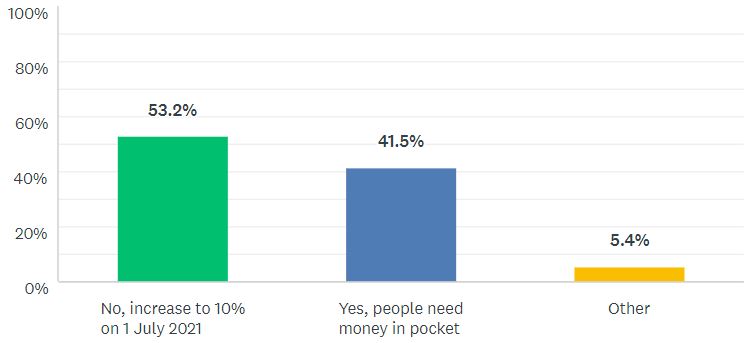

Our September survey sought readers' views on how the Australian Government has handled the COVID situation. The question on increasing the superannuation guarantee was:

Should the Government delay the legislated increase in Superannuation Guarantee?

Opinion was evenly divided. A little over 53% say the increase should go ahead, citing reasons such as it having been already delayed for too long; that 0.5% is only a small difference; and a belief that governments may never increase the SG if it delays it this time around.

Conversely, 41.5% think delaying the increase would be better given the financial impact of COVID may continue for a long time and to give business extra time to recover.

The remaining 5.4% who answered 'other' tended towards a wait-and-see approach, suggesting upcoming economic data should be taken into consideration; wanting a guarantee that if not now, it will be increased soon; or said that it won't make a difference either way.

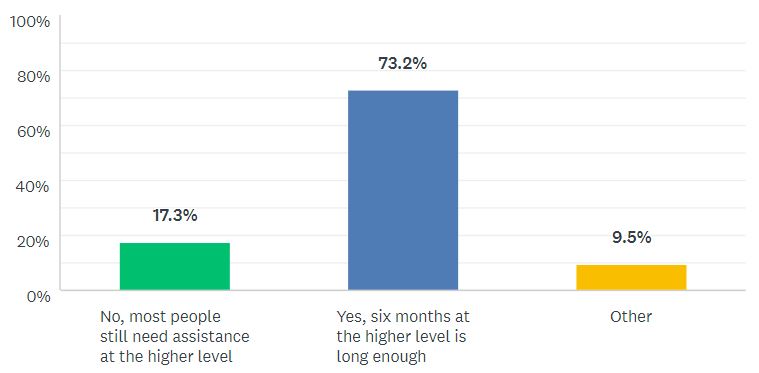

The next question was about JobKeeper:

Is the Government correct to wind back JobKeeper from 28 September 2020?

JobKeeper was a vital measure for many during the height of the COVID pandemic, but it was always intended to be temporary. It will fall to lower levels (depending on hours worked) next week.

A clear majority of readers (73%) thought that six months was enough for JobKeeper to remain at the highest level of $1,500 a fortnight. Just 17% wanted it to continue as is, while 9.5% had a different view.

To get a feel for the sentiments around both these issues, see comments replicated below.

Comments on SG

- Whilst I "benefit" from Super, I'd prefer it either we did not have a super system or it we simply had a central fund like a Norwegian fund.

- Super is one of the most important introductions of any Government in Australia. Maybe it should be Government administered (eg Future Fund) like the NZ system to replace the existing pension system.

- The public service gets 15% WTF.

- There are always reasons to delay these increases - the government should continue as legislated.

- It is easy to defer but the resulting pain is long term.

- Yes, delay the legislated increases but with the proviso that alternative commencement dates be included in amended legislation e.g. first staged increase deferred until 2023 with further increases adjusted accordingly.

- There have been enough delays to the increase in the Superannuation Guarantee. What the Government needs to do is reign in rogue companies (which is most of the Top 200 companies) who have been maximising Executive and shareholder largesse at the expense of employees. Wage growth in Australia outside the public sector is negative to non-existent and the government needs to address this wage growth to improve the overall Australian economy. Tinkering around the edge of superannuation is a cheap and easy solution which in the long run will negatively impact on all Australians and the Australian economy.

- The government (us) cannot afford it

- I believe the next year will be difficult for the ordinary bloke in the street.

