The Labor government seems intent on introducing its $3 million super tax as well as investigating broader tax reform to boost our flatlining economy. Before pushing through with changes, it’s critical to recognize who pays the bills and who owns the assets.

That’s where the Australian Taxation Office’s annual snapshot of individual tax returns is useful. Because not everyone lodges their returns on time, the latest data are from the 2022-2023 financial year, though they offer fascinating details, nonetheless.

The snapshot reveals around 16.1 million individuals lodged tax returns in 2023.

Breaking it down by generations, for every 100 Australians lodging returns:

- 18 are from Generation Z (born between 1996 and 2009)

- 35 are from Generation Y (born between 1980 and 1995)

- 29 are from Generation X (born between 1963 and 1979)

- 15 are Baby Boomers (born between 1946 and 1962)

- 3 are from the Silent Generation (born in or before 1945)

So, 82% of taxpayers are younger than Baby Boomers.

Of the 100 people, 72 received a tax refund, 21 owed tax and 7 were perfectly balanced. Just 9 declared a capital gain, while 14 earned rental income (7 with losses and 7 with profits). Meantime, the proportion of men and women who lodged returns were split 50:50, and 77 came from states on the east coast.

Let’s look further at the key points from the taxpayer snapshot.

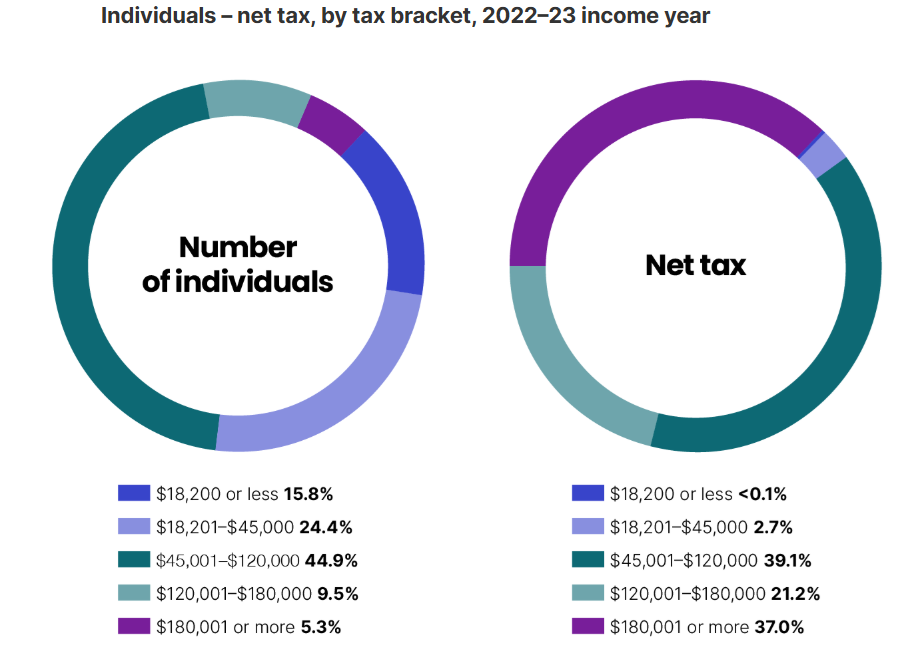

1. Who pays tax?

Australia has a progressive tax system where the more you earn, the more tax you pay. Most consider it a fair and equitable way for those with resources to provide for those without.

Nevertheless, the data on the gap between high- and low-income earners surprised me. Just 15% of Australians have an annual salary of $120,000 or more. And more than 40% earn less than $45,000 a year.

That 40% of taxpayers pay just 3% of the total tax tab. Meanwhile, the 15% earning more than $120,000 accounts for 68% of the net tax collected by the ATO.

The ATO breaks it down further by ranking the 100 people by taxable income:

- The top 3 paid 29% of all net tax

- The next 6 paid 18% of all net tax

- The next 30 paid 40% of all net tax

- The next 35 paid 13% of all net tax

- The final 21 paid no tax

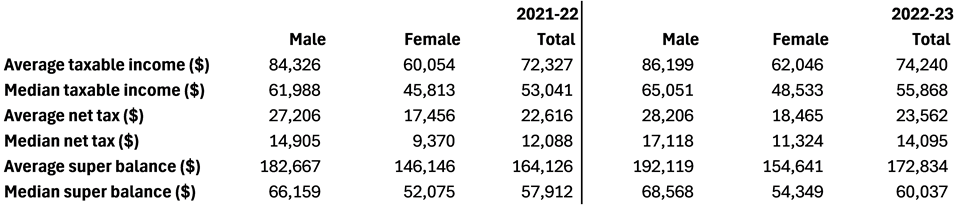

2. Taxable incomes

For the 2023 financial year, the average taxable income was $74,000. Averages can be deceiving, so it’s often better to look at median incomes. And on this front, the median wage was $56,000. Put another way, 50% of Australians earn less than $56,000 a year.

