The correlation between bonds and equities is very high and not likely to correct anytime soon. So what is the solution? More fixed income. A higher correlation means that overall portfolio risk has gone up, and the total risk can be managed down through a higher allocation to fixed income. Fixed income may not play out as a portfolio diversifier, but it will continue to serve its function as a volatility diversifier. The other good news is that due to elevated yields, fixed income remains attractive on a risk-adjusted basis.

Another way to risk-manage the high correlation environment is to broaden the investible opportunity set to include global markets. Establishing exposures to different currencies, markets and geographies can help diversify portfolios. This global approach is best implemented when relying on an active asset manager that can leverage potential sources of alpha.

For now, fixed income is no longer a portfolio diversifier

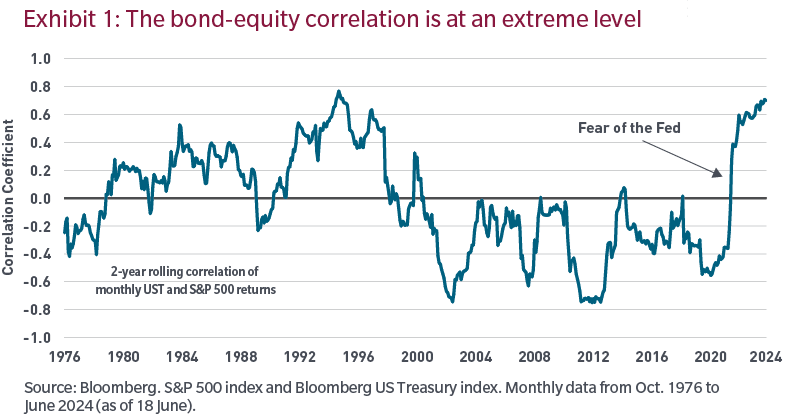

By historical standards, the bond-equity correlation is now very high. Based on a two-year window, the correlation stands at 0.71, the highest level since 1995 (Exhibit 1). A high bond-equity correlation means that the diversification benefits of fixed income have weakened. It also implies that total portfolio risk increases along with that correlation, making risk management an even more essential pillar of the investment process in a high-correlation world.

The bond-equity correlation is set to remain elevated in the period ahead

The sharp rise in the bond-equity correlation started in late 2021 when it became clear that a US Federal Reserve tightening cycle was imminent. The correlation corrected higher brutally, with the intensity of the Fed’s rate hikes surprising global investors.

While the Fed hiking cycle may well be over, the bond-equity correlation will not necessarily adjust lower. We believe, based on our macro regime framework, that the transition under way is likely to contribute to a persistently high correlation.

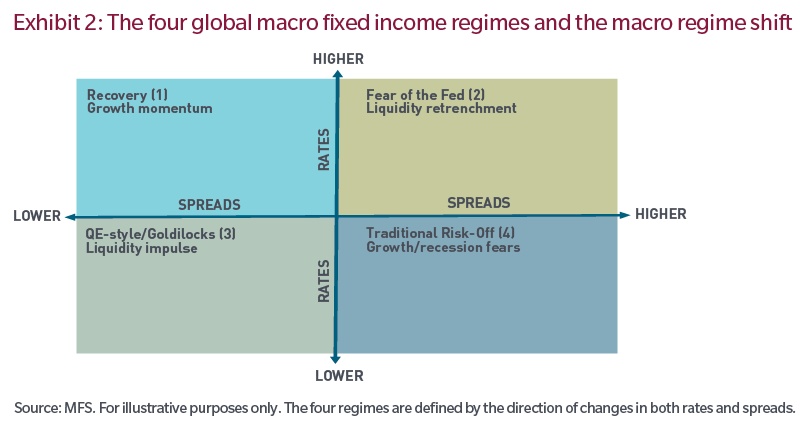

The prevailing macro regime during the central bank hiking phase of 2022 and 2023 was the so-called the fear of the Fed (Exhibit 2). Under that regime, rates corrected higher, while credit spreads widened. Broader risky assets came under pressure, which tended to promote a high bond-equity correlation. In 2022, both bonds and equities suffered losses.

Looking ahead, we believe the prevailing regime will likely shift to a QE-style, or Goldilocks, regime, the opposite of the 2022 and 2023 pattern. Under a Goldilocks regime, rates move lower while credit spreads tighten. Risky assets also tend to perform strongly, boosted by a central bank liquidity impulse, which means that the bond-equity correlation remains elevated. This is what we have observed over the past few months, reflecting the anticipation that the Fed is going to begin its easing cycle soon. Given that the Fed cuts have yet to be delivered, the Goldilocks regime is likely to stay in place for the foreseeable future. We believe that the bond-equity correlation will normalize lower, but not until the easing cycle is close to completion, taking us to late 2025. Once the easing cycle has run its course, the macro regime will likely shift again, this time to either the growth momentum regime or perhaps to the fear of the Fed regime.

