Before the 2008 Global Financial Crisis (GFC), duration – a measure of a bond portfolio’s sensitivity to interest rates – was the bedrock of defensive allocations in investor portfolios.

However, in more recent times, this has changed - duration has been in the doghouse with Australian investors. And for good reason.

Low bond yields meant traditional fixed rate bonds paid very little income.

Low bond yields also weakened the defensive qualities of duration; the negative stock-bond correlation became less reliable. 2022 encapsulated these concerns, with bonds selling off in tandem with equities. Bonds failed to deliver on their defensive promise exactly when it was needed the most.

But one thing we know for sure is that markets are always evolving. And today, an important question investors should be asking is whether duration is still something to be feared.

A new era for duration: Learning from 2022

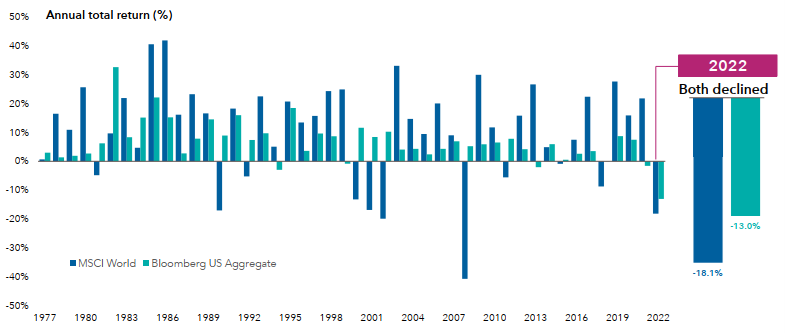

Many investors were understandably scarred by 2022. US equities declined by 18% and, while bonds did better, they too saw a decline of 13%.

It is important to put this in historical context – this was the first time in almost 50 years that both equities and bonds declined in the same year. And going back to 1977, there have only been 5 years in which bonds delivered negative returns. 2022 was unusual!

What drove negative returns for bonds that year? One of the most aggressive interest rate hike cycles we’ve seen in modern history. The Federal Reserve hiked the US cash rate by 4.25% (equivalent of 17 standard hikes!); the RBA was not far behind raising the cash rate by 3%.

Though this experience remains fresh in our minds, it is important to understand that a repeat of 2022 is very unlikely today. Our starting point is a much higher cash rate. Though a little above central bank targets, US inflation also sits in a comfortable range. The Federal Reserve sees rates as overly restrictive and expects to cut down to a 3% cash rate over the coming years. This would be positive for bond returns – a far cry from what we saw in 2022.

2022 was the first time in nearly 50 years that stocks and bonds both delivered negative returns

Past results are not a guarantee of future results. As at 31 December 2022 in USD terms. Returns above reflect annual total returns for all years. Stocks represented by the MSCI World Index. Bonds represented by the Bloomberg US Aggregate Bond Index. Sources: Capital Group, Bloomberg Index Services Ltd., MSCI.

The often-overlooked benefits of duration

We believe that in stable market environments duration can be valuable in investor portfolios.

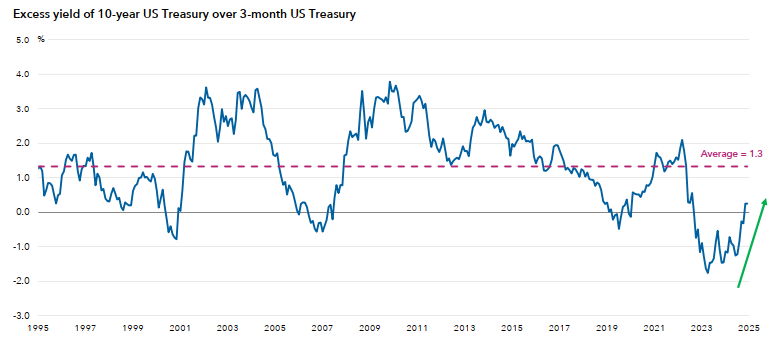

Firstly, duration has historically provided investors additional yield (or income) in portfolios. This benefit can be proxied by looking at the difference in yield between longer-duration bonds (e.g. 10 Year US Treasuries) and equivalent quality short-duration bonds (e.g. 3 Month Treasuries). As shown in the chart below, over the last 30 years this gap has averaged at 1.3%. In other words, an investor would have earned an additional 1.3% p.a. by allocating to fixed rate, duration exposed bonds.

