As 2020 nears an end, investors face a challenging combination of crosscurrents. On the positive side, the US election has passed with a market-friendly outcome and three COVID-19 vaccines appear to be within weeks of widespread distribution, with more likely to follow.

Typically, these events would be the all-clear signal investors need to shift out of defensive work-from-home beneficiaries into cyclical recovery plays. However, major developed countries across the Northern Hemisphere are facing new record levels of COVID-19 infections, spurring new economic lockdowns and increasing the risk that many companies, particularly small businesses, might not make it to the other side of this pandemic.

Judging from our earlier pandemic experience, this scenario would signal exactly the opposite market reaction as that to the vaccines. Investors face a timing conundrum, indicating yet again that it is likely to be darkest before the dawn.

The timing conundrum

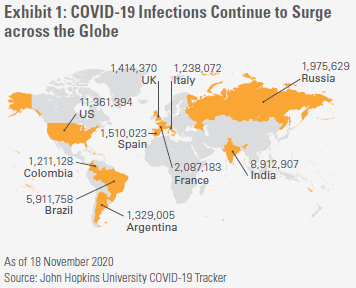

Against this backdrop we believe it is fair to say that the global outlook for 2021 is mixed. The positive news is that we are now at the beginning of the end of a pandemic that has infected more than 55 million people and resulted in at least 1.3 million global deaths (Exhibit 1).

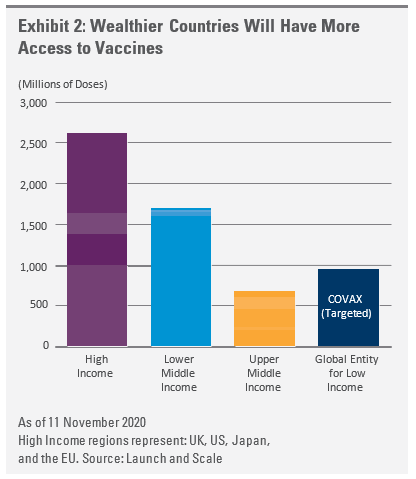

However, this process will be long and complex, and life may not return to normal in wealthy developed countries until 2022. Less wealthy countries will wait at the back of the queue for access to the vaccine and are likely to fall further behind developed economies in the meantime. Even within wealthier nations, inequitable distribution of the vaccine could exacerbate existing inequality.

Moreover, the consequences of the lack of fiscal follow-through to support economic activity in the United States are likely to accumulate, dampening the pace of the recovery. Fortunately, European governments have enacted significant fiscal stimulus packages and are poised to benefit from the European Union recovery fund as it begins disbursing funds in 2021. China, by contrast, has rebounded rapidly from the pandemic and is on track to deliver growth in 2021 at levels not seen in years on the back of significant monetary and fiscal stimulus.

This backdrop is not new. Navigating it is becoming more treacherous, however. Global central banks hoping to invigorate growth and increase inflation expectations continue to prop up the value of financial assets, but we appear to be approaching a point at which central banks can no longer drive the economy.

If that is the case, security selection will be more important than ever as we wait for a paradigm shift to economic growth that gives rise to the next investing regime.

The COVID-19 vaccine could result in major economic divergence

The creation of new vaccine techniques could herald a new dawn in vaccine technology which could mean humanity is less at risk from pandemics in the future. And yet, the politics of vaccine distribution may be the most challenging part of the process. How, when, and who gets access to the vaccine may exacerbate the inequalities that have marked the last few decades, create new forms of bio-inequality, and result in long-lasting imbalances. Policy makers can ensure the vaccine is distributed equitably, but if they fail, citizens may not forget. Exhibit 2 shows the potential inequity.

Let's summarise the positives and negatives for the US, Europe and China with more details in the full paper linked below.

US outlook: positives and negatives

Positives

- Vaccine approval and rollout will likely accelerate an economic recovery

- Continuing expansionary fiscal policy is likely, though it may be smaller than Democrats hope

- Extremely accommodative monetary policy will last for several years

Negatives

- Potential policy gridlock from a divided government

- Lack of meaningful additional monetary policy tools could limit effectiveness

Europe outlook: positives and negatives

Positives

- Major fiscal stimulus could greatly assist the economic recovery

- Stimulus targeting green investments could be critical in diminishing carbon emissions and catapult Europe into the lead on green technology

Negatives

- Political fragility, from Brexit to Hungary and Poland, could hamper recovery efforts

- A change in German leadership could bring uncertainty to the union

China outlook: positives and negatives

Positives

- A strong economic recovery could help keep the global economy afloat

- A greater emphasis on quality of growth could reduce pollution and health problems

Negatives

- Ongoing dependence on credit raises risks of excessive leverage

- The country’s human rights record will draw greater criticism and pressure

Investment implications

The next six months are likely to represent a choppy transition to the post-pandemic investing environment later in 2021. We urge investors to remain focused on the long term rather than trying to time the ups and downs of short-term market gyrations.

