with Nicholas A. Demko and Matthew Scholder

Editor's note: This article was written shortly before US pharmaceutical company Pfizer announced its vaccine is “more than 90% effective in preventing COVID-19 in participants”. Such an excellent result means that for every 100 people who catch COVID-19, only 10 will remain ill.

Morningstar analysts, Damien Conover, wrote this on 10 November 2020:

"With the vaccine’s efficacy over 90% and no major safety issues observed, we believe the regulatory agencies are likely to authorise it for emergency use in late 2020, followed by full approval in 2021 pending supportive final data. The US Food and Drug Administration has said it would need at least 50% efficacy to approve a covid-19 vaccine, and BNT162b2 clearly passes this threshold. Further, the lack of major safety issues should reassure regulators and the general public. With manufacturing ramping up, the firms expect to produce up to 1.3 billion doses in 2021."

However, Pfizer made the announcement in a media release based on a study lasting a few months and the results are not peer reviewed independently. While such progress is a great sign, the following article remains relevant.

Financial markets are betting big that one or more successful coronavirus vaccines will help society return to normal but with vaccines come multiple challenges, not least of which is people’s willingness to be vaccinated.

In our view, mass testing is needed until vaccines and therapeutics are widely available and accepted. As a result, companies in the life sciences supply chain may offer sustainable investment opportunities.

Multiple entries, hopefully multiple winners

Most vaccine markets are monopolies or duopolies, but in the case of COVID-19, the World Health Organization reports that there are 42 vaccines in clinical evaluation and over 149 in preclinical development. This is a multi-horse race, hopefully with multiple winners. It goes without saying that we hope this becomes an overcrowded market with immense competition and success for all involved.

But let’s look at this through an investment lens.

The entire global vaccine market generates approximately $30 billion annually. As optimism over the creation of successful coronavirus vaccines has grown, investors have priced a lot of it into biopharma stocks, adding nearly $100 billion to their market capitalizations. If asset prices are a reflection of future cash flow probabilities, the market has discounted optimistic outcomes such as successful drug discovery, price durability and recurring revenue.

However, following regulatory approvals, vaccine makers face mass production and distribution challenges. For example, China and India manufacture the bulk of the world’s vaccines, presenting the potential for bottlenecks. As well, limitations in airfreight capacity or the need for temperature-controlled delivery may slow distribution, particularly in warm-weather regions such as Africa, Asia and Central America.

Effectiveness of vaccines

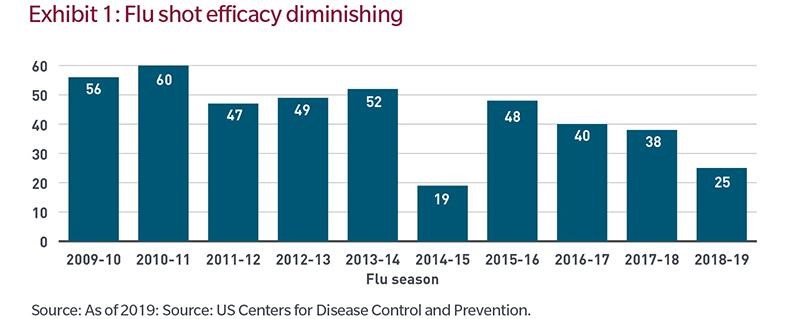

Manufacturing and distribution issues aside, there is a meaningful likelihood that efficacy rates will not bring herd immunity at any time soon. Exhibit 1 below is a 10-year look-back at the effectiveness of flu vaccines in the United States. Efficacy is low and has been falling for the past several years.

Additionally, under normal circumstances, a portion of society is typically skeptical of new vaccines. And given the politicisation of this disease, the percent of the population unwilling to be inoculated may be larger than normal. Hypothetically, a COVID-19 vaccine with 50% efficacy (applying a simply average from the chart above) consumed by 50% of the population would immunize only 25% of the population. While this is a simple assumption, it is material, as a 25% immunization rate would be well short of the 70% to 90% minimums often cited by epidemiologists as necessary to achieving herd immunity.

This is why society needs more COVID-19 testing. While these significant challenges — from drug discovery, to manufacturing and distribution, to garnering societal trust — are addressed, identifying those infected and isolating them early can prevent or limit contagion. Although therapeutics will accelerate recovery times and reduce hospitalizations, society will still need a step-function jump in testing.

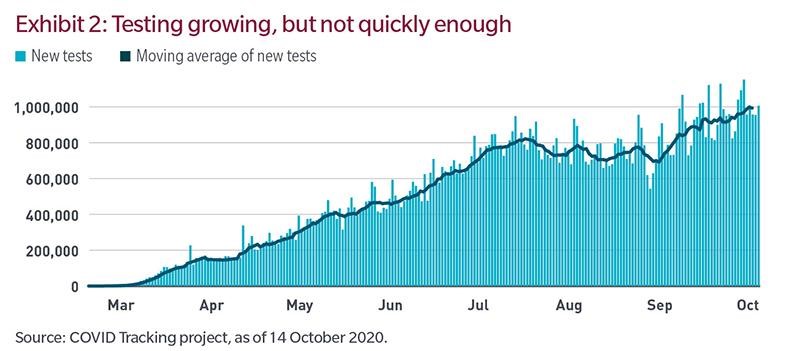

Testing capacity has grown a lot, as shown in the Exhibit 2. According to The COVID Tracking Project, the US saw exponential growth in testing during the spring and early summer. While the rate of growth has decelerated recently, the recent seven-day moving average is just under one million tests a day. That still isn’t enough.

According to a report by Duke University and The Rockefeller Foundation, asymptomatic people transmit approximately 30% to 60% of cases. The report concludes that given current infection rates, the US needs around 200 million tests a month compared with the current trend of about 25 million. Given a reasonable possibility that we will be experiencing meaningful community spread of the virus for some time to come, the best approach to resuming “normal” life would be mass testing.

With focus on vaccines, test manufacturers underappreciated

We think investors may be underappreciating the opportunity for COVID- 19 test manufacturers and services companies.

To be transparent, we have been overweight higher-quality life science instrumentation, medical device and related service companies for many years in several equity strategies. In general, we think these companies offer attractive long-term investment attributes such as:

- a 'razor/razor blade' recurring revenue model in which, following the sale of instrumentation, comes a high-margin, predictable revenue stream from consumables and reagents

- a scientific customer base that values quality, features and accuracy over cost and that encourages innovation and can command a premium price

- diverse and niche end-markets that enable only a handful of innovative companies to dominate market share in their product categories

We believe these three characteristics create sustainable, long-term economic moats that manifest themselves through a relatively strong return history and lower earnings volatility.

A handful of the largest life science companies not only develops, manufactures and distributes the global supply of COVID-19 testing supplies but also develops, manufactures and quality-checks vaccines and therapeutics. We don’t think it’s a coincidence that the current management of the virus through testing and the future management of the virus through vaccination are enabled by the same kinds of highly innovative companies that support modern scientific advancement.

Simply put, we believe companies in the global life sciences supply chain will create more sustainable profits than those in the highly-competitive vaccine market. While much of the current testing-related sales will be one-time in nature as society manages through the pandemic toward mass vaccination and natural immunity, the investments, innovation and future growth fueled by short-term virus-related revenues will potentially enable these companies to build on their long histories of investing in innovative, sustainable and high-returning endeavors.

Robert M. Almeida is a Portfolio Manager and Global Investment Strategist, and Nicholas A. Demko and Matthew Scholder are Equity Research Analysts at MFS Investment Management. The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.