Gold prices have risen to more than USD 1,950 per troy ounce (oz) in early March as the conflict in Ukraine, heightened inflationary concerns, and slowing economic growth combine to reignite demand for the trusted safe haven.

These events have seen a return to inflows for global gold ETFs, with holdings increasing by just over 2% in the first two months of the year (after falling by 5% in 2021). Concurrently, speculators in the gold futures market have more than doubled their net long position (i.e. positions that will profit if the gold price rises).

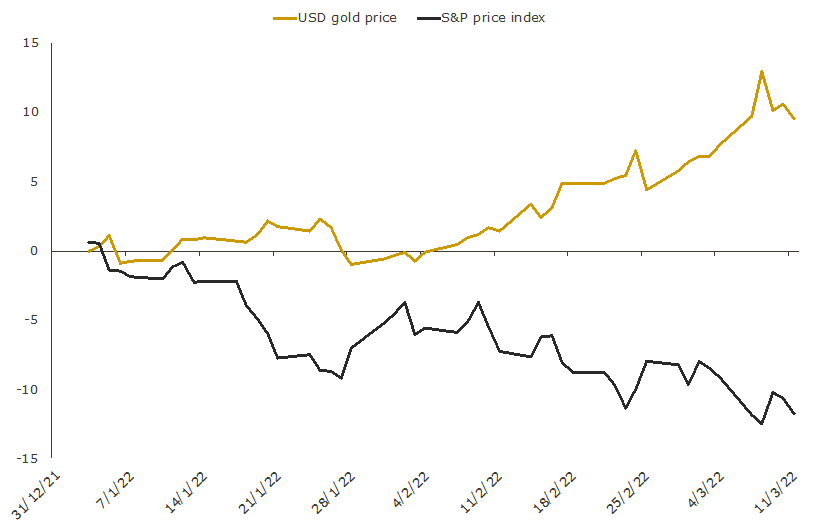

Performance wise, gold (priced in US dollars) has now outperformed US equities by approximately 20% since the start of the year (data to March 11), seen in the chart below.

US dollar gold price and the S&P 500 price index

YTD performance (%) to 11 March 2022

Source: The Perth Mint, MarketWatch, World Gold Council

The chart highlights that what we’ve seen so far in 2022 is another example of gold providing portfolio protection when it’s needed most.

Local investors have also benefitted from gold’s protective qualities. In Australian dollar terms, the YTD outperformance of gold relative to the local equity market is closer to 13%, with gold up by almost 8%.

The slight ‘underperformance’ of the Australian gold price compared to its US equivalent has led some to question whether it matters what currency you buy gold in, should you decide to include it in your portfolio.

Does it matter what currency you buy gold in?

Over the long-run, gold prices in many developed market countries have delivered relatively similar returns, with the difference between the US dollar gold price and the gold price in other currencies often explained by a combination of inflation and interest rate differentials.

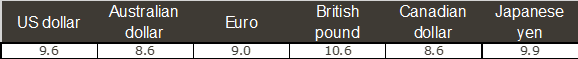

The similarities can be seen in the table below which shows the average annual returns for gold across a range of currencies from the year 2000 to the end of February this year.

Average annual returns (%) – gold in various currencies, 2000-2022 YTD

Source: Reuters, Incrementum Monthly Gold Compass – March 2022, data to end February

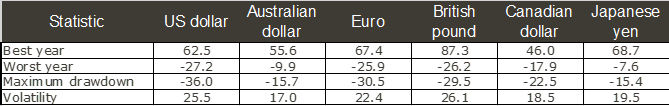

While long-run returns and the role that gold can play in a portfolio tend to be similar irrespective of the currency we are looking at, there are differences in shorter term price movements, volatility and drawdowns.

The following table, looking at the same currencies, highlight these differences.

Best year, worst year, maximum drawdown and volatility – gold in multiple currencies, 2000-2021

Source: The Perth Mint, World Gold Council. Based on calendar year data

Currency impacts magnify protective benefit of gold for Australian investors

When buying gold unhedged in Australian dollars, investors are taking on an additional source of risk and return. They are not only exposed to movements in the US dollar gold price, but also movements in the AUD/USD exchange rate.

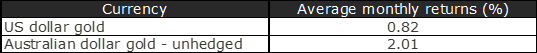

Rather than proving problematic, this additional source of risk and return has historically been beneficial for Australian investors looking to hedge equity market risk with a gold allocation, because the Australian dollar typically falls against the US dollar when equity markets fall.

Indeed, since the turn of the century, the Australian dollar has fallen against the US dollar 60% of the time the local equity market has seen a monthly decline. The average decline for the Australian dollar in the months the currency fell alongside the equity market was 3.5%.

In the 40% of times the Australian dollar rose against the US dollar while local equity markets sold off (as it has in 2022 so far), its average increase was just 2.6%.

Over this entire period, this exchange currency effect has been worth almost 1.2% in terms of the enhanced portfolio protection Australian investors would have received in the months that equities declined, assuming they held a gold position unhedged in Australian dollars.

Gold price moves when Australian equities fall, 2000 to 2021

Source: The Perth Mint, World Gold Council, RBA, MarketWatch

Home bias a factor

Most Australians have a home bias when it comes to their portfolio and total pool of assets, a fact underlined in a 2019 article published by Vanguard stating: “The level of equity home bias in Australian portfolios is among the highest in the world.”

This is entirely natural, given the largest asset most of us own, the family home, is priced in Australian dollars. Additionally, people earn most, if not all, of their income in local dollars, and it is a similar story with the cash and term deposits they hold.

Lastly, as it relates to the equity market and Australian investors specifically, there are understandable reasons investors prefer to be ‘overweight’ the ASX (hello franking credits), reinforcing the home bias.

Given this reality, the logic of holding gold unhedged in Australian dollars is arguably even more compelling.

Should the Australian dollar rise, then most of the assets you own will benefit from this currency appreciation, even if the unhedged gold position you hold underperforms a hedged equivalent.

But if the Australian dollar weakens, then the unhedged gold position will provide additional protection, not only within a portfolio of financial assets, but across the broader pool of real estate, cash and superannuation that most Australians are looking to grow and protect.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.