The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Given the current rental crisis across many parts of the country, The Australian Housing and Urban Research Institute (AHURI) has released a timely new report that profiles residential property landlords: who they are, who buys rental properties and who sells them, and how long they hold onto their investments.

The study, ‘Modelling landlord behaviour and its impact on rental affordability: Insights across two decades’ covers 2001-2021 and includes recommendations for government policy, which we’ll get to later.

Here are they key findings of the report:

1. More people are residential property landlords than ever before.

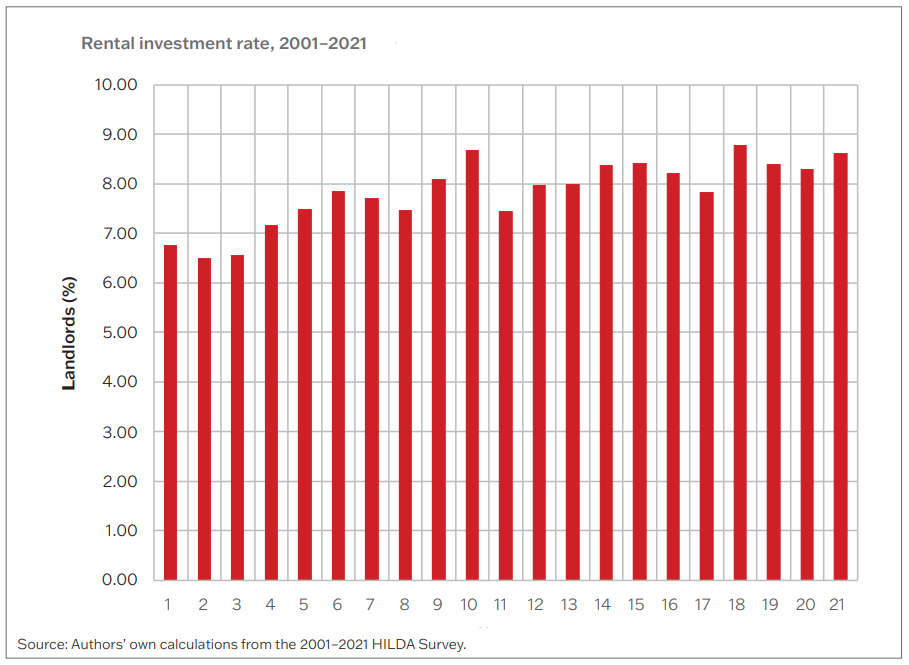

In 2021, 2.2 million Australians were landlords, accounting for about 8.7% of the population. That’s up from 6.8% two decades ago.

2. Most rental properties are sold within a short period of time.

50% of rental properties are sold within two years and the average holding period is four years. About 28% of rental properties are retained beyond 20 years.

