Among my various investment activities, I am the Portfolio Manager of the $110 million Australian Philanthropic Services Foundation (APS Foundation). This article focuses on how I have navigated the uncertainties and wild gyrations of investment markets during the COVID-19 pandemic and benefited from a relatively-large holding in private debt securities.

What is a public ancillary fund?

The APS Foundation is a communal philanthropic structure called a public ancillary fund, a structure which is very efficient and tax effective for people interested in philanthropy. It is particular attractive to those who need a tax deduction now but want the flexibility to undertake a regular flow of charitable giving over time.

At this time of year, APS Foundation attracts a lot of attention as people think about philanthropy and do their tax planning and prepare for the close of another financial year. I feel the privilege, excitement and 'pressure' of managing this Foundation and take it very seriously. The onset of the COVID-19 pandemic and resultant negative economic and market consequences have given me plenty to think about. Sometimes the words ‘cold sweat’ come to mind when investment markets fall 20%-30% virtually overnight and I think about how that may impact the APS Foundation and in turn its impact on the community!

The APS Foundation comprises around 300 giving funds (also known as sub-funds) established by individuals, families and companies. They make a tax-deductible donation of at least $50,000 to the Foundation, which is set aside into their own-named giving fund. Each year at least 4% of the giving-fund balance is given to charities recommended by the fund holder. The giving funds are pooled and invested together, with investment returns accruing to the underlying giving funds. Returns are tax-free, so good investment management can see the balance grow, increasing the amount for charities over time.

Investment objectives and strategy

The investment objective for the APS Foundation is to achieve a return after fees at least equal to CPI inflation +4% per annum, measured over rolling seven-year periods. A lot of factors were taken into account before landing on this objective, including:

- the need to distribute a minimum of 4% per annum to charities

- the likelihood of inflation affecting the value of the investments and income generated

- the risk of capital or income loss

- the liquidity of the investments

- the costs of investment alternatives and transactions, and

- the benefits of diversification of investments.

With these investment objectives in mind, we set broad investment ranges to ensure we have plenty of flexibility.

I decided long ago that it was paramount that a charitable foundation, like APS Foundation, needed to have a well-diversified investment portfolio. That would be my best protection against unexpected negative surprises that investment markets have a habit of delivering more often than we sometimes think.

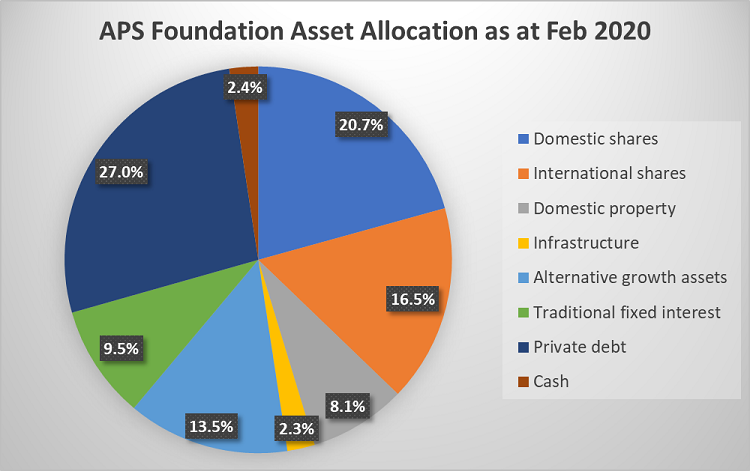

As at the end of February 2020 (just before COVID-19 started to hit hard) the asset allocation of the APS Foundation was as follows:

High allocation to private debt is an anomaly

Compared to say a typical balanced superannuation fund, the high allocation to private debt stands out. Private debt is a significant subset of broader credit markets, often resulting from private equity, securitisation and direct lending activities across various assets pools and corporate borrowers. Such exposures include leveraged loans, commercial, industrial and residential real estate loans, asset-backed loans and loans to businesses secured by their operating assets.

