The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

We all look to the leading intellects of investment management for lessons, including the legendary names such as Warren Buffett, Peter Lynch, Benjamin Graham, Jack Bogle, Terry Smith, Abby Cohen, Joel Greenblatt, Howard Marks and Charlie Munger. While they are consistent in many messages - the merit of investing for the long term and ignoring short-term noise is common - there are also significant differences. Who should we believe?

There is an excellent new interview with Oaktree's Howard Marks which challenges some of his contemporaries. He contradicts the famous Warren Buffett quote of:

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Or this:

"All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies."

Entire fund manager careers have been built on this simple belief. Just buy great companies. Terry Smith is less well known to Australians but he is the founder of Fundsmith and manages US$24 billion, and he uses a simple three-step investment strategy:

1. Buy good companies

2. Don’t overpay

3. Do nothing

Starting with good companies sounds obvious. Then Marks comes along and says that for a long time, his investing success has not depended on the quality of the company but the price paid for it:

"Now I’m investing in the worst public companies in America, and I’m making money steadily and safely. So this was really formative for me. What does it teach you? It’s not what you buy, it’s what you pay. That investing success doesn’t consist of buying good things but buying things well." (my bolding)

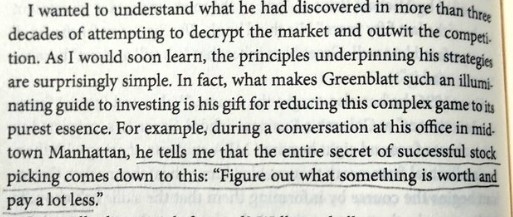

Marks is not alone. In his 2021 book, 'Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life', William Green writes about meeting billionaire hedge fund manager, Joel Greenblatt:

It's not as explicit as Marks in buying a poor company, but there's nothing there about buying a good one, just a cheap one. It's supposed to be that simple.

However, the problem for most investors taking the Marks and Greenblatt approach is that it is difficult to calculate what a company is worth. While Buffett appreciates the logic of comparing the intrinsic value with its market price, he recognises its limitations:

"Anyone calculating intrinsic value necessarily comes up with a highly subjective figure that will change both as estimates of future cash flows are revised and as interest rates move."

Which is why investing is more art than science despite fund managers spending their lives studying and learning and (mostly unsuccessfully) trying to outperform the market.

***

Contrary to popular belief, the stockmarket does not have a loser for every winner. Over the long term, the stockmarket is a positive-sum game. The average annual return on Australian shares in the last 100 years is about 11%. It's not a zero-sum game where all the gains and losses of all participants add to zero because the market increases in value over time as company profits grow.

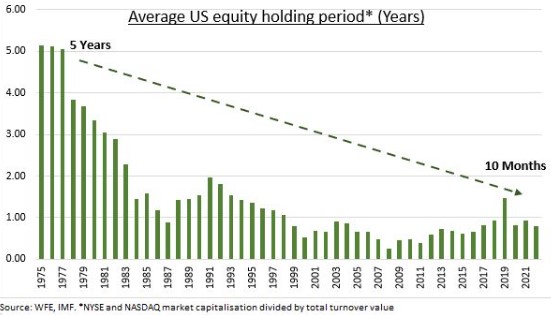

But not everyone is a long-term investor, and a minority set-and-forget. The average holding of US equities has fallen dramatically, from five years in the 1970s to only about 10 months now (and other New York Stock Exchange data suggests it could be as short as six months). Investors buy and sell as they react to headlines, and as Buffett also says:

“The stock market is a device for transferring money from the impatient to the patient.”

There are millions of participants every day buying and selling for different reasons, so why does the market rise and fall? One popular explanation is 'more buyers than sellers', such as when the rotation from low-yield bonds to stocks brought new money into equities in 2020 and 2021. But in 2023, flows to fixed interest have been strong, and yet the equity markets, particularly in the US, have risen.

