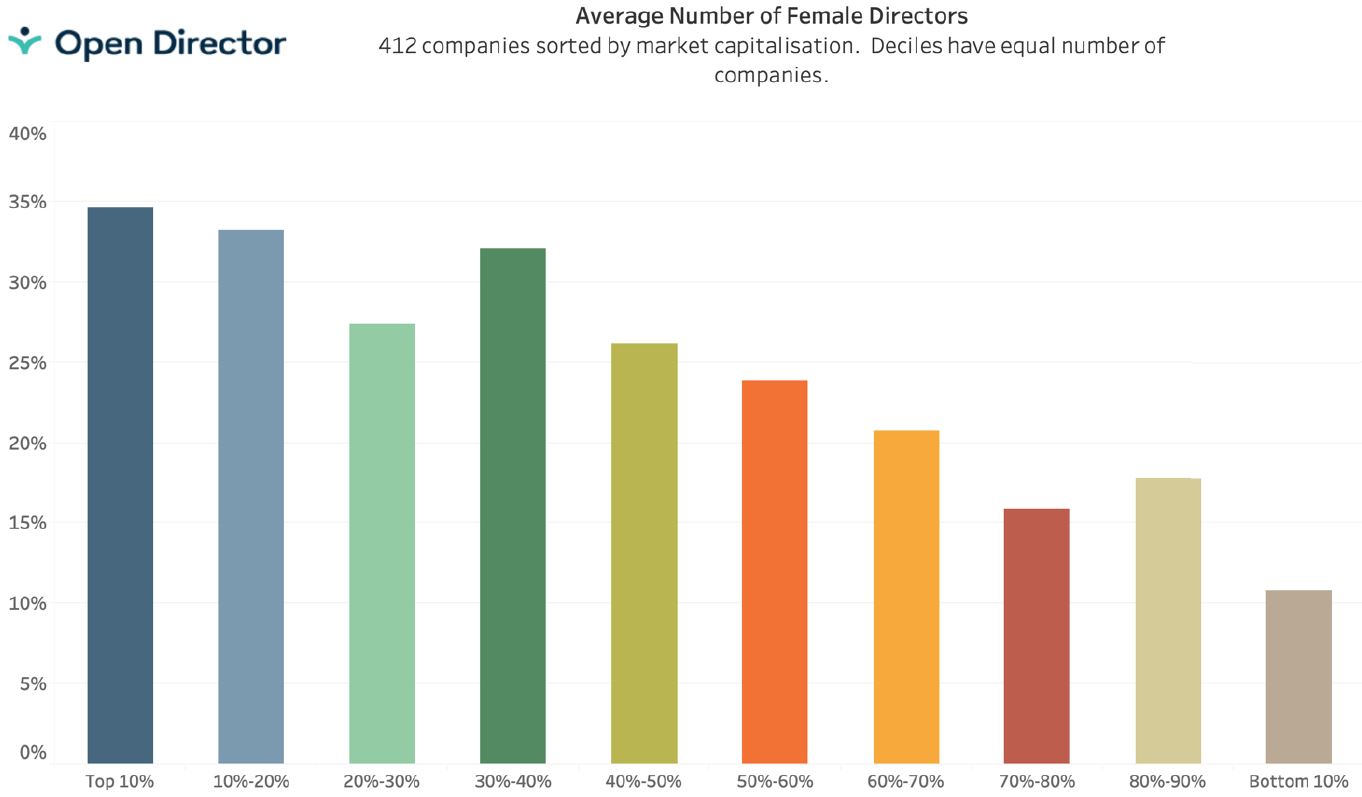

Bigger companies are materially better than smaller companies at improving gender diversity on boards. The relationship is linear. The largest 10% of companies, ranked by market capitalisation, have on average 35% of board members being female while the smallest 10% barely reach 10%.

OpenDirector tracks 412 listed companies, analysing the composition and performance of boards. The database also includes the directors and executives of 64 superannuation funds and 30 large government entities.

The results showing declining female representation on smaller company boards is obvious in the chart below.

Difficulty assessing a link to performance

There are many likely reasons why larger companies are more active in promoting women to boards.

Smaller company boards are often close-knit, smaller in director numbers and comprising of the company’s executives, original founders and even family.

Fewer women on smaller company boards has a material effect on academic work which investigates whether female directors or boards with higher female representation improve company shareholder returns. It is much harder for large companies like CBA (55% female board representation) or CSL (44%) to double in size than smaller companies like AfterPay (14%) or Magellan (14%). While a more worthwhile topic is the overall board diversity, it is interesting how often the gender issue alone becomes a centre of debate.

OpenDirector analyses the performance of directors and, by default, has an aggregate index of how female directors compare to male directors. Our individual director analysis is theoretically robust in that we create total return indices for each company adjusted for company sector and size. At this stage, our preliminary data indicates that female directors do not outperform their male counterparts.

