Weekend market update: The S&P/ASX200 lost 0.9% over last week ending with three lacklustre days and Friday down 0.6%. The US Federal Reserve made reassuring noises with Jerome Powell saying, "We will continue to provide the economy the support that it needs for as long as it takes." Despite this, bond rates rose again and the S&P500 was flat on Friday although NASDAQ was 0.8% stronger.

***

It's a year since the World Health Organisation declared COVID-19 a global pandemic, and we've all experienced daily lives in a way none of us expected. The 12-month range for the S&P/ASX200 is 4,402 to 6,900, a rise since February 2020 of 58%. Due to the changes in our spending habits - less travel, more on cars and homes - the fortunes of individual companies have varied significantly.

Let's take a quick look at three examples: Flight Centre, JB Hi-Fi and CBA. Note the time scales in the Morningstar charts are different to illustrate the main points.

Anyone who invested in Flight Centre at below $10 in March 2020 has done well as investors look through to a travel recovery. But the three-year chart below tells another story, a stock above $60 in 2018 and now below $19, with some analysts saying there's a lot more in its recovery yet.

Contrast this with a winner like JB Hi-Fi, as Australians spend money on electronics and improving equipment in our homes. Falling initially to below $25 in March 2020, it has recovered to be above its 2019 high and is now around $50.

And finally a stock most people have exposure to, directly or indirectly, this time charted over a decade. CBA has also had an impressive recovery from below $60 in March 2020 to about $87 now, but still below its all-time high above $96. Bank share prices are flat over six years but dividends are a lot better than term deposits.

Where do we stand one year on in the pandemic? Now the talk is of recovery, rising rates and inflation, so we turn to Howard Marks for his latest views in a webinar delivered this week. His major criticism is the market saying there is 'no price too high' for some stocks, but check his comments on public and private markets.

An Australian example of price exuberance is the remarkable recent fund raising for Afterpay, where investors lapped up $1.5 billion of 5-year zero-coupon convertible bonds. The only upside is in bettering the exercise price, a healthy $194.82, by 12 March 2026, yet the offer was six times over-subscribed. The share price at the time of the issue was about $135 and it is now about $110. The Afterpay founders did not participate and sold shares worth $60 million each. Hard to believe their bankers could have found $10 billion of demand for a security paying no interest for five years. The announcement that CBA will offer a BNPL service to four million existing debit and credit cardholders will not help Afterpay or the note holders.

It's interesting to hear from Gemma Dale how seasoned investors and traders using nabtrade have reacted recently to market conditions, seizing opportunities they would not have considered a year ago.

Brokers have seen a big increase in new clients in the last year, with Investment Trends reporting:

"At the end of 2020, the population of active retail online investors in Australia reached a new high of 1.25 million. Over the last 12 months alone, 435,000 Australians began trading listed investments for the very first time amidst the pandemic-induced lockdown. COVID-induced market volatility and a low interest rate environment were important prompts for first-time investors entering the market, but even more prominent was the desire to learn a new skill, highlighting how many Australians chose to spend their free time during the lockdowns. The record growth in investor numbers is also driven by strong interest for international stocks, with the number of active international share traders in Australia doubling from 54,000 to 109,000 in the 12 months to December 2020."

Sinclair Currie looks at how social media and inexpensive or free share platforms have changed the market, with a surprising argument that easy money has actually increased market risk, especially on the upside for anyone shorting stocks.

Looking to the future, six portfolio managers from Capital Group imagine life in 2030 and check the sectors and themes they like. It's an optimistic outlook that augers well for some companies.

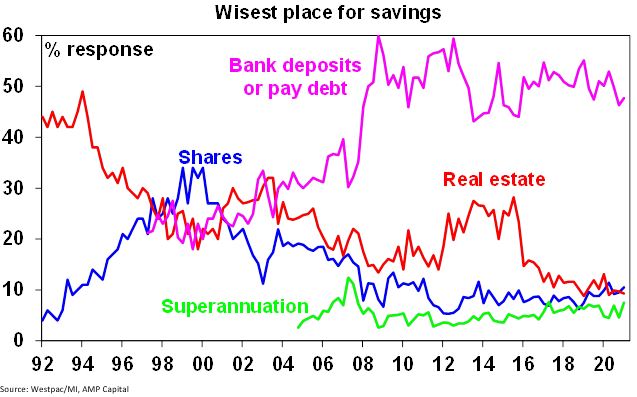

Notwithstanding these opportunities and low interest rates, the Westpac-Melbourne Institute Index of the wisest place for savings still favours bank deposits or paying off debt, while real estate intentions belie the current price rise frenzy at auctions. Shares have received an uptick recently but nowhere near levels of 20 years ago, before the GFC taught a generation that prices fall as well as rise.

This relatively low ranking for shares is despite the fact that most investors are aware that over the long run, equities will outperform investment alternatives. Take a guess when this was written:

“Students of financial history can point to historic levels of valuation to suggest that we are in a bubble. But students of psychology may be needed to complete the picture. For one thing, the financial markets have been so strong for so long that fear of market risk has mostly evaporated. People who used to hold bank certificates of deposit now maintain a portfolio of growth stocks. It is not really within human nature to comprehend that you may not know everything you think you know, and, further, that what you believe in could change on a dime.... With more and more of the market value of U.S. equities represented by lofty (in some cases infinite) multiples of current results, a change in sentiment could wipe out a large percentage of investor net worth. Sentiment, existing only in the minds of investors, is subject to change quickly and without notice.”

It reads as if it were written this week, but Seth Klarman wrote it 22 years ago in June 1999 (pages 32-36 on this link). Most patterns in markets are repeating and there's not much new.

Regardless of how shiny your crystal ball is, one thing's for sure, that China will have a profound impact on Australia for all our lifetimes. We depend on China for economic prosperity, but with dark sides to our relationship on military confrontation, human rights and trade sanctions. So it's good to keep our eyes on what is happening with our largest trading partner, and Qian Wang explains some of the challenges China is facing as it emerges quickly from the pandemic.

In a lighter but constructive mood, Nicholas Stotz marks another anniversary, a year since the death of Kenny Rogers, with a quirky look at what we can learn from The Gambler. Investing is not about winning the first few hands, as there'll be time enough for counting when the dealings done.

Finally, an important and controversial note from David Knox. There is a widely used chart which David cites which shows how wealthy people receive the most support in retirement due to generous superannuation benefits. But the chart critically assumes a high discount rate for future benefits, which reduces the value of the lifetime age pension. What happens with a more realistic assumption recasts the popular claim.

Still on super, in a strange move and another early access scheme, the media is reporting a plan to allow domestic violence victims to access up to $10,000 of their super. As the CEO of Women’s Safety NSW, Hayley Foster, told Crikey:

“It does send the message that you’ve got yourself into this business, you need to be responsible for getting yourself out of it. We as a society should be making sure that we’re putting in place the measures to assist people to get out of those unsafe situations.”

With culture and gender a hot topic, and notwithstanding some readers commenting that Firstlinks should avoid such topics, the White Paper from MFS International discusses responsibility for diversity and inclusion by businesses, individuals and, dare I say ... politicians.

And watch for a Special 400th Edition next week with unique features.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website