The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Every country develops differently. Each takes a unique path guided by its leaders, its institutions, its people, its rules and regulations, its taxes and incentives and ... that awkward word bandied around which is difficult to define ... its culture. In last week's release of the Reserve Bank Review, the most informative sections are not about the marginal changes in the number of economists involved in setting interest rates. The preoccupation with this headline-grabbing change is misplaced.

Rather, it is the description of the culture of the central bank which is most revealing, defined as follows:

"High-performing institutions have a culture that is aligned with their strategic direction. Culture is the shared values and beliefs that guide how members of an organisation approach their work and interact with each other (Department of the Prime Minister and Cabinet 2019). It lies at the heart of how organisations work. Important drivers of culture include the structure, systems (including governance), organisational policies and leadership of the organisation. Strategy focuses the organisation’s actions and decision making."

A substantial section of the Review is devoted to culture, and there are so many criticisms of leadership styles and hierarchy that it is difficult to see how Philip Lowe, at the Reserve Bank for 43 years and Governor since 2016, can implement the changes required. The Review even describes confusion between responsibilities for monetary policy and running the institution:

“formal roles and responsibilities relating to risk governance are somewhat unclear, with responsibility split between the Governor, the Reserve Bank Board and the Payments System Board.”

The interviews with staff identified:

"- risk aversion, which in this context shifts accountability or blame for potential mistakes

- lack of clear accountability

- a culturally ingrained deference to authority

- incentives that reward individuals for analytical output and those who appear to be across technical issues, resulting in resistance among some managers to genuinely delegate and empower team members.”

The Review also says decision-making is "highly concentrated in the Governor with limited board oversight” and:

"The Reserve Bank Board has not voted against a recommendation of the RBA executive in at least the last decade."

We focus on this most important part of the Review, the Reserve Bank's 'culture club', where decisions are made at the top and different views are discouraged. Philip Lowe wants to stay as Governor when his term ends in September 2023, and while he may be asking (to quote Boy George) "Do you really want to hurt me?", Treasurer Jim Chalmers is most likely to respond “Precious people always tell me that’s a step, a step too far."

A second article this week also dives into the Reserve Bank Review from a different perspective than other parts of the media, and while no less critical, disagrees with my article on the merits of some changes. You be the judge. Isaac Gross from Monash University is especially scathing of the lack of oversight by the Board, and the quality of its decisions, quoting:

"The Reserve Bank Board did not receive any written briefings proposing calendar-based forward guidance before it was introduced by the Governor in a speech in mid-October 2020."

As an aside, we have received several comments saying that while the Reserve Bank was wrong to hold rates low until May 2022, nobody was criticising them in late 2021. I'd like to point to at least one piece I wrote on 2 December 2021:

"Prudential regulators allowed the market to run too strongly over late 2020 and this year with 2021 house prices up around 26% in Sydney, Brisbane and Canberra. Financial stability should not be a boom and bust which pushes thousands out of the housing market while making others even wealthier, and encouraging those who enter the market to take on vast amounts of debt and struggle to withstand rate rises."

France protests, Australia relaxes on age pensions

While we are looking at culture, it is now a notable point in time when the eligibility for the age pension in Australia is about to increase to 67 (for people born after 1 January 1957) with few if any protests, while there is massive disruption and property damage in France as President Macron pushes through an increase in eligibility age from 62 to 64. We are running a quick survey question on why the French are protesting while Australians are sanguine. Are we more American than European in our commitment to work harder and longer?

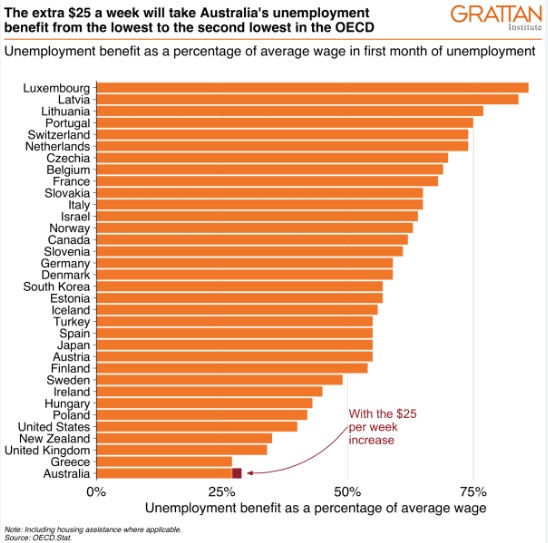

And we've thrown in a third question, which asks about a suitable level of unemployment benefit (JobKeeper or the dole) in Australia.

