In mid-1945, Tsutomu Yamaguchi was in Hiroshima in Japan for a three-month business trip. On the morning of August 6, he was preparing to leave the city with two colleagues for his hometown of Nagasaki when he realized he’d forgotten his identification papers, so he trekked back to his office to retrieve them. At 8.15am, the American bomber Enola Gay dropped an atomic bomb called ‘Little Boy’ near the centre of the city, about three kilometres from where Yamaguchi was walking.

Yamaguchi recalled that there was ‘a great flash in the sky, and I was blown over’. The bomb blinded him temporarily, ruptured his eardrums, and resulted in radiation burns on the left-hand side of his body. He managed to gather himself and eventually find his colleagues, who also survived. They spent a night in an air-raid shelter before returning to Nagasaki the next day.

Yamaguchi received treatment for two days and went back to work at Mitsubishi Heavy Industries on August 9. At 11am on that day, he was describing the Hiroshima bombing to his supervisor when the American bomber Bockscar dropped an atomic bomb called ‘Fat Man’ over Nagasaki. Again, Yamaguchi was about three kilometres from where the bomb landed. This time, he didn’t suffer any injuries, though he vomited and had a high fever for the next week.

Yamaguchi was only one of about 70 people who were affected by both bombs. Yet, he was the only person officially recognized by the Japanese government as having survived the two explosions.

Six days after the bombing of Nagasaki, Japan surrendered to the Allies, and World War Two was over by agreement on September 2.

The Hiroshima and Nagasaki bombs killed up to 226,000 people, mostly civilians. About half died on the days the bombs dropped, and many others died in the months after from radiation burns and illness.

Following the war, Yamaguchi worked as a translator for the occupation forces and later went back to Mitsubishi as an oil tank designer. By the 1980s, he became more strident in his opposition to atomic bombs. He called for the abolition of such bombs and for nuclear disarmament.

In 2009, when the Japanese government recognized him as a survivor of both bombs, Yamaguchi said:

“My double radiation exposure is now an official government record. It can tell the younger generation the horrifying history of the atomic bombings even after I die.”

And Yamaguchi died aged 93 in 2010.

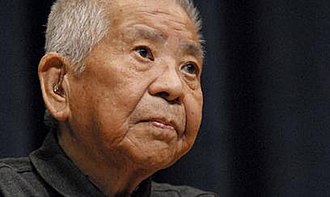

Tsutomu Yamaguchi

Source: Wikipedia

Why Yamaguchi’s story is powerful

After surviving the bombs, Yamaguchi’s life could have taken many paths. He could have wallowed in his wounds. He could have been bitter at America for their actions. He could have hated his own country for what happened.

Yet, amazingly, he worked for the Allies including the Americans, after the war. He also found a cause in fighting against atomic bombs and nuclear weapons. And he lobbied hard to be recognized by his country as a survivor of both bombs. Without this work, we may never have found out about his life.

Yamaguchi’s survival story is an amazing one. Yet just as powerful is what he did after the explosions - he made the best out of a horrific situation.

We’re story-telling animals

Tales like Yamaguchi’s touch us because we’re storytelling animals. We love to construct narratives around our own lives and the lives of others. These narratives are told after the event and can contain varying degrees of truth. And we particularly like stories like Yamaguchi’s, where something bad happens, though it ends with a relatively happy ending (for him, at least).

Human beings have always told elaborate stories and tried to convince as many people as possible to believe in them. Bestselling author of Sapiens, Yuval Noah Harari, suggests storytelling is a large part of the reason why homo sapiens have come to dominate other species:

“Fiction has enabled us not merely to imagine things, but to do so collectively. We can weave common myths such as the biblical creation story, the Dreamtime myths of Aboriginal Australians, and the nationalist myths of modern states. Such myths give Sapiens the unprecedented ability to cooperate flexibly in large numbers. Ants and bees can also work together in huge numbers, but they do so in a very rigid manner and only with close relatives. Wolves and chimpanzees cooperate far more flexibly than ants, but they can do so only with small numbers of other individuals that they know intimately. Sapiens can cooperate in extremely flexible ways with countless numbers of strangers.”

And Harari says stories are a way for us to give meaning to our own lives:

“Homo sapiens is a storytelling animal that thinks in stories rather than in numbers or graphs, and believes that the universe itself works like a story, replete with heroes and villains, conflicts and resolutions, climaxes and happy endings. When we look for the meaning of life, we want a story that will explain what reality is all about and what my particular role is in the cosmic drama. This role makes me a part of something bigger than myself, and gives meaning to all my experiences and choices.”

Stories can have negative effects too. Harari argues that if you simply tell the truth, no one will listen. Consequently, you won’t have any power because power comes from the stories you convince other people to believe. He says there will never be a society that values truth over power. And he gives examples of stories which can spread persecution, intolerance, and genocide. Nevertheless, Harari believes there are facts that are separate from fables and myths, and it’s our job to find these facts.

Dan McAdams, a professor at Northwestern University in the US, has developed a psychological theory called ‘narrative identity’ to describe our ability to use storytelling to make sense of the world. The theory suggests that at an early age, people begin to become historians of themselves. They start to see their past as something they can make meaning out of and frame it in a way that helps them understand where they may be going in future.

From his research, McAdam has found life stories are associated with psychological wellbeing. For example, those who tell redemptive stories about their past – stories which transition from bad to good – tend to live more meaningful lives.

Separating market truth from fiction

Given humans drive markets, it’s unsurprising that markets too are story-driven machines. Think about the narratives told at the start of 2022:

- Bitcoin and the rise of digital currency

- Sam Bankman-Fried, the billionaire face of this new economy

- Tech dominance

- The inexorable rise of venture capital and private equity

- The Fed will always save markets, aka the Fed Put

- 60/40 will always deliver

- Low interest rates are here to stay

- Inflation is transitory

- Russia will overrun Ukraine

These narratives turned out to be comically false by the end of last year. Yet they generated plenty of headlines during the preceding 12 months. Many of today’s market ‘truths’ may also prove short-lived by the end of 2023.

We not only like to develop stories around markets but stocks too. There’s the narrative around Australian companies that are taking on the world and winning. CSL is a good example of this (and valued at 36x forward P/E, it may need to take on other planets and win too). There are ‘cool’ stocks to own like Wesfarmers: after all, who doesn’t love Bunnings? There are turnaround stories such as Myer and Whitehaven Coal. And there are stocks that investors kick when they’re down – AMP and Zip, for instance.

With all the stories around markets and stocks, what is the average investors supposed to do? Well, it’s the job of investors to do as Harari says, and that is separate truth from fiction. And to recognize what they can and can’t control.

The truth lies in numbers. A company profit and loss statement is real; a balance sheet is real; and a cashflow statement is real.

In the long term, markets and companies are driven by earnings and the multiples attached to those earnings. If investors focus on these two things, they can ignore a lot of the white noise that surrounds them daily.

James Gruber is an Assistant Editor at Firstlinks and Morningstar. This article is general information and does not consider the circumstances of any investor.