Equity market performance from the beginning of the year has been a roller coaster.

Year-to-date, we have seen the strongest performance coming from US equities, mainly driven by the seven large tech stocks. Australian equities have been slightly positive for the year, and we are seeing bonds barely positive after negative returns in 2022.

From an investment perspective, it has felt like an episode of The Twilight Zone. What was happening did not reflect reality with the equity market being cheerily optimistic that the Federal Reserve (Fed) would come to its rescue by cutting rates before any real economic slowdown. This was despite all signs pointing to a Fed remaining firm in its fight against inflation.

What is clear is that we are going to see higher rates for longer – in the US, in Australia and most other developed markets.

We’re still seeing inflationary pressures in both countries and these pressures are likely to continue to impact markets throughout next year.

The US may be able to avoid a recession next year although a recession has followed the last five times when inflation peaked above 5%. US inflation hit 9.1% in June last year and has fallen to 3.1% at the end of November.

At least so far, a recession doesn’t look like a necessity in Australia, though that doesn’t rule out accidents, especially with the tightening cycle starting so late and so far from neutral, too. The reason a recession may be avoided, for now, is that neither inflation nor wages growth look completely out of control. Also, although resource prices have come off, they remain elevated and will continue to have a positive effect on GDP. That said, with current inflationary pressures, we believe there will be another rate rise in Q1 2024, likely in February.

Now more than ever, being selective is key for investors. My top picks for 2024 centre around being defensive and looking for pockets of opportunity.

1. Seek out financially strong companies with solid balance sheets

Companies with these characteristics, known as ‘quality’ companies, have historically shown resilience in the market environment we’re currently in. Quality stocks tend to be defensive and tend to outperform in times of volatility.

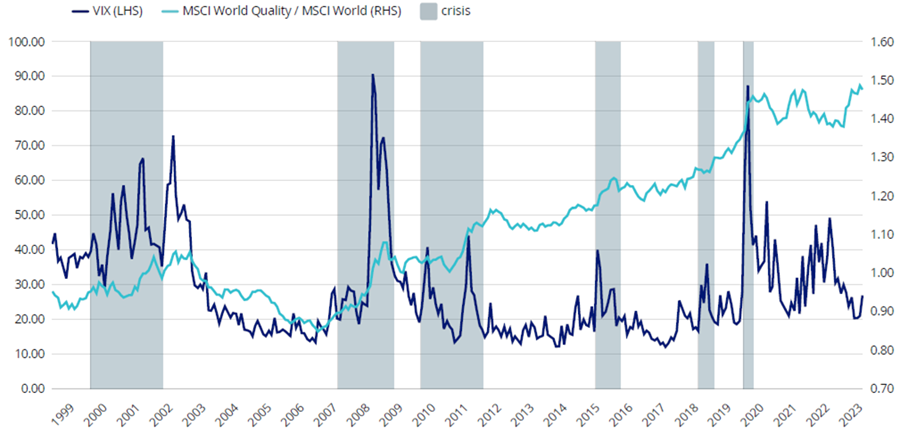

This is illustrated in the chart below. The VIX Index, shown in dark blue, is a measure of market volatility related to the S&P 500. The teal-coloured line is the ratio of global quality companies (represented by the MSCI World ex Australia Quality Index, known as the ‘Quality Index’) relative to the benchmark of the world’s largest companies (represented by the MSCI World ex Australia Index). When teal line is upward sloping, quality is outperforming. You can see quality companies outperformed during key crises, including the US banking crisis earlier this year.

Chart 1: Relative performance of Quality vs VIX

Source: MSCI Data/Calculations, Bloomberg. Chart shows performance of MSCI World ex Australia Quality relative to MSCI World ex Australia compared to VIX Index. Results include the reinvestment of all dividends. You cannot invest in an index. Past performance is not a reliable indicator of future performance of the index.