It's strange that a Labor Government, able to find funding for submarines, missiles, a football stadium in Hobart, war memorials, art galleries, Stage 3 tax cuts ... they seem to announce a new spending programme every day ... plays hard ball on unemployment benefits. The Government's own Economic Inclusion Advisory Group recommended that JobSeeker increase to 90% of the age pension from 60%, a rise of $18 a day. Former Treasury Secretary Ken Henry calls the current rate 'cruel'. The Australian Financial Review reports:

"Four federal Labor MPs have broken ranks to join calls for the government to increase the JobSeeker payment by $24 billion (over four years) at next month’s federal budget. The move came as the Government hinted it may increase the $50-a-day payment by a little in the May 9 budget, but not to the levels demanded by the welfare sector."

A Resolve Strategic Poll in Nine’s Sunday papers last weekend found on raising the amount paid to unemployed people: 43% support, 31% oppose, 26% undecided. Let us know what you think in the third question in our survey. If Grattan's numbers are correct, we seem mean on global standards, although international comparisons are notoriously difficult. Is this a reflection on the Australian 'culture'?

Three more significant charts this week.

We have previously highlighted the fall in money circulating in the system and its impact on inflation, economic activity and interest rates, and levels we are now seeing normally lead the major slowdowns.

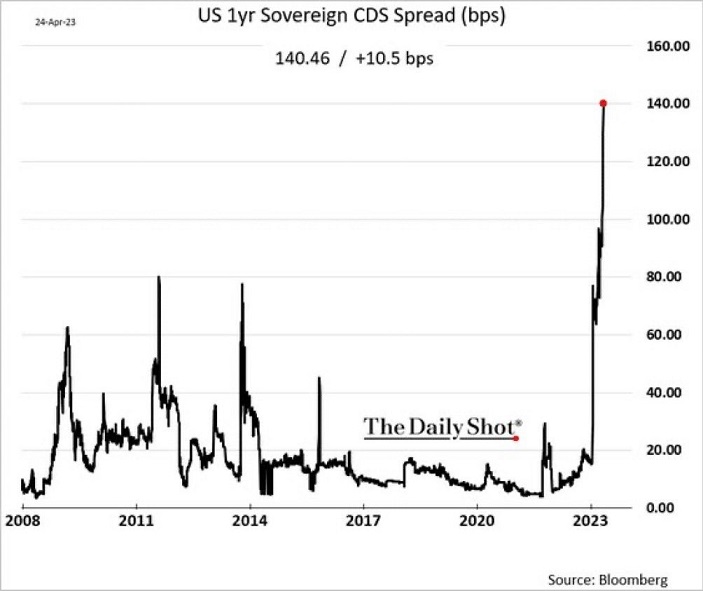

And we have never seen traders willing to pay so much (1.4%) on a Credit Default Swap (CDS) to protect against the US Government not meeting its debt repayment obligations as they fall due. This is not a highly liquid market compared with the US Treasury market, but it reflects concerns about the political impasse on the US debt ceiling, which is usually worked through.

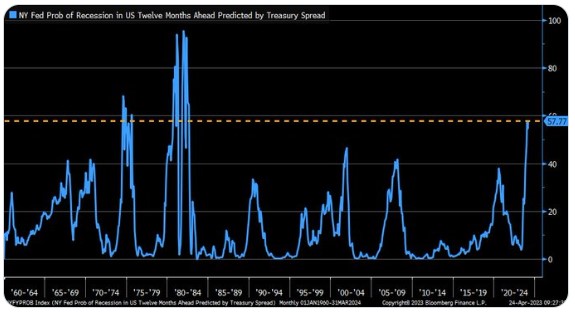

Finally, the Federal Reserve Bank of New York (one of the 12 Federal Reserve Banks in the US) runs a recession probability model and it is now at its highest since 1982. A cheery thought to end on.

On the Reserve Bank meeting next week to decide on the cash rate, economists seem split 50/50 on whether this week's fall in inflation is enough to continue the pause. Either way, the current cash rate is 3.6% and the three-year bond rate is below 3%, so the market thinks rate reductions are only a matter of time.

Graham Hand

Also in this week's edition ...

