If you open a bank account but refuse to disclose your Tax File Number, the bank is required by law to withhold tax from the interest paid to you. Your personal tax return needs to report all of the interest you earned, not just the after-tax portion you received. Your tax return must include that pre-paid tax, otherwise you would be paying tax twice on the same interest income. If you were not required to pay any tax, you would expect this tax previously withheld by the bank, paid to the ATO on your behalf, to be refunded to you.

How franking credits work

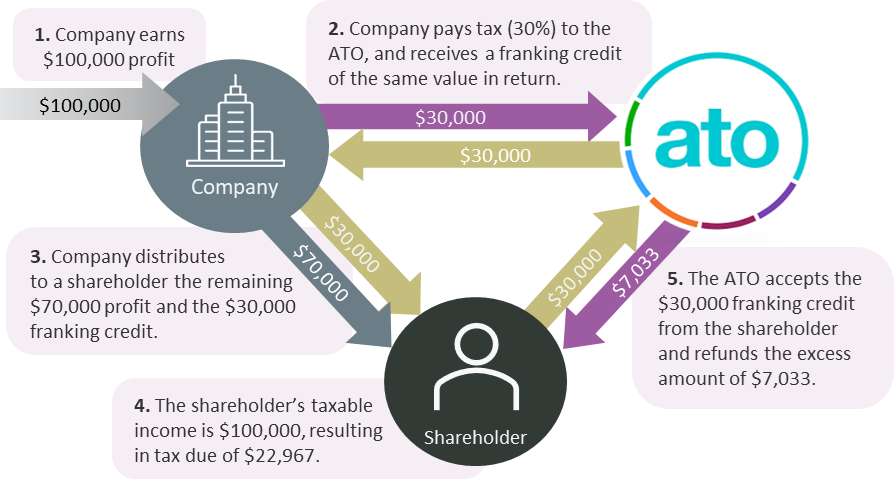

In most countries company profits are taxed twice. The company pays tax on its profits; the after-tax portion is sent to investors as a dividend and is then taxed again as personal income. In Australia, company profits are only taxed once - as personal income for shareholders.

As part-owners of a company, Australian shareholders are responsible for the tax on their share of the total company’s profits, not just the portion they receive as dividends. Therefore, their personal tax return needs to incorporate the pre-paid company tax withheld before they received their dividends.

This is achieved by adding the pre-paid company tax component of the dividend - franking credit – on to the personal taxable income of the dividend sent to the shareholder, who then must pay tax on that larger amount. It means shareholders are required to pay tax on income they never received, but the pre-paid company tax becomes a tax credit in that personal tax return.

With a $100 of company profits, $30 was sent to the ATO as company tax (30%) and $70 was sent to the investor as a dividend. The shareholder’s share of the company’s profit is $100, not $70, and so the shareholder’s taxable income is $100, not $70. That’s why the dividend needs to be “grossed up” - to include the franking credit as part of that personal taxable income. The tax payable on that taxable income of $100 depends on the shareholder’s marginal tax rate.

For shareholders with a marginal tax rate of 45%, they must pay $45 tax on that taxable income of $100 - and they pay more tax finally on that company profit than the company did initially. But the $30 pre-paid company tax becomes a tax credit and they only need to pay an additional $15 tax.

If the shareholder has a 30% marginal tax rate, their tax bill is $30 which is equal to their pre-paid tax credit and they have no more tax to pay. Their dividends are not tax-free; they are tax paid - that’s why it’s called “franking” - just like pre-paid postage.

For shareholders with a marginal tax rate lower than 30%, the tax credit is larger than their tax bill and they get a tax refund, just like a worker whose employer has paid excess tax on their behalf. It is a tax refund because it comes from the ATO, but it is actually an income payment from company profit, due to them as shareholders/owners that was withheld by the ATO until they completed their own tax return, on which no tax is payable.

Figure 1: Flows of tax and franking credits

Source: Parliamentary Budget Office.

It is a fair system

Franking credits are NOT a refund of tax never paid; they are a refund of income never received.

It would be more honest if the income derived from Australian shares were quoted as a pre-tax distribution which is the ‘grossed-up’ income amount of dividend PLUS franking credit - because that is every shareholder’s taxable income. The income distributions derived from every other investment class is quoted on a pre-tax basis.

Franking credits represents the same extra income (and the same pre-paid tax credit) for every shareholder, not just retirees. Note that the grossed-up amount is 42.85% higher than the dividend alone. ($100 compared to $70). Shareholders with high marginal tax rates use that extra income to pay some or all of their tax obligation. Shareholders with low marginal tax rates get some or all of that extra income refunded because they don’t need to pay as much tax.

Parliament has determined that the Future Fund, unions, hospitals, universities, charities, most pensioners and all super funds in pension mode, pay zero tax. For those taxpayers, their taxable income is $100, and their after-tax income is $100 comprised of $70 dividends and $30 franking credit refund. The refund is solely determined by their marginal tax rate.

For Australian taxpayers, franking credits ensure that company profits are always taxed only once, and always taxed as personal income for shareholders at their personal marginal tax rate. The system also ensures that foreign investors always pay tax in Australia at the company tax rate, because it is withheld before they receive their dividends.

The ATO could achieve exactly the same result of taxing company profits as personal income in the hands of shareholders at their marginal tax rate if there was no company tax, and all company profits were simply distributed to shareholders as taxable income, but then foreign investors would pay no tax in Australia.

Jon Kalkman is a former Director of the Australian Investors Association. This article is for general information purposes only and does not consider the circumstances of any investor. This article is based on an understanding of the rules at the time of writing and anyone considering changing their circumstances should consult a financial adviser.