Tobias Levkovitch of Citibank recently wrote about "The Invisible Buyers":

"The stock market is not a zero-sum game. There's a mistaken tendency to think that a dollar that leaves the equity market translates into a dollar less in the stock market. Equity prices often move on a change in perception typically caused by an upside earnings surprise, a takeover announcement, lowered guidance, etc., such that double digit changes can occur without a single dollar even changing hands at that moment. Hence, while flows matter, they aren't everything one should consider. Other facets can be as crucial to the understanding of likely stock price direction including economic trends, investor sentiment, valuation and the attraction of competing assets."

Long-term holders do not need to buy and sell continuously to do well. It's better to enjoy the gains of the market rising over time. But the market's trading is not predominantly made up of these long-horizon portfolios such as pension and superannuation funds, plus asset managers and individuals adjusting their portfolios based on calculations of intrinsic values versus market prices.

About 70% of market turnover is estimated to come from high-frequency trading (HFT) and day traders, in and out on the day based on algorithms or trading systems looking for daily wins without leaving exposures overnight. Here, the winners and losers generally cancel each other out.

And when a fad hits the market, such as the current focus on AI, the momentum takes on a life of its own. It is supported by social media and frenzied news stories about the gains in Nvidia or Microsoft and everybody wants a slice of the action. Even when the market's overall economic fundamentals are poor, such as facing signs of a recession and higher interest rates, the market can still rise. It has happened before and it will happen again.

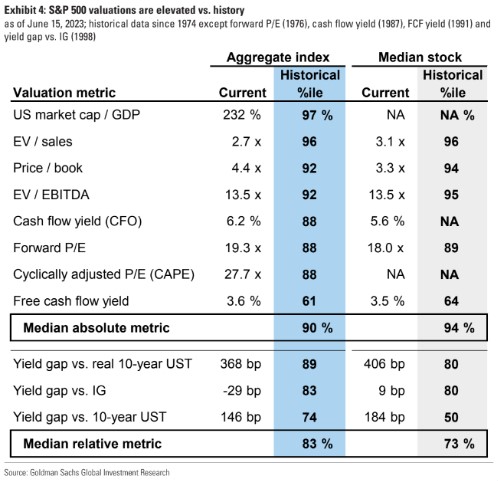

This chart from Goldman Sachs shows despite the uncertain outlook, most valuation metrics for the S&P500 are currently around the 90th historical percentile, indicating it is expensive and vulnerable to mean reversion.

But algorithms don't care. Once an algorithm detects a trend, the computers pile in until the trend shows signs of failing, and it can come down as quickly as the sell orders hit. A few people might calculate a value of an AI winner based on its intrinsic value but for most trades, it's irrelevant.

How does an algorithm work? There are many styles, such as HFTs arbitraging in large volumes for small gains, moving averages, mean reversion models and trend followers. When I worked at Colonial First State, I brought Aspect Capital to the Australian market, a managed futures fund with highly-sophisticated algorithms detecting trends in any market (stocks, bonds, commodities ... you name it) and following the trend. While long-term results are good, it often wins big but also loses if the trend suddenly reverses. It does not care about macro or company valuation factors, other than minor adjustments in its model.

One advantage of algorithms is the removal of some of the emotion from trading, as the machine consistently applies the investment theory. Nobody needs to follow each stock as the computer automates execution and monitoring. That's the main short-term competition, not a person who calculates an intrinsic value after a month of company research and meetings. It's little wonder the market overreacts on the upside and downside when the reaction is programmed into thousands of computer systems.

***

It's tax time, and laws on calculating capital gains are generous in allowing taxpayers to select from a range of cost prices and it's a gift which is costing the budget billions a year.

Also, with inflation high and indexing of pension eligibility levels next week, many more people will qualify for at least a part age pension, with assessable assets for a couple nearing $1 million. Even if the pension itself is not significant, the pensioner concession card might be.