The last two years have been quite unusual in that yield curves have been flat or even inverted. This has been normalising in recent quarters, and we expect to see term premia gradually return to levels closer to historical ranges.

Duration has provided additional income in most environments

Past results are not a guarantee of future results. As at 31 January 2025 in USD terms. Source: Bloomberg.

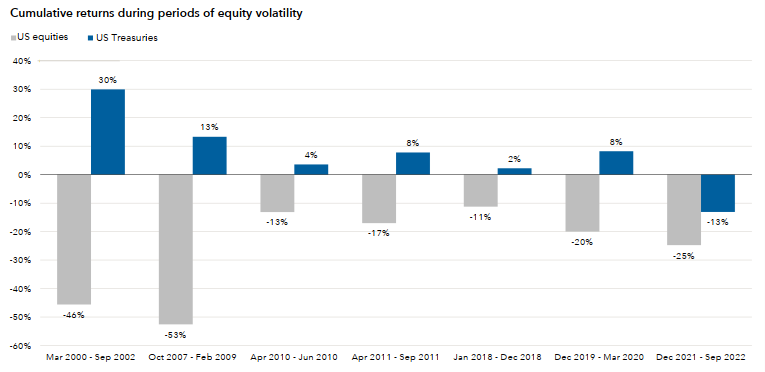

Secondly – and potentially more importantly today - duration has historically been a good diversifier of equity risk (don’t forget this key role of fixed income in a portfolio context).

In every significant equity drawdown over the last 25 years except for 2022, “hard duration” (proxied by US Treasuries) has provided positive returns, as shown in the chart below. In the uncertain times we now find ourselves in, this diversification benefit is critical. It allows investors to lean into their growth assets (e.g. equities, private credit etc.) with confidence, knowing that there is a strong defensive ballast there to provide potential protection in an unexpected downturn.

Historically, duration has been a good diversifier of equity risk

Past results are not a guarantee of future results. Data from January 2000 to December 2024, in USD terms. Source: Bloomberg. US equities represented by the S&P 500 Index. US Treasuries represented by the Bloomberg US Treasury Index. Analysis looks at equity market drawdowns greater than +10% since 2000.

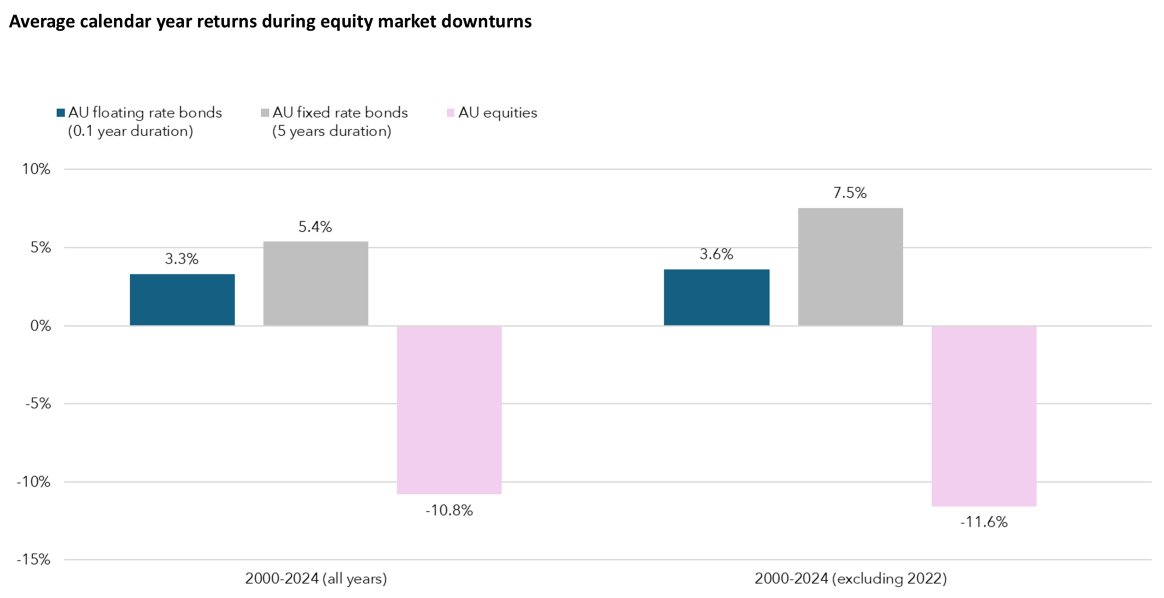

When thinking about the diversification benefits of bonds, it is worthwhile considering floating rate credit – now a ‘go-to’ fixed interest allocation for Australian investors.