The need for portfolio de-risking

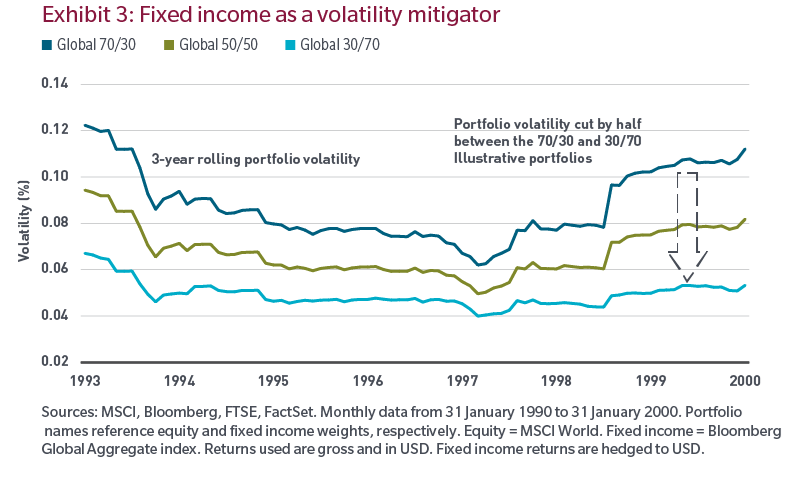

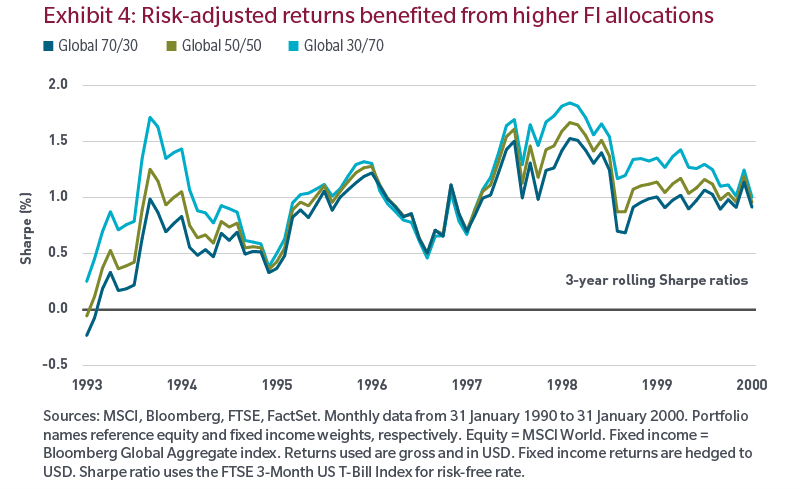

Paradoxically, the higher the bond-equity correlation, the higher the need for portfolio de-risking and therefore the higher the fixed income allocation should be, given fixed income’s historical status as a de-risking asset class. In other words, fixed income may not play out as a portfolio diversifier but may nonetheless continue to serve as a volatility diversifier. Using the 1990s as an illustration, amid a persistently elevated correlation during that decade, we can observe that a higher allocation to fixed income led to both lower portfolio volatility and better risk-adjusted returns over that period (Exhibits 3 and 4).