And farewell to Nobel Laureate Harry Markowitz, who died last week at the age of 95. I interviewed Harry a few times in California in 2013 and 2014 at the Research Affiliates Advisory Panel Conference. We have a special tribute from Rob Arnott, Chairman of Research Affiliates and long-term friend and colleague of Harry. My favourite moment with Harry came during a lively confrontation with fellow Nobel winner, Vernon Smith. Harry listened patiently while Smith explained an economic theory, until Harry could not take it any longer:

"Now we know why you won your Nobel Prize. Let me show you why I won mine."

And then he regaled us with numbers and proofs and theories, none of which I understood, but then I was the only person in the room without a PhD.

***

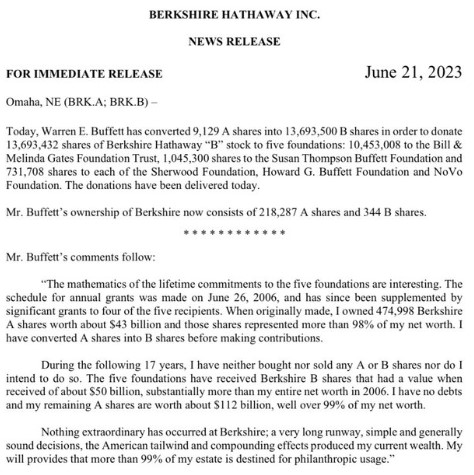

Check the latest step in Warren Buffett giving away nearly all his wealth. The value of Buffett's Berkshire shares in 2006 was US$43 billion or 98% of his net worth. Over the following 17 years, he has donated shares worth US$50 billion when received by charities, and yet his current Berkshire holding is worth US$112 billion and over 99% of his net worth. And his wife still gives him a few dollars to go to McDonalds on his way to work each day.

Graham Hand

Also in this week's edition ...

Ausbil's Paul Xiradis has managed an active Australian large-cap investment strategy for over 25 years and here he offers tips on how to find the best of the ASX's larger companies. He also details how his large cap portfolios are positioned now.

Although Australia does not have a death or inheritance tax as such, there is a de facto version when a superannuation death benefit is paid to the independent adult children of a member. Michael Hallinan of SUPERcentral explains when a 'death bed withdrawal' might be effective.

The 60/40 portfolio has come in for plenty of criticism given its poor performance last year. As we near the half way point of 2023, GSFM's Stephen Miller gives an update on the merits and weaknesses of the portfolio. He says it can still serve international investors well, though Australian investors would be better advised to tweak the strategy.

Many investors are excited by companies with direct exposure to popular themes such as AI and data. But what about the companies that are using these things to take their businesses to the next level? Francyne Mu of Franklin Templeton analyses three companies that are leveraging AI and data to become global powerhouses.

Our Wealth of Experience podcast is back, this time with special guest, Morningstar Global CIO Dan Kemp. He tells us the key pillars for investors to build resilient portfolios, including having the right asset mix, good advice, and staying the course. From our regulars, Graham discusses capital gains tax and the major implications of the Reserve Bank Review, while Peter offers four of his favourite market themes.

Two extra articles from Morningstar for the weekend. Shani Jayamaynne highlights three top picks from Morningstar investor subscribers, Joshua Peach looks at four stocks to avoid at current prices.

***

Weekend market update

On Friday in the US, there was a big rally into quarter end. Stocks climebed 1.2% on the S&P 500 to leave the broad average higher by 16.4% at the halfway point of 2023, while the Nasdaq 100 has logged a 37% uptick following Friday’s 1.54% move, marking its best first half on record. Long dated Treasurys caught a bid with the 30-year yield dropping seven basis points to 3.85%, though the two-year remained at its 4.87% multi-month highs. WTI crude climbed above US$70 a barrel and gold crept towards US$1,930 per ounce. The VIX descended to just above 13, down nearly 10 points from the end of last year.

From AAP Netdesk:

In Australia, the local share market closed the first half of the calendar year in the green, but inflationary pressures and the risk of recession bring ill portents for investors.

