The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Treasurer Jim Chalmers released the Review into the Reserve Bank on Thursday, and while many people are wearied by the media's preoccupation with monthly cash announcements and every word uttered by Governor Philip Lowe, the report is a revealing study of the functioning of our central bank. Mr Chalmers said:

"I thank the RBA Review Panel for this significant piece of work and look forward to working across the parliament and with the RBA to implement the recommendations. The review is all about ensuring Australia’s central bank and monetary policy arrangements are as strong and effective as they can be into the future.”

However, despite the extensive coverage given to the Review in the last few days espousing the significance of the changes, there's not much depth behind the recommendations. Governor Philip Lowe said of the changes:

“It’s not correct to say a different decision-making structure would make fundamental differences. We’re talking about improvements at the margin.”

And outgoing Reserve Bank Board member, Mark Barnaba, took exception to the Review's claims that discussions at Board meetings are not robust and challenging, and he said:

“Notwithstanding the length of the report and the number of recommendations, in substance the changes are more marginal than appear.”

The headline recommendation is the establishment of a Monetary Policy Board to set interest rates, and it should communicate more frequently than the current Board. For example, Recommendation 10 is headed "Strengthen monetary policy transparency and accountability". It includes steps for the Governor to present to the public more often, such as:

"The Governor should hold a press conference after each decision meeting to explain the Monetary Policy Board’s view of policy and economic developments."

and

"External Monetary Policy Board members should be expected to discuss the decisions and thinking of the Board publicly, including through at least one speech or public engagement a year."

But Governor Philip Lowe already makes regular speeches and most of them repeat previous points. I listen to or read all of them and the repetition of questions and answers and responses is tiresome.

The major change is now we will know whether some Board members dissented (and it's likely that they will more often given the Review's criticisms of passive members), especially since they will be encouraged to make their own public presentations. That's eight other Monetary Policy Board members making at least one public speech a year each, plus all the Governor's announcements. There will be so much content on interest rates out there that the market, investors and the public will be thoroughly confused. Or bored.

Back to the Report itself, it includes 51 recommendations, and the Treasurer will accept all of them in principle:

- the creation of two Boards, one to set monetary policy and another to oversee the operations of the Reserve Bank. Instead of the current dominance of business people on the Board, the interest rate group will include economists and experts in labour and financial markets.

- a confirmation of the Reserve Bank independence from government and the continued use of an inflation-targeting framework to set rates.

- the transformation will require legislation, but bipartisan support is expected.

There will be eight meetings a year of the monetary policy experts, instead of the current 11 a year by the Reserve Bank Board.

The Review Panel received more than 1,500 contributions and consulted 137 experts and representative groups. The extent of the changes will heighten speculation that the seven-year term of Governor Lowe will not be extended when it ends in September this year.

Chalmers will face little opposition to the recommendations, especially since they come from a respected, independent trio on the Panel.

What we can state at this critical moment in the history of financial markets in Australia is that the Reserve Bank has made some poor calls in the last two years, even by its own admittance. Delaying the first increase in cash rates until May 2022 still beggars belief when inflation signs were clear in late 2021, and maximum pandemic fear was two years earlier. The incredibly loose monetary policy of rates at 0.1% and cheap long-term loans to banks of $188 billion fuelled a housing price boom which severely compromises a generation of buyers ever owning a home. Social consequences rarely come much bigger.

Four leading voices, three from within the Reserve Bank itself, confirm this.

Ian Harper, Dean of the Melbourne Business School and Member of the Reserve Bank Board since 2016, told a panel discussion that during the pandemic, the Bank struggled to balance its dual responsibilities for the stability of the Australian financial system and holding inflation within the 2-3% target range.

"And both of those things led us to be extremely cautious - with hindsight, excessively cautious - in how we set interest rates during that time."

He then made a surprising confession:

"With the benefit of hindsight, obviously, we were well above what we would now accept to be the non-accelerating inflation rate of unemployment, as a result of which it looks like we did a terrible job."

Deputy Governor Michele Bullock, although only on the Board since April 2022, said they underestimated the combined impact of generous fiscal and monetary policy, and the Bank's message became “garbled”.

