The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Last Friday, a faulty software update from Crowdstrike led to a glitch in millions of Microsoft Windows systems worldwide. The so-called “blue screen of death” grounded planes in Los Angeles, disrupted doctors in the UK and, for reasons I still don’t understand, meant I wasn’t allowed to add a tip onto my card payment at dinner on Saturday night.

The effect on my life has been minimal. In fact, I made a rather guilty gain from it all. But the situation served up a reminder of how connected our world has become. And how our world’s complete and utter reliance on technology – not just one layer of it, but several interconnected layers of it – can suddenly leave us helpless.

99% of the time, the systems we have gravitated to have clear advantages. Paying with Apple Pay is easier than cash. Using Google Maps beats carrying an A-Z around or, heaven forbid, asking a stranger for directions. Storing patient records in the cloud means you don’t need as many servers on site. Or as many IT staff to look after them.

It is all fantastically efficient until it isn’t. What if the card terminal loses connection? What happens if your phone battery dies at a time where you really need directions? What if one of your software provider’s software providers has an outage?

Tech is great. But having a low-tech backup at your disposal might also be great. Before Saturday, the concept of cash was nearing the point of being dead to me. “The Outage” has made me consider carrying a few notes in my wallet, just in case.

***

Speaking of alternatives to tech, one downfall of the internet is that the algorithms delivering you content quickly latch on to what you click and spend most time reading. Once the algorithm works you out, most content you see will conform to your bias. It creates a kind of echo chamber.

Most of the macro content I consume (and see) has a bearish bias. One reason for this might be that most of my early reading was at the Benjamin Graham, Marc Faber and John Galbraith (writer of A Short History of Market Euphoria) end of the spectrum.

I am naturally disposed to think the next crash is coming soon and that I should act accordingly, a disposition compounded by any algorithm I influence. The problem with being bearish is that it can leave you without enough exposure to things going well. And in market history things have mostly gone well.

For that reason, getting out of the filter bubble can be useful. That requires you to make a conscious effort to read things and consult sources you might not see otherwise.

I brought up the idea of social media echo chambers because I think they could explain and sustain big shifts in the way people are investing.

A recent report into America’s wealthy and their investing habits from The Bank of America’s private bank shows a big generational divide. Not only in regards to asset classes preferences, but in where different generations of investors consume financial information. I think the two are linked.

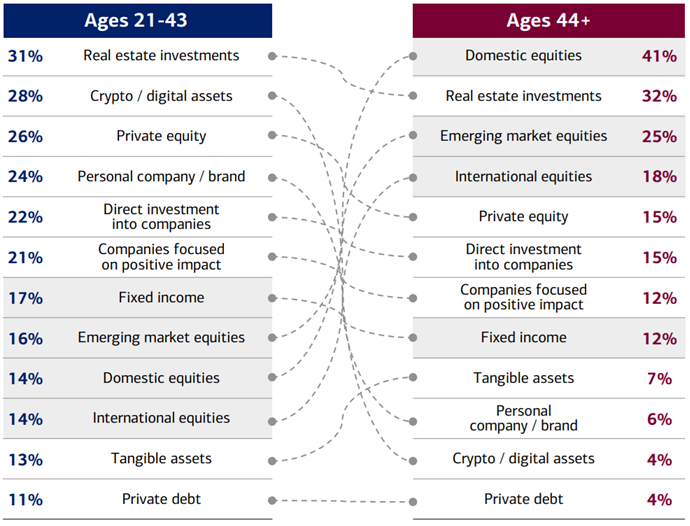

Here are the assets held by each generation (in any amount at all, not in terms of a % allocation):

