The initial attention around the new superannuation tax focussed on the $3 million number but analysis has moved to the method of calculation, especially taxing unrealised gains and not indexing the amount. The measurement difficulties started when the Government decided to clamp down on individuals with large balances. Super funds and SMSFs calculate taxable (assessable) income within each fund, but the Government wanted to impose an extra tax on super balances above $3 million. Super funds do not know the Total Superannuation Balances (TSB) of their members, and a method was needed which avoided a major systems redesign within each fund.

It looks increasingly like a rushed job where Treasury nominated the simplest method, and later the problems began to surface. The only place that records all superannuation balances is the Australian Taxation Office (ATO), where the amounts are:

“ … used to determine your eligibility to make contributions, receive co-contributions, and your spouse's eligibility to claim a tax offset for spouse contributions.”

Most people can find their TSB using ATO online services, usually accessed via MyGov, listed under ‘Super’, as shown below.

These records do not hold or calculate taxable (assessable) income across all super funds, so Treasury decided to tax the change in the TSB over the financial year for those with over $3 million. Easy peasy.

Treasurer Jim Chalmers was asked on the weekend if he would change the unrealised gains tax treatment.

“That's the advice of Treasury, working with other relevant agencies, that that is the most efficient, simplest and best way to go about it, and so that's what we intend to do.”

As the surprises reveal themselves, here are 10 aspects of the super tax worth knowing.

1. It’s a new 15% tax not a 30% tax and not a doubling of the tax

The title in my article last week calling it a 30% tax, as everyone does, was wrong. The article received over 180 comments and nobody pointed out the mistake. If it's a 30% tax, we must be able to answer the question, '30% of what?'. And there is no answer.

Nobody would argue that a 45% personal tax rate and a 10% on GST gives a total tax rate of 55%. The two taxes cannot be added together because the components are different. It’s the same with this new super tax (which does not have a name).

It is doubtful either Jim Chalmers or Treasury understood the calculation when they announced the new tax on 28 February 2023:

“From 2025-26, the concessional tax rate applied to future earnings for balances above $3 million will be 30%.”

This is incorrect. Rather, there are two different 15% taxes.

There is no 15% tax on ‘Earnings’ (as defined to include unrealised capital gains) in accumulation funds inside the $3 million limit. The tax is paid on taxable (assessable) income. The new tax is separate from personal income tax or the current tax on a superannuation fund. Although it is based on TSBs, the tax is imposed on the individual, not the fund.

The reason it is incorrectly called a 30% tax is not because the new tax itself is 30%, but it is on top of the 15% tax paid on accumulation funds. In fact, if a member held $3 million in a pension account, then it would be a 15% tax in total with 0% on the first $3 million.

Many journalists are calling it a 'doubling of the tax rate', but this is also wrong. It's not x becomes 2x, it's x plus y.

Consider how the new calculation will be made:

Tax Liability = 15% x Earnings x Proportion of Earnings over $3 million

‘Taxable income’ and the new ‘Earnings’ are radically different. An SMSF might hold an investment property which produces taxable income (net of expenses) of $10,000 in a financial year, but the property increases in value by $100,000. A 15% tax is applied to the $10,000 in an accumulation fund, but the new tax is imposed on the full $110,000 (income plus unrealised capital gain) according to the formula.

As the new tax is based on the growth in assets over a financial year, including unrealised gains, it is taking taxation into new ground.

In another sign that the policy was rushed, the complexities of Defined Benefit super schemes are not addressed. Many of these arrangements do not define an amount in super. Someone may expect to retire on $100,000 a year but they do not have a TSB.

2. Payment date can be delayed until FY28

There is some good news. Given the start is 1 July 2025 and first end-of-financial-year measurement is at 30 June 2026, SMSF trustees will have until 15 May 2027 to lodge their annual report. When the ATO receives the information, it needs to issue an assessment with timeframes for payment. With hundreds of thousands of SMSFs now given an incentive to report as late as possible, it’s unlikely payment will be required before 30 June 2027. It will be well into FY28 before the payment is due. A lot can change between now and FY28.

The point above is not only about delaying for tax flow or present value purposes, but it affects the actual calculation. Recall that tax liability relies on the definition of Earnings:

Earnings = TSB (end of FY) – TSB (start of FY) + Withdrawals – Contributions

A tax payment is a withdrawal. When the first measurement is made for FY26, there are no withdrawals for this new tax in that year. With delays, there may be no payment in FY27 either. So the first payment added to the Withdrawal definition is not until FY28, where Earnings as defined will be reduced.

3. The $3 million must be indexed or increased at some point

At some time in a future universe, the $3 million will be increased as it will capture too many people and remove the incentive to save in superannuation. The tax on super will be above some personal marginal tax rates. Jim Chalmers conceded as much on the weekend:

“What we're proposing is to leave it at $3 million, so that the system becomes more sustainable over time. But there's absolutely nothing preventing a government of either political persuasion, in the near term or in the longer term, from adjusting that threshold.”