Begona Dominguez, Professor of Economics at the University of Queensland, confirmed the poor timing, both down and up:

"It was clear by the middle of 2021 that we were on our way up; measures of inflation - expectations of inflation were rising and becoming more skewed, so I think we should have responded maybe six months earlier or so."

And as far back as November 2022, Philip Lowe himself apologised at a Senate Economics Committee hearing:

"I'm sorry that people listened to what we've said and acted on that, and now find themselves in a position they don't want to be in. People did not hear the caveats in what we said. We didn't get across the caveats clearly enough, and the community heard 2024. They didn't hear the conditionality. That's a failure on our part, we didn't communicate the caveats clearly enough, and we've certainly learned from that."

On 5 April, in an address to the National Press Club, he showed one reason why the Reserve Bank is pausing when other countries continue to raise rates.

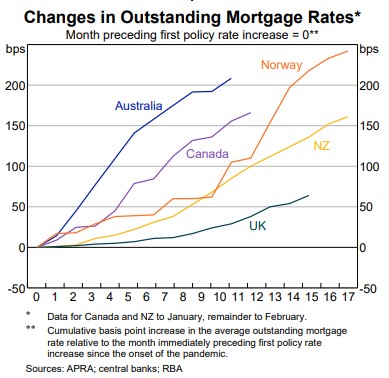

"And the 35% of households with a mortgage are experiencing, or will experience, a significant increase in their required payments. The predominance of variable-rate mortgages in Australia means that this is a more powerful transmission mechanism of monetary policy than in many other countries."

This chart does not include the US, where borrowers are protected by 30-year fixed rates. There's none of that in Australia. The recent minutes of the Reserve Bank Board show the decision to pause this month was a close call, leading economists to predict that the next rate increase will come next month, but Lowe also said:

"The Board is conscious that monetary policy operates with a lag and that the full effect of the increases to date is yet to be felt. It is also conscious that there are significant economic uncertainties at the moment. Given these lags and uncertainties, the Board judged that, with monetary policy now in restrictive territory, it was time to hold interest rates steady and accumulate more information."

How much more information comes in one month to justify an increase? With such mixed messages, the only reasonable interpretation is that the Reserve Bank Board itself does not know its next step until it meets again.

***

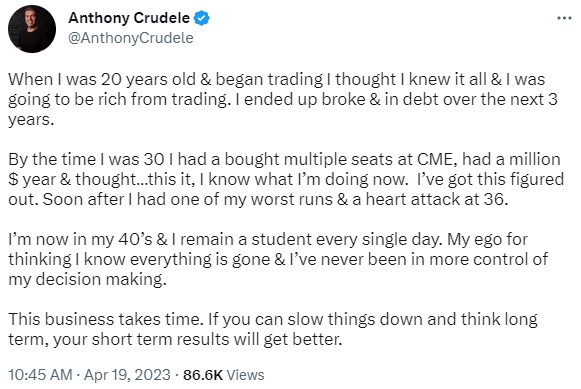

In recent years, investors have gained a better understanding of the impact of their personal behaviour on investment outcomes. The biggest influence on performance is not which fund manager or structure is selected, but the biases and preconceptions we all bring to our investing actions. As Morgan Housel, the author of The Psychology of Money and one of my favourite writers, puts it:

“The finance industry talks too much about what to do, and not enough about what happens in your head when you try to do it.”

We need to learn what goes on in our heads. For non-professionals, investing success is less about the metrics in intrinsic valuations, mean-variance analysis, Sharpe ratios, and - heaven help us - skewness or kurtosis. It's more about the behavioural impacts of loss aversion, confirmation bias, anchoring, overconfidence, reinforcement, incentives and mental accounting.

Each of us has different experiences and interactions which influence how we invest, but we know little about how billion of other people are thinking. When the market seems completely irrational, maybe that's simply our unique perception. Two fund managers with exactly the same training and years in the market may form totally opposite views on the prospects of the same company.

It can be difficult to shake off our preconceptions and our biases, leaving us stuck in an old paradigm. Many of our best fund managers fell in love in 2020 and 2021 with the infinite possibility of low rates forever and skyrocketing valuations of tech stocks which have since fallen by 90% or disappeared. But similarly, some traditional managers have endured a decade of underperformance because they were stuck on valuation techniques that overlook great growth companies.