Fixed income is attractive on a risk-adjusted basis

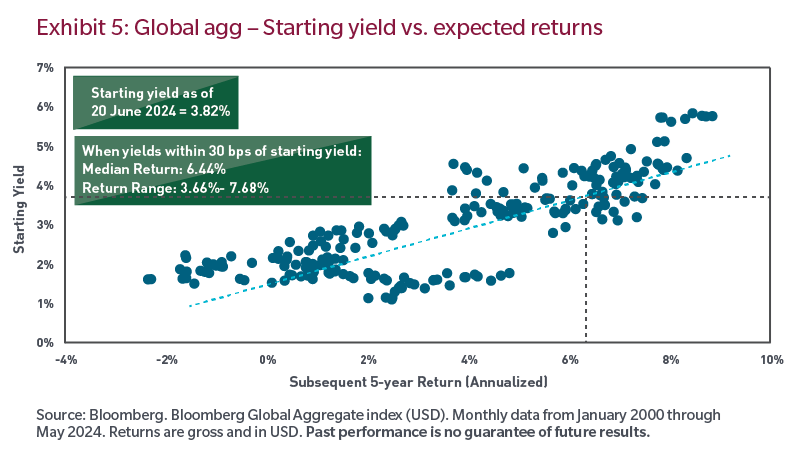

The macro environment has become more supportive of fixed income, reflecting the easing biases of major central banks, the likelihood of a soft landing scenario, and the continuing disinflation process in many countries. Current yields are well above long-term returns for many of the global fixed income sub-asset classes, which means that fixed income may be well positioned to potentially deliver robust returns in the period ahead. For the strategic investor with a longer time horizon, what really matters is total yield valuation, and that is still favorable. Historically, there has been a strong relationship between starting yields and subsequent returns. Looking at the global aggregate index, which currently yields 3.82%, we can see that in the past, a similar entry yield level was associated with a subsequent five-year median annualized return of 6.44% (with a return range of 3.66%/7.68%, Exhibit 5).

Going global as a correlation management strategy

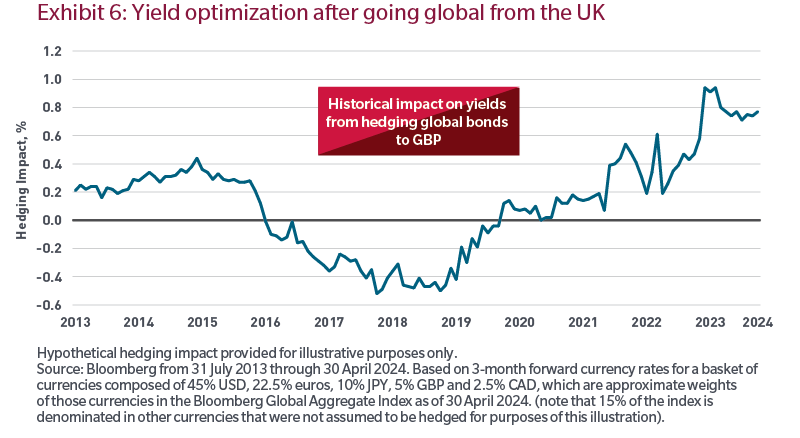

Investors with a strong home bias may benefit from broadening the investible opportunity set to global markets. While this does not directly address the high bond-equity correlation challenges, it may help boost a portfolio’s diversification profile through the introduction of multiple region, country and currency exposures. We have observed that exposure to global bonds on a FX-hedged basis can lead to both yield enhancement and lower portfolio volatility, especially if the home market is characterized by higher interest rates as it is in the United States and the United Kingdom (Exhibit 6).

The case for global, active management

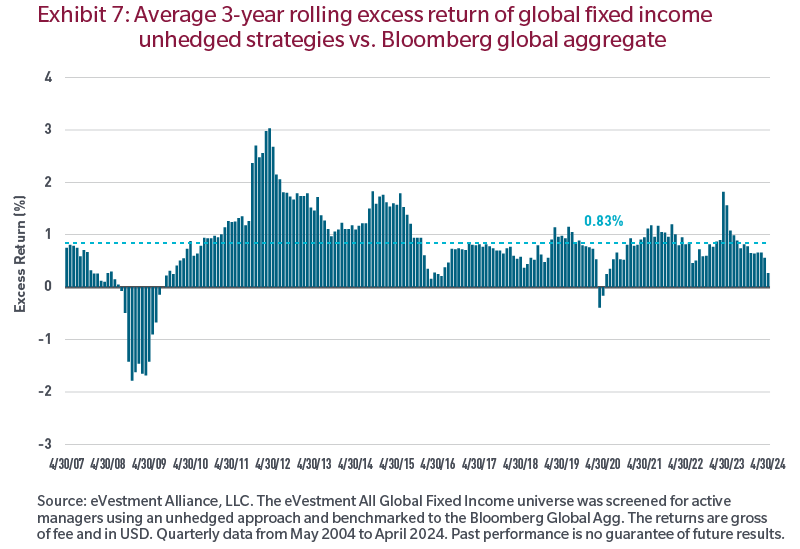

In our opinion, the global fixed income opportunity set is best leveraged when relying on an active manager that can potentially tap multiple sources of alpha, ranging from currency management to duration positioning to hedging strategies to asset and sector allocation and global security selection. The historical alpha is comfortably into positive territory, averaging 83 basis points (gross of fees) over the past 20 years, illustrating that an active approach to portfolio management in global fixed income potentially adds value (Exhibit 7).

Overall, we believe that the high bond-equity correlation, which is currently an important feature of global markets, does not argue against allocating more to fixed income. In fact, the way to try to manage the higher portfolio risk potentially involves a higher fixed income allocation.

Benoit Anne is Managing Director, Investment Solutions Group at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.