To help manage the economic impact of COVID-19, the federal government has announced a series of initiatives to help cushion the blow of these extraordinary times. On 24 March 2020 the government’s Coronavirus Economic Response Package Omnibus Act 2020 received Royal Assent.

As it did in the wake of the GFC, the government has reduced the minimum drawdown requirements on some pensions.

Minimum pension drawdowns

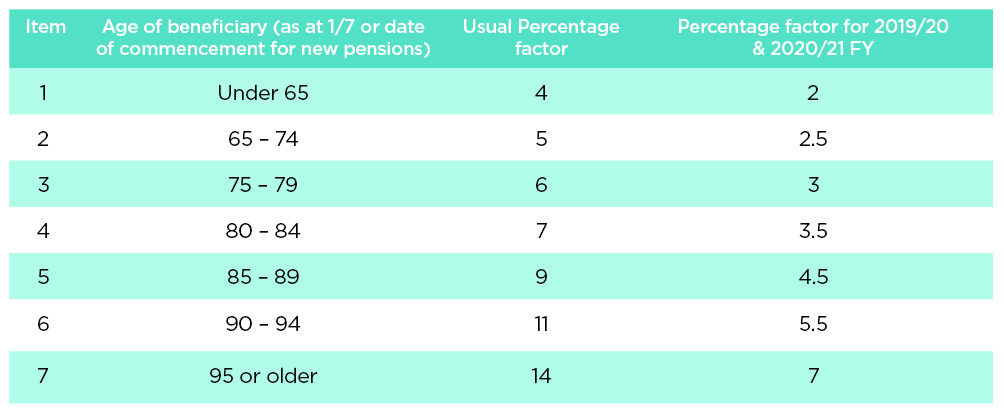

In relation to Account Based Pensions (ABP), minimum income stream benefits are determined by multiplying the balance of your ABP by the relevant pension factor, per the below table.

These halving of minimum requirement measures also apply to the following pensions:

- Market Linked Income Streams (MLIS)

- Transition to Retirement Income Streams (TRIS)

- Allocated Pensions (AP)

Where these pensions have a maximum withdrawal limit, there is no change to calculating the maximum.

Withdrawals from complying pensions that are determined by an actuary cannot be halved under these temporary provisions. Pension payment requirements will continue to be in accordance with the original expectations.

Adjusting prior payments

Where you have been receiving regular pension payments during this income year, it’s possible you have already received more than the required minimum pension payment amount for this income year. We have received questions about whether it’s possible to re-classify pension payment amounts that have already been paid as lump sum withdrawals rather than pension payments. This is due to the fact there may be benefits from having withdrawals treated as lump sums.

Having payments treated as lumps sums will impact your Transfer Balance Account (TBA) and may free up space within your Transfer Balance Cap (TBC), potentially allowing for further strategies in the future. Further to this, if you are under the age of 60, accessing the lump sum low rate cap may provide greater tax benefits at an individual level than receiving pension payments.

As regulator of SMSFs, the ATO's view on changing the treatment of payments is an important starting point. The below Q&A has been taken directly from the ATO's FAQ page dealing with COVID-19 and superannuation:

Question: I am retired and receive an account-based pension from my SMSF. My account-based pension has already paid me more than the reduced minimum annual payment required for the 2019–20 financial year. Is the amount over the minimum considered superannuation lump sum amounts?

Answer: Pension payments that you have already received cannot be re-categorised. Accordingly, payments made from your account-based pension in excess of the new reduced minimum annual payment required for the 2019–20 financial year are pension payments (that is, superannuation income stream benefits) for the year and not superannuation lump sums.

Further to this, the following must be considered before attempting to make any adjustments to prior payments:

- Treatment of benefit payments: For a withdrawal to be treated as a lump sum benefit you must request such a treatment prior to the payment being made. Trustees should have on file the appropriate paperwork to support such a payment.

- Timing of the law versus application of the law: Although the reductions in the drawdowns will apply for the entire 2019-20 and 2020-21 financial years, the legislation to support the changes only received Royal Assent on 24 March 2020 and commenced from 25 March 2020.

Any benefit payments that were previously classified as pension payments prior to 25 March 2020 were made based on the law at that point in time. In the event of an audit, it may be difficult to justify a claim of meeting the reduced minimum requirements before the law had been changed.