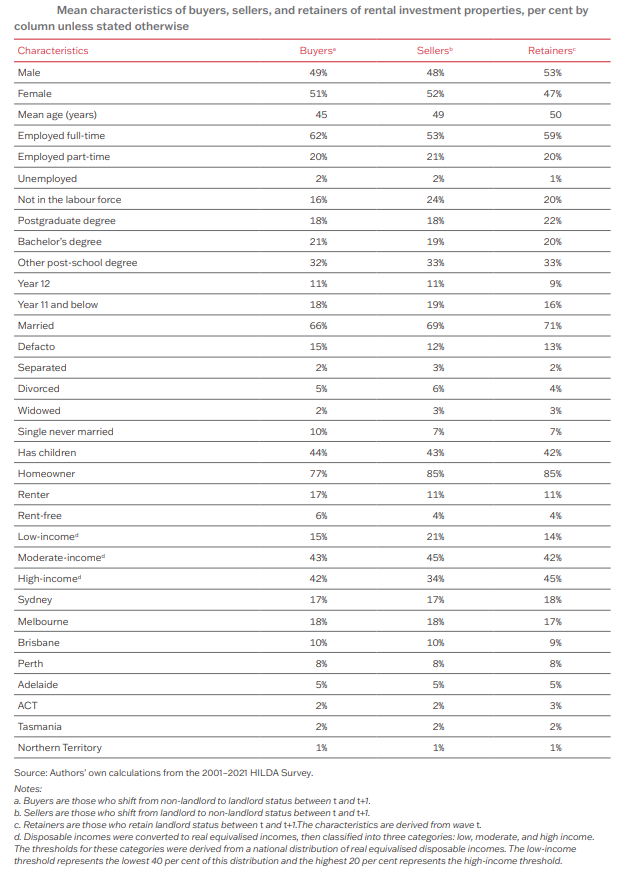

3. Buyers of rental properties are generally younger.

Many buyers are aged between 25 and 34. The typically profile of a buyer is also that they’re married, employed, have post-school education qualifications, higher incomes, and lower personal mortgage burdens, relative to outright owning.

Those who retain their rental properties for longer tend to be in stronger economic positions with full-time employment and higher incomes.

4. Landlords sell rental properties due to life transitions or financial difficulty.

The odds of selling a rental investment property in the short-term are raised among pre-retirement landlords aged 45-54 years, by marital separation, unemployment, the absence of post-school qualifications, lower incomes, and personal mortgage burdens.

5. People living in well-off areas are more likely to buy a rental investment property, but they’re also more likely to sell the property in the short-term.

6. Investment property purchases increase when economic conditions are strong.

(Unsurprising)

7. Negative gearing discourages the sale of rental investment properties and increases the average holding period for rental investments.

All things being equal, negative gearing provides significant incentives for landlords to hold onto properties. Being negatively geared reduces the odds of selling over time by nearly 20%.

If negative gearing was removed, it would increase the after-tax cost of holding a rental property and reduce the average hold period for rental investments. A one percentage point increase in the cost for holding rental properties raises the odds of selling over time by 8.9%.

8. Cutting the capital gains discount would reduce the supply of rental properties and push up rents.

The study did simulated models halving the CGT discount from 50% to 25% over the period 2001-2021, and found that landlord costs would increase, as would the chance that high income landlords sell their rental investment properties. It also found that average rents would have risen slightly, and rental cost burdens would have increased across all income groups.

Policy recommendations

While the report’s findings are enlightening, its policy recommendations are less so. The three main recommendations are:

- Establishing programs that offer education on property investment retention. This is to support landlords’ efforts to retain property and promote the supply of long-term rental housing to the rental property market.

- Any tax reforms such as reducing negative gearing should be done gradually to reduce the impact on rental markets. That’s because negative gearing benefits encourage the retention of rental investment properties, and decreasing these benefits suddenly would lead to a jump in rental property sales and a drop of properties available to renters.

- Long-term freezes to rental increases aren’t the answer. That’s because it would discourage the buying and retaining of rental properties, thereby reducing the supply of housing into the private rental market.

While the report focuses on landlords and what can be done to encourage them to buy and hold onto properties, there are other things that are needed to increase the supply of housing into the rental market, including:

- Incentivising new developments.

Governments can offer incentives such as reduced development costs and tax breaks to encourage builders to construct more rental properties.

- Reducing planning red tape.

There needs to be faster approvals for developers to help speed up the building of more rental homes.

- Increase institutional investment in the rental market.

Make it more attractive for institutional investors to enter the rental market by giving them tax incentives and promoting long-term leases.

- Encourage older people to downsize.

Reduce stamp duty and other impediments to downsizing. This can increase the supply of larger properties for families.

The AHIRU study provides valuable insights into landlords and some clues about how to fix the rental property market. These issues have been neglected at this Federal Election, which has focused almost exclusively on home buyers over renters. As houses become ever more unaffordable, forcing more people into renting, I suspect the rental market will become a more visible issue in future elections.

****

How much time have you spent reading about Trump and tariffs over the past two months? And how much of that time has been useful for your investing? If you're like me, the answers are: a lot, and zero. In my article this week, I urge investors to ignore Trump and instead focus on the time-tested investing principles for building real wealth.

James Gruber

Also in this week's edition...

Even experienced investors often fail to exploit the underlying potential of dividends. Why? Their focus typically diverts to high current yields. Josh Veltman and Jen Nurick suggest an alternative approach that can offer both a strategic edge and psychological anchor.

Labor has announced a $2.3 billion Cheaper Home Batteries Program, aimed at slashing the cost of home batteries. Open to all households, small businesses and community groups, the scheme aims to turbocharge battery uptake nationwide. Noel Whittaker says while good in theory, the scheme has several drawbacks.