Further, if we look at the performance of the Quality Index compared to its benchmark going back over the last 25 years, quality companies have shown significant outperformance in periods of contraction and recovery.

This is why taking a quality investing approach to global equities is often referred to as a “strategy for investing throughout the seasons”.

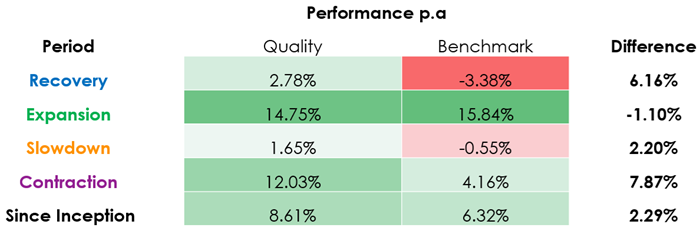

Table 1: Quality through the cycle

Source: ISM, MSCI, Bloomberg, since November 1997 to November 2023. Quality is MSCI World Ex Australia Quality Index. Benchmark is MSCI World Ex Australia Index. You cannot invest in an index.

2. Harness the growth potential of (the right) small caps

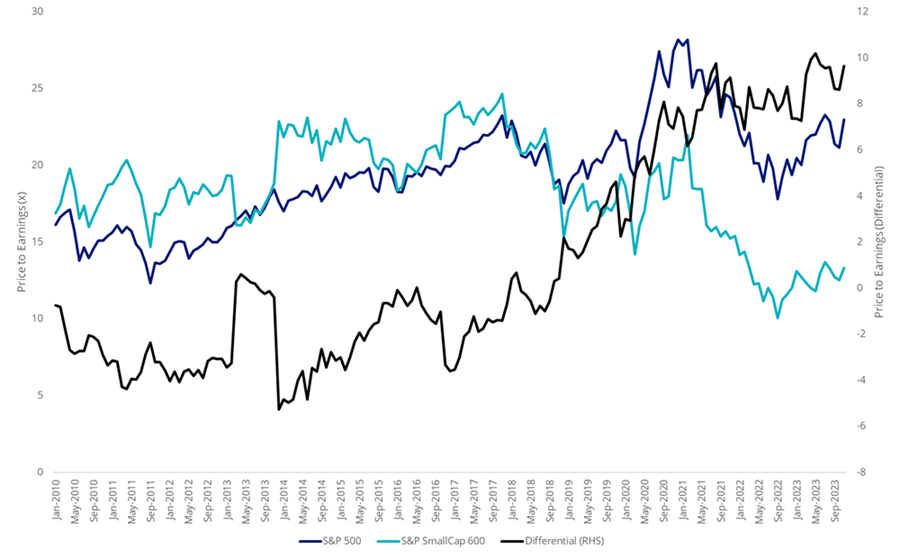

The next idea is an extension of the quality theme into global small caps. Global small caps in the past have performed better than large caps during periods of recovery. Right now, global small caps are looking relatively cheap compared to large caps and presenting a buying opportunity. If we then apply a quality screen to select only quality global small companies, performance looks even more promising.

Chart 2: Price to equity (P/E) of S&P 500 and S&P SmallCap 600

Global small caps, relative to large caps, remain as cheap as they have been in the past decade

Source: FactSet, 30 November 2023

3. Be mindful of the Australian equities trap

Australians continue to favour Australian companies, with Australian equities typically still dominating the majority of investment portfolios. The challenge is the Australian equities market is one of the most concentrated in the world. This is an important fact to consider, particularly those investors who use an ETF that tracks the S&P/ ASX 200. The top ten securities make up 47% of the S&P/ASX 200, with resources and finance sectors dominating. We have one company (BHP) making up around 11% of the S&P/ASX 200, and an additional 20% comprise of banks. This creates concentration risk.

