In the current environment, finding companies with above-market earnings growth over the medium-term backed by positive catalysts is becoming increasingly challenging. In our view, investors looking for these attributes could consider enterprise financial software companies.

Favourable investment catalysts

We believe these companies should deliver strong shareholder returns over the medium-term given numerous favourable industry tailwinds and investment attributes, including:

- Many legacy systems across the financial services industry are in need of major refreshing

- Growing demand for customer-focussed offerings within the Australian superannuation industry

- Heightened demand from customers of wealth management, pension providers and life insurance firms for mobile and digital solutions

- Highly sticky customer bases

- High degree of recurring revenue

- Extended visibility into the sales pipeline creating greater earnings certainty.

Enterprise financial software firms will benefit from two key goals, which are often interrelated:

- Migrating the middle and back office legacy systems to a current software solution as a means of improving efficiency.

- Improving the customer experience given changing consumer demands.

These catalysts as well as a simple framework demonstrating our approach to investing in this industry are detailed below, in addition to ways investors can gain exposure to this sector of the market.

Industry snapshot

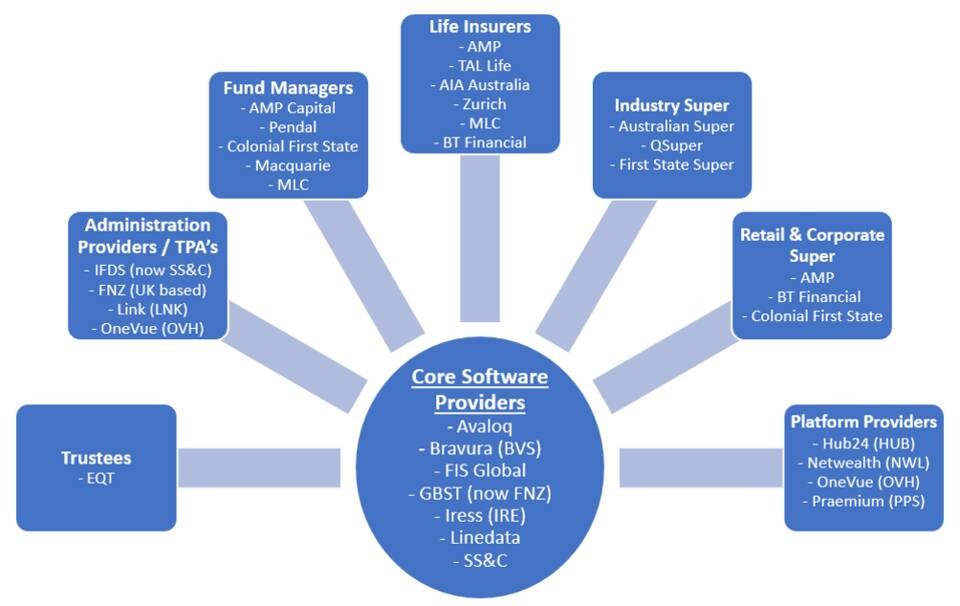

Enterprise financial software companies provide the core operating and product systems for a range of financial institutions including wealth managers, superannuation providers, insurers and often also the associated third-party administrators (TPAs). Their software products can touch the front, middle and back offices, with the majority of software firms having customers across multiple geographies.

It's the software providers that allow financial services firms to deliver new products with unique customer-focused propositions aligned to the constantly evolving regulatory landscape. These critical elements are either costly to manage or prohibitive to achieve on internally developed or legacy systems. New technology solutions allow financial services firms to focus on their core business and to compete more effectively against their peers.

The following diagram highlights the wide-reaching nature of the enterprise financial software providers within the Australian financial industry. This industry breadth and depth is a key value driver, and it's almost certain you have had a customer experience that was powered by these (mostly unknown) software firms.

Source: AMP Capital

Australian superannuation industry growth

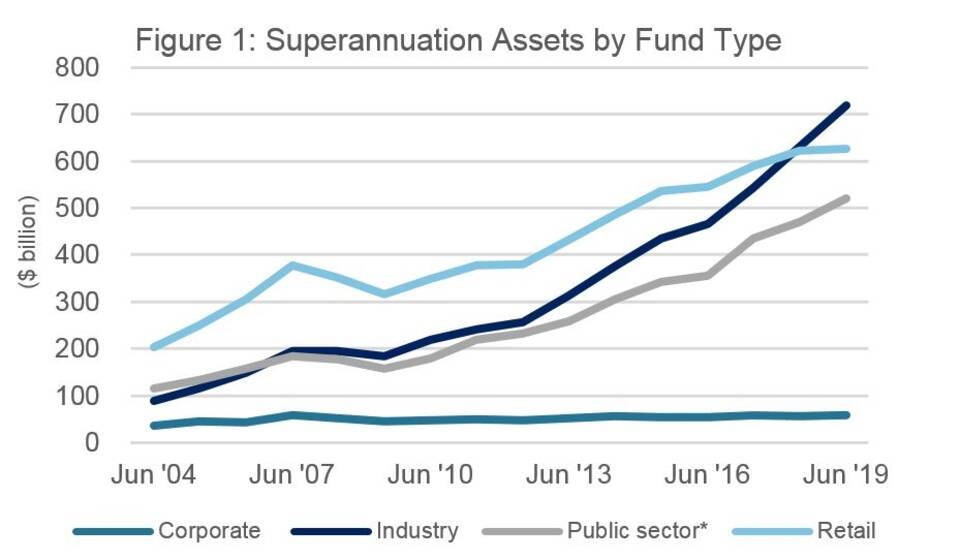

Figures 1 and 2 below highlight the growth in superannuation where industry funds now have more assets and members than any other fund type. The average number of members per industry fund also far exceeds any other fund type, driving an increasing need for technology to manage scale and provide an improved customer experience, particularly as mobile savvy millennials become a larger portion of the member pool.