Chinese electric vehicles have taken the world by storm. But with soaring tariffs, overcapacity, and rising scrutiny, they may face tougher times ahead, according to Carolyn Cui.

REITs have suffered in recent years from rising interest rates and trends such as work-from-home. Yet, since Trump's election, they started to quietly outperform. Can it continue? Resolution Capital's Andrew Parsons thinks REITs can offer a potential safe haven in a more volatile, Trumpian world.

European equities are surging ahead of the U.S this year, driven by strong earnings, undervaluation, and fiscal stimulus. With quality founder-led firms and a strengthening euro, Garry Laurence believes Europe may be the next global investment hotspot.

The Federal Treasurer, Jim Chalmers, has repeatedly trotted out the line that “there’s been a $207 billion cumulative improvement to the budget bottom line" since Labor took office. Tony Dillon says it's a rubbery claim that warrants further scrutiny.

Traditionally, duration – a measure of a bond portfolio’s sensitivity to interest rates – was the bedrock of defensive allocations in investor portfolios. However, in more recent times, this has changed - duration has been in the doghouse. Today, an important question is whether duration is still something to be feared. Haran Karunakaran of Capital Group suggests investors could benefit from adding a moderate amount of duration back into their portfolios.

In Firstlinks, we've written quite a bit about Australia's $5.4 trillion intergenerational wealth transfer, the largest in its history. This unprecedented shift is prompting many Australians to rethink the question of legacy: What do I truly want to leave behind? In response, many are turning to philanthropy. Rachael Rofe outlines how structured giving vehicles can maximise the impact of your legacy while making estate planning more tax efficient.

Two extra articles from Morningstar this weekend. Esther Holloway reports on a cheap lithium miner that can ride out the storm, while Joseph Taylor highlights three high quality buy the dip candidates.

Lastly, in this week's whitepaper, Magellan looks at the future of transport and the innovations that are transforming how we move.

Curated by James Gruber and Leisa Bell

****

Weekend market update

In the US on Friday, stocks rose by 0.7% on the S&P 500 to cap a stellar week for shareholders, as the broad index shook off Monday’s drop to log a near 6%, five-day advance. Treasurys maintained moderate strength with 2- and 30-year yields each declining three basis points to 3.74% and 4.74%, respectively, while WTI crude topped US$63 per barrel and gold retreated to US$3,308 an ounce. Bitcoin held steady north of $95,000 while the VIX closed before 25 for the first time since “liberation day.”

From AAP:

The Australian share market finished up for a second-straight week as the US tones down its tough talk on tariffs. The S&P/ASX200 rose 0.60% to7,968.2 on Thursday.

Eight of 11 local sectors finished higher on Thursday, with materials helping lift the bourse with a 1.2% gain.

Uranium miner Paladin was the top-200's best performer, up 12.7% to $12.39, continuing to rally a day after posting record quarterly production at its Langer Heinrich Mine.

Gold miners also fared well, with the precious metal bouncing following a profit taking dip after reaching an all-time high of $US3,500 an ounce on Tuesday.

Large cap iron ore miners eked out less than 1% gains on Thursday, but were up for the week. BHP lifted 4.6% and Rio Tinto was up 3.8% since Good Friday, as easing trade tensions boosted demand expectations for top importer China.

The ASX/200 financials sector has recovered almost two-thirds of its roughly 19% losses since hitting a record high in mid-February. Commonwealth Bank, the world's most expensive bank stock, is within striking distance of $168, breached on Wednesday, at $164.72.

Improving confidence around global trade pushed oil prices higher and helped energy stocks rebound 5.3% this week, but the sector is still down almost 18% in 2025.

ResMed helped lift the healthcare sector 1.2%, after the sleep device maker posted strong sales growth and confirmed its products were exempt from US tariffs.

Investors will be watching next week's March quarter inflation print closely for hints on what the Reserve Bank will do at its May meeting. Interest rate markets have fully priced a 25-basis-point cut for May 20,

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly Bond and Hybrid updates from ASX

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC Monthly Report from Morningstar

Plus updates and announcements on the Sponsor Noticeboard on our website