The analysts who correctly predicted the seriousness of the coronavirus outbreak in China as early as January 2020 were mainly right for the wrong reason. They said the quarantining of 400 million people would severely disrupt global manufacturing because China is the largest exporter of intermediate goods and produces at least 20% of products used in worldwide supply chains.

Since then, China has made significant progress in controlling deaths and infections, if we can believe the official numbers. Their Commerce Ministry announced that 90% of export-oriented companies in 19 provinces are back at work, trains are full again and shops and restaurants are trading. China is, we are told, recovering quickly.

Rather, the analysts are correct due to the spread of the virus in other parts of the world, threatening businesses and jobs, especially in the services sector. The extent of the outbreak in the US has yet to reveal itself but the US private health system cannot cope with a nationwide pandemic. As Scott Morrison said yesterday:

"Life is changing around the world. This is a once-in-a-100-year event. We are going to keep Australia running but it won't look like it normally does. Whatever we have to do, we have to do for six months."

Six months is optimistic as Europe, the US and Australia head for recession. Reserve Bank Governor, Philip Lowe, will make a speech today and take questions.

Investors must push through the difficult times and manage our own reactions and portfolios. John Maynard Keynes was a noted investor as well as a great economist, and he said:

"Slumps are experiences to be lived through and survived with as much equanimity and patience as possible. Advantage can be taken of them more because individual securities fall out of their reasonable parity with other securities on such occasions, than by attempts at wholesale shifts into and out of equities as a whole."

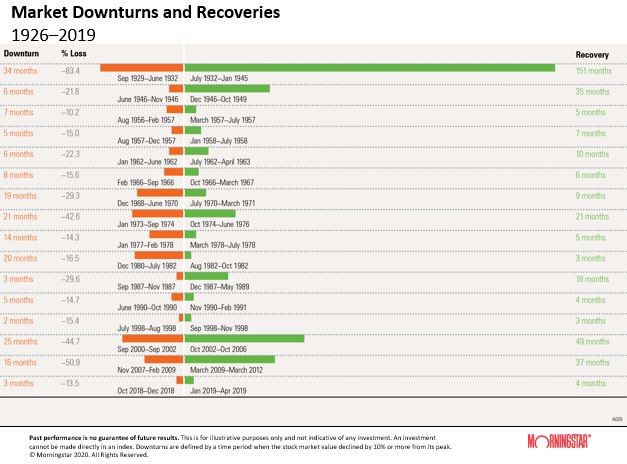

Equanimity and patience. The chart below from Morningstar shows major market shocks since 1926, including how long the downturn lasted and the recovery period. Look beyond the next few months and take confidence that a long-term plan designed for decades and not years should see a strong recovery.

Marcus Padley looks at the 13% turnaround in a few hours last Friday, when brave souls such as Bell Potter's Richard Coppleson called the bottom (he told clients, "When you see the last of the capitulation selling, as we saw today, it indicates a major market bottom has finally been seen."). Marcus gives his reasons why it's too soon to start buying.

Australia's leading futurist, Phil Ruthven AM, explains how the world's interconnections make a virus outbreak worse than in the past, but the stock market has a habit of exaggerating threats and opportunities.

John Pearce's UniSuper funds delivered such strong results for a decade to end 2019 that The Australian Financial Review featured him on its cover as 'Mr 18%' a few weeks ago. Faced with heavy shifts from equities to cash by his members, he issued a video update as well as suspending UniSuper's stock-lending programme.

Every equity investor is coping with severe falls and probably recriminating themselves for not seeing the market as overvalued, and hanging on to biases relating to anchoring, hindsight, loss aversion, sunk costs and confirmation bias. As Vishal Khandelwal says, it is irrelevant how much you paid for your shares. What matters is whether the future prospects make a company worth holding for the long term.

Vivek Prabhu has managed bond portfolios in many different market conditions. Although this interview took place before the worst of the market dislocation, it gives great insights into how Perpetual Investments manages relative value and risks in bond portfolios. It's especially relevant at a time when bonds did not provide as much refuge as some investors hoped, with investment-grade bonds experiencing the worst week in the 20-year life of major indices.

We then use four charts to show how markets normally recover after a fall, and how difficult it is to time the stock market. Even if you sold before the collapse, when do you invest again?

Faced with the loss in most superannuation accounts, Olivia Long calls on the government to provide assistance to retirees drawing down a pension account and reduce minimums.

Morningstar is delivering to investors a wide range of content to improve decision-making in these uncertain times. This week, we share Glenn Freeman's short video interview with Hamish Douglass and provide a widely-quoted research study on the global impact of coronavirus and likely vaccines. We then use the Morningstar Stock Screener to look for specific qualities in companies, such as those with strong moats and attractive prices following the sell off. Consider a free trial to Morningstar Premium which includes free access to Sharesight's portfolio management software (which I have used for my own portfolio for many years).

AMP Capital Chief Economist Shane Oliver offers five charts to review in these tough markets, as he also warns that auction clearance rates are heading south. The big unknown as most assets fall in price is what will happen to residential property prices.

Graham Hand, Managing Editor

For a PDF version of this week’s newsletter articles, click here.