will continue to gain a concessional tax rate on their fund earnings, but it will be 30% rather than 15%."

With journalists rushing to produce copy quickly amid new announcements, clarifications were understandably needed, such as this from the SMH:

To be clear, it's not individuals with super over $3 million that will have all earnings taxed at 30%. The earnings on the first $3 million will remain taxed at the current 15% (or 0% in pension mode) and only the earnings on the amount over $3 million will be taxed at 30%.

We decided to wait until we knew more and Treasury issued a Fact Sheet the following day, with a surprise in the way earnings will be calculated. Not only will the Australian Taxation Office issue tax liability notices to individuals in the 2026-27 financial year, but earnings will include unrealised capital gains. This will have significant consequences.

We take a dive into the politics of the rushed decision and how the tax calculation will be made, using Treasury's examples.

What happened to the 'conversation' Jim Chalmers wanted with the Australian people about the best way to tax superannuation? For two weeks, he said he was only opening the debate, then woosh! ... out came the policy. Labor is managing the politics as much as the policy.

It's always a magical mystery tour whenever a Prime Minister or Treasurer says they want to have a 'conversation' because conversations should include listening as well as speaking. A female friend who is currently dating online told me some blokes talk for 95% of the time on how good they are, thinking it's a winning strategy. It isn't. If Anthony Albanese and Jim Chalmers were initially simply flying a kite, it came crashing down like the 95% bloke. They even made a decision before considering responses to the consultation on the purpose of superannuation which was supposed to precede any changes to tax concessions.

A sign that Labor took a snap decision to avoid the broken election accusation is in the strength of the undertakings prior to the last election. We have uncovered the biggest. The promise of "stability and certainty" in superannuation was repeated four times by Assistant Treasurer Stephen Jones in less than three minutes at the SMSF Association Conference in 2022, the super sector most affected by the proposed changes. Here's an extract:

“Anthony Albanese wanted me to deliver a particular message to everyone in the (SMSF) sector today. And it's about stability and certainty ... So the message we want to send to you is around stability and certainty in an uncertain time. The last thing that we want the SMSF sector, whether it’s advisers, whether it's accountants, or the customers that you serve, the last thing that we want you worried about is the next regulatory hit coming out of Canberra. We want you focused on delivering great outcomes for members and for retirees themselves. We want you to have peace of mind in your retirement. We want to make the case that your nest egg, your retirement savings are always going to be safer under Labor."(my bolding)

It's no wonder Albanese called his troops together before such revelations gained a firm foothold. No weasly "intention" or "major change" qualification there, and even an extraordinary "the last thing that we want you worried about is the next regulatory hit coming out of Canberra".

Remarkably, it's exactly what Scott Morrison said to the SMSF Association in 2016, seven years ago, only months before he introduced the Transfer Balance Cap of $1.6 million. Opposition Leader Peter Dutton is loving the opportunity to accuse Labor of a new tax and broken promises, but Labor is simply playing the same political game as the Liberals.

Until the next election, Dutton will argue the changes are unacceptable, supported by the Murdoch media. It's not the only thing that's 'unnaceptable'.

We dissect the similarity between the two speeches and show that hypocrisy has no political boundaries, especially when it comes to superannuation. Now that's worthy of a conversation.

Anyway, Happy Birthday today to Anthony Albanese, reaching the big 60, and Jim Chalmers, a youthful 45. It's been a stressful week for you both and you should relax over dinner with a bottle of red.

***

In a previous life, a team of interest rate traders reported to me. I wanted to experience the ups and downs of making trading profits and losses based on my view on future rates, so I operated a proprietary trading account within the bank's system. I allowed myself a modest trading limit and I did okay on small positions.

Thank goodness I have not traded bank bill futures over the last 18 months. I would have lost plenty. While everyone knew rates would rise, the market has been well ahead of the Reserve Bank and most major economists, even to the point of Governor Philip Lowe saying some of the future rate levels were completely unjustified. But since proven correct. I did not expect cash to go well above 4% because hundreds of thousands of people on 2% mortgages would roll into 7%, and a 5% hit would cripple the future for many families. Where do most people find $50,000 in after-tax dollars on a $1 million mortgage?