Generally speaking, private debt loans, as the name suggests, do not trade on open markets and hence are usually very illiquid (except for some asset-backed securities). Once a loan is made it is typically held to maturity, with terms generally ranging between one and five years, with varying repayment profiles.

Due to its illiquidity, private debt as an asset class will not suit all investors. But for a patient investor with a longer-term investment horizon, who is less concerned about liquidity and seeks attractive current income returns, private debt funds can provide a good risk/return trade off versus high-yield bonds, for example. This suits APS Foundation.

Driven by changes to bank capital requirements

Since the GFC, changes in the bank regulatory capital environment in Australia have increased bank reserving requirements. Similarly, relatively-buoyant equity markets and Australia’s dividend imputation system have seen corporates and investors alike continue to favour equity over corporate bond issuances.

The former has led to a significant contraction in traditional bank lending to small and mid-sized businesses with limited real estate security for example.

The latter has perpetuated an underservicing of capital requirements for these and much larger enterprises through private credit.

This has created a 'funding gap' among Australia's major banks to these businesses, which has now been filled by a number of specialist non-bank lenders. This has greatly assisted the growth of the private debt market and the opportunity for investors like APS Foundation to participate in an area that was once only the domain of the banks. It is interesting to note that Australia’s non-bank lending market is materially smaller as a percentage of the overall market relative to the US and Europe and is expected to continue to grow materially.

The nature of private debt markets

Typically, private debt funds, depending on their risk profile and security exposures, may yield between 5% - 15% per annum. While 'high yield' has generally been synonymous with high risk, this is mitigated if a focus is taken on senior secured investments. These rank in priority to other creditors or equity – particularly listed equity - for liquidity and payment and there is strong asset or cashflow backing to the loan. With a diversity of their underlying collateral, private debt markets deliver opportunities for experienced credit managers.

Australian-based providers of private debt who I have invested with include Revolution Asset Management, Realside Financial Group, PIMCO, Merricks Capital, Longreach Alternatives, Aquasia, Causeway Financial, Pure Asset Management, and Ventra Capital (of which I am also a shareholder and director). And there are many more in this growing market that I have not met.

Performance of the APS portfolio

So how has the APS Foundation investment performance fared of late? During the months of March and April 2020, when the pandemic hit hardest, the Foundation fell 6.1% in value. Although no one wants to see a negative result, this has been a credible performance relative to other multi-sector funds. During this same two-month period, Australian shares decreased 11.4%, unhedged international shares decreased 4.4%, listed property trusts decreased 21.5%, and fixed interest (as measured by the Bloomberg AusBond Composite Index) fell 0.3%.

I believe the private debt exposure has played a significant stabilising role in that result. We have carefully reviewed the value of all private debt in the portfolio to ensure they are realistic given the information currently known. This included a detailed enquiry with each underlying manager of the various private debt securities who in turn has done a granular review of each of their portfolios.

The investment objective of CPI inflation + 4% per annum after fees, measured over rolling seven-year periods, has been met to date, even taking into account the sharp falls over the last quarter. The returns since inception in mid-2012 are 10.1% compound per annum compared to the return objective of 5.9% compound per annum.

Apply these returns to a giving fund established seven years ago with a donation of $100,000 which has distributed the minimum 4% to charity each year. As at April 2020, the giving fund would have gifted $35,348 to charity and its balance grown to $140,949. The structure and its return deliver a compelling style of giving that allows a philanthropist to both give and grow money for charity.

Chris Cuffe is Chairman of Australian Philanthropic Services as well as Portfolio Manager of the APS Foundation. Anyone interested in knowing more about APS, including establishing a public ancillary fund before the end of the financial year, should check the APS website.

Chris is also involved with a number of other groups as a director, chairman and investment professional. Chris was one of the founders of Cuffelinks, the predecessor to Firstlinks. This article is general information and does not consider the circumstances fo any investors. Anyone wishing to know more about investments mentioned in this article should seek professional advice as private debts are not as secure as bank deposits or similar.