“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton

Irrespective of whether you think Bitcoin is a Ponzi scheme, the future of money, or something in between, there is no doubting it is grabbing global attention as front-page financial news.

Prices rose to more than US$50,000 per coin in February 2021, helped by news that Tesla invested US$1.5 billion into the cryptocurrency. From early March 2020, when it was trading below US$5,000, the Bitcoin price rallied more than 1,000%, though it has pulled back in the last two weeks.

Has Bitcoin taken gold's mantle?

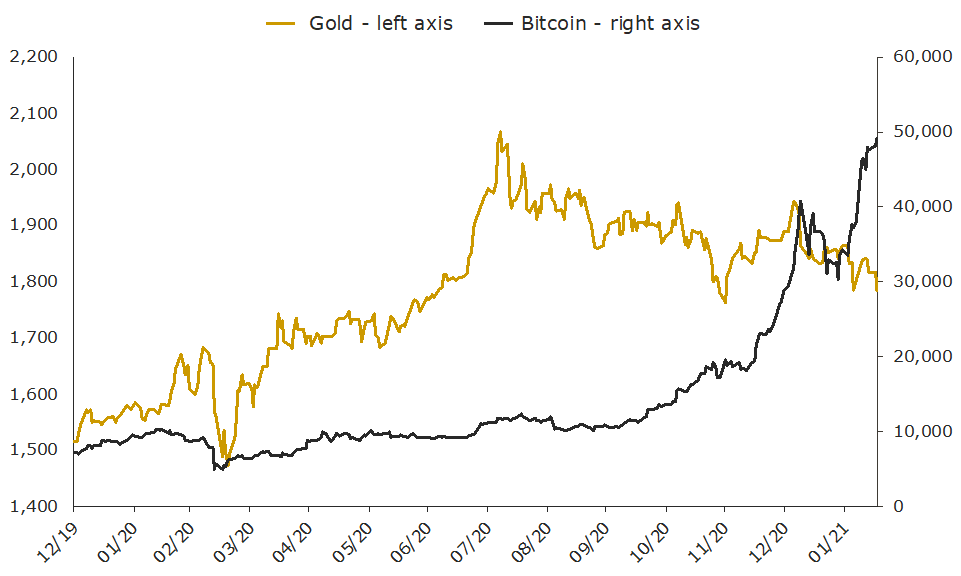

The skyrocketing price of Bitcoin has more or less coincided with a meaningful pullback in gold, as shown below, which had traded at all-time highs above US$2,000 per troy ounce in August 2020.

Gold and Bitcoin prices – December 2019 to February 2021

Source: World Gold Council, LBMA, Coinmetrics, data to morning of 17 February 2021

Given the divergent fortunes of the two assets in the past few months, there is no shortage of commentators stating that the precious metal is being usurped by its purported digital counterpart, with some going so far as to encourage investors to drop gold and reallocate to Bitcoin instead.

Our latest report, Gold, Bitcoin and the Elon effect (linked below), questions the wisdom of this narrative, not least because of the multiple bubble warning signs in cryptocurrency markets today.

These include the parabolic price move itself, the launch of Bitcoin ETFs and planned IPOs of cryptocurrency exchanges. It is hard to think of a more euphoric moment for Bitcoin than the world’s richest man using company money to invest in this nascent asset class.

Despite those warnings, we have no strongly held view on where the Bitcoin price goes from here, and acknowledged that as a market, it has matured since the last mania seen in 2017. There is now better transparency around liquidity data, enhanced custody solutions and a range of new product offerings, all of which are helping generate interest. Our report highlights the multiple attributes by which investors can, and indeed should, compare gold and Bitcoin, which remain two vastly different investments.

With one notable exception, gold appears to have advantages over the world’s most famous cryptocurrency.

10 key takeaways on gold versus Bitcoin

- Bitcoin beats gold hands down for generating speculative returns in rapid fashion, and likely always will. There is a price to pay for this, with larger drawdowns (price falls), and volatility that is 12 times higher than gold.

- The gold market (which includes gold used in jewellery form, industry, ETFs and physical bars and coins) is significantly larger in terms of overall value, with a market capitalisation that is more than 10 times the Bitcoin market. The gold market is substantially more liquid, averaging approximately 90 times the daily turnover of the Bitcoin market in 2020, though liquidity in cryptocurrency markets has risen substantially in the past few months.

- Free storage options for gold can be much lower risk than free Bitcoin storage options given the counterparty risk inherent in the latter.

- Gold is a lower cost investment than Bitcoin, with gold ETPs like Perth Mint Gold (ASX:PMGOLD) offering gold exposure for 0.15% p.a. versus 1-2% p.a. for existing Bitcoin products.

- Gold has a more diverse set of use cases – for investment, as a reserve asset for central banks, as a display (and store) of wealth in jewellery form, and in industry. Bitcoin is almost exclusively used for speculation, with payment volumes across the cryptocurrency network declining in the last three years.

- Gold has a multi-millennia track record as a store of value and has been the best performing asset in equity market corrections over the past 50 years. In contrast, it is far too early to say that Bitcoin is a store of wealth. This is no fault of Bitcoin per se, rather an acknowledgment that it has only existed in an era of low inflation, economic expansion (up until COVID-19), and a record bull market run in equities.

- Physical gold can play a beneficial role in a portfolio, given its low overall correlation to financial assets, its traditional outperformance in risk-off environments, its high liquidity and lack of credit risk. By comparison, despite the recent surge in the price, there seems little compelling reason for institutional investors or companies to include Bitcoin in diversified portfolios or on company balance sheets.

- Gold’s network effect is far stronger than Bitcoin’s, evidenced by the perpetual marketing of Bitcoin as digital gold. Gold is not marketed as analogue Bitcoin!

- Bitcoin remains under threat both from hard forks and corruptions of the Bitcoin network itself, as well as thousands of other cryptocurrencies. Gold remains globally recognised as a store of wealth, a status that has been built over thousands of years and remains rock solid (pun intended) today.

- The gold market is far more decentralised, with the precious metal mined, refined, and owned by central banks, households and investors the world over. Bitcoin is predominately held by a small group of owners, and Bitcoin mining is concentrated in one country, China, which controls more than 60% of Bitcoin's hash rate.

Given the above factors, the precious metal will still likely be the preferred investment option for risk-conscious investors looking to protect capital in the years ahead.

The full report can be accessed here.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.