The Weekend Edition includes a market update (after the editorial) plus Morningstar adds links to two additional articles.

The English language is in a continuous state of 'linguistic drift', and some words and phrases we use regularly today will disappear in future, replaced by new expressions. Australians are proud of their local lingo, and each year, the Australian National Dictionary Centre announces a Word of the Year. The words point to events in the headlines each year, such as 'teal' (2022), 'iso' (2020), 'democracy sausage' (2016), 'shirtfront' (2014), 'green-on-blue' (2012), 'vuvuzela' (2010), and 'podcast' (2006).

Even when words stay in common usage, they sometimes develop new meanings, and 'superannuation' is a prime example. Its etymology, or origin, dates to the 1600s, when 'superannuated' meant 'to declare obsolete'. It comes from the Latin 'superannuatus', meaning 'to be too old', from super = over and annus = year. We don't use the word in its old meaning much anymore, but it used to be common to say something was 'superannuated' when it was obsolete due to age or disrepair. We have superannuated our fax machines, our iPods, our VCRs and our old computers and mobile phones.

In fact, the word has gone full circle. Where it meant impaired or disqualified or obsolete due to old age in 1690, it graduated to 'retirement and pension because of age', to today's superannuation which is something we all want more of. It is money to live on in the golden years, for fit and healthy 60-year-olds who expect to live another 30 years. There's nothing outmoded or old-fashioned about superannuation now.

Since 1992, governments have loved the idea of retirement savings so much that they regularly devised clever new ways to allow as much money as possible into super, even with a couple of $1 million opportunities. They came up with cool names like downsizer or salary sacrifice or carry forwards for all these ideas. And the people said: "Gimme more, more, more!"

And then, having set up and further developed a system to encourage large amounts into retirement savings, this glorious thing called superannuation, the authorities suddenly realised it had become an investing nirvana. Low tax, take it out in a lump sum if you want it, leave it to the children, invest in anything. Buy a vintage car, art, wine ... whatever your heart desires. Even own your business premises in an SMSF and rent it to yourself.

And then it's ... oh dear ... what have we done? Those wealthy bastards out there are using it for inheritance, not retirement. Some dropkick has $400 million in there. That doesn't sound obsolete.

It's become such a good thing, so simply wonderful and so favourably taxed, that governments are now scrambling to find ways to stop people having too much of it. Or new ways to tax it. It's like: "Yes, we told you to put as much as possible into super, and we invented new ways for you to do it. Now, take it out or we'll tax it."

Last week, Treasury issued a Consultation Paper on the new tax on super balances over $3 million. It's the latest claw-back as governments realise superannuation needs to return to its old roots, strictly to provide for those who are 'too old'.

The paper issued on 31 March 2023 is similar to the original Press Release of 28 February 2023. Treasury still calls it a "headline tax rate to 30%, up from 15%", which it is not, because the first 15% is taxed completely differently to the second 15%. And their main justification for the ridiculous decision to tax unrealised capital gains is because it's easy to calculate:

"The approach to estimate earnings seeks to be simple and minimise unnecessary or additional compliance costs by largely relying on data reported through existing arrangements."

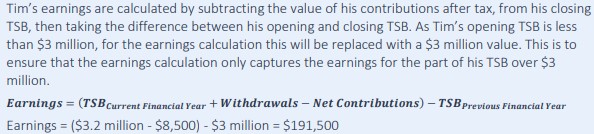

There is one clarification on how earnings will be calculated, using the Total Superannuation Balance (TSB):

" ... the previous financial year’s TSB will be adjusted to equal $3 million for the purposes of calculating earnings. This approach ensures that any growth in the fund that occurs below the $3 million threshold is not counted as earnings."

Treasury gives this example:

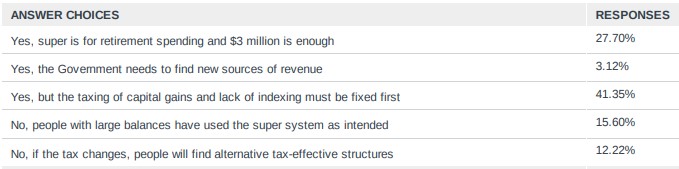

There are 15 consultation questions and the deadline is 17 April for anyone who wants to vent their spleen. In our recent Reader Survey, here are the responses on the $3 million tax from about 800 people. Over 70% in favour, but with most saying the indexation and unrealised capital gains aspects must be addressed.