Our reluctance to publish detailed results is because bias still exists in this area. Female representation is higher in established companies than new entrepreneurial companies. If work is to be done on improving female representation on boards, a good place to start may well be increasing women on start-ups and private equity IPOs. This point is known to the experts.

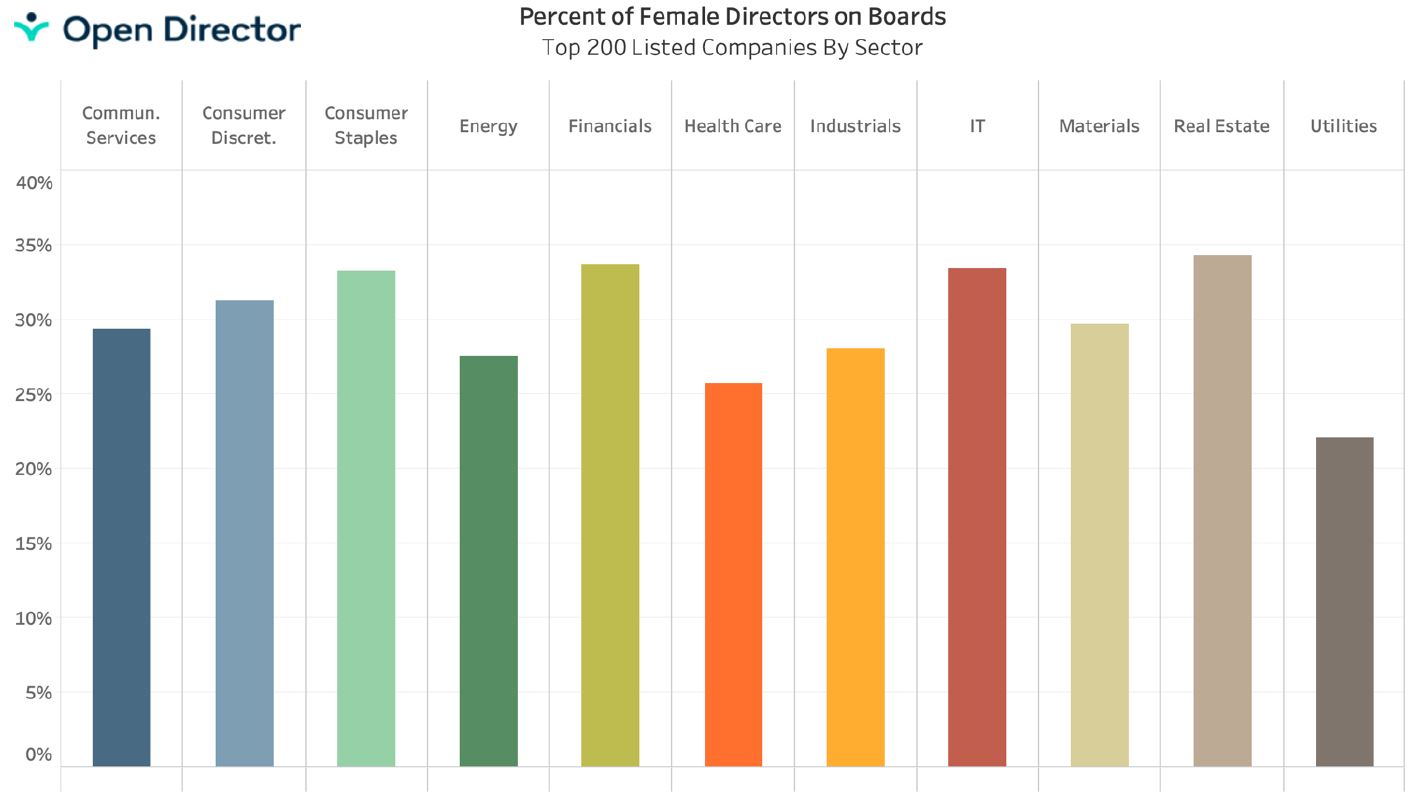

Interestingly, female representation on boards is reasonably consistent across sectors. While representation is slightly lower in more ‘blokey’ industries like energy, industries and minerals, it is not glaringly so. Utilities appear to have low representation, but there are few companies in this sector.

Female representation on boards is increasing but still low. Of the 324 directors who were appointed in the last 12 months in our database, 118 or 36% were female. While increasing the average number of women on boards, these are not exceptional growth rates. As today’s CEOs become tomorrow’s directors, perhaps the more concerning statistics is that of the 34 new CEOs appointed to boards, only three were women.

Donald Hellyer is Director of OpenDirector and CEO of the development company BigFuture.