Warren Buffett's mate, Charlie Munger, made one of his typically-pointed analogies in a speech at Harvard University in 1995, which he called The Psychology of Human Misjudgment:

"I am very interested in the subject of human misjudgment, and Lord knows I’ve created a good bit of it ...

... the human mind is a lot like the human egg, and the human egg has a shut-off device. When one sperm gets in, it shuts down so the next one can’t get in. The human mind has a big tendency of the same sort. And here again, it doesn’t just catch ordinary mortals; it catches the deans of physics. According to Max Planck, the really innovative, important new physics was never really accepted by the old guard. Instead a new guard came along that was less brain-blocked by its previous conclusions."

When I listen to fund manager presentations and their stock stories, I try to determine if they have fallen in love with a stock. If they espouse its wonders with little mention of its shortcomings, and then express frustration that the market simply does not understand, it's time to dig a little deeper.

But there's a perverse problem faced by some funds due to the behaviours of their investors, especially selling when the market is low and buying when it is hot. Open-ended funds may be forced to buy or sell by the applications and withdrawals of their clients, even against the preferences of the fund manager. I recently invested in a low-profile fund where I was required to submit my investment beliefs in advance for approval, to convince the manager that I was not flighty and would take a long-term perspective. His fund is now closed to new members and old ones rarely leave.

In The Wall Street Journal, Jason Zweig writes:

"The typical fund returned an average of 7.7% annually over the three decades, after fees. Fund investors, however, earned only 6.9% annually because of their chronic compulsion to chase hot performance and flee when it goes cold.

Such buy-high-and-sell-low behavior tends to flood fund managers with cash at times when stocks have already risen in price, and to force the funds to sell stocks after a decline. The managers can perform only as well as their worst investors allow them to."

Most fund managers are so desperate to build their funds that they will take money from anyone. I admire the manager who made me qualify to invest as there is some truth to this "managers can perform only as well as their worst investors allow them to." To the extent it can be controlled, such as a fund manager accepting a large institutional mandate, it's vital to ensure everyone understands the types of market that suit the manager's style. Nobody should allocate to an active manager with anything short of a five-to-eight-year horizon.

In an article this week, author and portfolio manager Joe Wiggins asks why both investors and fund managers do not focus on skill more often, relying more on easier discussions about performance outcomes and stock stories than a proof of the special abilities of the manager.

Even when results are good, it might be a fortuitous moment in time and circumstances can easily change.

***

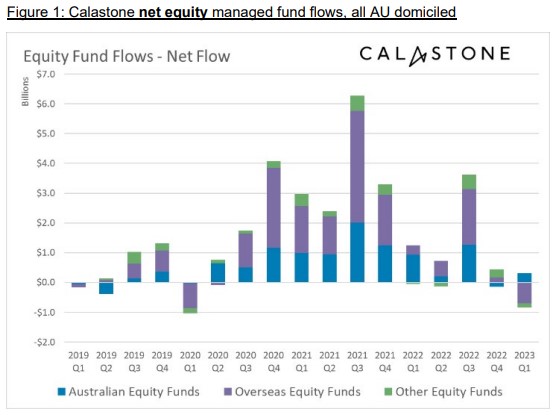

Regardless of the evidence that picking the market is usually a fruitless exercise, investors are reacting to the current global uncertainty, and missing the strength of the stockmarket in 2023. Calastone (over 95% of Australian managed fund flows pass across their network each month) reports Australian investors pulled a net $516 million from managed equity funds in Q1 2023, the worst outflows since Q1 2020. However, domestic equities saw inflows while funds investing overseas lost capital, and fixed income funds saw inflows in January and February turn to profit-taking in March.

Teresa Walker, Managing Director at Calastone, said:

“Australia’s stockmarket is performing in line with its global peers, yet investors drew a marked dividing line in Q1 between home and abroad."