Let’s consider George whose original minimum required pension drawdown was $35,110. George was receiving a monthly drawdown of $2,926 on the first day of each month. From 1 July 2019, to the date of Royal Assent (24 March 2020), George has received payments totaling $26,334. As this amount exceeds George’s reduced minimum drawdown amount of $17,560, he is not required to withdraw any further amounts for the remainder of 2019/20.

Assuming George continues to receive the monthly payments, he may look at the potential benefits of treating the remaining payments for the year as lump sum benefits. What George is unable to do is have any of the previous monthly pension payments re-classified. They must remain as pension payments.

Pensions must be paid in cash

Where you also have an accumulation account in the fund, and you have unrestricted access to that account, it will be tempting to reclassify pension payments in excess of the new reduced drawdown amount as lump sum withdrawals from the accumulation account. This will have the effect of increasing the fund’s exempt current pension income (ECPI) deduction. Once again, this reclassification cannot occur if the documentation on file supports the fact that the payment was a pension payment.

One final point on pension payments. They must be paid in cash. As of 1 July 2017, lump sum payments are no longer able to be used to meet minimum pension requirements. As the end of the 2019/20 financial year approaches, and even though the minimum drawdown rates have been reduced, if the new reduced minimum pension amount has not yet been paid, and the cash holdings and/or cashflow of your fund have decreased (because for example the fund’s investment income has reduced as a result of the COVID-19) it may be prudent to start considering how payments will be funded prior to the end of the year now.

Temporary Early Access to Super (TEAS)

A second superannuation measure that may assist you cope with the impact of COVID-19 is the temporary condition of release that may allow early access to your benefits. For further details about the eligibility criteria please refer to our previous article on accessing your super here. That article explores, not only TEAS but other conditions of release that may provide additional options to accessing superannuation.

As part of the application process, you are required to certify that you satisfy the eligibility criteria. You can apply for TEAS via your myGov account. If you don’t have a myGov account or cannot access it, applications can be completed over the phone by contacting the ATO. Although you may not need to supply any supporting evidence of eligibility as part of the application, you will be required to maintain it on file in case you are asked to produce it at a later date.

After you have verified your identity, you will see a list of funds, along with the available balance in each account, that they can select to access benefits from. In the case of a new SMSF, which has yet to lodge its first annual return with the ATO, no balance will appear but that doesn’t preclude you requesting an amount to be withdrawn from your SMSF.

In this situation, the determination issued by the ATO will stipulate the amount that can be withdrawn from the SMSF and it will be up to you, as the trustee of the SMSF, to determine if there are sufficient funds in your member account. You can choose up to five accounts but are limited to only one application in this financial year, and another application next financial year, as long as that application is made before 24 September 2020. Regardless of how many accounts are chosen, the maximum amount that can be accessed is $10,000 per application.

The ATO expects to issue notices of acceptance or rejection within four days but depending on volumes of applications may do so within one to two days. The main difference between SMSF and APRA fund members is that release authorities for APRA funds will be sent directly to the fund, whereas if you are an SMSF member you will receive any notifications directly from the ATO. You will then be required to supply the release authority to the trustees, in most circumstances this will be yourself.

Once a trustee receives a valid determination it is expected that payments are made as soon as practicable, as a single lump sum amount not exceeding the amount stated on the determination. A lower amount may be paid if your account balance is insufficient to cover the stated amount or you formally document a request to the trustee for a lower amount. However, you will be unable to request a top up of the remaining amount later.

The application process must be followed and a favourable determination must be issued by the ATO before you are able to access your SMSF benefits. Accessing benefits without meeting a condition of release may result in action being taken for illegal early access of benefits.

We are aware of strategies that involve members accessing their superannuation savings early under the TEAS and then recontributing the withdrawn amount back to their fund as either a salary sacrifice contribution or as a personal deductible contribution. The ATO has asked individuals, tax agents and businesses to be mindful that it is not acceptable to apply for relief payments where eligibility may be questionable. Applications for relief through stimulus measures which are based on artificial arrangements will see the ATO take swift action.

To stay on top of the latest news in relation to COVID-19 and SMSFs keep an eye on our articles on the SuperConcepts website here.

Anthony Cullen is an SMSF Technical Specialist at SuperConcepts, a sponsor of Firstlinks. This article is for general information purposes only and does not consider any individual’s investment objectives.

For more articles and papers from SuperConcepts, please click here.