- Employers/companies need to rebuild their businesses first.

- Those with jobs can afford the increase, it doesn't affect those without jobs.

- the SG is high enough at present, no need to increase it until economic conditions are much better than now.

- Proceed to 10% and then pause would be a sensible option

- Only delay them. Do not scrap them.

- No, retirees are outliving their pension so it should be addressed sooner than later. Also there should be a max fee cap on superannuation.

- It is a difficult time to increase the SG but this government can't be trusted to comply with a deferral. I am willing to agree to a deferral of the increase but only if the there is some guarantee that it will take place one day.

- Desperate times call for desperate measures

- I am worried that some people might lose their jobs if employers can't afford the additional levy.

- People always end up broke on pay day, so it's best to make them save for the future.

- 9.5% is insufficient to build a sufficient retirement nest egg for average income earners. We need to reduce future demand on the age pension. The sooner we start these much delayed increases, with the aim of ultimately getting to 15%, the better.

- Chances of employees actually getting a salary rise are zero so this at least adds slightly to their potential financial worth

- We must look to the long-term future, not the short term problems. Super is needed to relieve government pension financial pressure down the track.

- Super is paid by the employer, so workers get no extra money.

- It depends on how the economy is going. There is no point in going ahead with this if it will cause more company failures or more people to withdraw their super early.

- Current level is right for now. Despite a widespread ignorance, it is a wage component in lieu of a cost-of-living wage rise.

- Let's stick to the original plan...there for a reason. Will save pension costs in the long run. Think long term??

- Super is a loser for most low income people.

- During the liberal government freeze on contributions rising there were very low rates of wage growth. The main reason was the low rate of union membership in the workforce. Thus the main argument against the increase in Super is fallacious.

- Sort out the investment and fee structure for super funds to increase member returns before giving the managers any more revenue.

- The increases have been delayed once already. The early withdrawal scheme only makes it even more important for low-wage earners to re-build their super balances as quickly as possible.

- But pause after that for more years. The rise to 12% is too quick. Better to help people build Super by doing more to reduce financial advisors fees to time and materials only.

- It will have a long-term benefit for both the recipients and the government of the day when the recipients retire.

- There is never a good time to increase the superannuation guarantee. It should go ahead as many people will need the extra when they retire. It has I think been proven that 9.5% is insufficient to build enough funds for people to retire on.

- We aren’t going to see any wage rises, it’s not an either/or choice. Why shouldn’t people be able to enjoy a better standard of living in retirement? Delaying just means more money spent on welfare by future governments. I thought the whole point of superannuation was to encourage us to be more self- reliant and reduce the amount spent on welfare ( the funny thing is- when it’s spent on old people it’s seen as an entitlement to the pension, and when it’s spent on anyone else, it’s welfare)

- Super is still not enough so should be increased as soon as possible.

- Money now foregoes money later, but cash in the pocket now (if it is spent) is likely to assist with positive individual psychological effects as well as the compounding effect of additional money circulating around the economy.

- Whilst i agree in general with increasing the rate, i think the ability to pay now is in question. However, whenever is there a good time?

- There is no evidence that wages benefited from the suspension of SGC payments in the past, so the argument currently being used to justify a delay is fallacious

- It has a marginal effect on wages and profits and locks in retirement funds

- It's disingenuous for employers to say that higher super will mean they can't hire people or that they can't afford to pay it.

- We need to pay our own way - and most people need to be forced to pay their own way

- if it has to go up at some stage then it has to go up - no use in delaying it any longer

- Everyone has their fingers in the pie why not working people who deserve the increase as there has been no significant wage increase for years.

- It is only a relatively small increase.

- Not sure that it matters given that it won't help the unemployed in any case.

- Apart from low income earners paying less than 15% tax, experts suggest we should be aiming to save 15% for retirement.

- I'll gnaw my own left testicle off on the day I hear the BCA or Morrison Government bleat anything other than "Tax cuts for business and wage freezes". The saddest thing of all in their bleating is that they know full-well (they're not stupid) that what they advocate does precisely zero for Australia and society, and plenty for the already-well off.

- It seems ridiculous to put money in one pocket and take it from another.

- For most there is always the capability to add to concessional contributions above the minimum in any case

- people need wage increases but they also need to paying 12% of their wages over their working lives to go near enough super

- Like everything in life you won’t recall this lift in 20 years’ time.