There were signs of respite in the CPI this week when it increased by 7.4% in the year to January 2023, below expectations of 8.1%.The major contributors to the annual increase were food, housing, recreation and culture. The Cash Rate Futures fell by about 0.1% on the day. We also saw GDP numbers which, according to CBA economists:

"The 0.5%/quarter increase in real GDP over Q4 22 was weaker than the market median of 0.8% ... The tailwind of strong population growth in Australia means that the economy means that the economy must expand by ~0.4% per quarter to stop it from going backwards on a per capita basis. Indeed the ABS today reported that GDP per capita was flat over Q4 22. We expect a per capita recession in 2023."

The article by Ryan Wells this week is a fascinating look at Australia's population growth due to the recovery of migration, which is why CBA makes this 'per capital' distinction.

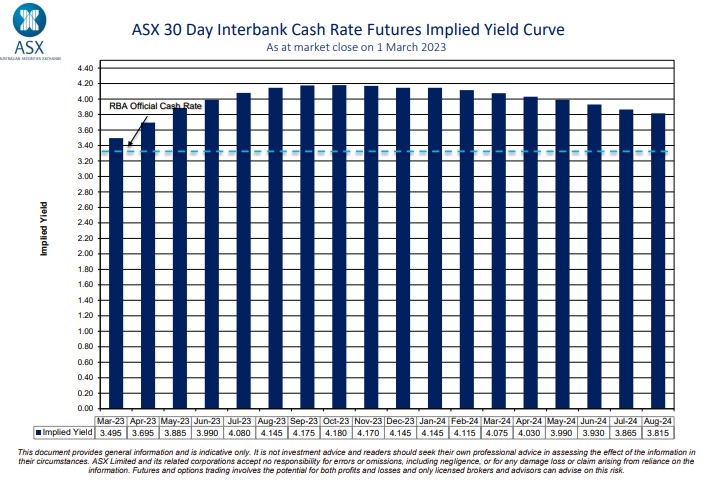

The current cash rate is 3.35% and the market is saying about 0.85% higher by September 2023, or three to four more rate hikes. It looks too high with signs of a slowing economy and inflation. If it happens, it is merciless with such a blunt instrument, hitting those who can least afford it. Ironically for a policy which is supposed to reduce demand, wealthy people holding cash and term deposits and no loans are seeing a big income boost and they will spend more. We have progressed nowhere in decades of using monetary policy, leaving rates at zero for too long and now going too high. It's disturbing to recall that the Reserve Bank waited until May 2022, only nine months ago, to make the first cash rate increase from 0.1%.

For anyone who thinks they can do a better job, a couple of the Board positions are now open. And probably a Governor role by September. But beware. Based on recent years, unanimity is expected and troublemakers need not apply.