There still seems a large gap between pay for men and women. The median salary for men is around $65,000 while for women, it’s less than $49,000. This doesn’t consider the proportion of men and women that are working full-time versus part-time or casual.

Finally, the average superannuation balance is close to $173,000. However, the median balance is only $60,000.

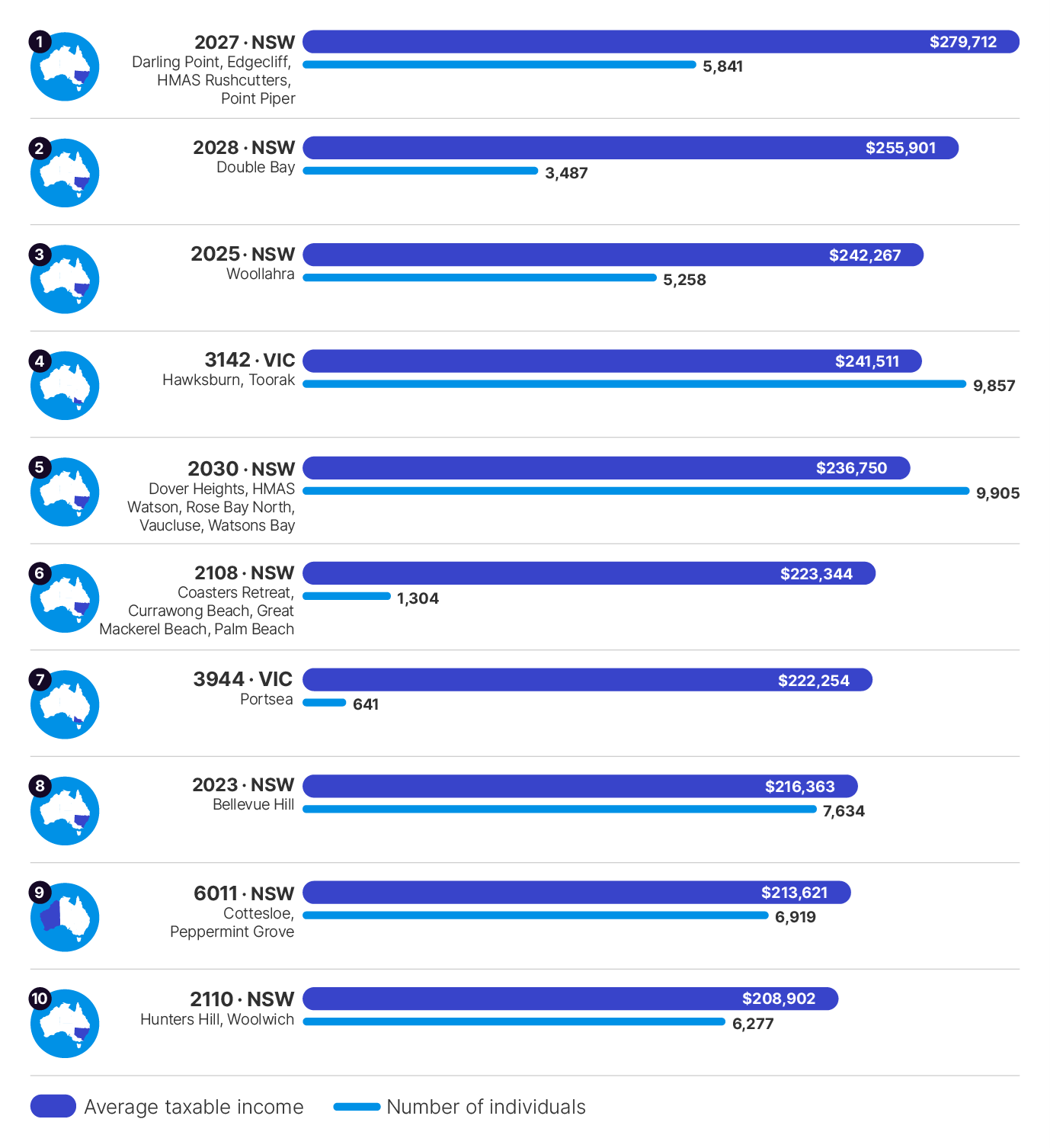

3. Top taxpayers by postcode

Let’s turn to the top end of town and the top 10 postcodes by average income. NSW has 7 of the leading postcodes, Victoria 2 and Western Australia 1 (the ATO chart below mistakenly places Cottesloe and Peppermint Grove in NSW instead of WA).