- it has been delayed way too long already. The time is never right so just get on with it. And don't stop at 12% keep going until at least 15%.

- Employers cannot constantly be paying unearned income to employees for ever increasing compulsory contributions

- Don't understand 2nd possible response. Surely with increase in SGC it would come off available wages and be LESS money in pockets (until Retirement of course)

- Salaries are not going to increase even if SG remains unchanged

- Delay until recovery is evident. The latest economist highlights material negative GDP growth in 2020 (90% of over 40 countries listed pg 72). This is with the benefit of significant government intervention. Hard not to be gloomy about 2021. Government should defer until global recovery evident.

- This really depends on the state of the economy in July 2021. I don't have a crystal ball.

- The increase should be delayed, not cancelled. Suggest delay until 1 July 2022, with other increases to take effect as legislated.

- How can anyone in politics can even suggest to delay the increase of super when pollies receive 15% in super. They have no moral basis to delay this increase.

- It's a long-term goal that shouldn't be impacted by short-term events

- 0.5% is minimal and manageable and it has been delayed already so it is due. Further increases should be reconsidered though.

- With a population growing older, not increasing compulsory super contributions is only going to increase welfare spending in the future. An increase in super should only put the country's finances into a better position going forward. And it allows a better retirement lifestyle for everyone...

- Superannuation contribution taxes are already unfair on low income earners, as they often pay as high an effective tax rate on contributions than if they had kept the money, due to SAPTO, LITO etc. They live shorter lives than average due to poverty, so let the poor buggers have their money now.

- Any notion that people will end up with another 0.5% in their pockets is ideological twaddle that ignores evidence.

- 12% seems like a reasonable number. Certainly not on the high side. Every cent not saved now is a future government liability and a future debt for our kids. And it is only 0.5% per year! Wage increases, inflation, wealth effects, taxation are all way more significant.

- As Keating so succinctly pointed out there has been little wage growth over the last decade ...and I expect little over the next so at least there is some improvement for workers with compulsory super

- I very much doubt employees would get the extra 0.5% in their pay, companies will not pass this on as normal income. At least lifting the SG will make sure the money gets into an account in their name.

- Stimulate the economy first

- keeping super at the same rate won't stimulate spending or wage growth

- Consumption needs more economic support than investment at this stage

- Look after the future, for once, and deny short-term gain at the expense of long-term pain.

- I feel 10% is the right number.

- Seems entirely political to make such a minor tweak to a well-supported system.

- No rush to decide yet. Wait for December figures

- The government should stop looking for ways to undermine superannuation and line the pockets of the wealthy now while leaving the less well-off totally dependent on the pension in retirement.

- The increase in superannuation was done by a labor government to allow for increased fees to be milked by industry funds. The government should concentrate on preventing superannuation being skimmed by fund managers and investment advisors.

- Near term wage growth is more critical than serving the selfish interests of the Rent-seeking super industry

- what is the point of superannuation if you're paying off a mortgage? rule #1 of investing, pay off debt first. 9.5% is plenty of savings

- It's okay for government employees or employees of large corporations but small business can't afford it at the moment.

- Any increase in SG will come at the expense wage growth, which is sorely needed as the economy attempts to recover.

- There are no wage increases and this way there will be more for people in retirement

- Salary plus super guarantee equals basic cost to employer of an employee, if you increase the super guarantee it puts downward pressure on any increases in salary

- People need to contribute toward their retirement. The age pension is not enough to live in retirement as people expect

- It is a question around remuneration, not super. Can the country afford a wage increase? If our remuneration is competitive, why is so much manufacturing, etc, off-shored because of lower wages costs? Australians want a standard of living and it seems that the source is that elusive money tree in the garden. Perhaps another way to look at compulsory super is to make it that employees have to contribute a percentage of their rem rather than an across the board statutory contribution rate born by the employer.

- There has been little wage growth over the last 5 to 10 years and I think it is a fallacy to think that not increasing the super guarantee will result in more disposable income. Most businesses do not view the SG as employee income but rather an addition expense

- If we don't start putting the increases in place the can will continue to get kicked down the road.

