All I am reading and hearing all around is this. Volatility is your friend. Stick to the long term. Don’t touch your portfolio. Keep some cash. Invest that in a staggered manner. Recheck your asset allocation. Shuffle your stock portfolio. Don’t borrow to invest. Don’t speculate. Quickly search for new stock ideas. Stop watching news.

Well, let’s cut it all.

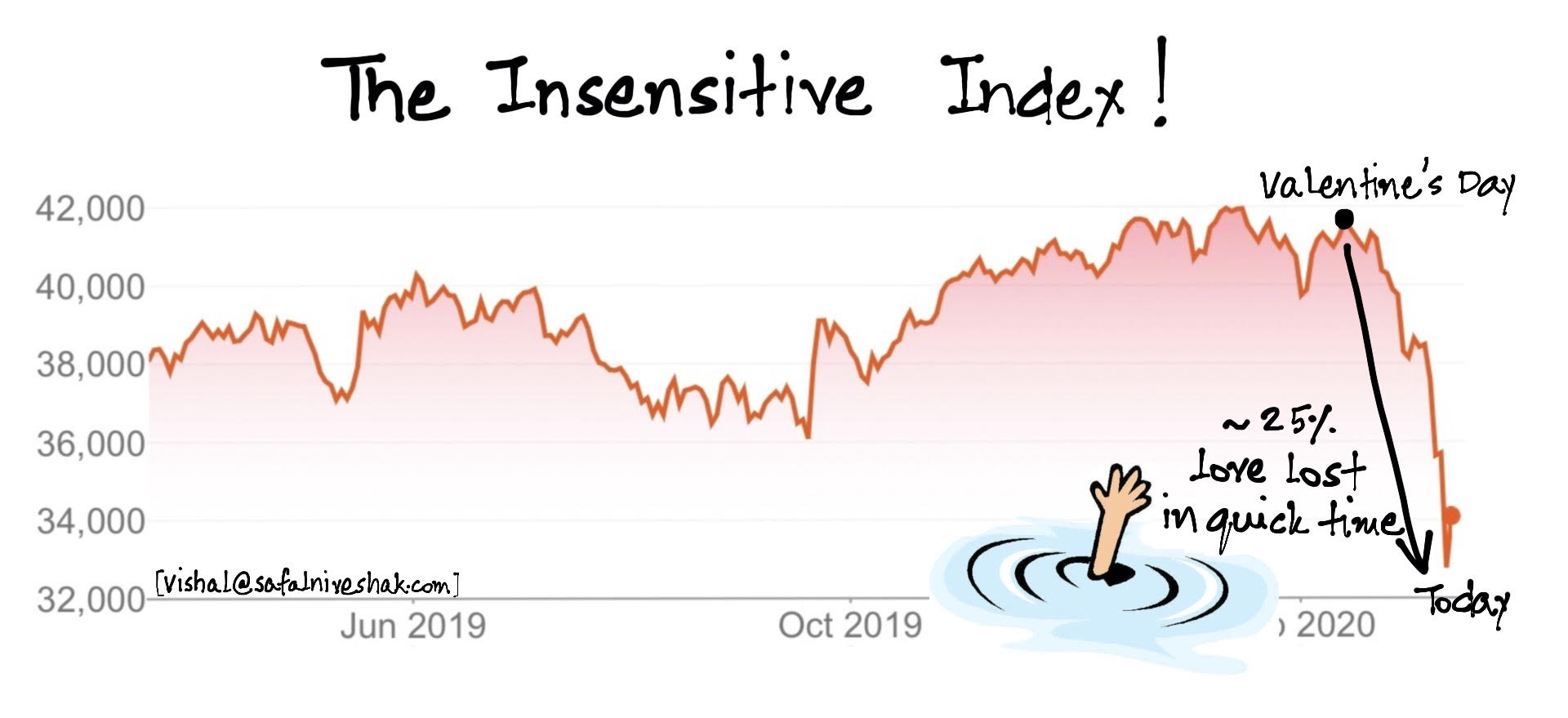

The markets are sneezing bad, and your portfolio may be in a sea of red on account of the big recent declines.

Amidst this, what can you do?

Rue your losses and hold on to them? Sell your winners so that you don’t lose your paper profits? Become greedy because others are fearful? Become fearful because others are fearful? By the way, who are these others anyways?

Things look so confusing out there. And so are all kinds of advice that is floating in the news and social media. Everyone is out there to remind you of how dumb you have been and how smart they are. Stop there!

Here’s something simpler, very soothing to the soul, and very effective too, that I advise you to do now. This is the exact same advice I’ve given to myself, so we are in the same boat.

So, what’s my advice?

Let bygones be bygones. Forget everything. Start afresh.

Nobody has any clue what is going to happen, short term or long term. After the dust (sorry, virus) settles, people who will get it right will simply be the ones whom luck chose to side with. They may appear on television and remind you how their prediction went right, without revealing which one, and how their skill shone through the crisis. But, believe me, those would just be the lucky ones.

Even you don’t have any clue of where all this is heading. All you can see now and act upon now is what has happened in the recent past and how you have done through it all. Your brain, like mine, is poisoned by a heady cocktail of anchoring bias, endowment bias, availability, hindsight bias, social proof, sunk cost, confirmation bias, loss aversion, etc.

How do you maintain sanity with such poison running through your mind?

Simple. Forget everything. Start afresh. But how do you go about it? Where do you start? What do you forget?

Here’s what to do.

Take a print of your current portfolio but just the names of stocks you own. Exclude your buy price and the current stock price. This is so that you forget at what price you bought a stock and whether that is up or down from that level till today.

This is another reminder that your cost price must not matter when you are deciding what to do with your stocks today. What matters is where the stock is today, and where the business and its intrinsic value may be 10 years down the line.

Anyways, coming back to your portfolio, take a re-look at your thesis on each stock, one by one, and objectively.

Ask this question for each stock you own: “If I did not own this stock already, and of what I know now about this business, management quality, competitive advantage, staying power, long term growth, and current valuation, would I buy it for the first time today?"

If the answer is yes, keep the stock. Period.

If the answer is no, sell the stock. Period.

Then run this question on other stocks in your watchlist, this time forgetting from where those stocks have fallen or risen from.

Ask this question for these new stocks – “Of what I know now about this business, management quality, competitive advantage, staying power, long term growth, and current valuation, would I buy this new stock for the first time today?

If the answer is yes, buy the stock. Period.

If the answer is no, skip the stock. Period.

Most biases that wreak havoc on our minds as investors are creation of what stock prices have done in recent times and whether we have earned or lost money on them or have seen others earning or losing money on them.

Performance of underlying businesses – good or bad – don’t cause us much trouble as their stock prices do.

So, if you wish to really clear your mind and get into a position of some sanity as things fall apart around you, the most potent tool in your arsenal is the idea of forgetting, better ignoring, what stock prices – of your portfolio companies and those in your watchlist – have done since the time you own them and especially in recent times.

Plus, don’t listen to anyone who would remind you how smart they are and how dumb you have been. Forget them too.

Just forget everything, also forgive yourself for any past mistakes, and start afresh.

Vishal Khandelwal is a writer, educator, investor, and Founder of SafalNiveshak.com. This article is for general information only and does not take into account any person’s individual financial situation.