Weekend market update: It was a week of falls for sharemarkets with worries about inflation and higher bond rates pushing the S&P/ASX200 down 1.3% on Friday to take the week to a small loss. US shares were down 0.7% for the week. The 10-year bond rate in both the US and Australia is up about 0.8% since the March 2020 lows showing how difficult it is to rely on bonds for a defensive allocation when rates are so low.

***

The Reserve Bank of Australia (RBA) is putting borrowers ahead of depositors despite declining incomes for millions of savers and retirees being a drag on economic growth. The focus is on the cost of debt, even if low rates feed into strong residential property prices and do first-home buyers no favours. In fact, the RBA Board seems relaxed that retirees are taking more risk to generate income. The latest Board minutes say:

"Members also discussed the effect that low interest rates have on financial and macroeconomic stability. They acknowledged the risks inherent in investors searching for yield in a low interest rate environment, including risks linked to higher leverage and asset prices, particularly in the housing market. The Board concluded that there were greater benefits for financial stability from a stronger economy, while acknowledging the importance of closely monitoring risks in asset prices."

How does the RBA 'closely monitor risks in asset prices'? Bitcoin at US$50,000? Surging home prices? Equity markets at all-time highs during a pandemic? Our quotes on expert warnings are becoming tiresome, but here's another from Mohamed A. El-Erian, Chief Economic Adviser to German investment giant Allianz in Politico last week:

“We are now living through the greatest disconnect between financial markets and the real economy that we have ever seen. And we now have younger retail investors who have disposable cash, are savvy at social media and have cost-free platforms.”

There was also a subtle change in the RBA minutes, moving from the 2020 message of “the Board is not expecting to increase the cash rate for at least three years” to the latest wording of “2024 at the earliest”.

The price of money is only half the problem for investors who want a safe deposit haven. The RBA is pumping so much cash into the system that banks do not need customer deposits.

I sat down last week with someone who has been at the centre of liquidity flows, central bank policies and interest rates for decades. I worked with Peter Sheahan at CBA about 35 years ago and I asked him to explain the impact of RBA policies on bank funding and retiree savings, and he went even further. He believes central banks have delivered a liquidity nirvana to financial markets that will underpin asset prices for a decade or more.

Contrasting opinions make a market. Peter takes the opposite view to those saying the market is too frothy and due a correction. The RBA and other central banks will save us, notwithstanding the recent drift up in bond rates. The Board minutes also announced an extension of the government bond buying programme once the original $100 billion finishes in April 2021 when the RBA will buy another $100 billion of bonds. You be the judge on how long this support can hold up asset prices despite an inflationary threat.

In another note of optimism, Kent Williams highlights the pent up spending power of the Australian consumer, and like Peter, draws on the massive increase in bank deposits as proof consumers have plenty of firepower.

With so much money floating around and banks eager to lend, CBA economists came out on Monday with a new prediction for house prices:

"We expect strong growth in national dwelling prices of ~14% over the next two years (8 capital city basis). A critical assumption underpinning our forecasts is the cash rate remaining at its record low of 0.1%, which is in line with RBA forward guidance ... Our forecast profile is centred on prices growth of 8% in 2021 and 6% in 2022. The risks are skewed towards stronger outcomes given the strength of the demand impulse from the reduction in mortgage rates over 2020."

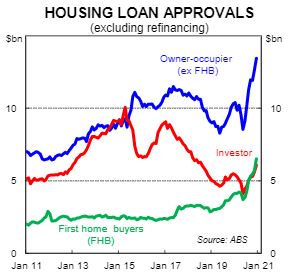

14% in two years from a group of economists who a year ago were predicting price falls. With the relaxation in the responsible lending laws and borrowers eager for sub-2% rates, little wonder housing loans are growing rapidly.

Anyone saving to buy their first house can blame the RBA for higher prices.

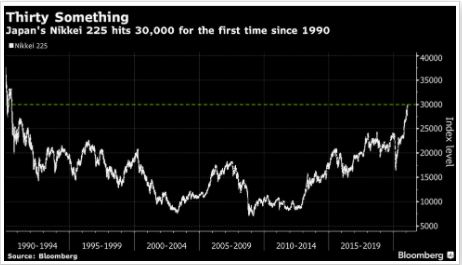

Even the Japanese equity market, where a generation or two of investors are really learning that "time in the market, not timing the market" is a guiding principle, has finally returned above 30,000 for the first time since 1990.

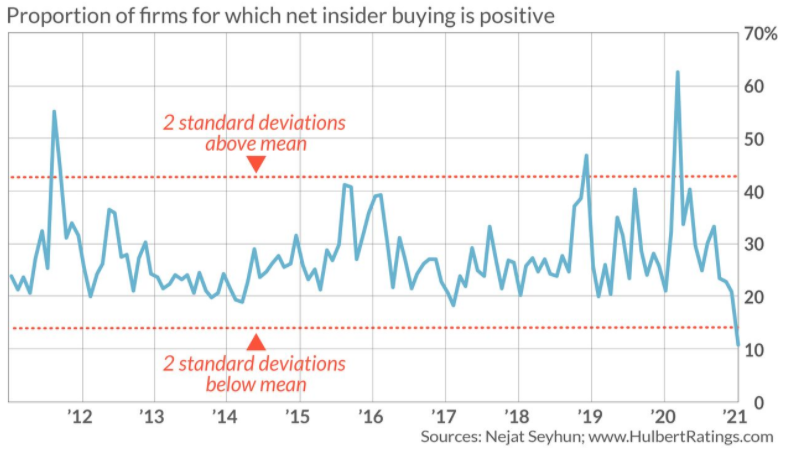

Not only were an incredible 90% of IPOs in 2020 in the US made by companies which are not making a profit, but executives and board members within companies do not even believe their own optimistic stories. Insider buying of shares is at its lowest level in a decade, as shown below.

Senator Jane Hume, Minister for Superannuation, Financial Services and the Digital Economy, spoke at the Association of Superannuation Funds of Australia (ASFA) conference last week. She said superannuation is the “most frustratingly partisan sector of financial services” and she criticised the industry's reluctance to support a reform agenda. In what may be an election year, it is important for retirement plans and super policy to know what the Minister is thinking, so we reproduce another speech she made this week to the SMSF Association. She gave a strong endorsement of SMSFs and raised the importance of the Retirement Income Covenant. The Treasurer also introduced the Your Future, Your Super legislation this week.

Only about 20% of Australians have a financial adviser, yet almost everyone heading for retirement would benefit from professional advice given the super, estate planning and social security opportunities later in life. Tim Fuller takes us through the steps to expect in the advice process to encourage a few more people make a call.

Last week's article by Dr Rodney Brown created a lively debate about inequity and taxing the rich, and it reminded us of a famous tax example quoted by Howard Marks that we published a couple of years ago. To round out the debate, here is Marks again.

Richard Dinham explains why the decumulation stage of retirement, when people start spending money in the absence of a salary, differs from the prior accumulation period, and how retirees can adjust.

Geoff Warren is a leading researcher on retirement and superannuation, and he has provided a summary of his latest work. Technical in parts but it gives insights into how to set a portfolio for minimum income, target income and funding bequests.

This week's Sponsor White Paper from First Sentier Investors (a finalist in the Morningstar Fund Manager of the year Awards 2021) gives an overview of three key issues due to changes sparked by the pandemic. It includes case studies from investment teams on how they are responding.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website