- Wage growth has been slow in recent years without any increase to the SG. In that time proportion of profit to shareholders has grown as compared to workers. The proposals to defer/cancel the SG rise is further evidence of declining worker bargaining power.

- While i fully support employer super contributions, a 12-month delay on increasing super would assist employers and would hasten a covid-19 recovery.

- The claim that this will reduce wages or delay wage rises is a fallacy

- Living in retirement and being financially "OK" is not going to get easier.

- Let people make their own decisions

- Sure business is doing it tough but 0.5% in extra wage costs is not going affect the business community as much as the loss of that super contribution especially for low income earners now trying to recoup funds withdrawn.

- People have the freedom to salary sacrifice to the level being considered. From the Labor party rhetoric, one might think that they believe any increase in super is going to come from the employer and hence is a wage rise - and perhaps it might be in the public sector.

- Let's pause and see where the pandemic leaves Australia placed (from many different perspectives)

- Let it go to 10% and then let individuals decide whether they want to salary sacrifice any additional funds. Public servants should be brought back to 10% from the current 15% handout from other taxpayers.

- Not until further economic assessment

- more importantly businesses don't need the burden of increased costs

- Stop trying to be big brother. Let people save for their own retirement.

- There has been no wage growth for years so you cannot say that the SGC increase would stop any wage growth. The increase has already been delayed various times as it seems there is never a 'right' time to introduce it.

Comments on JobKeeper

- Virtually uncontrolled distribution of money with no checks and balances.

- JobKeeper has so many unfair issues.

- A gradual reduction is needed it cannot go on indefinitely.

- He government should however implement other measures to assist those still Impacted in VIc and Qld.

- There has to be a point at which economic reality takes over, the reductions may be too much but there needs to be a stepping down.

- It's reasonable to reduce the rate, but it should be extended further for certain industry sectors which will not be anywhere near back to normal by the end of March, e.g. entertainment industry

- As a worker who is unable to work due to government restrictions, Jobkeeper should remain until the Government restrictions end. If the Government wish to impose restrictions, then the same Government should subsidise those that are losing/have lost income. In my opinion, Jobkeeper should be better targeted and paid in proportion to lost income.

- When I was young I did all the jobs that I really didn't like. Now kids won't even go fruit picking. I even delivered pamphlets in my eighties... Do you think I wanted to?

- The economy has to be opened up, the sugar has to be taken of the table

- Australians are frustrated staying at home with nothing to do. Human beings are meant to move and create.

- The federal government is still fighting the last war, a budget surplus is of no importance at the moment.

- perhaps it will encourage vic govt to wind back the stage 4 covid restrictions presently in place so that people can get back to work. My understanding of the purpose of the restrictions was to temper the hospital emergencies rather than eliminate the virus which isn’t possible.

- Yes, hyper-inflation threats could be a problem later if not addressed.

- It needs to be scaled back but a sudden withdrawal will have a catastrophic impact on the economy

- BUT JobSeeker is a different matter. The support for the unemployed should be maintained, albeit at a lower level than the reduced JobKeeper.

- Although the Victorian Government may need to step up to help businesses shut down by the Government's excessive and poorly designed business and activity restrictions (and to compensate for the Government's incompetent mismanagement of the hotel quarantine system - every other State Government managed to get it right - which released the virus back into the community and stymied moves towards opening up).

- Need to consider the situation in metro Melbourne and tourist destinations such as Cairns

- If lower socio-economic level people don't have any money they can't spend. If they can't spend business can't sell etc etc. Tax cuts are not the answer as the higher level people will be unlikely to spend more; rather they will save the extra money and hence nothing will be achieved.

- Lowering the level is OK but only first lowering. Eligibility for part-time workers should be capped.

- A tough one for pollies, getting the balance right but they have to start weaning at some point.

- Too many stories of businesses doing quite nicely with job keeper. Others suffering from the distortions.

- With the exception of Victoria where it should be continued at the high level until cases are below 10 a day, and then for several more months until they get to a Covid normal like other States.

- We have to start the reduction process.

- We can't keep the economy on life support for ever; at some point we have to let zombie companies and businesses die with dignity.

- Quite a lot of it is being saved judging by the national savings reports. I even have a friend who feels so guilty about getting it, she is working longer hours for her employer than originally.

- Federal government can't prop up State messes forever. Premiers have to accept responsibility for their decisions.