Yes, superannuation remains a great vehicle to save for retirement, but there is an asset which is even more fundamental for future prosperity. Its benefits transcend the financial and go to the emotional, a place of security, of wellbeing, of lifestyle. It's a place to call home, owning not renting. If there is one thing that beats super hands down in retirement, it is owning a home, a place to rest your head without the fear of a landlord throwing you out. In super, we develop strategies on asset allocation and portfolio construction, but greater focus is needed in financial planning on the route to owning a home.

We duke it out between senior voices in superannuation. Andrew Gale, former chair of the SMSF Association and leading public policy expert, takes a critical look at the claims that super concessions cost the Budget something like $50 billion a year, arguing the net cost is much lower. And Brendan Coates and Joey Moloney of Grattan say we have created a super system where the benefits go to the wealthy and much bigger reforms are needed than the tiny impact of the new $3 million tax.

Then Andrew Yee of HLB Mann Judd explains how some of his clients are already reacting to the proposed new tax, especially focussing on assets that can be revalued and generate an unwanted, unrealised capital gain liability.

***

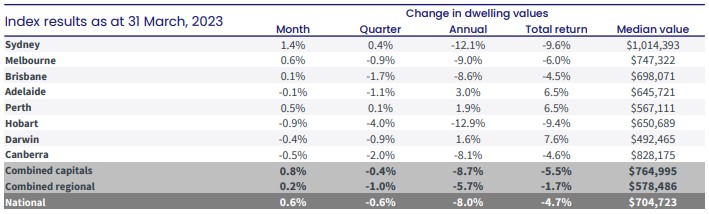

On the subject of residential real estate, the market is at a critical juncture with the first month-on-month price rises for a year in March 2023 in CoreLogic’s National Home Value Index. Sydney led the way with a 1.4% gain. CoreLogic’s Research Director, Tim Lawless, said the rise was due to low advertised stock levels, extremely tight rental conditions and additional demand from overseas migration.

“Advertised supply has been below average since September last year ... With rental markets this tight, it’s likely we are seeing some spillover from renting into purchasing, although with mortgage rates so high, not everyone who wants to buy will be able to qualify for a loan. Similarly, with net overseas migration at record levels and rising, there is a chance more permanent or long-term migrants who can afford to, will skip the rental phase and fast track a home purchase simply because they can’t find rental accommodation.”

CoreLogic Home Value Index, released 3 April 2023

So now everyone is wondering whether March was a one-off before prices continue falling. The fixed rate mortgage cliff is high. My view is not much will happen with prices over the rest of 2023 with forces pushing each way. While we may not have seen the last of the cash rate increases, we are at or near the top, but anecdotal evidence is that inflation is still high. Only 35% of people have a mortgage and the rest will continue spending.

CBA economists pored over the words in the RBA announcement for important subtle changes, and found two:

"In the March Statement accompanying the Board decision it was stated that, “the Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target”.

Today that sentence was changed to, “the Board expects that some further tightening of monetary policy may well be needed to ensure that inflation returns to target.” (our emphasis in bold).

The Governor has inserted the word “some” before the word “further”. And more importantly the word “will” has been replaced with “may”."

What games we play! In the hours before the Reserve Bank announcement, economists across the country agonised about their own rate call, feeling the absolute necessity to make one final bid. Is this the best use of the expensive and precious time of so many talented people, to produce contrary pontifications that are confirmed as right or wrong within an hour? Who benefits from that other than a later "I told you so" from one and "They got it wrong" from another. Here are two from from my mailbox an hour before Phil Lowe's decision:

"We expect the Reserve Bank of Australia (RBA) to pause at the April meeting as it assesses the outlook for the economy and the feed-through of monetary tightening."

"We continue to expect the RBA to increase the cash rate by 25bps at today’s meeting, to 3.85%. The labour market and inflation have slowed only modestly meaning additional tightening is still needed."