Individuals – top 10 postcodes, by average taxable income, 2022–23 income year

It isn’t a surprise to see Sydney’s eastern suburbs occupy four of the top five spots. The likes of Darling Point and Point Piper have average wages of $279,000, a reasonable way ahead of Double Bay in second place.

People in Hawksburn and Toorak in Melbourne have average salaries of $242,000.

Meantime, WA’s only entrants, Cottesloe and Peppermint Grove, have average wages of $214,000.

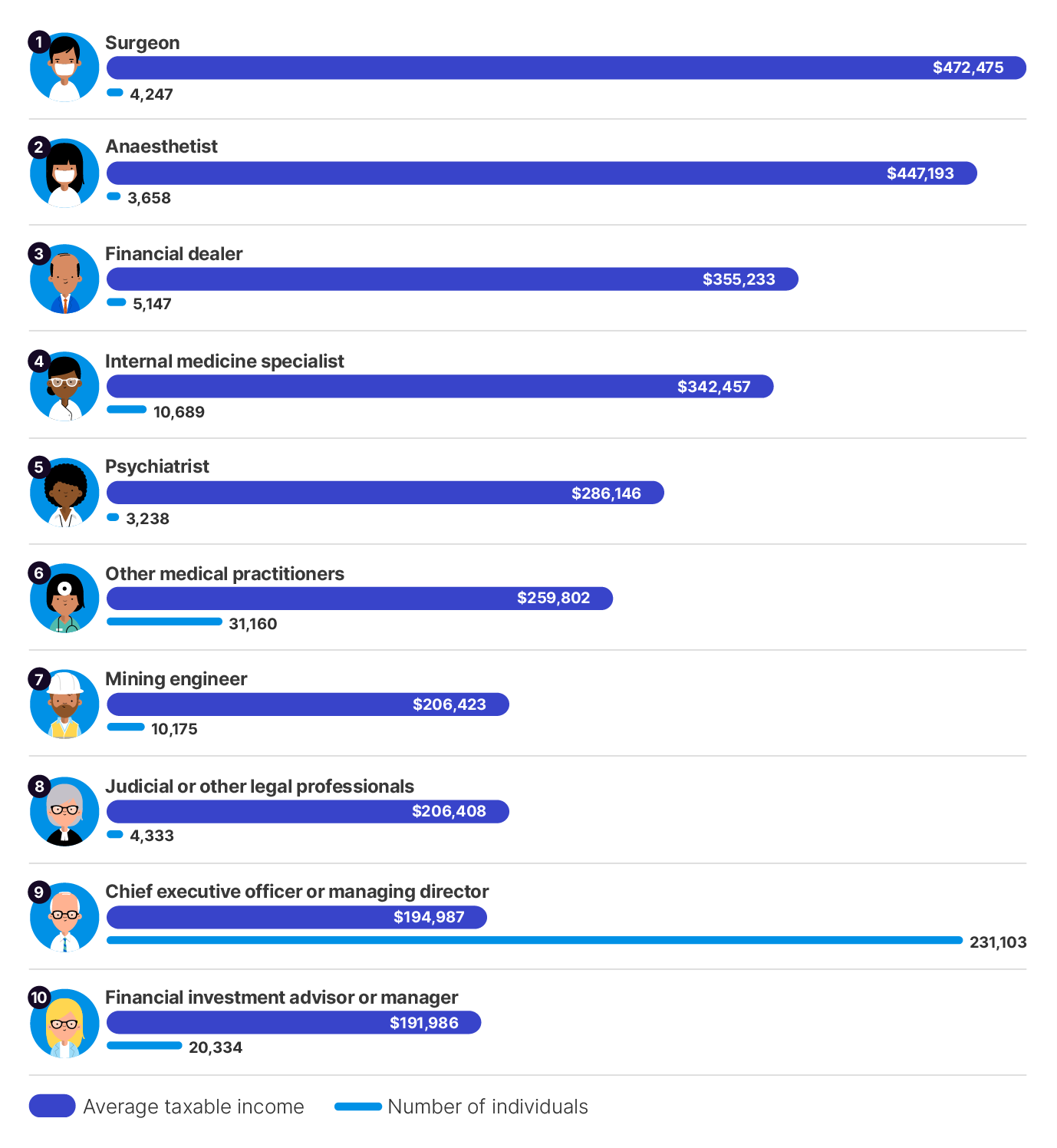

4. Top taxpayers by occupation

Unsurprisingly, the medical field dominates the leading taxpayers by profession. Surgeons top the list for average incomes, followed by anesthetists. Interestingly, anesthetists earn the most on a