The benchmark S&P/ASX200 index on Friday finished up 8.4 points, or 0.12%, to 7,184.1, while the broader All Ordinaries rose 11.9 points, or 0.16%, to 7,401.5.

The bourse is up 2.3% since the beginning of 2023 but in the last three months has bounced around listlessly between resistance at 7390 and support at 7055.

The majority of the 11 official ASX sectors gained on Friday with only consumer staples, health care and real estate in the red.

Information technology stocks were the pick of the day, up 0.83% on average. Family tracking app Life360 jumped 3.8% to a one-year high of $7.60, while Xero ascended 1.4%.

Of the heavyweight miners, BHP edged up 0.1% to $44.99, Rio Tinto rose 0.2% and Fortescue Metals finished 0.3% higher.

The big banks were mixed with CBA and NAB up 0.2 and 0.1% respectively, while Westpac dropped 0.4% and ANZ finished flat.

Downer EDI rose 4.3% to a six-month high of $4.11 after sealing a $4.6 billion contract with the Queensland government to design and manufacture 65 six-car trains for the state's new passenger fleet.

Worley rose 1% to $15.79 after the energy and resources consultancy announced the appointment of former Chevron vice president Joe Geagea to the board.

AGL climbed 0.8% despite the Australian Energy Regulator launching Federal Court proceedings against the company for failing to provide backup electricity services at its Bayswater and Loy Yang A generators between 2018 and 2020.

Bubs recovered from falling 5.6% by lunchtime to finish flat after the baby formula maker lowered revenue forecasts for its China business.

Storage King owner Abacus fell 3.2% after going ex-dividend, while plus-size fashion brand City Chic soared 15.2% to 38c.

Cancer immunotherapy developer Imugene jumped 2.3% to 9.1c after its HER-Vaxx therapy was found to have induced antibodies correlated with tumour reduction, resulting in "statistically significant overall survival benefit".

Vegemite maker Bega Cheese hit a decade low of $2.85 as traders continue to abandon the stock following a disappointing trading update on Tuesday.

Link shares tumbled 13.9% after the financial services technology provider announced its contract with superannuation fund HESTA would not be renewed.

From Shane Oliver, AMP:

- Global share markets mostly rose over the last week supported by resilient economic data in the US, lower inflation readings and nothing new from central banks. For the week US shares rose 2.3%, Eurozone shares rose 2.8% and Japanese shares gained 1.2%, but Chinese shares fell 0.6%. Reflecting the positive global lead along with lower-than-expected monthly Australian inflation data the Australian share market rose 1.5% over the last week with gains led by IT, property, consumer discretionary and energy shares. Bond yields rose. Oil prices rose but metal and iron ore prices fell. The $A also fell slightly, while the $US was flat.

- The 2022-23 financial year saw a solid rebound in superannuation returns (of around 8-9%) after the negative returns of the prior year as global and Australian shares rebounded on signs that inflation has peaked, central banks may be near the top on rates and as worries about the war in Ukraine receded. Global shares returned around 16% or around 18% once dividends are included and Australian shares rose 9.7% or about 14% allowing for dividends. And Australian bond returns look to have been modestly positive as bond yields settled down, after last year’s losses. The relative underperformance of Australian shares kicked in over the last six months and reflects a combination of increased hawkishness on the part of the RBA and concerns about the strength of the recovery in China.

- We continue to see shares doing okay on a 12-month view as central banks ease up as inflation cools but the risk of a near term correction is high. Leading economic indicators continue to point to a high risk of recession in the US and the risk of recession in Australia is now around 50%. China’s recovery is looking less robust than expected and policy stimulus there so far has been pretty modest. Central banks are probably close to the top but they remain hawkish with a high risk of going too far. And while the month of July is often good for shares (particularly in Australian shares after June tax loss selling is reversed) the period out to September-October is often rough for shares.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website