Market experts have been warning investors to brace for the end of the longest bull run in history. This should be a time when many Australians are turning to financial advisers as they look to preserve their wealth and financial security. But the perception of the adviser value proposition is at record lows and many financial advisers are also struggling to remain positive at this time of need for their clients.

In recognising the impact an adviser can make to an investor’s overall financial well-being, Russell Investments has quantified the contribution professional advice can add to an investor’s portfolio over their lifetime. Our aim is to aid advisers with a repeatable and memorable framework to help them have open and frank conversations about their value proposition.

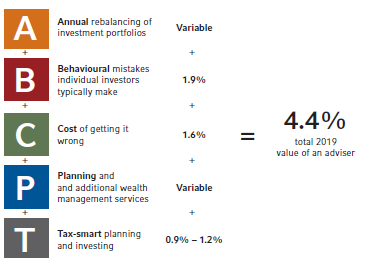

Our second annual Value of an Adviser Report estimates an investor gains a minimum of 4.4% p.a. through an advice partnership, which can make a massive difference to the financial security of the average Australian investor over their lifetime.

Building blocks that comprise an adviser’s real value

Here, we take a holistic look at the building blocks that comprise an adviser’s real value proposition throughout a client’s investing journey.

A is for Annual Rebalancing = variable % p.a.

Left to their own devices, individuals tend to let portfolios drift and, as a result, portfolios can look vastly different from their initial state over time. The potential result of an un-rebalanced portfolio is demonstrated in the chart below. A hypothetical balanced index portfolio that has not been rebalanced would look more like a growth portfolio and expose the investor to risks not initially agreed to.

Disciplined rebalancing is crucial to avoiding unnecessary risk exposure when investing. For example, if a certain asset class is performing strongly it can be tempting to hold an overweight position in that class. If the market corrects, investors may find themselves with too much invested in a volatile asset class.

Rebalancing is a key positive value add of advice, but we consider it variable as it depends on markets in the measurement period.

B is for Behavioural Mistakes = 1.9% p.a.

Despite strong evidence that portfolio value increases over time, investors can still feel compelled to react to short-term market volatility, serving to undermine their long-term objectives.

Advisers can play a critical role in helping clients adhere to their long-term financial plan and make better investment decisions by helping them skirt around some 200 identified behavioural tendencies that impact investing including Loss Aversion, Overconfidence, Familiarity and Herding.

If we just focus on herding, we look at the return if an investor bought and held an index. We then look at the flows into funds and ETFs through the market cycle. As markets rise, invariably, people put money in and buy high. As markets fall, investors lock that loss in by selling their funds and ETFs.

Our statistics show, the average fund investor’s inclination to chase past performance came at a cost of 1.9% p.a. from 1984-2018. This cost may well have been avoided with professional guidance.

C is for the Cost of Getting It Wrong = 1.6.% p.a.

There can be a clear disconnect between an investor’s risk profile and return expectations. In fact, research by Deloitte Access Economics found younger investors were more risk averse than their older counterparts. The research found around 81% of investors under 35 years old said they were seeking guaranteed or stable returns, compared to 41% of those aged over 55. On another note, 21% of the most risk-averse investors expected returns over 10%.

Looking below at average returns of Australian equity and bond portfolios over a 20-year period, an investor with 70% of their portfolio in growth assets and 30% in defensive would earn an average annual return of 10.9% over the 20-year period. Meanwhile, an investor with 30% growth assets and 70% defensive would achieve annualised returns of 9.3% over the same period.

In this scenario, an investor under 35 invested conservatively instead of in the growth option would have forgone an average of 1.6% return every year for 20 years. On $100,000 invested, that’s a significant difference of almost $200,000 to the final return.

Beyond investment-only advice

P is for Planning = variable % p.a.

Further to building and regularly updating bespoke financial plans and conducting regulatory reviews, financial advisers offer ancillary services including tax and estate planning, investment and cash flow analysis, retirement income planning and assistance with annual tax return preparation.

Like annual rebalancing, the quantification of this value add is variable as it depends on an adviser’s practice and services offered.

T is for Tax-smart investing = 0.9% – 1.2% p.a.

Lastly, quality financial advisers have the technical expertise to help clients make the most of their tax circumstances as well as avoid any unexpected surprises at tax time as regulatory changes occur.

We believe that the value of an adviser for tax-smart investing is at least the sum of tax effective investment strategies and salary sacrifice pre and post superannuation contributions (depending on account balances).

Therefore, we estimate the value of an adviser to range between 0.9%-1.2%p.a. depending on whether the client is in an accumulation or transition to retirement phase.

The bottom line

Russell Investments believes the importance of articulating the tangible benefits financial advice provides investors cannot be understated. From the knowledge and expertise required to help clients build personalised portfolios, to the support they provide when market conditions change, and the range of additional wealth management services they offer, such as tax and estate planning.

While we are empowering adviser conversation with clients, we are also providing investors with a framework of what financial advice looks like.

Looking forward, we believe advisers practicing a full value proposition will thrive in the current challenging environment.

Jodie Hampshire is Managing Director, Australia for Russell Investments. Based in Sydney, Jodie has overall responsibility for Russell Investment’s Australian business across Institutional and Advisor and Intermediaries Solutions. This article is general information and does not consider the circumstances of any individual.