The $3 million amount becomes worth far less in future dollars under various assumptions. Finance Minister Katy Gallagher admitted in Parliament this week:

“In 30 years, Treasury predicts that roughly only the top 10% will retire with superannuation balances of around $3 million.”

The Financial Services Council (FSC) which represents large superannuation fund states:

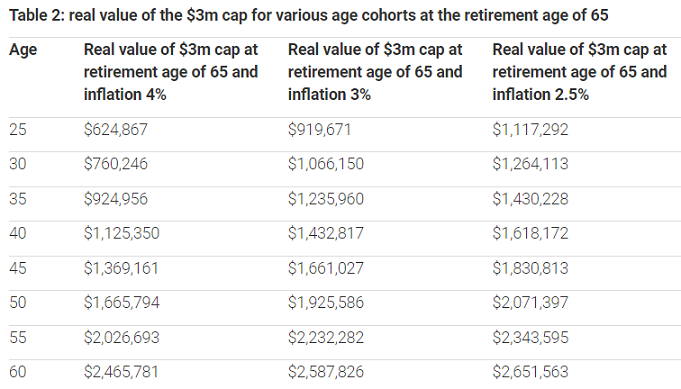

“If the Government does not index the proposed $3 million superannuation balance cap, 500,000 Australian taxpayers will breach the cap in their life and face a 30% earnings tax, including 204,000 Australians under the age of 30 ... Leaving the cap stuck at $3 million will mean that in today’s dollars a 30-year-old will have a real cap of around $1 million, calling into question the intergenerational fairness of an unindexed cap.”

(Again, an incorrect reference to a '30% earnings tax'. What are 'earnings'?).

The FSC gives the example of a 25-year-old professional earning $100,000 with a current superannuation balance of $35,000 would reach the $3 million threshold by the time they retire at age 65. The FSC provides this table showing the real value of $3 million at various inflation rates.

Source: FSC, ATO.

4. The limit is worth only $2.5 million now

Even now, we should stop referring to the limit as $3 million, as that is a future value set now, years before its start. It will never be worth $3 million in today’s dollars. With the earliest calculation date for the new tax at 30 June 2026 which is over three years away, assuming inflation at 6%, the future value of $3 million is equivalent to $2.5 million now. Anyone considering the likely impact should think in terms of the value on 30 June 2026 which is about $2.5 million in today’s terms.

To be clear, the new tax will be limited to individuals who have more than $3 million in superannuation at the end (not the beginning) of a financial year.

5. Valuations will become critical, even the wild guesses

An SMSF can hold almost anything and there is a vast range of investments where valuations vary widely, even between experts. Valuations are needed at the moment for super funds, for example, to determine the TSB because non-concessional contributions cannot be made where (currently) balances are over $1.7 million. But where the valuation directly drives the amount of tax paid by the member, they become far more critical.

In future, arguments will arise between trustees and valuers due to the taxation of unrealised gains, and it's likely that trustees will shop around valuers for the best number. Trustees will want as high a value as possible for 1 July 2025 and as low as possible for 30 June 2026. Consider these examples:

- A farm bought 10 years ago which has gone through cycles of drought and floods with harvests varying from the best to the worst years on record.

- A factory built 30 years ago where the land is now be worth more without the factory.

- A doctor’s surgery in a country town that cannot attract a doctor.

- A restaurant that struggled during Covid, recovered with JobKeeper, closed during lock downs, fought to attract staff, raised prices to combat inflation, benefitted from high migration but will be hit in a recession.

And then there are art collections, vintage cars, wines, NFTs … if Treasury thinks an accurate, independent value can be placed on all assets and then a tax imposed, it is creating an administrative headache.

6. No discount on (realised or unrealised) capital gains

Assets held in superannuation and sold receive discounted capital gains tax if held for longer than 12 months at two-thirds of 15%, or 10%. Not only will unrealised capital gains be taxed at the full 15%, but so will realised gains which increase the TSB at the end of the financial year.

In addition, if Earnings as defined show a loss, such as due to super balances falling over the financial year, there will be no tax refund.

7. Equalise balances as divorce becomes a plan

The TSB applies per person, not for an entire SMSF, and where one member of a couple has $5.8 million in super and the other none, the tax implications are profound versus two people with $2.9 million.

However, it is not possible to transfer super to a spouse except in small amounts. For example, up to 85% of concessional contributions can be split with a spouse in any financial year, but the cap on these contributions is $27,500. For a person earning less than $37,000 per year, their spouse can contribute up to $3,000 each year and receive a $540 tax rebate.

Where a strategy is desired to quickly transfer millions to take advantage of two limits, and it may become a meaningful plan to divorce and give half the super to the spouse as settlement, then take any mandatory separation requirement, and remarry with the super split. This is only one example of the creativity which the new tax will unleash.

While we’re on the subject of couples, if one member of a couple dies and passes their super to their spouse as a pension, the balance will be included in the survivor’s TSB, and become subject to the new tax if the TSB is large enough.

8. No tax refund or recovery if super balance falls below $3 million

A ‘loss’ in the new 'Earnings' calculation can be carried forward into subsequent years to reduce a future year’s Earnings. However, if the TSB is lower at the end of a following financial year than at the beginning, and there are no contributions or withdrawals, there will be no refund for tax paid in the prior year.