***

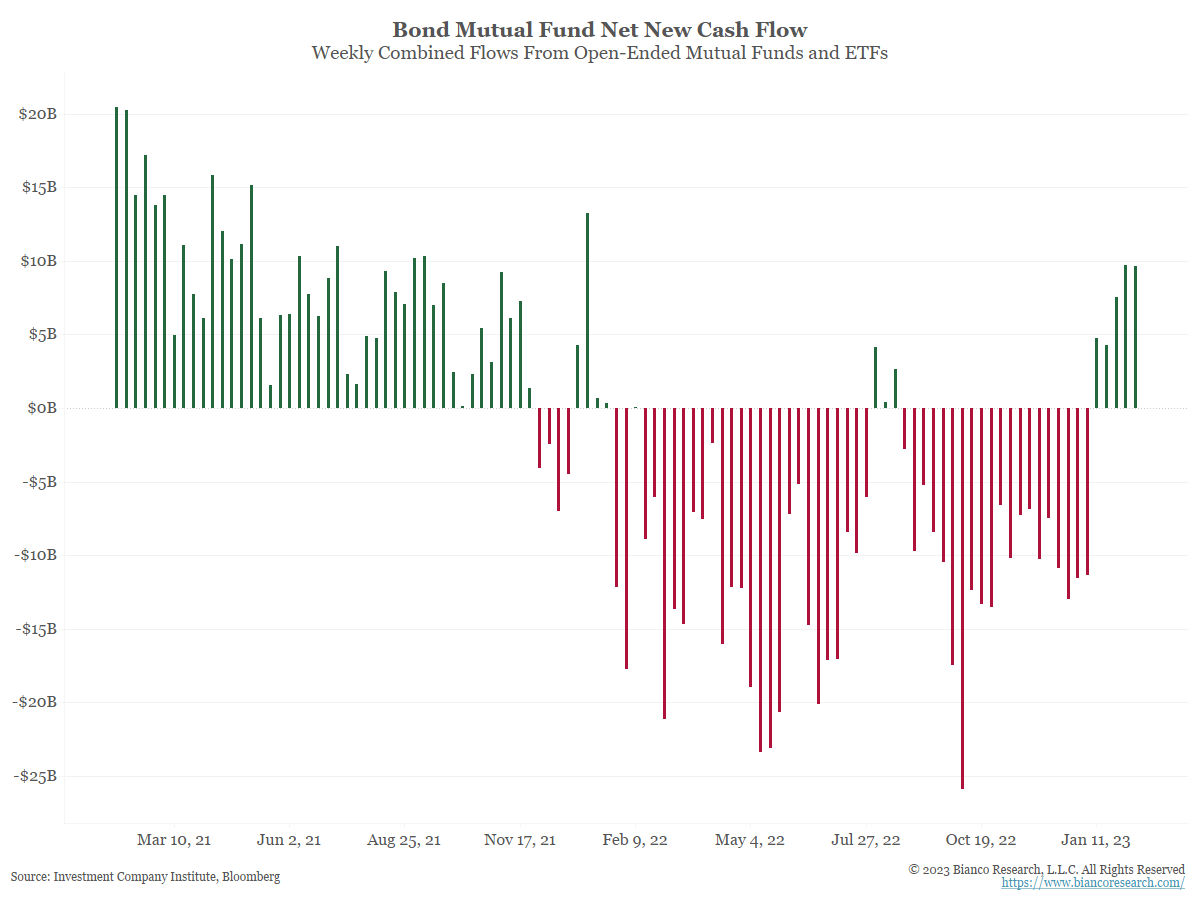

Elsewhere in markets, money is again flowing into bonds after outflows throughout 2022, as the data below for the US shows. Many investors were burnt by the capital losses from rising rates but are now attracted by the higher absolute returns and expectations in the US that inflation has peaked.

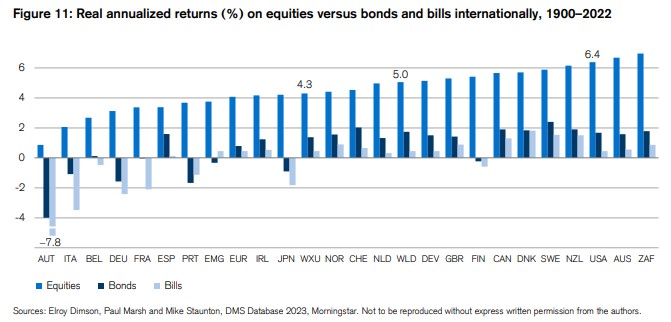

But for long-term returns, for those who can tough out the stockmarket falls, equity markets deliver the most rewards. We have featured the work of Elroy Dimson and his colleagues previously, where they update global investment returns each year since 1900. The latest edition of the Credit Suisse Global Investment Returns Yearbook was recently released, and the annualised returns on equities versus bonds are shown below, with Australia close to the top on equities. These are real returns, after inflation.

Graham Hand

Also in this week's edition ...

So much going on, make time for our bumper selection of new articles.

Tribeca's Jun Bei Liu says the February 2023 reporting season showed the resiliency of corporate earnings. Looking forward, she says earnings are likely to disappoint market expectations in the first half, but once Earnings Per Share consensus estimates come down, the market could be ready for take-off. She's positive on the likes of Ramsay Healthcare, Lottery Corporation and A2 Milk.

VanEck's Cameron McCormack is also bullish as he thinks economic growth will remain relatively strong thanks to demand from China. He is overweight the resource and consumer staples sectors but neutral on banks given headwinds of competition and higher bad debts.

We're entering a new era of fiscal stimulus and a boom in intangible asset investment, says Jacob Mitchell of Antipodes Partners. We've seen this movie before in the 1970s and the result is increased volatility in nominal GDP and a decline in equity market multiples.

James Gruber muses that stockmarket prices are like email: they’re distraction machines. With email, it often distracts people from getting work done efficiently. With stock prices, they distract investors from what really matters: the businesses underlying them.

Retirees with large super balances may be required to draw more than they wish to qualify for tax concessions, says Michael Hutton of HLB Mann Judd. It's a good problem to have but what do you do with the excess money? Michael offers some suggestions.

When the numbers for net migration in 2022 are released, they're likely to be +400,000, much stronger than Government forecasts. Ryan Wells says the numbers won't ease off much this year either. This will have many implications including increasing total consumer spending and expanding the labour force.