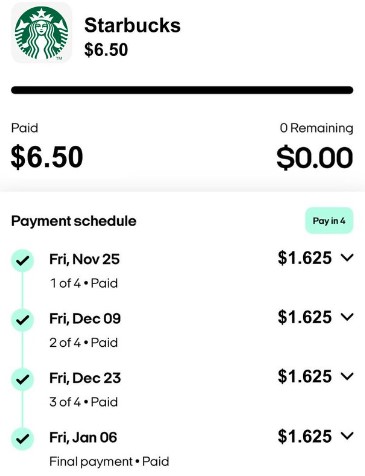

And if anyone needs evidence that coffee shops can charge almost whatever they wish for an almond milk latte with a dash of pistachio syrup, here's what BNPL financial freedom looks like.

Also in this week's edition ...

Cameron McCormack of VanEck looks at listed property trusts (A-REITs), many of which have performed poorly in the last 12 months. The crucial question is whether the necessary value markdowns from rising rates and WFH trends are already build into the market prices. Morningstar's Alex Prineas believes the downside is mainly priced in as most A-REITs are trading well below their net tangible assets and his valuations, and are stronger than offshore portfolios.

"Australian listed property players have lower gearing, largely locked-in long-term debt, and have limited need to tap debt markets over the next 18 months ... Major REITs in Australia have solid fundamentals."

James Gruber looks at the market narratives and storytelling pitched at investors, but it's the numbers in the company earnings and balance sheets that really matter.

And Richard Dinham of Fidelity reports on survey results showing many people enter retirement earlier than they expected, and while anxious at first, they often settle into a more balanced rhythm and acceptance of their circumstances.

In the weekend update by Morningstar, Josh Peach has two articles, one on how ASX healthcare stocks may provide a haven for defensively-minded investors, and the other on how Australian infrastructure service provider Ventia Services Group has been added to Morningstar's best ideas list.

This week's White Paper is VanEck’s latest quarterly economic outlook, encouraging investors to focus on liquidity, strong balance sheets and cash flow, and avoid highly volatile and speculative assets.

Graham Hand

***

Long weekend market update

On Thursday in the US, stocks floated higher by 0.4% on the S&P 500 to wrap up the holiday-shortened trading week, while in the bond market, two-year yields rose three basis points to 3.82% while the 30-year ticked to 3.54% from 3.56% yesterday. Gold pulled back to $2,022/oz, WTI crude held near $80 a barrel and the VIX remained south of 19.

From AAP Netdesk:

Australian shares sank lower into negative territory to close out the shortened holiday week. The benchmark S&P/ASX200 index closed Thursday down 18.2 points, or 0.25%, to 7,219, while the All Ordinaries finished 22.3 points lower, or 0.3%, to 7,412.

Thursday's negative close snapped the ASX's eight-session winning streak, its longest since October 2017.

Despite closing out the day in the negative, the market ended the week in the green, up 0.57%, bolstered by earlier gains.

Health care, utilities and consumer staples led the day's gains on the ASX on Thursday, parting a sea of red on the eve of Easter, with the tech sector suffering the biggest losses.

In the health sector, Australian medical diagnostics company Rhythm Biosciences had healthy gains, closing up 5.4% to $4.85 after its abstracts for the company's colon cancer diagnostic test were accepted at the 2023 American Society of Clinical Oncology annual meeting.

Biotech company CSL bolstered the sector, finishing up 2.24% to $300.18.

APA Group led gains in the utilities sector, rising 2.2%, followed by AGL Energy with a 1.5% boost.

Tech stocks collectively shaved more than 2% with industry heavyweights Wisetech and Xero both dropping more than 2.3%.

The major banks finished the session in the red, led by NAB, which was down 0.6%.

ANZ followed closely behind, declining 0.5% while CBA and Westpac shares ended the day relatively flat, both down 0.05%.

The market will reopen on Tuesday after the long Easter weekend.

Latest updates

PDF version of Firstlinks Newsletter

LIC (LMI) Monthly Review from Independent Investment Research

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website