A chorus of market watchers insists the current rally in equities is overdone and that markets are ripe for a correction. They cite an array of indicators—ranging from surging inflows into exchange-traded funds and record call-option volumes to Warren Buffett’s Berkshire holding vast cash reserves, not to mention lofty S&P 500 price-to-book and price-to-earnings ratios and a speculative frenzy in crypto and meme-coins.

Such signals, they say, reflect a frothy market ready to tumble.

Yet not only are high prices an insufficient trigger for a crash, but these warnings echo predictions of recessions and crashes that have circulated since 2022 and never materialised. Indeed, the dire forecasts of an economic downturn in 2022, 2023, and 2024 were all off the mark.

To be fair, a market correction is always possible. Corrections, after all, are a feature of investing, and there have been double-digit pullbacks in the S&P500 during every US presidential term since 1901, bar three. In fact, the worst pull backs have all occurred during Republican presidential terms. However, it is also important to address the problem by inverting the question and asking whether the core conditions for a sustained bull market remain intact as we move into the new year.

Why the rally persisted through 2024

To understand why 2025 may be another positive year, and perhaps even the best of the last three, it helps to revisit the logic behind our bullish stance maintained through 2022, 2023, and 2024. A helpful framework, and one that has proven prescient many times over, was provided nearly five decades ago by the Hong Kong-based research house Gavekal. As long as positive economic growth coincides with disinflation—slowing inflation—innovative companies with pricing power tend to flourish, as do their equity prices.

Contrary to persistent recession warnings, the global economy continued to expand at a modest pace over the last two years, and inflation has largely moderated.

As long as the outlook for economic growth and disinflation remains in the green zone, there is no reason to expect prices to correct.

Many point to the strength in prices of the so-called 'Magnificent Seven' U.S. tech giants as a sign of irrational exuberance. Their shares soared, and many suggest they have rallied beyond historically safe multiples. But remember, these companies are innovative companies with pricing power. Over the last 50 years, these are the companies investors have chased amid disinflation and positive economic growth.

Another driver of the rally was the simple arithmetic of valuation. In late 2022, price-to-earnings (PE) ratios—particularly for smaller-cap U.S. stocks—were near historical lows, reflecting deep uncertainty and waning investor popularity. Buying shares at low multiples and selling later at the same modest multiples will always offer returns that match the underlying earnings growth of the company. As popularity (and thus valuations) inevitably recover, investors benefit twice: from earnings growth and from multiple expansion. Since September 2022, the S&P 500 has risen by about 70%, and the S&P 600 small-cap index by around 42%. So that worked as expected.

Signs of exuberance

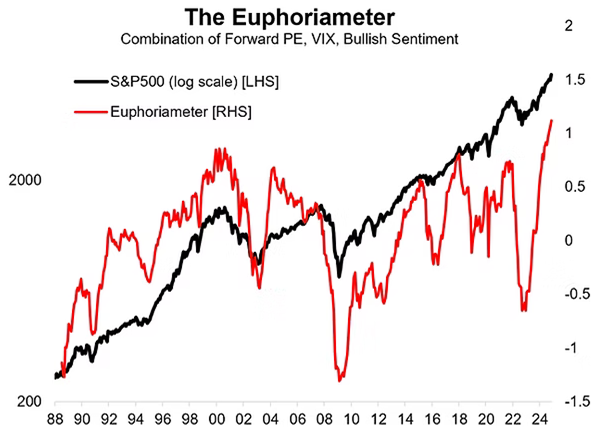

There’s a measure for irrational exuberance produced by Callum Thomas, the founder of Topdowncharts, in Queenstown, New Zealand.

The “Euphoriameter” developed by Callum Thomas, blends investor surveys, forward price-to-earnings ratios, and implied volatility into a single measure designed to spot periods of extreme optimism or despair.

Thomas currently estimates the return on the S&P 500 over the next five to ten years may average around negative five per cent per annum. He suggests an environment of euphoric sentiment and extended valuations exist and it might be wiser to look beyond U.S. equities for better returns, pointing to emerging markets, commodities, credit, Treasuries, and even cash as potentially more attractive bets.

Source: Topdowncharts

A cursory inspection of the Euphoriameter might lead one to sell everything and head for the hills. But a closer examination reveals extreme optimism has appeared many times before—1992, 2004, 2015, and 2017—without halting the market’s longer-term climb. Indeed, on each of those occasions, the S&P500 rallied for some years.

As we look ahead, it’s true that some indicators suggest caution. Speculative excesses, traditionally associated with late-stage booms, are increasingly visible. Stunts like a multimillion-dollar sale of a banana duct-taped to a wall and renewed enthusiasm for meme-coins and non-fungible tokens (NFTs) resemble the more frivolous hallmarks of market enthusiasm. Still, these episodes are occurring in peripheral corners of the financial landscape, not in assets critical to the global financial system’s stability.

Yes, the S&P 500’s price-to-book ratio and the Shiller CAPE ratio appear elevated by historical standards. But the composition of the S&P 500 has radically shifted over decades. It’s dominated now by companies whose value lies in intangible assets—software, patents, networks—rather than railroads, factories, and physical capital items. Higher price-to-book ratios are inevitable. Similarly, the CAPE ratio’s alarm bells may be muted if pandemic-era earnings skew the decade-long average of earnings that comprise the denominator.

Will 2025 still shine?

Despite calls for a downturn, the conditions that buoyed equities in previous years—positive growth and disinflation—persist. These, combined with America’s unique advantages – including world’s best productivity and demographics, world-leading investment in research and development and energy self-sufficiency have captured investors imagination and could lead the boom to become a bubble by late 2025.

Of course, no market moves in a straight line. Corrections will occur, and potential geopolitical shocks—such as China making a move on Taiwan—would change the outlook abruptly. Moreover, looking beyond 2025, the massive refinancing of trillions in global debt at higher interest rates could squeeze liquidity and temper the rally in subsequent years.

Still, it appears we are not yet at that euphoric zenith described by legendary investor John Templeton, who said: “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” While we may be edging closer to that latter stage, it’s doubtful we are there yet. The exuberant vertical run-up in broad indices, which often marks the final innings of a bull market, has yet to materialize fully.

Roger Montgomery is the Chairman of Montgomery Investment Management and an author at www.RogerMontgomery.com. This article is for general information only and does not consider the circumstances of any individual.