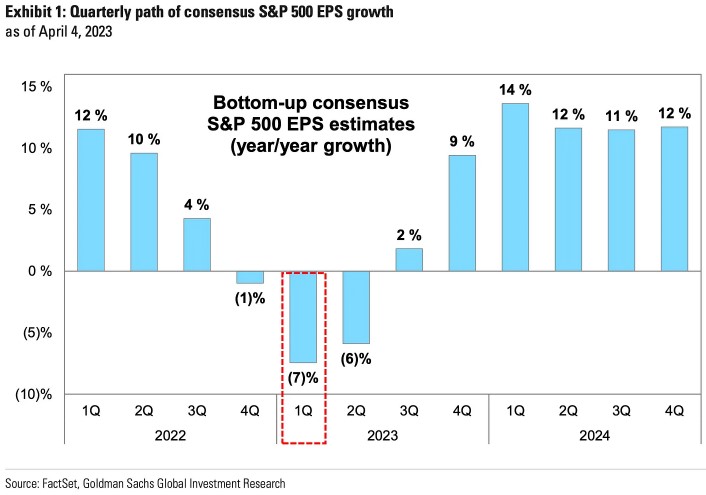

Investor caution is driven by doubts about global corporate earnings and a stubborn US Fed determined to continue raising rates to kill inflation, and likely push the economy into a recession. Rates have increased at the fastest pace since the 1980s and something more than a few small US banks will break before this cycle is over. The Goldman Sachs chart below of consensus Earnings Per Share (EPS) suggests most of 2023 will not be good but investors need to be ready for a 2024 recovery. Not that investors should be encouraged to time the market, which does have a remarkable capacity to look through near-term problems to the future prospects.

***

My article dives into the rules imposed by ASIC on financial product providers under the Design and Distribution Obligations, and why they are denying investors (retail and wholesale) the ability to participate in rollovers of investments they have held for many years. Surely this was not an intended consequence, and changes are suggested.

Graham Hand

Also in this week's edition ...

Meg Heffron's monthly column unpacks the increasingly-important Total Superannuation Balance (TSB). While it's a term that may sound self-explanatory, it's anything but and will become a crucial number for many if the proposed new tax on those with more than $3 million in super is introduced.

It was notable this week that CEO of the SMSF Association, Peter Burgess, issued a statement saying:

“The proposed model has been designed for APRA regulated funds, yet three-quarters of the estimated 80,000 members being impacted are SMSF members ... It is unfair that SMSF members with balances above $3 million will be required to pay tax on unrealised gains because some APRA regulated funds may find it difficult to report the taxable earnings attributable to members ... With minor system and reporting changes, the SMSF sector, and we understand some APRA regulated funds, can report a member’s actual taxable earnings to the ATO on an annual basis.

So, we are asking the Government to give these funds the opportunity of reporting actual earnings rather than the proposed model which would calculate earnings based on the movement in the member’s total super balance and, which by definition, includes unrealised gains."

Jim Chalmers is only a few weeks away from delivering his second Budget, and Peter Martin reports on a survey of 59 leading economists on the policy changes he should adopt if efficiency and equity ruled over politics. Of course, most of these changes will not be mentioned on 9 May but it does show where billions in extra revenue are buried in our tax and concessions system.

For many, the active versus passive debate can be divisive - you’re either one or the other. But Shane Woldendorp from Orbis says both approaches have their strengths and weaknesses, which suggests that perhaps the answer is to create a blended approach. Shane provides actionable advice about how to do this.

As more Australians return to international travel and hold their investments in unhedged global funds or stocks, the level of the Australian dollar increasingly affects returns and money in the pocket. The currency has fallen against the US dollar in recent years but Andrew Canobi of Franklin Templeton sees reason for strength in 2023.

In the face of rising economic risks, switching money into bank deposits may be the first thing that income-oriented investors think of. Andrew Lockhart of Metrics Credit Partners says there may be better options. He says private debt can provide reduced capital volatility and reliable income, but also attractive risk-adjusted returns that are linked to inflation.

Two extra articles from Morningstar for the weekend. Russel Kinnel describes the mistakes which result in investors underperforming the funds they invest in, and Joshua Peach looks at three high-profile takeovers in Healius, Newcrest and InvoCare to see if shareholders are receiving a good price.

In this week's White Paper, Neuberger Berman checks why markets did surprisingly well in Q1 2023 but the investment team considers Fed actions to control inflation will likely push the economy into recession and hit corporate earnings.

***

Weekend market update

On Friday in the US, stocks went sideways to wrap up one of the duller trading weeks in recent memory. Treasury bond finished a little weaker with two- and 30-year yields each rising marginally to 4.17% and 3.78%, respectively. WTI crude edged back towards $78 a barrel and gold slipped below US$2,000 per ounce. The VIX retreated to below 17.