median basis ($425,000 vs $366,000 for surgeons). This indicates that top surgeons earn a lot more than less experienced surgeons, whereas it's a flatter playing field for anesthetists.

The number of people in leading medical professions is relatively low. Greater numbers of top-earning individuals are found in the occupations of CEO/MD and financial adviser/manager.

Having 231,000 as Chief Executives or Managing Directors seems like a lot, though it’s only about 1.4% of total taxpayers.

Individuals – top 10 occupations, by average taxable income, 2022–23 income year

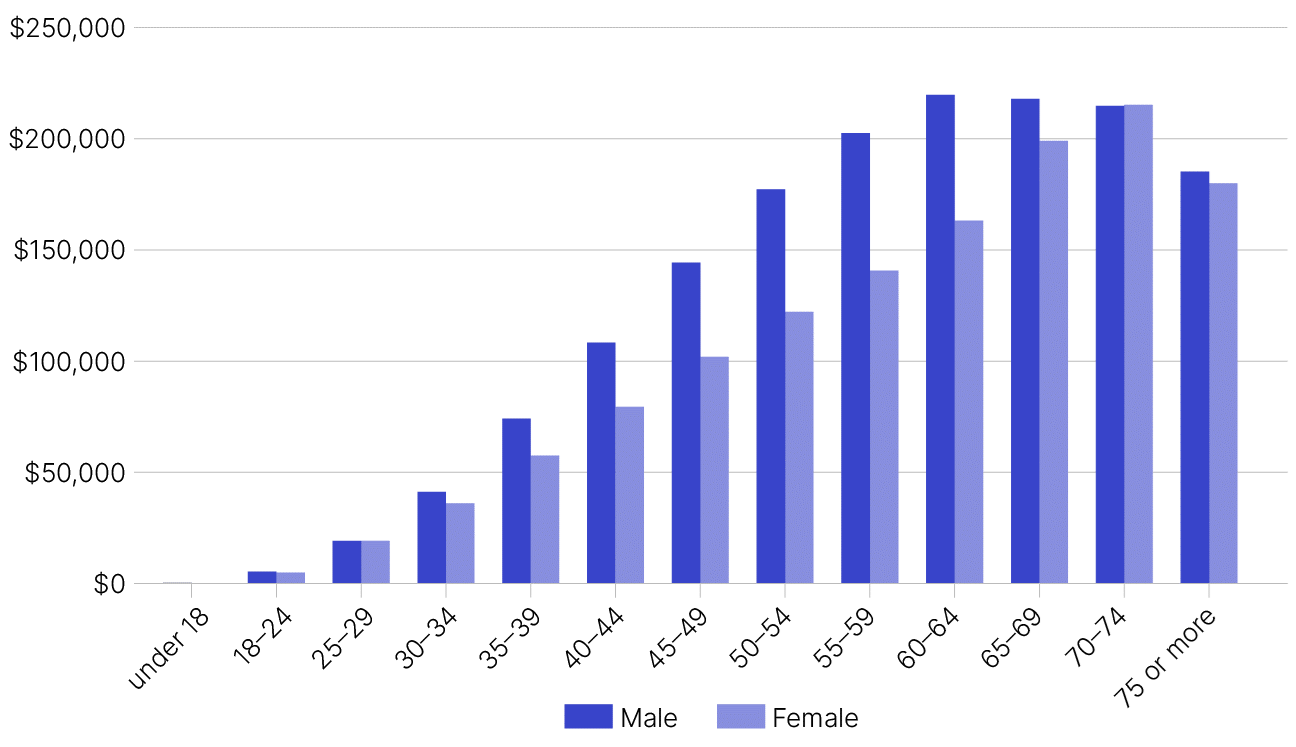

5. Average super balances by age

As mentioned, the median super balance is $60,000. Naturally, older people hold more super.

