In 2020, as COVID-19 caused markets to whipsaw in response to economic recovery, vaccine and immunity hopes, the job of analysts assessing long-term asset value became far more complex and fast-moving.

The accelerated rate of change brought on by COVID also sped up critical investment decisions, highlighted the importance of Environmental, Social and Governance (ESG) considerations and expanded the discussion to include responsible investing and active ownership.

Social risk and active ownership questions

The year began with the enormous loss and hardship associated Australia’s bushfires. Summer brought another wave of COVID and more lockdowns. Not surprisingly, client interactions throughout 2020 touched on one, if not all, aspects of the ever-growing ESG issues. Questions on social risk, such as human welfare, supply chain and climate, as well as reputational risks, are now at the forefront of the investment discussion.

This has moved the ESG conversation beyond E, S and G factors and their application and integration into valuation models to what they need to be anchored to in order to drive change, which is active ownership.

The Principles for Responsible Investment (PRI) defines active ownership as the ‘use of the rights and position of ownership to influence the activities or behaviour of investee companies’, that is to say, the use of ESG engagement and proxy voting.

Regardless of how an investor chooses to own an asset, ownership is ultimately an undertaking to knowing a company’s business, and how the company is positioned for growth is essential to understanding its sustainability over the long term.

This was truer than ever in 2020 as businesses found ways to help their stakeholders deal with multidimensional crises such as COVID that overnight turned the world virtual, forcing individuals, families, communities, organisations, states and markets to interact in ways and on a scale never seen before.

The role of passive and active managers

Both passive (index) and active managers have an important role to play in realising the potential value that thoughtful engagement and proxy voting can create. While large passive managers have the size to influence voting on broad issues, their ability to effect nuanced engagements with companies is likely hindered simply because they own so many companies. Index investors generally have to buy all the companies in the relevant benchmark.

Typically, active managers are better positioned to look into businesses, industry operations and management. They use all the available information, including non-financial information (which is becoming increasingly mandated), to determine what will have a material impact on those businesses.

If they do not know the business well enough, they cannot tell the difference between one that is sustainable and socially responsible or not. Nor are they able to effectively challenge company management on how to deal with ESG risks and take advantage of ESG opportunities.

Active investors with deep research capabilities are able to perform 'materiality discovery' similar to price discovery and engage in a sustained way with investee companies to instigate change.

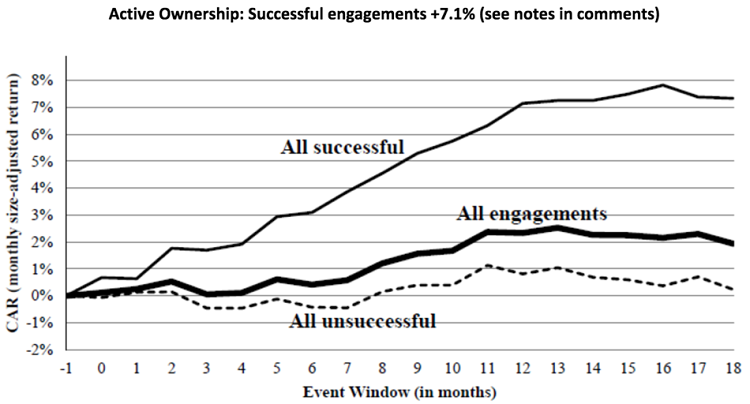

Research from Cambridge University shows that:

"ESG engagements generate cumulative size-adjusted abnormal return of +2.3% over the following year on the initial engagement. Cumulative abnormal returns are much higher for successful engagements (+7.1%)."

The research found no market reaction to unsuccessful engagements.

Investment organisations that manage sustainable investing through ESG integration, proxy voting and engagement are more likely to create sustainable value over the long term.

In addition, these active ownership attributes improve their ability to achieve their client’s objectives and meet their fiduciary responsibilities. We have yet to be convinced that offering products with ESG screens or overlays can do the same, perhaps it ticks a short-term box, but true long-term stewards should demand more.

ESG risk assessment a blunt tool

In our experience, investors want to know what longer-term, sustained improvement in the relevant ESG areas a company has made. Whilst we understand why transparency and measurement is important, we caution against an over reliance on narrow or blunt measurement tools, which cannot be expected to capture the nuance and range of the ESG risks faced by, and opportunities available to, companies.

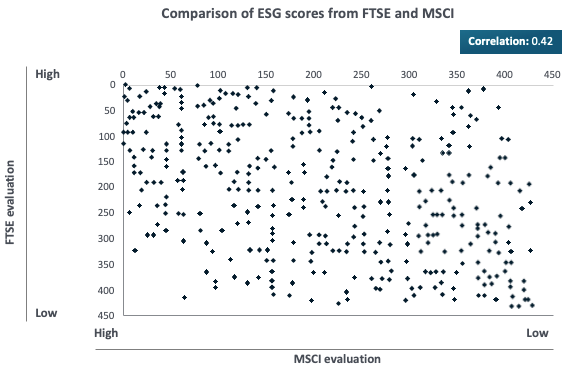

The chaos in the marketplace in relation to assessing companies for ESG is well illustrated below. The world’s largest rating agencies, FTSE and MSCI, are virtually uncorrelated when it comes to ESG materiality. This creates an opportunity for managers such as MFS to engage with clients on how the criteria that we, ourselves, have been building can potentially drive long-term performance on their behalf.

ESG must include active ownership

Client alignment is at the heart of active ownership, so a critical part of the ESG discussion is to understand whether your investment manager is aligned with your views and how sustainability is factored into the investment process undertaken.

Active ownership will become a necessity and the norm for all managers, both active and passive. There is a chance that that passive owners, not passive managers, will get punished if they do not use their voting power to build more sustainable practices at companies.

At a time when we are facing more pressure and complexity than ever before, the managers who survive will be those that align with their clients' long-term needs and support the transition to a more sustainable society. This philosophy fuels our beliefs as an active manager.

Marian Poirier is Senior Managing Director, Australia for MFS Investment Management. The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.