Market update for close of week ending Saturday 22 May 2020.

The US market was relatively quiet on Friday, although the week was good with US shares rising 3.2% for a post-recovery high. Europe also did well for the week and Australia was up 1.7%. The major corporate news on Friday was Hertz filing for bankruptcy after demand for rental cars collapsed. Fresh doubts surfaced about the Remdesivir and Moderna COVID treatments.

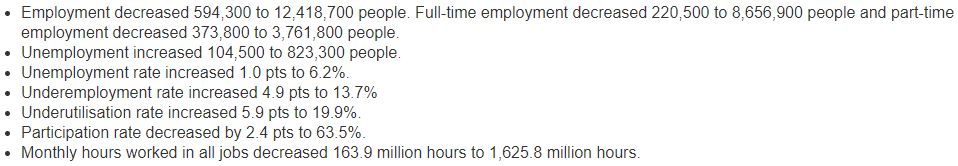

One of the victims of COVID-19 is Australia as a private sector, market-based economy. It's become a publicly-subsidised economy. The downturn is disguised in the official numbers. Unemployment in April rose only 1% from 5.2% to 6.2% which seemed like a good result. But looking deeper, with 12.9 million employed people in Australia, net job losses were 594,000, as shown below. That's more like 5%, not 1%, but because most of them were deemed no longer looking for work, they were not counted as unemployed. Worse, 3 million are already on JobKeeper and about 1.6 million are on JobSeeker.

(Treasury had advised that 6.5 million people were registered for JobKeeper but this has been revised down to an expected 3.5 million due to a mistake in the way businesses were filling out the relevant forms).

Add it all up and most workers are either unemployed, underemployed, paid by the Government or they have given up looking. The monthly hours of work lost was more like 10%, as shown in the ABS statement on jobs.

The ABS has even decided that JobKeeper payments will be included in the national accounts, making the forthcoming GDP figures much better than expected. Is that really 'production', a measure of the economy's size?

The Australian Bankers Association last week advised that almost 10% of mortgage payments have been deferred, and overall, the total number of loans deferred is over 700,000 worth $211 billion. Interest is still accruing but unpaid, leaving many borrowers with more debt than at the start of the crisis. What happens at the end of the deferral period, just as JobKeeper is supposed to finish?

In this context, in our first article, Dr David Morgan AO, former CEO of Westpac and now Chairman of Chi-X, provides an excellent perspective on his expectations for the recovery, taking a big picture view on the slow bounce back.

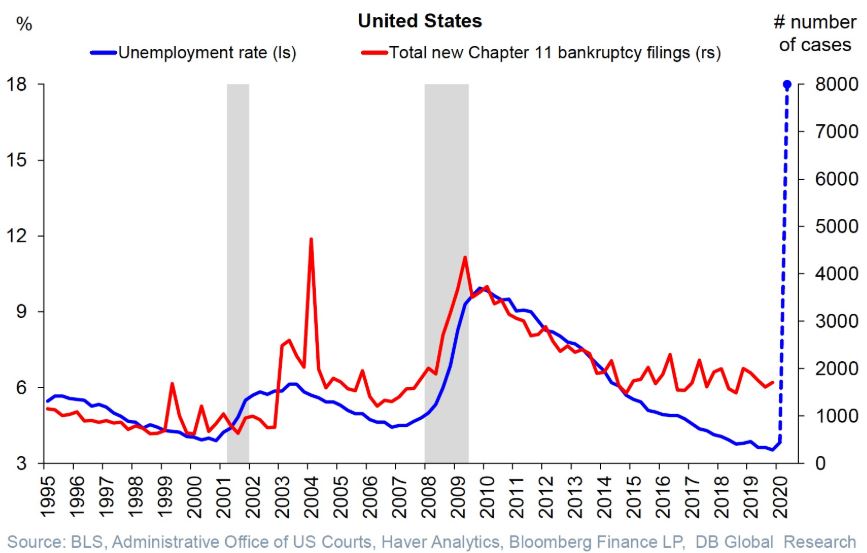

One of the factors the bulls are relying on is the "Don't fight the Fed' injection of trillions of dollars into the US economy. But liquidity is not solvency. Making money available to buy the debt of a struggling company does not make it a good company, and US earnings reported for Q1 2020 were down 64% year-on-year. As the chart below shows, US bankruptcies often follow the US unemployment rate.

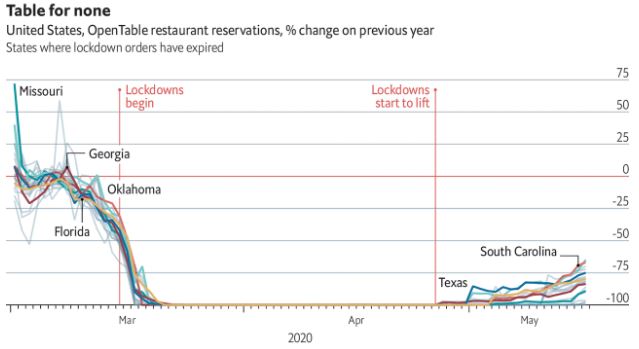

As The Economist reports this week, data from OpenTable, a restaurant-booking website, shows people stopped attending restaurants well before the lockdowns, and are now not returning in big numbers after restrictions were lifted. OpenTable estimates one-quarter of restaurants will never open again.

It's a quip but not as ridiculous as it sounds to say the Federal Reserve has begun human trials of a bankruptcy vaccine. Take a look at this amazing US debt database.

If there's one factor which ensures Australia will not be immune from the fallout, it is the decline in net overseas migration, which has driven the majority of Australia's strong population growth in recent years. The Government expects a decline of 85% in net overseas migration in 2020/21 versus 240,000 last year. We have already seen a 99% drop in overseas visitors to Australia during April, with over 50,000 net departures. These declines will have profound implications for employment and housing demand, including falling rent on residential real estate.

Will the crisis drive a major policy rethink? Phil Ruthven takes a critical look at the claim that COVID-19 opens opportunities for policy reforms by checking how Australia may fare in three crucial areas needed for productivity to prosper.

Even those who have not been watching the amazing Netflix series on Michael Jordan, The Last Dance, have probably read the media feedback. Jonathan Hoyle weighs into the controversial subject of whether business can learn anything from Jordan's single-minded winning ways.

(As an aside, Jordan’s signed and match-worn Nike Air Jordan sneakers from his rookie season in 1985 fetched $US560,000 in an online auction a few days ago, an all-time record price for signature sneakers).

Back to the world of investing, there are more people looking for 'the next big thing' than ever before. Charles Dalziell asks whether a long-term investor should bother.

One asset class that has seen major price falls and only modest recoveries is the listed property trusts, or A-REITs. Adrian Harrington says they are not all equal, and he checks listed versus unlisted outcomes.

Back on debt funding by governments, Miles Staude explores the limits and shows why risk is heightened in all markets. Then Mike Murray uncovers a healthcare stock that is not only defensive in the crisis but offers good growth opportunties.

Two articles on management of personal finances. Brendan Ryan explains a surprising ability of relatively wealthy investors to access government benefits, while Anthony Cullen says it is vital that two new measures designed to help in the crisis are properly understood.

Then bonus pieces from Esty Dwek on which markets will recover first from COVID-19, while Michael Collins considers four major changes that are likely to endure.

In this week's White Paper, Legg Mason affiliate Western Asset describes their outlook for the June 2020 quarter, seeing more of a U-shape than V-shape. In the updates below, the BetaShares April ETF Report shows that sector continues to grow and is back above $60 billion.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Reviews from BetaShares and Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website