We lead this week with James Gruber, who asks the question: should you give your children their inheritance before you die? It's a touchy subject that’s likely to get discussed more often as Baby Boomers in Australia grow older, die richer, leave behind larger bequests and the Bank of Mum and Dad is required to finance more homes. James investigates the pros and cons of the debate, including a review of a recent book advocating that people should ‘die with zero’.

There’s nothing income-oriented investors love more than high-yielding stocks, although Karen Watkin and colleagues at AllianceBernstein warn that these stocks may not offer the best returns through the market cycle. Traditional dividend stocks tend to be more defensive, with relatively stable business models and stronger balance sheets. These are great qualities during periods of market stress yet not as beneficial when markets turn.

Superannuation has been receiving plenty of negative press recently, but Ross Clare and ASFA suggest it’s serving Australia well. It’s substantially improving retirement incomes for nearly two million retired Australians by providing regular income streams. And it's also easing the burden on the government to fund retirements.

A recent Treasury Department statement on tax spending includes franking credits, which may be a coincidence or something more ominous. Tony Dillon isn’t sure which, yet he makes the case for why the Labor Government shouldn't target refundable franked credits to raise revenue.

Two extra articles from Morningstar for the weekend. Joshua Peach looks at three ASX stocks that fund managers are buying, while Abhinav Davuluri highlights a wide-moat US-listed tech stock that's still cheap even after a 60% rally.

And in this week's White Paper, Magellan Asset Management outline why it's bullish on US payments heavyweight, Mastercard.

***

Weekend market update

From AAP Netdesk:

The local bourse snapped its longest losing streak in 10 months after better-than-expected earnings reports from US tech titans, even as economic data painted a gloomy picture for the world's biggest economy. The benchmark S&P/ASX200 index on Friday finished up 16.5 points, or 0.23%, to 7,309.2.

The real estate sector was the biggest gainer, rising 1.1%. Mirvac climbed 3.4% to a nearly two-month high of $2.41 as the property developer said it had retained 97.5% occupancy across its portfolio in the March quarter.

In tech, Megaport had soared 41.5% to a nearly two-month high of $5.63 after the cloud computing company announced its attempts to right-size its finances were paying off, and it now expects to make around double the consensus expectations of $9 million for 2022/23.

In the heavyweight financial sector all of the Big Four banks were higher.

ANZ added 1% to $24.35, Westpac climbed 0.9% to $22.47, NAB grew 0.4% to $28.84 and CBA finished 0.3% higher at $99.36.

The materials sector closed up 0.5%, with gains for the iron ore giants and lithium miners but losses for most goldminers. BHP added 0.2% to $44, Fortescue climbed 0.4% to $20.94 and Rio Tinto edged 0.1% higher at $112.25.

Lithium miner Pilbara finished up 7.1% to $4.24 on a quarterly update, while Northern Star ended down 3% to $13.46 as gold prices slipped on the prospect of another rate rise.

Coles fell 1.4% to $18.20 as the supermarket giant reported third-quarter group sales rose 6.5% to $9.7 billion, in the final set of results for CEO Steven Cain before he's replaced by Leah Weckert.

From Shane Oliver, AMP:

Global share markets were mixed over the last week with US shares initially down but then boosted by tech sector earnings to be up 0.9% and Japanese shares rose 1%, but Eurozone shares fell 0.9% and Chinese shares fell 0.1%.

Shares have had a good start to the year – with global shares up 8.5% and Australian shares up 3.8% - and falling inflation is a big positive, but the going may get a bit rough over the next few months. Bank stress is continuing to impact in the US with concerns about First Republic escalating again suggesting the issue may still not be contained, the US debt ceiling issue is starting to hot up, inflation likely won’t fall in a straight line, recession risks remain high and the period from May to September is often rough for shares.

Australian shares are likely to be caught up in this as the recovery in China is so far less commodity intensive than thought earlier this year which partly explains the local market’s relative underperformance so far this year. Investor concerns about the need to raise the US debt ceiling are likely to escalate.

Following significant falls in inflation in the US, Canada and New Zealand, Australian inflation is now also falling, adding to confidence we have seen the peak. CPI inflation fell back to 7%yoy and trimmed mean inflation fell to 6.6%yoy with both below RBA forecasts. While another RBA hike on Tuesday can’t be ruled out given RBA concerns about wages growth and faster population growth adding to housing related inflation and rising wealth, on balance we expect the RBA to leave rates on hold for May. Either way, from later this year or early next we anticipate rate cuts to deal with a slowing economy.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website