(Thursday's newsletter did not reach all our readers so we are resending to our entire database with some adjustments).

Weekend market update: On Friday in the US, the S&P500 fell 0.4% but NASDAQ held on to its recent gains despite almost 250,000 new virus cases. Over the week, the US was up 1.3% on the rollout of vaccines. Australia completed seven consecutive weeks of rises with the S&P/ASX200 up 0.5% but it fell a hefty 81 points or 1.2% on Friday due to the Northern Beaches outbreak. Demand for iron ore supported the currency to above US$0.76.

***

In our final edition for the year, we feature a free ebook of 20 interviews conducted with market experts across a wide range of asset classes and investment styles. A great Christmas read. Then we take a close look at ETFs, check the outlook for 2021, review where super policies are headed and reveal some fresh investment ideas.

But first ...

If there is one thing 2020 taught us, it is to expect the unexpected. Although people like Bill Gates forecast in 2014 that a pandemic on a global scale would hit at some time, nobody seriously factored it into investment analysis. And even when COVID-19 struck, many analysts forecast economic doom and market collapses which also proved wrong.

Remember when Amazon was expected to kill Australian retailers? No doubt Gerry Harvey and Ruslan Kogan thought 'bring it on'. Remember Afterpay trading at $8 in March and now it's over $110. Remember how regulations would kill big tech? Remember how loan defaults would bury banks during the pandemic? And now, any number of companies are panned for their expensive valuations as the market runs on optimism. Who's to know if any company is in bubble territory?

But in another league is the recent IPO of DoorDash in the US. It was valued at US$16 billion in its last private funding round in June 2020 and it listed at US$102 before closing its first day at US$189 with a market value of US$72 billion. It's a seven-year-old startup that lost US$667 million in 2019 and US$149 million in the nine months to September 2020.

This company is not like Tesla which at least is changing the way we think about cars, even if it is also overvalued. DoorDash is an app for ordering food.

Asad Hussain is the lead mobility analyst at PitchBook (a Morningstar company), and prior to the float, he wrote:

"We believe DoorDash could be valued north of $25 billion in an IPO. Our analysis is based on favourable market conditions, increased investor enthusiasm, derisked regulatory environment, valuations of precedent transactions, and a similar valuation multiple to what the company has traded at in the past."

Well, US$72 billion is well north of US$25 billion, and David Trainer, CEO of New Constructs, called it “the most ridiculous IPO of 2020”. He added:

“They do not have a way to make money long term. There's a lot of competition and we're seeing their market share decline. At the end of the day, this business is a race to a zero-margin business because there's really no differentiation."

Every market high delivers companies which mark a point in history, and DoorDash is an early candidate for a stock we will refer to for many years.

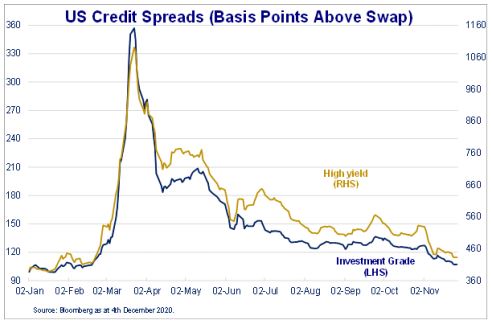

Of course, market euphoria is not limited to IPOs. Both high yield (formerly junk bonds) and investment grade bonds have rallied strongly since the start of April, and it's as if the disruption of a global pandemic never happened. Thousands of companies are stressed and with winter coming in the US, the pandemic numbers will get worse. But the search for yield is relentless, as shown below. Remember basket-case Greece? Its 10-year bonds are now trading close to 0.5%.