- Reduction should be based on successfully increasing turnover, not some arbitrary date.

- I think it should be maintained at least until 31 December. It can be assessed as time goes on but there are many people who will be struggling if it is decreased. The only change at this stage should be part time workers to get less.

- I think it needs to be means tested like other payments.

- Job keeper will be required for longer but more targeted approach required to benefit those that truly need it. Get rid of some loopholes

- The scheme should be revised to take away the overpayment of some workers and extended to people previously deemed ineligible to receive it, particularly those who had to dip into their Super.

- Most of the country is beyond the crisis point and the JobKeeper funds need to be slowly eased rather than creating a "cliff". There is also the negative impacts to consider relating to the ongoing and additional reliance on the funds for the individual as well as the economy.

- Jobkeeper was an excellent prompt, though blunt, response to a drastic situation. We now have an opportunity to better tailor its delivery, and place a larger emphasis on self-reliance.

- However there should be much more policing of the scheme to reduce costs by eliminating fraudulent use

- Employment is slowly recovering Other than in Victoria where additional assistance may be required.

- Too many lower-paid workers are better off on the current JobKeeper.

- Govt can't continue to prop up business and their employees if the business is not viable anyway.

- they have blown so much of our money on this...

- The amounts being paid to people were too high and should be reduced more quickly.

- Most people 'naturally' become addicted to handouts.

- Programme needs modification & greater scrutiny to prevent abuse and avoid unwarranted payments.

- The total level of assistance should be broadly maintained, but the eligibility criteria need to be redesigned to more closely tailor amounts paid to employees' normal (ie, pre-COVID) income and to focus more on the industries most affected by COVID restrictions/shut-downs.

- it should have been better designed and targeted, and go the time necessary, not some set of arbitrary dated unconnected to what's happening

- It should be target toward employees most in need

- The reduction will drive people back to seek work.

- The economy is doing better than expected and some small businesses will fail anyway.

- Should depend on the level of employment, Victoria's basket case economy isn't helping.

- A targeted needs-based system which is fraud protected would be utopia. Some ppl are in need, some have wants, some are thieves.

- More gradual and targeted wind back.

- No opinion. Politicians will try whatever it takes to get themselves re-elected.

- Introducing Job Keeper was a knee-jerk that proved to be good, but probably too generous and too poorly targeted / nuanced. I think adjustments of some sort should have been brought in as soon as the problems with JK were recognised. I'm not well enough informed to know what the "right" (or maybe "best") adjustments should be, but adjustments were needed, the sooner the better.

- Difficult for me to say at my stage of life (aged 71)

- One of the reasons the morons who run the states (especially those who run VIC, QLD and WA) are happy to screw up the national economy is that they still have support from within their state. Once the federal handouts are stopped, those supporters will realise how destructive the policies of their state premiers are, people will turn against their state governments, provoking some positive action on their parts. Only then will the economy bounce back. Until then the imbeciles who run states like VIC, QLD and WA will continue to destroy the economy and the social fabric of Australia.

- The psychological impact is important. Jobkeeper must end at some stage and people should begin to prepare for that.

- We have flattened the curve and there is now too much helicopter money. We have to adjust to a new world

- Most people seem to be able to live on this. The saving rate is up for a reason.

- It is propping up businesses that will close down anyway. Many employees don't want to work whilst they are receiving free money.

- Wind back where possible, but industry where suffering is significant - pubs, restaurants, travel should continue.

- This might take a lot longer than expected. Should be winded back to more sustainable levels

- Welfare cannot go on forever.

- Yes, but need for further extension should be continuously monitored

- It is money that will be spent and stimulate the economy

- Need further time to make this decision

- Can't keep paying wage subsidies forever...

- Six Months should give people time to adjust and make their own arrangements, However Victoria is not there yet maybe they require more time and the State should be committed to this in some way as some decisions made have stopped people from working unnecessarily (e.g. Jim's Mowing franchises v Local Council Groundsmen)

- Job keeper should be wound back for the people that don’t need it, but continue for another 6 months per people and businesses that need it to survive with the prospect of then managing to survive, but not to support zombie companies.

- Now be more strategic and be prepared to keep it for longer

- Extension at original rates only discourages some people from aggressively seeking paid employment.

