On Monday, one of the most compelling sports documentaries ever broadcast came to a thrilling end. I’m talking, of course, about The Last Dance, the story of Michael Jordan and the Chicago Bulls. In case you don't know anything about it, see this two-minute video. As Jordan says, "Winning has a price. Leadership has a price."

View this two-minute excerpt from The Last Dance

It has sparked endless fascinating debates (if you like sport) such as which other athletes have similarly dominated their sports. We came up with this short list— Mike Tyson, Tiger Woods, Serena Williams, Michael Schumacher, Don Bradman, Wayne Gretzky and Messi/Ronaldo. But I’m sure you’ll have your own.

Why was The Last Dance so fascinating? In part, it was an insight into the pursuit of excellence in its purest form. Jordan’s ambition, drive and tenacity were at times both beautiful and inspiring, but also brutal and intimidating. Or maybe it was the shock of hearing a sports star talk in such honest terms. How we all dread the post-match ‘interviews’ with today’s players. Whatever the question, you know you’ll get the trifecta: it’s not about me, it’s about the team; credit to the oppo’ – they ran us hard; and, we’re just taking one game at a time.

For those in the business world, earnest debates have ensued on what we can learn from Michael and the Bulls. The answer, I’m afraid, is very little. Sport is a terrible metaphor for business. Here are eight reasons why.

1. Chicago simply got lucky

One of the greatest athletes of all time landed on their doorstep and they promptly won six titles. They won nothing before Jordan and have won nothing since (in fact, the post-Jordan Bulls have never made the Finals and missed the Playoffs 10/21 times). Yes, they had a great coach in Phil Jackson (he won a further five titles with The Lakers) but he couldn’t win without Michael. With just five players in a team, basketball is unique amongst team sports in that one great player can have such a huge impact. Even Jordan’s soccer equivalent, Lionel Messi, couldn’t lead an ordinary Argentinian team to World Cup glory. This isn’t the story of a great team—it’s the story of a uniquely gifted individual.

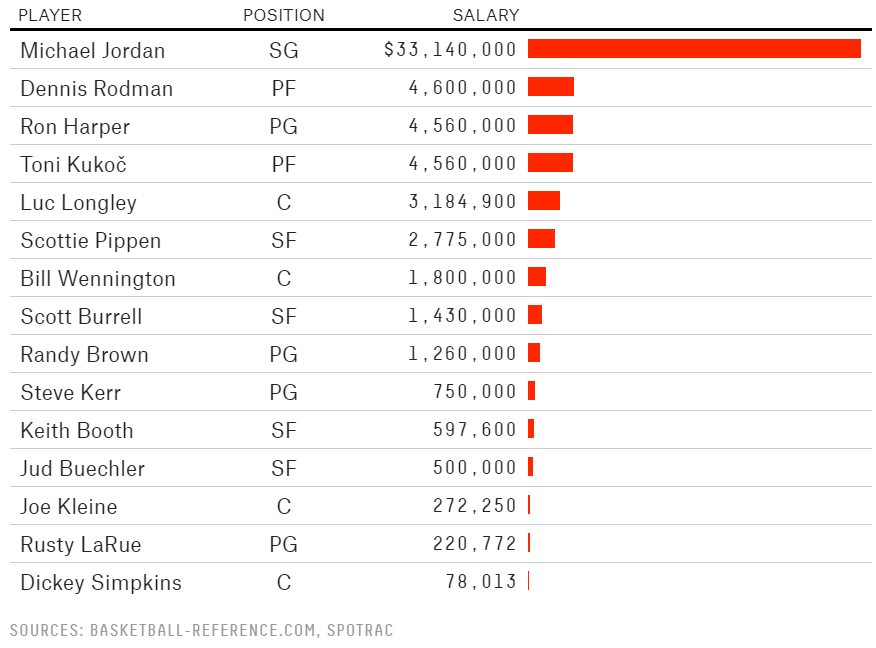

In case there is any doubt as to Jordan’s worth, here’s the Chicago Bulls 1997-98 season roster. Jordan was paid more than the rest of the team combined.

2. Winning is different from succeeding

Sports teams exist to beat the competition. Businesses, on the other hand, succeed by delighting their customers. It helps if they are better than their competition but being different and standing for something is equally important. Apple devotees love the beauty and creativity of their product suite, those who wear Nike’s Air Jordans identify with the street appeal of both brands, but sports fans just want their team to win.