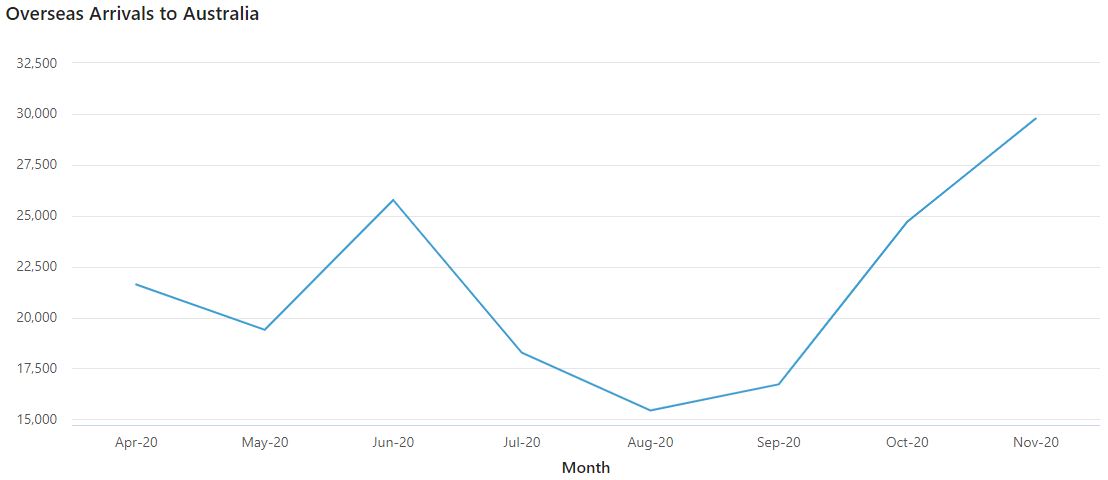

We can see reasons for the optimism even in the worst-affected of all industries, airlines, although this week's virus spike in NSW is a threat. The chart below from the ABS shows overseas arrivals to Australia. With our strict quarantining requirements, it's surprising to see nearly 30,000 arrivals in a month (although not all go into lengthy isolation). Jetstar reported last week that 850 return flights a month will run by March 2021, or 10% more than in March 2019, but it relies on community transmission remaining close to zero.

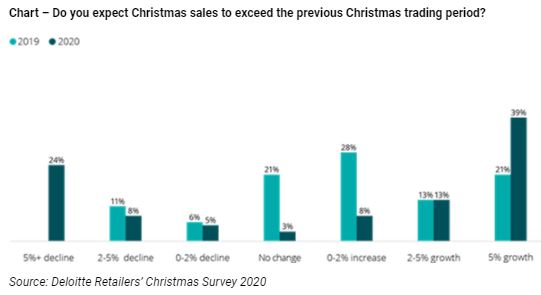

On the other hand, Christmas spending will not benefit all retailers equally. Deloitte’s recent Retailers’ Christmas Survey shows a record number of retailers expecting sales growth above 5% but a quarter of retailers expect declines of more than 5%. Food and household goods are strong while clothing, department stores and cafes are lagging.

In this week's packed edition ...

The free ebook brings together 20 favourite interviews from 2020.

The final discussion for the year is with Evan Reedman, Head of Product at Vanguard, who describes the success of ETFs and how his company decides which products to launch. Backing up Evan's views, November 2020 was an historic month for ETFs, and BetaShares summarises the major milestones and identifies which funds and asset classes are benefitting.

Then Dawn Kanelleas looks beyond the large caps to identify small companies which are prospering and why market conditions suit them.

After a slow start to the year, 2020 is ending with an IPO bang as owners look to capitalise on bags of cash looking for a home. But it's not a road paved with gold and Andrew Mitchell explains what he looks for in an IPO.

We continue our articles looking into what 2021 promises with Ron Temple and Apratim Gautam who are not as optimistic as others. They list the negatives and positives including the inequitable rollout of vaccines.

Then two important papers from super industry leaders. Andrew Boal of Rice Warner says it's time the work done by various reviews led to greater clarity on superannuation objectives and post-retirement products, while Tim Hodgson of the Thinking Ahead Institute makes pointed criticisms of the Government's 'Your Future, Your Super' reforms as a poor way to measure fund performance.

Finally, an important checklist from Jonathan See for anyone taking the opportunity over the holiday season to clean up their personal affairs. Don't leave a paperwork and administrative nightmare behind for some poor friend or relative to clean up after you die.

In a year when ESG investing has further entrenched itself in the mainstream, our final White Paper for 2020 from Perpetual looks at how renewable energy is straining our existing energy system during such a rapid transition.

Thanks for following us again in 2020, our highest year of reader engagement with the added distribution resources of Morningstar.

Firstlinks is taking a short break and we will return with lots of great investing ideas from our leading contributors. Have a good and healthy Christmas as you catch up on some reading.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website