- You need to start to wind this back to then be able to determine what other measures will be required.

- It needs to be wound back to ensure people return to work as it is becoming apparent the marginal increase in the financial benefit of working is insufficient with the boosted dole.

- Some winding back may be warranted. Tuning JobKeeper to align with business reality is far more important.

- We need to balance rising debt+risk with stimulus. I know many people who are better off than they have ever been. I think that we should wind it back.

- Presumably will be strictly monitored ...Victorians in particular will need much more help

- jobkeeper 2.0 is better targetted and more reasonable in quantum except for victoria

- Premiers have no incentive to re-consider restrictions while Fed Govt pays

- too costly

- Of course it had to be simple to get enacted quickly. Now with more time some simple steps like showing what your previous income was would help stop paying someone double in Jobkeeper what their previous income was. I have heard from some employers how hard it is to get people to work as they would take a big drop in pay vs jobkeeper.

- Get people back to work or re-deployed elsewhere

- again stricter eligibility should have happened. There were some business's effected early on but now OK and still receiving benefits, think specialist doctors who originally couldn't do elective surgery but can now

- it needs to be wound back, a middle path may be reducing it by 50% for three months with a view to discontinue in January 2021

- This HAS to be coupled in a removal of economic activity restrictions - Australia needs to get back to work, NOW.

- Requires tweaking

- States need to bear financial cost once they make unilateral decisions. Otherwise others paid the cost of their decisions. And I live in Victoria.

- It as a necessary and generous policy. It’s was unfortunate to hear of people abusing the system.

- But the base level of Jobseeker needs to be increased.

- States continuing politically-driven border closures should supplement the assistance for businesses suffering in their states.

- it's needs to be an intelligent support - which I don't expect of this government

- We have to get back to work

- Weak businesses need to be gradually weaned from support so their stronger competitors can gain market share and hire more staff.

- Welfare is a safety net and recipients should realise it's not forever. Every dollar paid out must be repaid.

- It has to taper at some stage. Free money cannot last forever.

- eligibility should be scrutinised more.

- The government can't sustain handing out more and more money and we will be paying it back in years to come

- Shouldn’t be any job keeper

- Unfortunately this disaster is going on longer than expected and a lot of people desperately need this assistance and will til things improve. (god knows when)

- Might be better to make the amount variable more like a percentage of wage, seems ridiculous if people are earning more from JobKeeper than they used to earn from the actual job

- It was a sensible measure but too loosely designed. Government support should be targeted and this was reckless.

- It was a good move to start this in the first place. PPL have had time to reset their spending.

- Government needs to continue income support but eligibility needs to be tightened to eliminate unintended outcomes such as some “casuals” receiving far greater job keeper income than they would have working

- There are limits to the ability of the government to keep paying out. In all states except Victoria it needs to be cut back, in Victoria it should be continued.

- However some consideration for Victoria, having undergone extended lockdowns should have been incorporated. NSW also to a lesser extent.

- Yes, but only if employer super contributions were delayed and if employers contributed to some of the lower JobKeeper shortfall.

- Needs to become more targeted

- Consider the "other side of the coin".

- Now monitor the situation and don’t let people fall through the cracks

- Balance where it is really needed against need to move us along to new-normal.

- It’s done the job but to many have ripped off the system and that needs to stop

- JobKeeper has delayed the worst of the recession to date and may have reduced the permanent closure of many businesses, but will leave an awful debt for future generations. It's a tough question.

- It probably needs some re-engineering to work in the scenario that it is required for much longer.

- The government (ie other taxpayers) have provided a safety net which allows individuals and businesses to determine future employment and opportunities. Zombie businesses cannot be supported indefinitely.

- Six months at higher level also too long, or rather too much. Financially irresponsible to have thrown money at people without them even asking.

- Some people unfortunately use the benefit as a hammock rather than a safety net.

- Some companies are gaming JobKeeper and making nice profits.

- I believe the government is correct to wind back JobKeeper, except in Victoria's case, where government lockdowns in a very broad scale are impacting employees and employers with dire consequences.

- The eligibility needs refining so people cannot earn more than they did pre COVID.

- I have friends who lost their workforce because of generosity of job keeper. I agree with jobkeeper, but some distortion of economy occurs. Austerity great failure in Greece, need to learn from it, and act carefully.