Stating the obvious, floating rate bonds have negligible duration exposure. This means that their price is not impacted by interest rate moves. For example, if a central bank cuts rates in response to an economic downturn, floating rate bonds would not benefit from capital appreciation. This means the diversification benefit of floating rate bonds is limited.

This is illustrated clearly in the chart below, comparing the return of fixed vs. floating rate bonds during equity market downturns. Fixed rate bonds (with approx. 5 years of duration) have generated much stronger returns during equity market downturns compared to floating rate. If we exclude 2022 – an unusual ‘one-in-fifty-year’ occurrence – the diversification benefit of fixed rate bonds is even more pronounced.

While floating rate credit can add value in a portfolio, its role as a defensive ballast is not necessarily a strength.

Fixed rate bonds have provided stronger diversification benefits compared to floating rate

Past results are not a guarantee of future results. Data from December 2000 to December 2024, in AUD terms. Source: Bloomberg. AU fixed rate bonds represented by the Bloomberg AusBond Composite Index. AU floating rate bonds represented by the Bloomberg AusBond Composite Index. AU equities represented by the ASX200 Index.

Duration’s diversification benefits are more reliable today

More so than the last few years, fixed rate bonds today are well placed to provide this diversification within an equity dominated portfolio. Higher cash rates mean there is more room for bond yields to fall, which can provide greater capital appreciation during risk-off events.

Moreover, central banks now have both the ability and the willingness to cut rates when economic conditions worsen. This was less feasible in 2022 when cash rates were near zero and fighting inflation was the main priority.

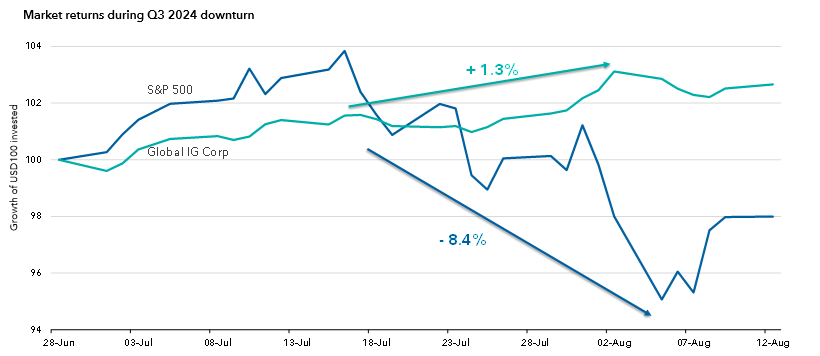

This shift in the Fed’s reaction function (and the market’s anticipation of what the Fed might do) was clearly illustrated in early August 2024. At that time, a weaker-than-expected labour report in the US and lower market liquidity led to a correction in equity markets and increased expectations for Fed rate cuts. As equity markets sold off, higher quality bonds partially offset this with positive returns. With inflation now under better control, the Fed’s dual mandate of managing inflation and employment has enabled it to shift its focus towards supporting the labour market.

Diversification in action

Past results are not a guarantee of future results. Data from 30 June 2024 to 12 August 2024, in USD terms. The investment results shown here are for S&P 500 Index (net dividends reinvested) and Bloomberg Global Aggregate Corporate Total Return USD Hedged Index. Source: Bloomberg. Fed: Federal Reserve. IG: Investment grade.

A time to be on friendlier terms with duration

Two years on from 2022 and investors remain cautious about duration.

However, we think now is the time to reconsider your biases. With heightened geopolitical uncertainty, having a strong ballast is crucial in a portfolio. And duration can play a key role in delivering that.

A combination of higher bond yields and a change in the macroeconomic environment means duration can now bring several potential benefits back to bond portfolios.

- Additional yield compensation: Comparable to pre-GFC levels

- Returning diversification benefits: Providing stability during market downturns

- Lower risk of a 2022-style intervention from central banks: Reduced likelihood of aggressive rate hikes

As a result, we think investors could benefit from adding a moderate amount of duration back into portfolios.

Doing this within a wrapper of a high-quality global credit strategy could be particularly attractive given the potential to earn additional income and take advantage of mispricing across this very broad universe.

Haran Karunakaran is an Investment Director at Capital Group (Australia), a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.