*Public sector assets have been restated to remove the adoption of AASB1056 for comparison purposes. Past performance is not a reliable indicator of future performance. Source: APRA June 2019

With this ongoing growth, super funds need improved customer service with a deeper, more targeted offering typically utilising technology via mobile oriented solutions. This provides an opportunity for super funds to adopt a technology enabled in-house model as opposed to utilising TPA’s or heavily manual processes.

A recent example of this occurring is the Iress (ASX:IRE) and ESSSuper agreement, where ESSSuper will transition to the Automated Super Admin product offered by Iress.

Such operating models enable super funds to more closely own the customer relationship, which will become even more important as the industry continues to scale and to offer broader, more compelling customer-focused products.

Customer centricity

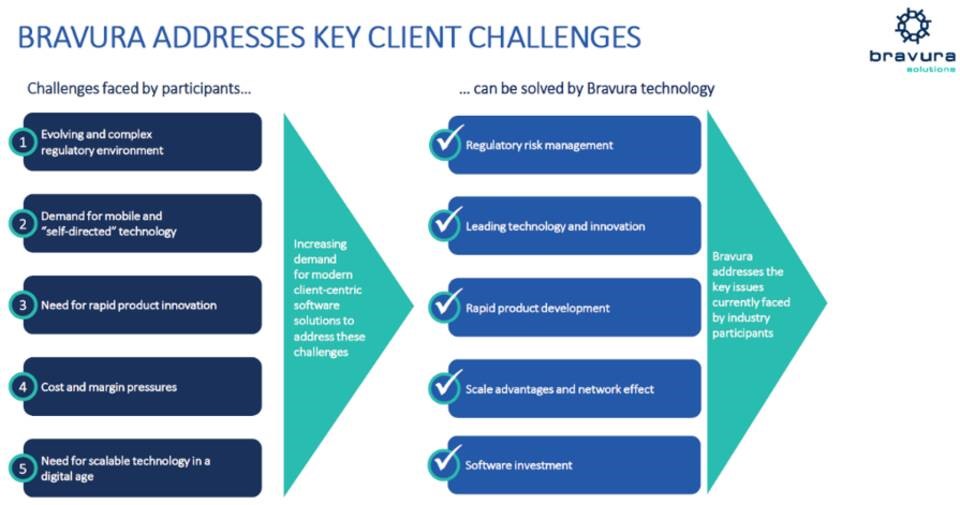

Many large firms both in Australia and offshore (particularly the UK) operate on legacy systems cobbled together from multiple acquisitions. Such systems prohibit a deep level of customer focus, typically resulting in customers being under-served relative to other industries. With heightened regulatory requirements, these legacy systems are an increasing cost burden on firms to stay relevant to new regulatory requirements.

A best-in-class technology creates the potential for wealth managers, pension providers and life insurers to regain control of the customer relationship. Achieving this should create long-term benefits through building a deeper and more meaningful relationship with the end customer, while also reducing the regulatory burden on firms.

A useful diagram contextualising this was provided in an ASX release from Bravura Solutions (ASX:BVS) and shown below.

Source: ASX Announcement (BVS) 20 February 2020

Manual processes unable to scale

Firms with heavily manual processes are under increasing pressure to find solutions that overcome issues with fluctuations in demand. This has recently been witnessed during COVID-19, where firms across multiple industries with heavily manual processes were unable to provide a consistent level of service in peak customer demand periods. We see this as a catalyst for financial services firms to revisit their business processes and believe technology will almost certainly be at the forefront of any solution that enables scale.

How we think about investing in this sector

The decision for a business to change its core technology is by no means a small one. Costs are extremely high – generally upwards of $100 million on large deals – and unsurprisingly, it’s not straightforward to migrate to a new system, with new implementations typically taking up to 36 months. Cases of failed implementations are also not unheard of, although none relating to ASX-listed companies that we are aware of. Given these dynamics, there is a high degree of inertia with customers reluctant to migrate their technology.

Keeping the above factors in mind, our investment analysis within this industry is focused on answering two key questions:

- Are there significant reasons for financial services firms to review and migrate the core IT ecosystem? Put another way: What is the sales pipeline and how likely are these leads to convert into revenue?

- Which software provider appears to have the best-in-class technology offering?

These questions may seem simplistic, however when assessing an investment where opportunities for new sales could be lumpy but very significant when they come, it is important to clearly understand which software provider is likely to be the biggest beneficiary of an increased sales pipeline within the industry.

Furthermore, we are also mindful of valuations across the sector particularly as it relates to the earnings growth the company is expected to deliver over the medium term.

How we are gaining exposure

In our view, Bravura Solutions and Iress Ltd provide exposure to the market opportunities mentioned above. Both have an overlapping product suite, with Iress having a larger market share in the financial planning space and Bravura having a deeper offering and more customers in the enterprise financial software space.

We believe that both companies share similar characteristics with reasonable balance sheets providing the optionality for further acquisitions (Bravura more so), offshore exposure, high degree of recurring revenue and valuations that look reasonable in the current market environment. Bravura is likely to deliver mid-teens earnings growth over the medium term.

In summary, enterprise financial software companies have favourable attributes and industry tailwinds that may see investors rewarded over the medium term.

Kent Williams is a Small Caps Analyst at AMP Capital, a sponsor of Firstlinks. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs.

For more articles and papers from AMP Capital, click here.