Depending on who you ask, you’ll get the answer you want on the ASX reporting season. There have been enough positive surprises, earnings upgrades and share price reactions to support a bull(ish) view and there have been enough disappointments, earnings downgrades and share price declines to support a bear(ish) view. But truth told, this is always the case. Reporting season usually has a little bit of everything depending on how you look at it.

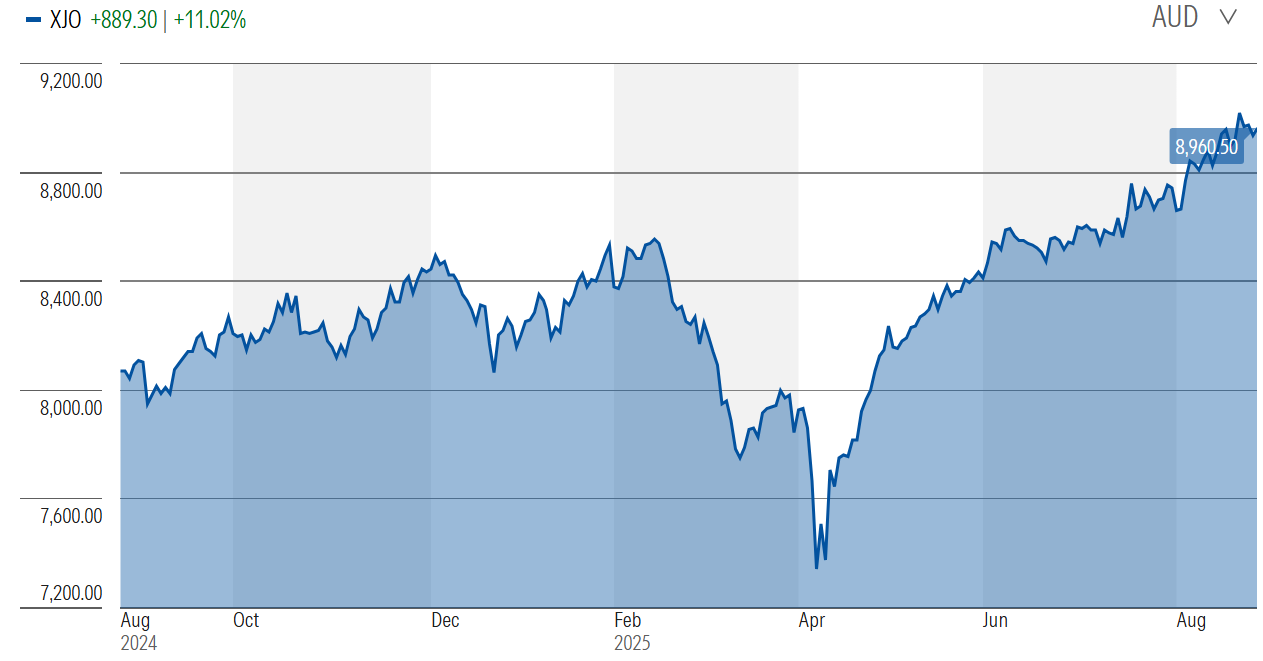

Admittedly the reporting season has been volatile with several outsized share price moves by large and/or well held stocks in both directions (CSL, Cochlear, WiseTech, Domino’s and James Hardie on the downside and Brambles, Computershare, ZIP, Seek on the upside). But behind this volatility has been an equity market that has ground its way higher, to be 3% above where it started the reporting season.

Considering where equity market valuations sat heading into reporting season (in the 95% percentile) and the broadly negative trend in post result earnings revisions, we think the equity market has shown an enormous degree of resiliency and believe this sets it up for further gains as we focus on what lies ahead rather than what is in the rear vision mirror. In addition, investors are always willing to look a little further ahead when there are signs that the economy is at an inflection point and/or when we are in a policy rate cut cycle.

Five key themes from results

But before we evaluate what the reporting season means for the equity market and portfolio positioning, there are several trends that emerged worth discussing:

First, results have been patchy which reflects an economic backdrop that is soft, but with pockets of strength. For instance, the consumer backdrop was weak with retailers generally facing soft consumer demand. However, those with dominant positions (such as JB Hi-Fi) were able to significantly outperform the broader category as were those who have been technology assisted such as CAR Group, REA Group or SEEK Ltd. The same can be said across the property sector where office (Dexus) remains weak but retail and residential (SGP and Scentre group) continue to perform well.

Second, revenue lines were broadly disappointing – reflecting a softer demand backdrop as well as headwinds from tariff uncertainty, US economic weakness and for a select few, disappointment from New Zealand exposure. However, this was offset by more resilient and often improving margins due to pricing power (Telstra, REA Group), strong cost control or via companies which had previously implemented cost-out programs or applied more disciplined capital allocation (Coles, Fortescue, Downer, Worley). As a driver of upside, this should not be surprising given every company should have strong cost control when revenue is softening. However, applying this lever successfully can be difficult in real time.

Third, we have seen some green shoots from China, albeit very early days. This came from both the commodity and consumer driven areas but caution on the potential for further policy easing has also translated into a cautious outlook but with upside potential. We have seen the reverse from those with exposure into the US where there was a strong message that conditions were tough from James Hardie, Bluescope Steel, Sims and Reliance Worldwide where macro concerns and US economic weakness were major headwinds. We think this reflects pockets of weakness rather than broad economic weakness coming out of the US with ZIP producing an exceptionally strong result.

Fourth, across financials the banks generally produced solid results often impressing on lending growth and some net interest margin tailwinds (ANZ, Bendigo, Commonwealth and Westpac) while insurers also had solid pricing power leading to broad based upgrades. However, price action was not necessarily in line with the result surprise or quality of the print with CBA selling off post result but ANZ, Bendigo and Westpac rallying strongly.

Last, macro commentators are fixated on the absolute level of earnings growth and the magnitude of downgrades seen throughout the reporting season as constraints for the equity market outlook. We have a much more optimistic outlook and think that the market can trade meaningfully higher despite a modest earnings outlook given policy rates will fall further and macroeconomic conditions are set to improve.

Source: Morningstar

Why things are looking up

If anything, corporate Australia has emerged through an economic soft path in solid shape. If this is the worst that it gets (and we think it is), then it’s just not that bad. Similarly, it’s very hard to be pessimistic when domestic conditions should get better over the coming 12 months, when both the consumer and businesses will get a kicker from lower interest rates and where global uncertainty (particularly around trade) should also begin to normalise. These conditions are supportive of corporate earnings and while the incremental (year on year) gain might look modest, it’s the direction of travel that matters most when we are at an inflection point rather than the magnitude of the gain.

Looking ahead, investors should be positioned to take advantage of a cyclical upswing and lower policy rates. Domestic consumer and industrial facing areas are on the cusp of an upswing, and they can outperform defensive areas where earnings safety and deliverability have been important. Similarly, we think the outlook will also improve for global cyclicals (particularly in the US) as the Fed resumes its rate cut cycle in September. For the past five months we have urged investors to stick with the equity rally despite concerns from every direction. The reporting season has shown us that Australian corporates are well positioned to leverage into an economic upswing and the focus should be on gaining exposure to this.

Jun Bei Liu is a co-Founder and Lead Portfolio Manager at Ten Cap. Jun Bei is also a popular media personality and a highly sought after public speaker about her investment views. This information is intended for general use only. The information presented does not take into account the investment objectives, financial situation or advisory needs of any particular person.