Source: 2024 Bank of America Private Bank Study of Wealthy Americans

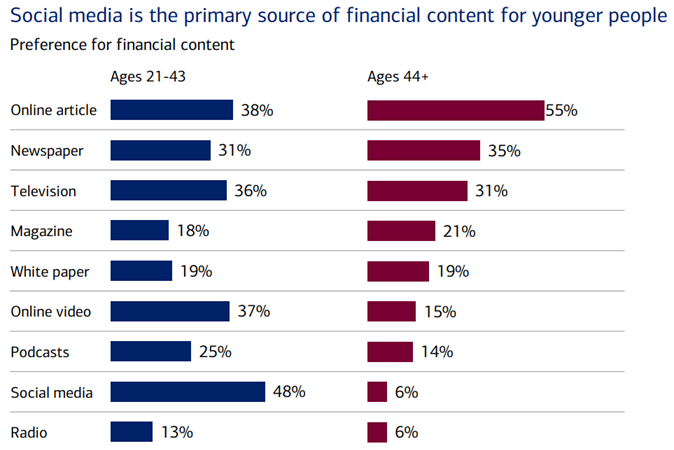

And here is where wealthy US investors prefer to get investing content:

Source: 2024 Bank of America Private Bank Study of Wealthy Americans

I will use crypto as the most obvious and extreme example.

28% of the wealthy 21–43-year-olds in BoA’s study own crypto or digital assets versus 4% of the 44+ group. The latter matches with our Firstlinks customer survey, where 95% of the respondents in our latest survey were 45 or older. Less than 5% of you own cryptocurrency and over 85% of you have no intention to.

Flipping back to the American study, 48% of the BoA’s 21–43-year-old respondents like getting financial content from social media compared to just 6% of the 44+ year old group of respondents. 37% of the younger group like getting financial content from online video sources (read YouTube, maybe even TikTok?) versus just 15% for the older group.

Social media and YouTube aren’t just platforms where people in the crypto space are generally better at making content and making it go viral. They are also the two most algorithm-heavy, echo chamber like sources of information you could think of.

If you have been surprised by how long the crypto “fad” has endured, you might be surprised for a while longer yet. It isn’t going to go away just because people on one side of the debate write articles or make videos saying that it’s stupid. Those on the other side of the fence won’t even see the content.

Hopefully today’s edition bursts through the filter bubble and gives you a healthy dose of variety. And don’t worry – I wasn’t warming you up for a piece on Bitcoin.

Joseph Taylor

In today’s edition of Firstlinks…

Inflation reduces the power of your savings, makes essentials more expensive and cuts the amount left over for luxuries. This makes it one of the biggest threats to a comfortable retirement. This is why most retirement products target returns above CPI – the most commonly used gauge of inflation. But does CPI provide an accurate idea of how much household costs are rising? Harry Chemay thinks otherwise. In this article, he explores how rising living costs really affect retirees.

Around 47% of our recent survey respondents were members of a Self-Managed Super Fund. These readers are not alone – data from the ATO shows that over 1.1 million Australians are SMSF members too. SMSF users are generally seeking greater choice and control of how they invest for retirement. But how do these advantages square up against potential downsides? Tony Kaye digs into the merits of a DIY approach versus investing in an APRA regulated fund.

Being diagnosed with a terminal condition often leads to worries beyond the illness itself. These will often include questions about how the patient and their family can be provided for financially, both during and after treatment. Brooke Logan explains options people in this situation might be able to access, including accessing super early and claiming terminal illness benefits.

Many people retiring today were working long before the Super Guarantee came into place. As a result, today’s retirees may rely more on assets outside of super than future generations. For many, the family home is by far their biggest asset. Andrew Boal encourages policymakers and retirees to rethink the role it plays in retirement planning.

The performance of a few mega-cap stocks in the US has made it nigh on impossible for active managers there to beat the index. It’s also emboldened and created a new generation of passive investors, not only in the US but across the world. When it comes to Australia, though, a feature of our major indexes could give active investors the upper hand. Tim Carleton explains why.

Private credit funds have attracted a lot of attention recently and investors are still getting to grips with the asset class. Nehemiah Richardson explains some differences between global and Australian private credit. He also highlights that growing demand has led to more complex and riskier private credit securities coming to market. He says a focus on quality and diversification looks crucial.

Human beings aren’t the logical machines that most economic models suggest we are. In fact, we are prone to making seemingly illogical decisions – especially when there is a potential loss or gain on the table. This has obvious implication for investing. In this extract from his recent research, David Walsh explores the potential for a trading strategy to exploit these biases in the stock market.

