While there is a consensus amongst most economists that the impact of the upcoming recession will be worse than the GFC but not as severe as the depression of the 1930s, this has not been reflected in global equity markets.

In the US, from which most stock markets generally take their lead, the COVID-19 death toll has now passed 114,000 and is continuing to rise by a weekly average of about 1,000 deaths per day. In response to a flattening of the infections curve and the lifting of lockdowns, the Dow Jones Industrial Average has rallied 48% from its March lows and is now close to its all-time highs set in February this year.

While the rate of new infections has steadied in recent months and has not risen as social distancing restrictions are eased as yet, the US is still recording new cases averaging above 20,000 per day and recently passed two million in total.

In contrast, rates of infection continue to surge in Brazil, Russia and India. The highest number of worldwide daily cases recorded since the pandemic began was 130,511 on 4 June 2020 so on a global basis the virus is clearly not controlled.

Disconnect between company results and stock markets

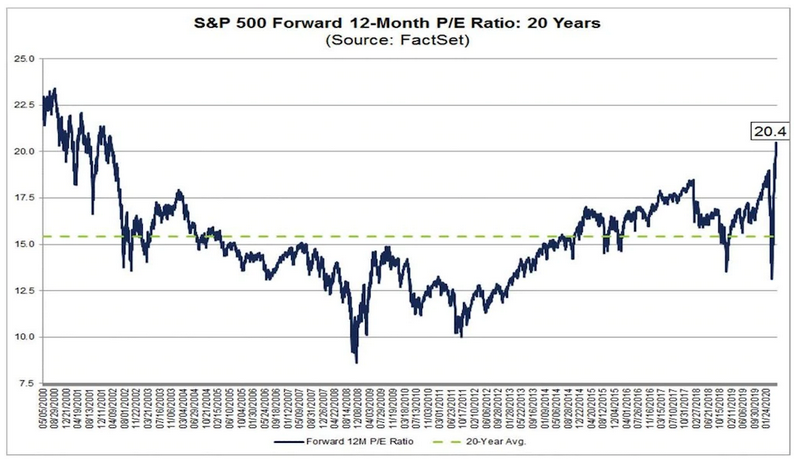

Economically, US corporate profitability fell by over USD300 billion in the first quarter of 2020, the second-highest fall on record. Second quarter results are expected to be much worse. At the end of April the US market was trading at forward PE levels not seen since the dot com boom and has since exceeded these levels moving to a ratio of around 23.

Source: FactSet, Business Insider.

Credit ratings agency Standard & Poor’s currently has a record number of 1,287 companies on negative watch or outlook for downgrade despite S&P having already downgraded 700 companies since the crisis began. Media articles are warning of an upcoming 'pandemic of corporate bankruptcies' in the US so large it may overwhelm the court system.

Geopolitical tensions between the US and China have also increased both due to accusations of the origins of COVID-19 and China’s clampdown in Hong Kong. Both Presidential candidates are expected to make a ‘tough on China’ mantra into November as part of their electoral campaigns. Stresses also remain in the global oil markets and the precise terms of Brexit still need to be negotiated.

The mainstream rationale to justify current market pricing is the predicted effectiveness of the various economic stimulus packages of major central banks to do ‘whatever it takes’. The flaw with such a rationale is these measures are being used to ameliorate a problem that did not exist before the stimulus.

More downside risk that upside potential

What if instead of borrowing an additional US$3 trillion, the US government borrowed an additional US$330 trillion and gave every American citizen a cheque for US$1 million? Will that be good for the economy? While this proposition is outlandish, it illustrates the point that unlimited quantitative easing (printing of money) is unlikely to be a panacea. If it were, why was this not the economic policy in place before the pandemic and not simply the response?

The rationale for a higher stock market relies heavily on the belief the stimulus will result in a ’V’ shaped recovery where global economies bouncing back quickly with little lasting damage from the very sharp, and by definition temporary, declines in GDP and increases in unemployment.

Will the actual economic recoveries both globally and locally be ‘V’, ‘U’ or ‘L’ shaped? These letters representing a very sharp recovery (‘V’), one which takes slightly longer to bottom out and recover (‘U’), or one where there is no or a slow recovery (‘L’). The equity markets are discounting the latter two possibilities and are pricing in a near certainty of the former.

It therefore appears as if there is far greater downside than upside risk. If events transpire to challenge the market expectation of a ‘V’ shaped recovery, without residual ‘scarring’ of the economy causing long term damage, then equity markets are likely to adjust their expectations downwards. It is hard to imagine what news could cause equity markets to move significantly higher; perhaps another unexpected fall in US unemployment from a record high of 14.7% to a slightly less worse 13.4% as occurred on 5 June? Even after the second-worst unemployment rate in US history, the Nasdaq composite index rallied to a new record high.

A vaccine would drive an all-time high

The acid test would be if news miraculously emerged of an immediately-available vaccine or cure for COVID–19. Such an event would take equities beyond their all-time highs in late February 2020 when COVID-19 cases were less than 1,000 a day and mainly contained within China. Such a scenario would imply a better forward outlook than pre-COVID with absolutely no short- or long-term damage done to the economy. This just does not seem cogent.

To accept such an argument is to ignore the parable of the Broken Window as espoused by French economist Frederic Bastiat in his 1850 essay, “That Which We See and That Which We Do Not See”. Bastiat argues a broken window for a shopkeeper appears to create economic stimulus for the glazier (that which we see). What is hidden is the alternate and better uses of the shopkeeper's money going to the butcher or the baker (that which we do not see).

If the COVID-19 crisis had not occurred, the stimulus funds could have been profitably used elsewhere. This alternate opportunity has now been lost. As Bastiat said, “society loses the value of things that are uselessly destroyed”. The starkest example is the over 400,000 recorded deaths from COVID-19 so far globally. If the COVID-19 shutdown is to have no effect on future corporate earnings why not shut down the global economy for a week or a month every year and give everyone extra time at home with their families?

In Australia, while the equity markets have not been as optimistic, a domestic recession is still expected with a base case fall in GDP projected by the RBA of 9%. Unemployment rises above 10% in their latest Statement of Monetary Policy. If the US markets were to again turn bearish (and have a ‘W’ shaped recovery?), it is unlikely Australia will be immune.

Moray Vincent is Executive Director Amicus Advisory, an independent fixed income research firm that provides advisory services to conservative wholesale credit investors. Operating since 2008, it currently has around $1.8 billion of funds under advice. This article is general information and does not consider the circumstances of any investor.