Watching the US market open on Friday evening Sydney time was slightly surreal. As unemployment was announced at 14.7% following a loss of over 20 million jobs in April, the worst report in history, the S&P500 quickly jumped over 1%. By the end of the day, the index was up 1.7% or 3.4% for the week. This followed a strong rise in Australia as the Government announced the lifting of lockdown restrictions.

Even the 'Oracle of Omaha' must have been bemused. Few investors are as influential as Warren Buffett, although for the moment, the stock market is ignoring his caution. The annual meeting of Berkshire Hathaway was held last weekend in a virtual format without his offsider, Charlie Munger, and it contained the usual insights. Most significant, Buffett did not use the heavy market falls in February to buy shares. In fact, rather than 'buy when others are fearful', he was a net seller of US$6 billion for the quarter, including disposing of all his airline shares. Berkshire is sitting on US$137 billion in cash, suggesting he expects better buying opportunities to come. For the moment, though, the pump-priming by the US Fed seems to be winning.

Although Berkshire lost US$50 billion in the March quarter based on revaluations, Buffett was sanguine and spent a great deal of time describing the historical context of previous crises. He said:

"I would like to take you through a little history. If you were to pick one time to be born and one place to be born, and you didn’t know what your sex was going to be, you didn’t know what your intelligence would be, you didn’t know what your special talents or special deficiencies would be. That if you could do that one time, you would not pick 1720, you would not pick 1820, you would not pick 1920. You’d pick today, and you would pick America ...

I'm not saying that this is the right time to buy stocks if you mean by 'right' that they’re going to go up instead of down. I don’t know where they’re going to go in the next day, or week, or month, or year. But I hope I know enough to know, well, I think I can buy a cross section and do fine over 20 or 30 years. And you may think that’s kind of, for a guy, 89, that that’s kind of an optimistic viewpoint. But I hope that really everybody would buy stocks with the idea that they’re buying partnerships in businesses and they wouldn’t look at them as chips to move around, up or down."

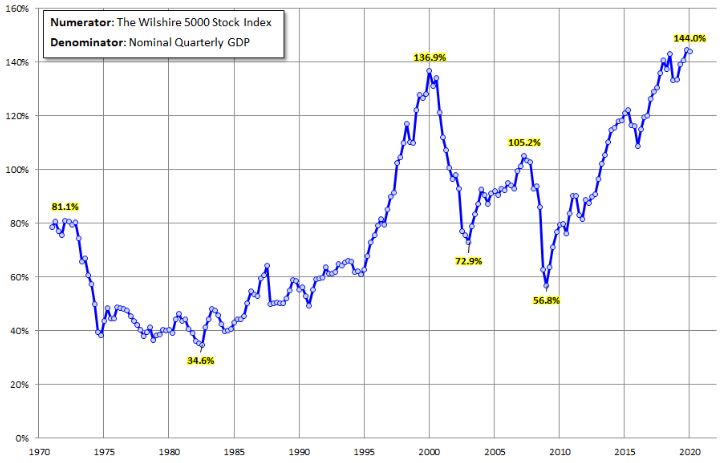

Perhaps one reason he is not buying is the level of the 'Buffett Indicator', the ratio of the market value of all listed equities to US GDP. He said back in 2001 that "it is probably the best single measure of where valuations stand at any given moment."

Using the broad-based index of the Wilshire 5000 shows the market is at its highest level since 1970, and that's before GDP falls as expected in the June quarter. Buffett's view is that investors cannot gain wealth at a rate that exceeds the growth in US business. He said in 2001:

"For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you."

Buffett Indicator Variant, Wilshire 5000 to GDP as at May 2020

Source: Advisor Perspectives

Morningstar's Berkshire Hathaway specialist, Greggory Warren, summarises his major takeaways from the meeting, as well as presenting a short video.

Moving to retirement planning, when aiming for a desired level of spending in the future, a rate must be assumed for earnings on investments. Many super funds default to 7.5%, despite bonds currently offering only 0.25% and equities being fully valued. We delve into models of Robert Shiller, London Business School, Research Affiliates and Schroders to estimate a sustainable future performance assumption.

Complementing this, Stephen Miller takes a look at the perils of forecasting in the current market, but despite the unknowns, he sees more risks to the downside.

Still on long-term planning, Wade Matterson provides updated data on the spending of older retirees, who might not need as much money as they expect. Financial advisers often need to convince their retired clients to spend more.

Over the years, we have received many questions on how Net Tangible Assets for Listed Investment Companies (LICs) are calculated. It seems such a simple concept, but as Scott Whiddett and colleagues show, there is a lot of discretion you should know about.

Nathan Zaia checks the value in Australian banks after their heavy price falls and dividend suspensions, to see whether they should continue to play a role in so many portfolios.

As Australia starts to relax coronavirus-inspired restrictions, Michael Collins says policymakers are faced with major ethical issues. Then Tony Dillon questions whether borrowers reducing repayments really realise how much more a loan will cost them, and some of the bank benevolence is not what it seems.

Finally, on his 68th birthday, Kevin Kelly, Co-Founder of Wired magazine has posted 68 little gems of wisdom with something for everyone.

This week's White Paper from Perpetual Investments explains how 'real return' funds work, and whether they have a place in the new investing environment.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website