Two extra articles from Morningstar for the weekend. Mark LaMonica explores a potential way for retirees to get higher returns and Joseph Taylor looks at valuations in Australia’s listed property sector.

This week’s Sponsor White Paper comes from Franklin Templeton. Stephen Dover shares how Franklin Templeton are thinking about the next three years. This includes a look at global growth and inflation, a comparison of today’s stock markets to past periods and potential opportunities in government bonds.

***

Weekend market update

On Friday in the US, stocks stormed higher by 1.1% on the S&P 500 to recoup just over half of this week’s losses. The Nasdaq gained 1% to narrow its five-day decline to 2.5% and the Russell 2,000 added 1.7% to settle 3.5% north of last Friday’s finish. Treasurys enjoyed a broad-based rally with 2- and 30-year yields each dropping five basis points to 4.36% and 4.45%, respectively, while WTI crude slipped below US$77 a barrel, gold leapt to US$2,387 an ounce, bitcoin rose to US$67,700 and the VIX retreated below 17, down two points on the day.

From Shane Oliver, AMP:

- Global share markets fell over the last week on the back of softer than hoped for big tech earnings, concerns about growth and political uncertainty in the US. Much of the weakness in the US remained concentrated in IT shares with a rotation away from tech continuing to support small caps with the Russell 2000 hanging onto much of its 13% rise since early July. Japanese shares were also hit by talk of further monetary tightening in the week ahead which has in turn pushed up the Yen. And Chinese shares continue to get dragged down by the lack of decisive stimulus coming out of the Third Plenum despite several stimulus moves over the last week. Australian shares were dragged lower by the global falls – led by resources, property, utility and IT stocks – with a fall of around 0.5% for the week. The ASX 200 is still remaining above its March record high though. Bond yields rose slightly in the US, UK, Japan and Australia but fell slightly in France and Germany. Oil, metal and iron ore prices fell as did the $A and the $US was little changed.

- The good news is that global interest rates are continuing to roll over as the focus for central bankers shifts from getting inflation down to avoiding recession. This was highlighted in the past week by the Bank of Canada cutting its key policy rate by 0.25% for a second consecutive time taking it to 4.5%, with more cuts likely ahead as BoC Governor Macklem was dovish citing labour market slack and concerns about household spending. The BoC is now likely to cut twice more this year.

- In the US, the risk of recession is growing with former New York Fed President Bill Dudley arguing that the rise in unemployment in the US is approaching levels that in the past have signalled recession and inflation pressures have abated so the Fed should preferably cut in the week ahead. While Dudley is just one view, he is pretty balanced and if he is thinking that way several others at the Fed are likely to be too. So, while a Fed cut looks unlikely until September as it waits for more confidence on inflation and stronger than expected June quarter GDP growth suggests no urgency, a surprise cut can’t be ruled out at its meeting in the week ahead with the money market attaching a 25% probability. By September though a rate cut is fully priced in by the money market with nearly three cuts now priced in by year end. August, September and October are also likely to see cuts from the UK, NZ and the ECB so a global easing cycle in developed countries will be well underway. Emerging markets have already clearly moved in that direction with China easing again in the last week – albeit only marginally. Lower interest rates will be positive for shares on a 6 to 12 month view, providing recession is avoided.

- The bad news is that shares may be entering another correction on the back of a growth scare. For some time we have been concerned that shares are at high risk of another correction as valuations are stretched, investment sentiment looks somewhat optimistic, recession risk is high, there has been a heavy reliance on tech and specifically AI shares to keep the key US share market going and geopolitical risk particularly around the US election but also around the Middle East (with now a Houthi/Israel front), China and Ukraine is high. Concerns about a reversal in the Japanese carry trade may also be impacting, although this should be minor as even with another BoJ hike in the week ahead and other central banks cutting, Japanese rates will still be well below rates in other countries. July is normally a seasonally strong month and US, Japanese, global and Australian shares made record highs this month, but August and September are historically more difficult. So, as we enter the seasonally weak period of August and September a correction may now be starting to unfold and so may have further to run.

Curated by Joseph Taylor and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website