The third annual Value of an Adviser report from Russell Investments outlines five key elements that make up the value of advice, including:

- preventing behavioural mistakes

- advising on appropriate asset allocation

- making investors aware of the cost of holding cash

- providing advice on tax effective strategies, and

- knowledge in additional wealth management services.

The rise of the retail investor

While the financial advice industry has undergone a significant period of disruption and uncertainty in recent years, the profession is now on a more promising trajectory.

New education requirements and regulations are transforming the sector and the exit of the major banks from the wealth management space has left plenty of room for new, innovative players.

But the COVID-19 pandemic and its economic impact have proven to be a critical event that has effectively allowed financial advisers to shine. When markets took a hit and the world went into a panic in the early months of 2020, Australians turned to financial advisers for guidance.

The impact of COVID-19 on the personal finances of Australians and financial markets has created a growing phenomenon: the rise of the retail investor actively participating in the stock market.

During a period of extreme volatility, Australian investors of all ages and levels of experience have jumped into the market, hoping to emulate the wealth they have seen others achieve. It is in this environment where financial advisers have provided value.

According to this year’s Value of an Adviser report, helping clients avoid common behavioural tendencies such as chasing short-term volatility comprises 2.2% of a total 5.2% in value advisers provide their clients each year.

The report argues that, statistically, the average equity fund investor’s inclination to chase past performance cost 2.2% annually in the 34-year period from 1984–2020.

Behaviour coaching is a vital service. While there is strong evidence that portfolio value increases over time, investors can still feel compelled to react to short-term market volatility, which can undermine their long-term objectives.

The report notes that during both COVID-19 and over the longer term without professional advice, investors fall prey to their own behavioural biases, leading to losses in their portfolios that could impact their financial security.

Tax-effective investing

Often considered the realm of the accounting profession, tax is also an important conversation between financial advisers and their clients. Advisers can assist in the management and optimisation of investment tax in a number of ways, including structural tax strategies, managing client-driven trading, and making portfolio recommendations that are tax-efficient for clients.

Taking into account these approaches, Russell Investments estimates the tax-effective investing benefit that advisers can provide is around 1.5% p.a.

In terms of portfolio advice, advisers are also recommending managed portfolios as they provide opportunities to better manage a client’s investment tax implications. Managed portfolios that sit on investment platforms and are professionally managed by an investment manager allow investors to hold the portfolio components directly, providing more transparency and control when optimising tax for individual clients.

When it comes to helping clients with more specific and complex tax needs, many financial advisers work in close partnership with accountants, solicitors, and other professionals. This combined experience provides significant advantages to clients.

Rounding out the numbers

While avoiding behavioural mistakes (2.2% p.a.) and tax-effective investment advice (1.5% p.a.) provide the lion’s share of an adviser’s total value to clients per year (5.2%), it is important to recognise the other aspects that are included in the report.

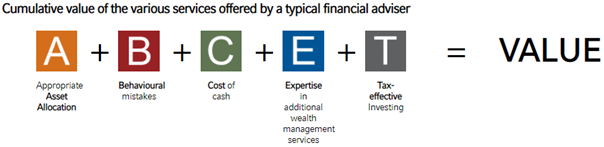

The following formula helps to understand the full value of financial advice services: A+B+C+E+T = value of an adviser.

The formula can be explained as follows:

- A is Appropriate asset allocation = 0.90% p.a. Helping clients to work through their values, preferences, and motivations from the outset.

- B is for Behavioural mistakes = 2.2% p.a. Helping clients avoid common behavioural tendencies may help achieve better portfolio returns than those investors making decisions without professional guidance.

- C is for Cost of cash = 0.6% p.a. Holding too much cash can come at a cost. Advisers can assist clients in investing in a well-diversified portfolio that seeks to balance the needs of liquidity and targeting growth within the risk levels appropriate to the client.

- E is for Expertise = more added value. A common misconception is that financial advisers are purely investment managers, whose only job is to select investments and achieve a certain level of return. Quality financial advice goes way beyond this.

- T is for Tax-effective investing = 1.5% p.a. Advisers play an important role in a client’s tax journey, helping them navigate key components when it comes to tax-efficient strategies.

Expert knowledge is invaluable through periods of change. Whether personal circumstances change, due to redundancy, personal trauma, inheritance or business transactions, advisers will work with clients to identify the best path forward.

If there are external changes, like legislative changes, tax treatment of super or other assets, an adviser will be able to assess the details of the change and evaluate the impacts to the client’s individual circumstances.

As the nation navigates its first recession in close to three decades, the value of financial advice has never been more important.

Tanya Hoshek is Head of Distribution, Adviser & Intermediary Solutions at Russell Investments. A full copy of the report can be requested here. This article is for general information only and does not consider the financial circumstances of any individual.