And they don’t care how ugly this is. Jose Mourinho came in for much criticism when managing Chelsea for his tedious style of play (go 1-0 up and then 'park the bus') but the criticism only came from non-Chelsea fans. Oh, what The Kop wouldn’t have given at the time for a turgid 1-0 Liverpool win!

3. There’s no ‘I’ in Team but there is in Win

The employees of a sports team are a world apart from those of a business. Firstly, they have an exceptionally short playing life. According to the Wall Street Journal, the average football career in the NFL (Not For Long) is just 2.66 years. This means players are singularly focused on maximising their personal earnings in the shortest period possible. Second, they need to build their personal brands to complement their playing incomes. The result is a bunch of narcissistic mercenaries. Third, most sports operate a salary cap, meaning the best players have their earnings limited by law (Johnathan Thurston and Cameron Smith would have earned far more if the NRL operated a free market). The most pernicious effect of a salary cap is that it reduces the incentive to find and train young talent.

Business employees, on the other hand, can look forward to careers measured in decades, with performance peaking well into their 50s. Companies, free to pay their staff whatever they consider them to be worth, are incentivised to recruit and train young talent. Culture really matters in business. It’s not just the fancy buzzword of the day—culture promotes loyalty, growth and stability.

4. Coaches are not CEOs

Because staff and players have such different motivations, the mentality of business managers and sports coaches are poles apart. The best business managers are great listeners, who nurture their talent with patient, supportive guidance. In contrast, the most effective sports coaches are tyrants. The only comparison to the business world are turnaround situations, where decisive, ruthless and often unpopular leadership is required. Sports teams are essentially narcissistic mercenaries run by tyrants.

5. Mavericks don’t work in business

It was fascinating to watch how Jackson and Jordan gave special treatment to the talented but idiosyncratic Dennis Rodman. They needed him and were prepared to make allowances. It’s challenging for a business to do this as it tears at the fabric of their culture.

6. Ownership matters

Businesses are run to maximise the capital of the owners. Period. The owners of sports teams (often individuals) do so for a variety of reasons. These include avoiding execution (Russian oligarchs buying English Premiership teams), conferring legitimacy (Middle Eastern regimes with dubious human rights records) and vanity projects (the ultimate toy for every self-respecting billionaire). The profit motive rarely figures. This means that the key metrics for success of sports teams and businesses are so different. One has to feel sympathy for the long-suffering fans of Sunderland F.C. (the subject of an equally compelling sports documentary Sunderland Til I Die). Their club is owned by a cash-strapped cowboy fan, whereas their bitter rivals Newcastle are on the verge of seeing their beloved club transferred to Saudi Arabia’s Public Investment Fund. Such is the lottery of sport.

7. The separation of revenues from profit

Businesses are often owned by thousands of small shareholders, whose rights are protected by a board, which appoints a CEO to make the decisions. The key appointment for owners of sports teams, on the other hand, is the coach. Most teams don’t have a Jerry Krause-like figure who wielded real power (mainly, it would appear, by keeping his stars at each other’s throats). Business leaders are incentivised to grow revenues whilse keeping a very keen eye on costs, whilst coaches care solely about revenues (winning)—profit growth is Someone Else’s Problem. This separation of ownership of revenues from costs is unique to sport.

8. Legacy matters in business

Both Manchester United and the Chicago Bulls were great teams for a period, but when their stars left, they headed straight into the wilderness where they remain today. A successful business CEO, on the other hand, is defined as much by her legacy as her results while in power. Succession planning is at the forefront of the mind of every decent business leader.

So enjoy The Last Dance for what it is - a fascinating sports documentary, expertly directed by Jason Hehir, on the pursuit of excellence and of one of the greatest athletes of all time.

And for those business leaders who crave leadership lessons from the sporting world, read Legacy instead, James Kerr’s brilliant book of the greatest team of all time - The All Blacks.

Jonathan Hoyle is CEO of boutique private wealth firm, Stanford Brown, and a sports fan (especially Manchester United and the Manly Sea Eagles). He can be found on a Saturday afternoon playing soccer for Manly Allambie O-35s Div 4. Every game feels like the World Cup Final.