From AAP Netdesk:

The local share market finished modestly lower on Friday, snapping its streak of three weekly wins. The benchmark S&P/ASX200 index finished down 31.8 points, or 0.43%, to 7,330.4, while the broader All Ordinaries ended 32.4 points lower, or 0.43%, to 7,523.

The mining sector was again the worst laggard for a second day, falling 1.5% as both BHP and Rio Tinto released quarterly production updates. BHP fell 2.3% to $45.02, Rio Tinto dropped 2.8% to $117 and Fortescue Metals retreated 4.2% to $21.49 in FMG's worst daily losses since late February.

In the heavyweight banking sector, Westpac fell 1.2% to $22.29, ANZ dipped 0.5% to $24.33, while CBA and NAB both lost 1.1% to finish at $99.80 and $22.29 respectively. Also, Bank of Queensland dropped 5% and Bendigo and Adelaide fell 2.2%, while Virgin Money UK dropped 2.4%.

Whitehaven Coal was the biggest gainer among big companies, rising 5.9% to $7.38 after announcing it had $2.7 billion in the bank as of March 31 after making $1.2 billion in coal sales during the quarter, and was preparing to resume its share buyback program next week.

Woodside was flat at $33.69 as the energy giant reaffirmed its full-year production guidance despite announcing that its March quarter production was down 9% quarter-on-quarter due to planned turnaround and maintenance activities.

Looking forward, next week the market will be closed on Tuesday for Anzac Day. Then on Wednesday the Australian Bureau of Statistics will release Consumer Price Index data for the March quarter, which will be closely watched as a key indicator for whether the RBA will resume raising interest rates at its next meeting on May 2.

From Shane Oliver, AMP:

Global share markets were mixed and mostly little changed over the last week amidst mixed economic data. US shares fell 0.1% for the week but Eurozone shares rose 0.3% and Japanese shares rose 0.2%. Chinese shares fell 1.5% though. Australian shares fell 0.4% with falls in resources stocks offsetting gains in finance, industrial and property shares. Bond yields rose, but oil, metal and iron ore prices fell. The $A fell slightly with a slight rise in the $US.

Inflation pressures are continuing to recede. Following the fall in US inflation for March, inflation data in Canada, New Zealand and to a lesser extent the UK all fell in March and by more than expected in Canada and New Zealand. The plunge in tradeable inflation (goods and services that are imported or in competition with imports) in New Zealand suggests reasonable prospects for a similar fall in Australia.

Some change coming to the way the RBA does things following the independent review. But it won’t change the RBA’s focus or what happens to interest rates. Looking at the key recommendations:

- The RBA has already been targeting both price stability and full employment under Governor Lowe – which partly explains why it’s been less aggressive in raising rates than other central banks.

- Its not clear that switching to regular press conferences and commentary from external Monetary Policy Board members will add much except more noise and potentially confusion around RBA decisions (as seen in other countries like the US) and the RBA already supplies a lot of information (maybe too much).

- Removal of the “on average, over time” reference to the inflation target with the RBA explaining “how it is using its flexibility” may make the RBA less tolerant of short-term deviations from the inflation target and so could result in more aggressive and volatile moves in interest rates posing a greater threat to full employment.

- Switching to less meetings may contribute to better quality decisions, but it may also make the RBA less agile, reduce “announcement effects” and necessitate bigger moves.

- The potential for external members to outvote the RBA members on the Monetary Policy Board could create confusion and actually reduce formal RBA accountability.

- At a high level it's questionable whether moving to the separate Monetary Policy Board, less meetings, more press conferences and more speakers model employed in several other countries is justified when those countries have not necessarily achieved better economic outcomes than the RBA.

- Overall, the recommended changes if fully implemented are unlikely to have a significant impact on the outlook for monetary policy. In particular, there is nothing in the recommendations pointing to a less hawkish RBA that some may have been hoping for. Don’t forget that there are plenty of other central banks - in the UK, NZ, Canada and the US - that have separate monetary policy committees, less meetings and press conferences after each meeting, but which have actually been more aggressive and arguably less balanced in raising interest rates than the RBA has!

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website