Retirement outcomes is a hugely complex and challenging area for the superannuation industry.

From a financial perspective, the retirement problem is an integrated dynamic consumption and investment problem. There are many sources of uncertainty, especially investment returns and mortality outcomes.

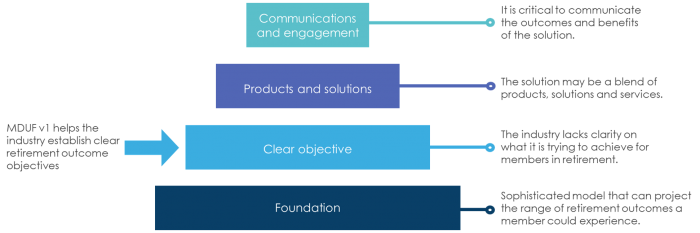

The superannuation industry is unclear what it is trying to achieve for retirees. Many super funds remain lump sum focused.

Setting retirement preferences

Yet academic researchers have had a framework for addressing retirement outcome problems for nearly 50 years. They use something called a utility function, which in simple terms is establishing a set of retirement preferences and reflecting these in a formula. With clear objectives reflected into a metric, we can then design products and services which increase the expected utility of member’s outcomes.

Eliciting someone’s preferences is part of financial advice. It is also a hard thing to do well.

The challenge is different for super funds who may have members default into retirement solutions. It is necessary for trustees to assume a sensible, paternal, set of preferences for default members.

Mine Wealth + Wellbeing has a dedicated retirement outcome modelling team that has focused on this area for a few years. Our Board endorsed us to create a utility function which we can then use to better assess the products and services that we provide to our members.

Rather than do this on our own, and create the risk of being too different from the rest of the industry, we collaborated, creating a working group of 14 researchers from industry and academia (see panel members here). Over 18 months we developed a metric which we call the ‘Member’s Default Utility Function version 1’, or ‘MDUF v1’ for short (with a name like this you can deduce I don’t have a marketing bone in my body!). We use ‘v1’ because every two or three years we would like to update MDUF to account for new research into retiree preferences.

Converting preferences to ‘utility’

What preferences are included in MDUF v1? Hopefully as you read through these you are nodding your head in agreement:

- Members prefer higher (rather than lower) income in retirement

- Members would prefer a smooth rather than a volatile income stream

- It would be undesirable for a member to outlive their retirement savings (or the income stream it generates)

- Members are economically risk averse: this means that the size of the joy experienced from a higher level of consumption is less than the size of the pain experienced by an equivalently sized reduction in consumption

- Members place some value on the residual benefit at death.

We then produced a formula and associated parameter values which establish the trade-off between the different preferences. You can see that some pull against each other. We think there is an important ‘straw man’ role for MDUF v1 – funds or advice groups who believe they have greater insight into the preferences of their members or clients can create their own version (we provide a ‘how to’ document to help).

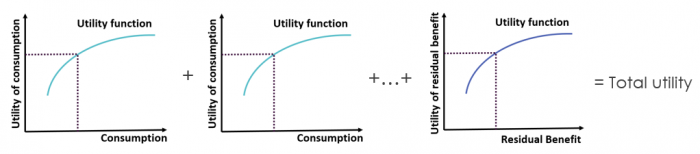

Multiple preferences make for a complex formula but importantly we can easily reflect the MDUF v1 into a diagram.

MDUF is not just a formula, it implies a framework for thinking about retirement outcomes. Looking at the diagram above, we can see the following:

- Retirement is a collection of periods of retirement income and a final payment (residual benefit)

- A utility function simply converts the income (or consumption) into a measure of the experience of that consumption. Our utility function is a curve which ‘bends over’, incorporating risk aversion. That is, higher outcomes are valued but lower outcomes are penalised more harshly

- We sum the utility of each individual payment to get a total utility score. This would represent the total utility of one possible outcome for a retirement solution. But there are many possible outcomes. So, it would be appropriate to simulate many possible scenarios accounting for different investment and mortality outcomes, calculate the associated utility, and then calculate the expected utility of a retirement solution.

This all sounds complex, but retirement is a complex challenge. You ignore the complexity at a cost to your members, or clients.

A solution for a specific person

MDUF is a quick and ready way to compare the pay-off profiles of different retirement solutions. Consider the following two profiles:

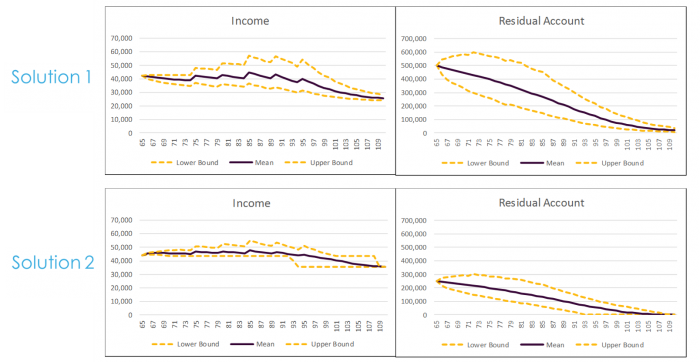

In the example, the modelled scenario is of a single man, home owner, with $500,000 at retirement. Solution 1 is simply an account based pension, investing 50% in equities and 50% in cash, following the minimum drawdown rules (our modelling incorporates age pension payments). Solution 2 involves 50% annuitisation and a 50% allocation to the account based pension.

The first column considers the income stream while the second column models the residual benefit if someone were to die at a particular age. The purple lines are expected outcomes while the yellow lines are 90% confidence intervals, providing some insight into the range of possible outcomes.

Which solution is better?

What a difficult question! There is no clear winner and one is forced to make trade-offs between level of income, volatility of income and the residual benefit profile. MDUF v1 does all the heavy lifting. In this case, Solution 2 achieves a higher (better) MDUF score.

The MDUF project attempts to help the industry step forward. The message is that you need a clear objective of what you are trying to achieve in retirement and represent this as a metric (or scoreboard), before you can effectively design good retirement solutions.

There is an unlimited number of possible applications of MDUF by many different industry participants, be it super funds, financial advisors, asset managers, insurance groups, policymakers, retirees or ratings groups.

We would like to thank all members of the Working Group for their contributions, and also AIST and ASFA for being supportive custodians.

We encourage you to think about this work, and consider what important aspects you can pull out of it. Don’t make the mistake of rushing to solution mode yet. Think what problem you want to solve, what is your objective, and how can you quantify what you are trying to achieve. This is where MDUF v1 may be a useful straw man for you.

David Bell is Chief Investment Officer at Mine Wealth + Wellbeing. Estelle Liu is a Quantitative Analyst in Mine’s Investment team, focused on retirement outcome modelling. MDUF v1 has been made freely available to all in the industry via the websites of MDUF’s custodians, AIST and ASFA. You will find papers (from the introductory through to the highly complex), presentations, models and FAQ’s.

David Bell is a Co-Founder of Cuffelinks and he won the BTIM Retirement Innovation Award from SuperRatings for this research.