If money is removed from super and the TSB falls below $3 million permanently, or the individual dies, there many never be an opportunity to use the carry-forward loss.

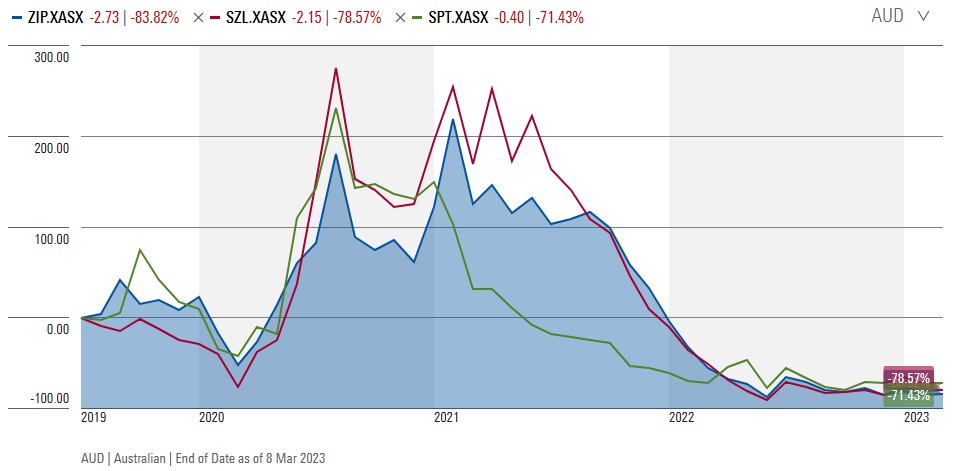

There are many examples where an asset placed into an SMSF rises quickly in value over a financial year, and the member will be presented with a large tax bill. The asset may then fall in value and never recover. Imagine if this new tax operated during the boom and bust of BNPL stocks such as Zip, Sezzle and Splitit, which were popular with retail investors including SMSF trustees.

Share prices of three BNPL stocks since 1 July 2019

Source: Morningstar Investor

9. Inability to remove excess from super without a Condition of Release

The new tax of 15% on Earnings on top of 15% on taxable income (deliberately not calling it 30%) will turn people away from large superannuation balances. Articles are already appearing about alternatives, such as the tax-free family home, family trusts, investment bonds and private investment companies.

Many members will move money out of super where a ‘Condition of Release’ has been met. The Government is unlikely to resist this, and probably welcome it, as Treasury must believe anyone with over $3 million in super has enough to meet the ‘Objective of Super’ to provide income in retirement. Removal of assets from the tax-advantaged vehicle may rank as a job well done for Treasurer Jim Chalmers, although putting more money into expensive family homes is hardly nation-building.

But that's not possible for people with large balances who have not met a Condition of Release. The Government will need to decide if they will give the option for anybody to remove money from super provided the balance does not go below $3 million.

For those who have achieved a Conditon of Release and who know they face a large tax bill, they may consider withdrawing money from their super in June to avoid the $3 million limit, especially if they are only just over it.

10. Wide range of potential impact on Earnings

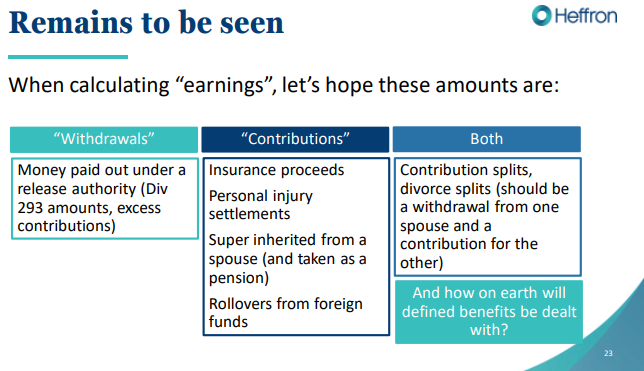

The definition of TSB is critical, being the difference between the EOFY balance and SOFY balance, minus Contributions plus Withdrawals. These flows come in many forms within superannuation, as this graphic from Heffron shows. It ‘Remains to be seen' what is included.

Taxing unrealised gains causes super reassessment

In an Institute of Financial Professionals Australia (IFPA) webinar this week, speakers said they were already fielding calls from clients who were asking about alternatives to holding money in superannuation. Planned additional contributions had been postponed and decisions to place assets in an SMSF were being reconsidered.

There is plenty of such anecdotal evidence that the role of superannuation in long-term investment planning is being reassessed, not only for those currently with large balances, but for those aspiring in that direction. It's highly unlikely that the Treasurer and Treasury wanted to bring doubt to our lauded superannuation system.

To share your views on the merit of the new super tax, please see our current Reader Survey.

Graham Hand is Editor-at-Large for Firstlinks. This article is general information based on interpretations of the Fact Sheet provided by Treasury. The final version of any legislation may differ from current intentions and any person should consider financial advice before acting on the proposed changes. Thanks to Heffron for additional insights.