It's surprising little has been written about the outperformance of gold against almost every other asset class in Australian dollar terms in 2022. Sawan Tanna investigates whether gold can continue to shine this year.

In the weekend update by Morningstar, Josh Peach hunts for the ASX's best dividend stocks while Margaret Guidici recommends five undervalued US semiconductor shares.

Lastly, this week's White Paper by Heffron Consulting looks into the ins and outs of SMSF pensions.

***

Weekend market update

On Friday in the US, the bulls are back in control, as stocks ripped higher by 1.6% on the S&P 500 to leave the index higher by 6.1% in 2023, while Treasurys enjoyed a bull-flattening rally with the long bond sinking 13 basis points to 3.90%. Gold maintained recent momentum with a 1% rise to $1,861 per ounce, WTI crude tested $80 a barrel and the VIX tumbled to 18.5 after settling near 21 on Monday.

From AAP Netdesk:

On Friday, the local share market managed to claw back some of its losses but still finished in the red for the fourth straight week. The S&P/ASX200 on Friday finished up 28.2 points, or 0.39%, to 7,283.6, leaving the benchmark index down 0.3 points since last Friday's close and down 3.6% from its February 3 finish. The broader All Ordinaries on Friday gained 24 points, or 0.32%, to 7,484.

Every sector finished higher on Friday except for the interest-rate-sensitive real estate industry, which fell 0.3%. Telecommunications was the biggest gainer, rising 0.9%.

In the energy sector, Woodside rose another 0.5%, to a two-month high of $37.79, after positive results earlier in the week, while Santos added 1.3% to $7.20.

In mining, BHP rose 0.6% to $48.32, Rio Tinto gained 1.6% to $126.43 but Fortescue Metals fell 1.3% to $22.76. Also, Mineral Resources dropped 0.7% to $89.42 as the mining services company declared its $497 million takeover offer for Norwest Energy would be its final and best bid, while Liontown Resources soared 13.4% to $1.63 after Bell Potter slapped a speculative buy rating and $2.81 price target on the lithium developer.

The big banks all bounced back from Thursday's sharp sell-off prompted by a warning that Australian mortgage arrears, while still low, were increasing. NAB rose 1.1% to $29.15, CBA added 0.7% to $97.75, Westpac climbed 0.4% to $21.73 and ANZ gained 0.6% to $23.85.

From Shane Oliver, AMP:

- Global share markets rose over the last week with hopes that interest rates won’t rise any more than already priced in. For the week US shares rose 1.9% with a solid rebound from technical support levels, Eurozone shares rose 2.4% and Japanese and Chinese shares both rose 1.7%. Despite the positive global lead, the Australian share market fell 0.3% with gains in resources stocks more than offset by losses in other sectors, particularly financials and property stocks. Bond yields rose further with the US 10-year bond yield briefly rising above 4%. Oil, metal and iron ore prices all rose as did the $A with the $US down for the week.

- Global inflation and the risk of more rate hikes triggering a recession remains the main concern for investment markets. The good news is that our US Pipeline Inflation Indicator, despite rising slightly in the last week, continues to point to a further fall in inflation reflecting improved supply, lower freight costs & the downtrend in business surveys regarding costs & prices.

- Maybe Australia is different, justifying relatively lower interest rates after all. RBA commentary over the last month has been very hawkish, and particularly so were its comments in its last board meeting minutes implying that the lower cash rate in Australia (now 3.35%) compared to comparable countries (with a range of 4% to 4.75% in the UK, Canada, the US and NZ) may not be justified with little evidence to suggest monetary policy is more potent in Australia. Our view has been that monetary policy is more potent in Australia – due to high debt ratios and a high reliance on short term mortgage rates. The run of recent data since the last RBA meeting supports this with: weak jobs data; a plunge in consumer confidence back to recessionary lows; slower than expected wages growth; stagnant nominal retail sales since September (and falling retail sales in real terms); weaker than expected underlying December quarter GDP growth (absent net exports it would have gone backwards); and weaker than expected inflation in January. This is all against the backdrop of an ongoing plunge in building approvals and housing finance.

- Economic data can run hot and cold and seasonal adjustment issues may be playing a role but taken together the run of recent data suggests that demand is cooling and inflation has peaked. As such we remain concerned that the RBA over-reacted to the December quarter CPI release in adopting a very hawkish stance over the last month. Our view is that the RBA has likely already done enough to cool growth and inflation and so should pause to allow more time for lags to work particularly given the run of soft recent data.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website