Australian shares are outperforming the US sharemarket amid a rally in commodities. This is pushing up the big miners on the Australian Securities Exchange (ASX) while the technology-heavy US share market has fallen hard this year on higher bond yields. VanEck expects this trend to continue through 2022 given higher commodity prices are likely to persist and support the local market even as bond yields rise, which is hitting US shares harder than local shares.

The 10-year Australian government bond yield has jumped over 3% and could climb to 3.5% in the short term with strong inflationary expectations being priced into bonds. US inflation surged to a new four-decade high of 8.5% in March from a year earlier, driven up by skyrocketing energy and food costs, supply constraints and strong consumer demand. The yield on the 10-year Treasury has climbed close to 3%. The 10-year Australian government bond yields could continue to rise, given inflationary pressures have been exacerbated by higher energy prices and wage costs too are likely to rise if the unemployment rate falls below 4%, which is expected by the central bank.

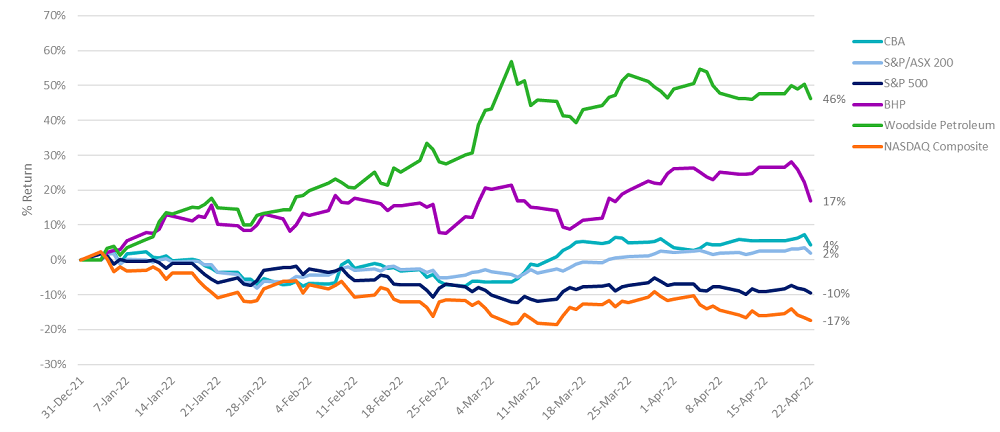

While the local market hasn’t been hard hit by rising yields, the US market, with its heavy representation of growth shares, has been dented. Over the year to 22 April, the Australian share market has easily outperformed the S&P 500 and the NASDAQ, rising by 1.9%, compared to falls of 9.5% for the S&P 500 and 17.3% for the Nasdaq Composite Index. That means the ASX 200 has outperformed the benchmark US index by around 11 percentage points this year. The local market has been buoyed by resources giants BHP and Rio Tinto, whose prices have risen with commodities, particularly iron ore and coal. Commodities work as a hedge against inflation, and they are clearly rising with inflation this year.

Time for value to shine

VanEck expects that Australian shares could continue to outperform those in the US given that inflation is also higher in the US than in Australia, with the local Consumer Price Index sitting at 5.1% in the first quarter of 2022. In addition, the nation’s largest companies are the big miners and other ‘value’ shares which are relatively more resilient to inflation and higher bond yields.

As the US market is heavier with technology and other growth companies, it is more vulnerable to higher bond yields than the Australian share market, which has benefited from higher commodity prices. The S&P 500 is dominated by global technology companies like Amazon, Apple, and Microsoft, which have higher price/earnings (P/E) ratios and more growth expectations built into them, that is, they rely heavily on expectations of future earnings for their current valuations. The value of a company’s stock is the sum of all of its expected future earnings. Future earnings are discounted using a long-term interest rate to estimate their current value. So rising bond yields have dented the value of technology companies in the US in recent times; they are worth less now than just a few months ago when bond yields were lower, hence the hard fall in the tech-heavy Nasdaq this year and also the S&P 500. Shares in Netflix, for example, have been smashed by higher bond yields in recent times. The company lost US$54 billion in market value in one day alone, after it reported a surprise decline in its subscriber base.

In contrast, “value stocks” such as the big Australian miners, are more resilient to higher bond yields. They are companies that are currently profitable, but have low to moderate growth expectations, so therefore, relatively low price-to-earnings multiples. Higher bond yields are much less of a problem for the big miners and other value stocks since they are less expensive to begin with, compared to pricier technology companies, whose prices have been hurt by higher yields.

Supporting the local market’s outperformance, shares in oil exporters Woodside Petroleum and Santos are higher by 46.2% and 29.2%, respectively, over the calendar year to 22 April, while BHP and Rio Tinto have gained by 16.8% and 13.5%, respectively. They are doing well in spite of, or because of higher inflation.

The big banks, which are cyclical, also tend to do well in a rising interest rate environment, as it allows them to increase their margins. We have seen CBA trade near all-time high levels towards $110/share in recent times despite higher bond yields pushing up its funding costs. CBA shares are higher by 4.3% over the year to 22 April, compared to the overall Australian share market which is up 1.9% as measured by the S&P/ASX 200. Investors need to be mindful that with higher interest rates there will likely be downward pressure on asset prices and credit growth.

Performance of select companies and indices

Source: Bloomberg, data is YTD to 22 April 2022. Past performance is not a reliable indicator of future performance.

This inflationary environment is conducive to further gains by the big miners and other value shares on the ASX. Australian companies that can maintain or increase their prices, and therefore margins, without turning away customers, will be the winners as inflation shoots higher. And they could be winning more profits and earnings than shares in the US which could be hit harder by higher bond yields and even higher levels of inflation as commodity prices rise.

So, after many years of underperforming, 2022 could finally be the year that Australian shares outperform the US market.

AUD on track to US80¢

VanEck also expects the Australian dollar to gain in value, despite its current dip on Chinese Covid-19 lockdowns. We believe it is headed towards 80 US cents this year, rising with commodity prices. That is a good thing for local companies buying imported goods as it will help to contain inflation of goods priced in US dollars. And with the CPI much higher in the US than in Australia, there could be more pain for company profits in the US than for Australian companies as costs there potentially rise more quickly than here.

But a rising currency also means that investors may want to consider hedging the currency exposure on their offshore investments. While a falling Australian dollar amplifies returns from foreign investments, a rising Australian dollar against the US currency will eat into returns from investments denominated in US dollars once their value is converted back into local currency. So, for investors who have previously left their investments unhedged, now may be the to time consider some level of currency hedging.

Russel Chesler is Head of Investments and Capital Markets at VanEck, a sponsor of Firstlinks. Russel is responsible for managing VanEck's Australian ETFs. This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, please click here.