Weekend update: The US market rallied strongly on Friday with the S&P500 up 2.6% and NASDAQ another 2%, almost touching its all-time high. The creation of 2.5 million jobs in the US in May was much better than expected. Australia added 4.2% last week to continue the rebound, now only 16% off the February high. The market is firmly in 'risk-on' at the moment and ignoring bad news.

***

Drought, bushfires and coronavirus ... the Treasurer has admitted Australia is now in a recession after the fall in the March quarter GDP. The June quarter is certain to be worse. And such are the times we live in, despite blood and fires on the streets of dozens of US cities where 40 million people are unemployed, markets continue to rise and the ASX200 is now 35% up from its 23 March low. The market has factored in a V-shape recovery that still seems hard to fathom.

Much of the optimism is due to the stimulus packages. The withdrawal of up to $20,000 from superannuation is understandable for anyone struggling financially during the epidemic. A loss of retirement savings in 30 years is no match for a present-day need to put food on the table or pay the rent. But many young people who have accessed both JobKeeper and their super have more money during this crisis than ever before in their lives. Treasurer Josh Frydenberg actively encouraged it with statements such as “this is the people's money and this is the time they need it most”.

There have always been rules that allow access to super for hardship, but it was previously difficult to qualify. Where the new policy falls down is the ease with which so many can withdraw. Although in theory it is targetted at people disadvantaged by the virus due to unemployment or a loss of hours, the guidelines say:

"You will not be required to attach evidence to support your application; however, you should retain records and documents to confirm your eligibility."

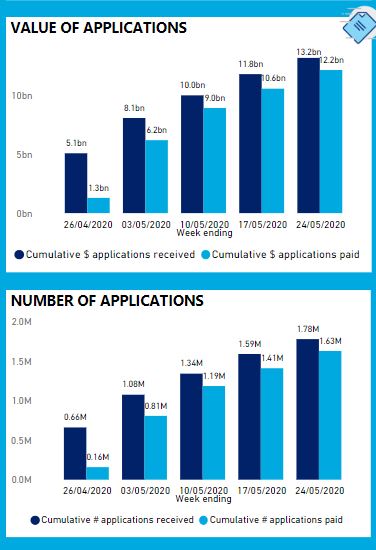

It's a low bar to jump over, and less than 1% of applications have been rejected. There is no requirement to confirm the loss of hours is not compensated by government support. About 1.8 million people have applied for $13.2 billion already. Given there is a month to go on the first $10,000, with another $10,000 from 1 July, withdrawals could top $30 billion.

Source: APRA Early Release Scheme statistics

Source: APRA Early Release Scheme statistics

Most worrying is evidence (from a smallish sample of 13,000) from AlphaBeta (part of Accenture) that 40% of people who have withdrawn money have experienced no drop in income. The research suggests increased spending on discretionary items such as clothing, furniture, cars and alcohol, with about 12% spent on gambling. There's a lot of 'want' rather than 'need'.

As a recent article by David Bell and the compounding article last week both show, the long-term consequence of early withdrawal is a major loss of retirement savings. Scott Morrison says the Government has no interest in what people are spending the money on, but consider these statements from retailers (courtesy of NAOS):

“JobKeeper in our view is certainly fueling a lot of growth [in sneaker sales]. It really resonated with kids that they had some money.” Daniel Agostinelli, CEO, Accent Group, owner of high-end sneaker stores, HypeDC and Platypus.

“Used vehicles have really taken off – much stronger than new cars – and actually better than pre-COVID. It’s a lot of first-time younger buyers. In the past they would have caught the train or the bus – they’re now planning to drive”. Anthony Altomonte, Managing Director, The Alto Group, car dealers

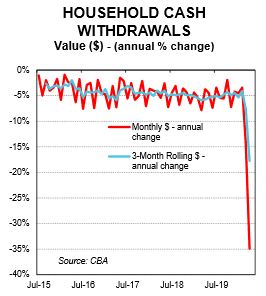

More cars on our clogged roads and less super in the accounts of young people with nice sneakers are two unwelcome, long-term impacts of COVID-19. The use of cash also has rapidly declined and this change will endure. Anyone who owns an ATM has become another victim of the virus.

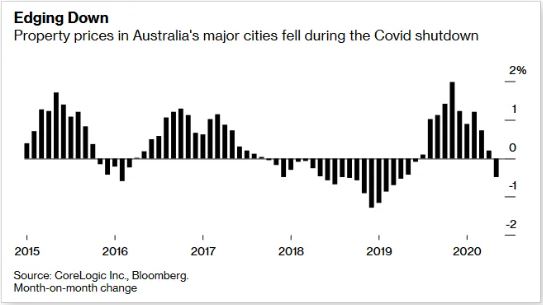

However, with $7 trillion in Australian residential housing, there is no doubt which asset class delivers the biggest wealth impact across the nation, and the first signs of a reversal from the boom of late 2019 are now in CoreLogic's numbers.

In Edition 360, a full 360 degree market review ...

Stephen Mayne is Australia's leading shareholder activist, and his analysis of Share Purchase Plans (SPP) shows how poorly retail shareholders are often treated. For example, in my own case, an allocation of only 672 shares with a refund of $27,048 on a $30,000 application for Auckland Airport was not worth the paperwork, and the Cochlear story in Stephen's article is as bad.

It's great to welcome back my co-founder Chris Cuffe who describes his use of private debt funds in managing the portfolio of the APS Foundation. Read about the tax advantages of charitable subfunds as we near the end of FY20.

Then updates from leading Australian investment managers. Matt Reynolds describes three market facts and three mistakes everyone should consider, Anton Tagliaferro shows the types of companies he is now looking for, and Kej Somaia discusses portfolio construction and explains how his asset mix has changed since COVID-19 hit. Decades of experience from these fundies.

It's easy to think that all index funds are the same, but it is often not easy to replicate an index. Duncan Burns describes what to look for.

Pamela Hegarty says the pandemic has accelerated digitial and disruptive changes, and she highlights the areas she is now watching closely.

The share price of Afterpay has moved from $8 to $50 in the space of only two months, and Lex Hall checks the fair value placed on the stock by Morningstar analysts.

Each month, Jonathan Rochford reviews global media and provides links to stories most people have missed. Provocative, quirky, unusual and plain weird.

This week's White Paper from Capital Group offers ten quick tips for retirees hit by market falls while drawing down a pension.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website