With the US political system likely to be mired in the gridlock of divided government, fiscal policy probably will not jolt the global economy out of its longer-term lethargy. The EU recovery fund and ongoing Chinese stimulus measures offer some hope of a stronger economic rebound than occurred after the Global Financial Crisis when much of the euro area suffered under excessively rigid dogma around fiscal conservatism. This ideological rigidity cost tens of millions of people years of economic vitality and has had lifelong implications for earnings, health, and happiness.

This time, Europe seems to have risen to the occasion and is trying to accelerate the recovery, while also using the opportunity to more aggressively target climate change.

Monetary policy may continue to be a focal point for investors but central banks have few tools left at their disposal. With negative real interest rates across developed markets, investors seeking income likely will continue to struggle to find attractive opportunities.

We believe much of the developed market sovereign debt universe is unattractive. We would either rely on an actively-managed global fixed income strategy that can tactically allocate to attractive opportunities or, if investing directly, we would seek incremental returns from investment grade corporate credit, high-grade securitised credit and select hard currency emerging markets debt issues. The extra yield on these assets results from incremental risk, but at this stage of the economic cycle, appears attractive relative to the alternatives.

The 'lesser evil' of asset allocation

We have seen in the past that extended periods of extraordinarily low interest rates can lead equities to appreciate as investors choose the “lesser evil” in their asset allocations. We expect 2021 to be no different. Our base case is that equity valuations continue to climb. The conundrum we face within the equity market is the tension between the cyclical impetus to invest in stocks that tend to outperform as their returns on capital improve after economic downturns versus the structural benefits from persistent ultra-low interest rates for quality and growth stocks. The stocks that are likely to benefit from cyclical improvement are not limited to those traditionally viewed as being value stocks. There are many companies across a range of subsectors that have traded materially lower as investors seem to have concluded that the decrease in demand and the subsequent decline in returns on capital caused by the pandemic are permanent rather than temporary.

In some cases, we disagree and would argue that the arrival of vaccines should lift those shares higher. On the flip side of the story, the market has also priced other stocks that have benefited from the pandemic as if the gains are permanent and returns will remain elevated for years to come. In some cases, we believe this optimism is well placed as structural trends were accelerated and pulled forward. In others, however, it is not, and we expect meaningful downside moves in some shares as the pandemic winds down.

While the jury is out on factor allocation decisions, considerations around the level and trajectory of financial productivity relative to the valuation of shares are critical from a security selection basis.

In this case, we would caution against chasing companies that depend on cash flows far in the future as they are susceptible not only to the risk of failing to deliver on their business plans, but also to seeing their valuations compressed severely if interest rate trends change and discount rates increase vis-a-vis future cash flows.

Quality stocks, on the other hand, have a long history of outperforming markets through the cycle, albeit with short punctuated periods of relative weakness. We would focus on capitalizing on near-term anomalies to position in these quality companies, complemented by companies that can improve returns to pre-pandemic levels as we exit this crisis.

Summary of opportunities

The pandemic has exposed fragilities that had been overlooked for decades and that will now need to be addressed. At the same time, we saw that governments can respond to a crisis with both fiscal and monetary policy tools that can be very effective.

The key is sustaining the use of those tools long enough to exit the crisis, rather than misinterpreting the success of the policies to mean the stimulus is no longer needed. In the United States, we expect significant policy changes from President-Elect Biden, but also legislative gridlock. The EU recovery fund and stimulus programs in China should help lift growth locally, but the United States will have to wait for a cyclical recovery after the pandemic. We expect central banks will continue to try to stimulate growth, though they have few remaining tools.

Investors will still face difficult decisions regarding sources of income, diversification, and capital appreciation. We would encourage focusing on bottom-up fundamentals for each individual security, while also avoiding the instinct to move too far out on the risk curve. The past year has been tumultuous, but there is a light over the horizon. Moreover, as a result of the pandemic, the power of scientific innovation has been demonstrated and should give us optimism as we seek to address other big challenges such as chronic health issues and climate change.

Ronald Temple, CFA is Co-Head of Multi-Asset and Head of US Equity and Apratim Gautam is a Macroeconomic and Policy Analyst at Lazard Asset Management. This article is general information and does not consider the circumstances of any investor.

A copy of the full report can be accessed here.