The largest super balances belong to 60-64-year-old men, at $219,000. Obviously super balances decrease beyond that age as retirees draw down their super.

However, for women, the bigger super balances belong to those aged 70-74. Whether this is due to spouses departing, I am not entirely sure.

Superannuation balances for men and women

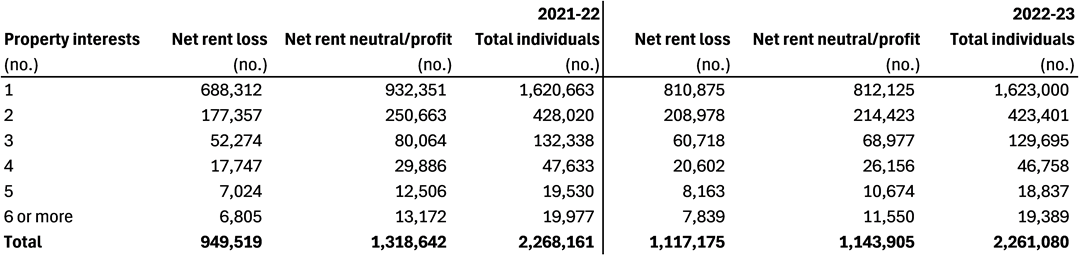

6. Who owns investment properties?

Moving onto who owns our assets.

Residential property is the largest asset class by far, valued at around $11 trillion, and most Australians have their wealth tied up in real estate.

The ATO data shows that 2.26 million Australians own investment property, or 14% of all taxpayers. Of these, more than 1.6 million have just one investment property. And almost 215,000 own three investment properties or more.

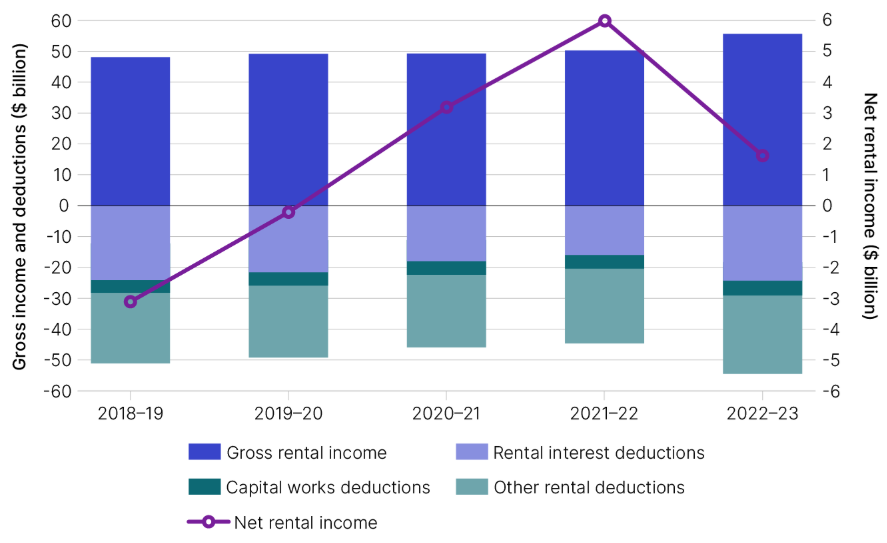

Australia’s property landlords get more than $56 billion in gross income from renters. That’s significantly more than the $49 billion collected two years prior (thank you, rental inflation post Covid).

However, after mortgage interest and other deductions, investment property owners only earned $1.6 billion in net income. Albeit, that’s better than the net losses from 2018 to 2020 when Covid-related rental assistance impacted landlords.

Individuals – rental income and deductions, 2018-19 to 2022-23 income

One takeaway

There are different ways to interpret this ATO data. My takeaway is that there are a relatively small group of people who earn the most, own the most, and pay the bulk of the taxes, and a much greater group that struggles to make ends meet and pays little to no tax.

Our system requires a delicate balance of taxing the well-off in a fair and equitable way to help the less fortunate. The art for policymakers is doing this in a way that doesn't discourage the accumulate of income and wealth, and also encourages mobility up the income ladder.

* Thanks to Firstlinks’ subscriber, Bill, who requested an update to Graham Hand’s 2021 article, 100 Aussies: five charts on who earns, pays and owns.

James Gruber is Editor of Firstlinks.