Investors can build a more defensive Australian equities portfolio that is less concentrated, by reducing their allocation to the mega caps and having a greater allocation to large and mid-caps. An equal weighting approach is one way to achieve this goal. Equally weighting delivers more diversification and is therefore less risky as you are less reliant on a couple of sectors and a limited number of securities; while it also gives you the added bonus of a portfolio better positioned to take advantage of the grow prospects of large and mid-caps.

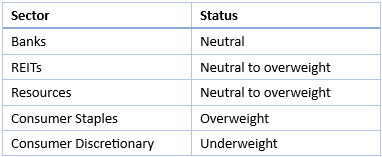

Our house view on Australian sectors:

4. The safe haven of gold

While the barbarous relic (gold) hit a new, all-time high recently, we see a number of drivers that point to continued gold price strength in 2024, including the shift in consensus beliefs on short-term interest rate expectations and a correction in the US dollar.

Gold has historically offered resilience during times of volatility as well as during inflationary periods. An environment where rates remain high due to inflation also bodes well for gold.

Our view is the drivers that have pushed up the price of the shiny metal are still firmly in place and do not look to be receding any time soon. For this reason, it is entirely plausible that the rush on gold will continue.

Broad economic weakness is generally supportive of gold prices. To this point, it has been said that gold is a ‘hedge’ against the US Government. This is a government that has in excess US$33 trillion of debt (over 120% of GDP). Meanwhile real GDP in the US for 2024 is forecast to be just 1.2%, a weak result which could drive investors away from other asset classes toward the safe haven of gold.

5. Bonds outlook

In fixed income it may very well be time to add duration to your portfolio. Although the 10-year Australian government bond yield has pulled back from the 5% level it is till yielding around 4.3% in mid-December, which in our view still offers good value.

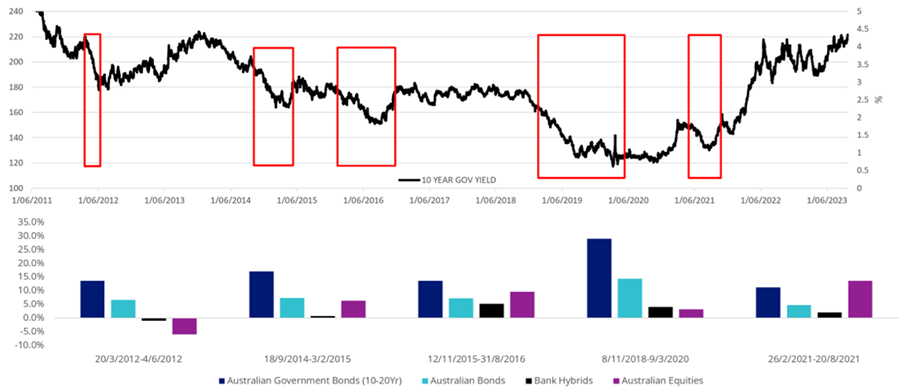

When yields fall, the value of a bond increases with the effect being greater the longer the term of the bond. Looking at historical asset class returns during periods of economic downturn, longer term government bonds outperformed. While we’ve had almost three years of poor returns, 2024 could be the year for fixed income to perform again.

Chart 3: Longer term government bonds outperformed during periods of economic downturn

Source: VanEck, Bloomberg, as at 31 August 2023. Australian Government Bonds (10-20Yr) as S&P/ASX Government Bond 10-20Yr Index, Australian Bonds as Ausbond composite index, Bank Hybrids as Solactive Australian Hybrid Securities Index, Australian Equities as S&P/ASX 200 Index. Results are calculated to the last business day of the month and assume immediate reinvestment of all distributions. You cannot invest directly in an Index. Past performance is not a reliable indicator of future performance of the index. Australian equities, S&P/ASX 200 Index shown for general stock market comparison purposes only.

Russel Chesler is Head of Investments and Capital Markets at VanEck, a sponsor of Firstlinks. Russel is responsible for managing VanEck's Australian ETFs. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, please click here.