Ever walked into your local supermarket to find heavily discounted strawberries on prominent display while farther down the aisle you pay double the price for a similar looking bucket?

If you do fall for the extra-advantageous offering, you'll find there's not much healthy life left in those cheaply priced berries. You had better start eating them now!

On more than just a few occasions, the offerings put forward by the share market are made up of similar underlying characteristics, which is why buying the ‘cheaper’ option available is not always the best decision for an investor to make.

Recently my mind wandered off to private hospital operator Healthscope, whose valuation discount between 2014 (ASX re-listing) and 2019 (acquisition by private equity) vis a vis the much larger Ramsay Health Care [RHC] was often touted as a signal that investors had been under-appreciating Healthscope's true potential.

Since then, Ramsay Health Care has had its own struggles and today's share price is reflective of that reality. But fully privatised Healthscope might be on the verge of collapsing under $1.6 billion in debt, leaving its ASX-listed landlord unable to collect current and outstanding rent payments.

I cannot help but think that the relative valuation discount would have only grown larger had Healthscope remained a publicly listed company.

A similar observation can be made regarding Ainsworth Game Technology [AGI] which since 2002 has presented itself as the cheaper-priced alternative for multinational Aristocrat Leisure [ALL] but seldom has this resulted in higher investment rewards for those taking the leap.

Source: Morningstar. As of 20 May 2025.

It certainly never resulted in sustainably higher rewards as that share price has effectively known one direction only --southwards-- since 2013. Similar as with Healthscope six years ago, Ainsworth Game Technology is likely to be privatised and delisted later this year, as suitor/majority shareholder Novomatic has finally bitten the bullet.

US-headquartered Light & Wonder [LNW] also trades on lower multiples than Aristocrat, while offering higher growth potential given a smaller size and post corporate re-invention, but reality on the share market has proved noticeably more challenging. Post sell-off, the shares are still up some 30% since early 2023 but shares in Aristocrat have doubled.

For good measure: Aristocrat has taken its smaller challenger to court, and won, which explains part of the discrepancy, but recent results also revealed there's no escaping general industry challenges and investors are prepared to put more faith in Aristocrat's decade-long track record that has made it one of the local success stories from the past ten years and beyond.

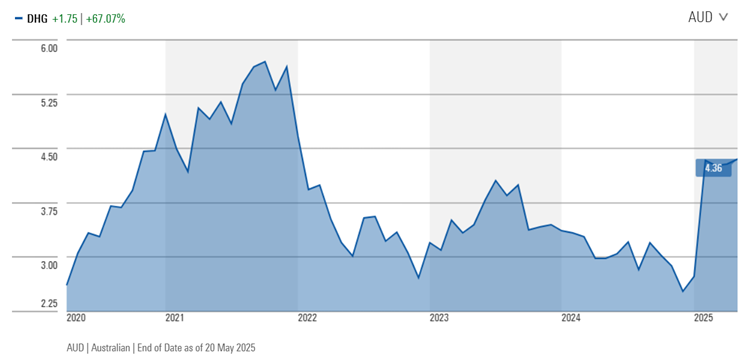

Staying with the pending de-listing theme, it looks like Domain Holdings Australia [DHG] too might soon change ownership and be de-listed from the ASX. Domain shares have consistently traded at a relative discount to industry leader REA Group [REA], reason enough for many to recommend its shares against a much more 'expensively' priced local market leader.

Source: Morningstar. As of 20 May 2025.

The reality? With a total return of circa 44% over the past seven years, Domain shares have not been able to keep up with the broader market (including dividends) while REA Group shares delivered home run after home run, rewarding loyal shareholders to the tune of 155% versus circa 85% for the ASX200 Accumulation index.

In similar vein, shares in the cheaper-priced Atlas Arteria [ALX] have returned about half as much as the much larger, more solid offering put forward by Transurban [TCL] over the decade past. Atlas Arteria is rumoured to have full take-over interest from IFM Investors which already owns 28% of its equity.

Source: Morningstar. As of 20 May 2025.

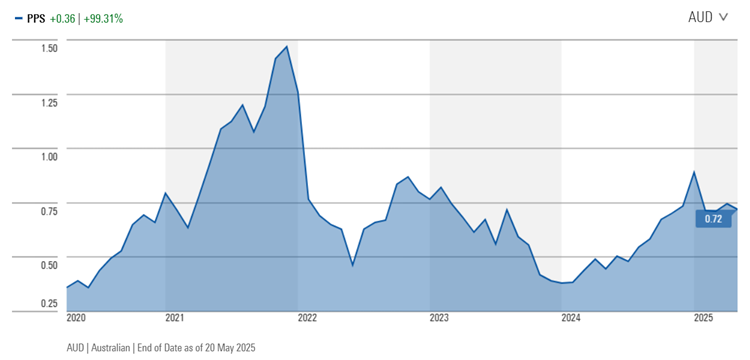

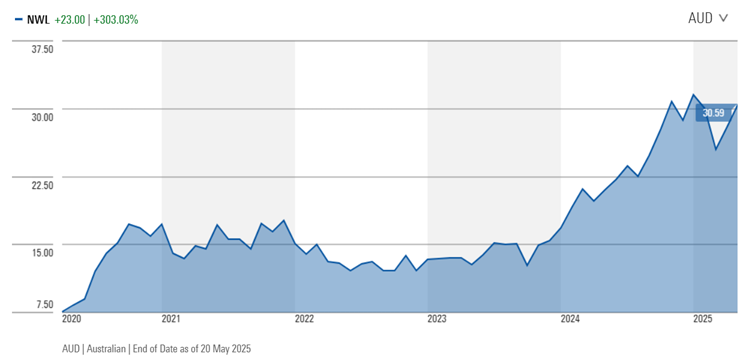

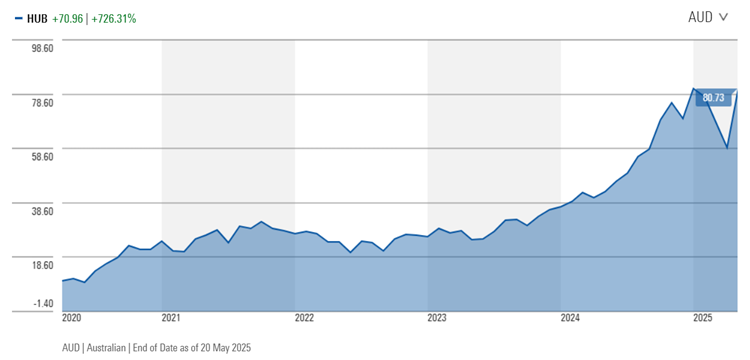

Constant take-over speculation equally surrounds investment platform operator Praemium [PPS], whose valuation --you probably guessed it already-- forever shines brightly against the elevated multiples rewarded to much larger industry challengers Netwealth Group [NWL] and Hub24 [HUB].

Yet again, outside of brief periods when shares in Praemium out-rally their more ‘expensive’ peers, investors have done themselves no favours by switching out of Netwealth or Hub24 shares in favour of the industry laggard. Returns from both Netwealth and Hub24 shares have been nothing short of spectacular since 2020 and both are setting new all-time record highs in 2025.

Source: Morningstar. As of 20 May 2025.

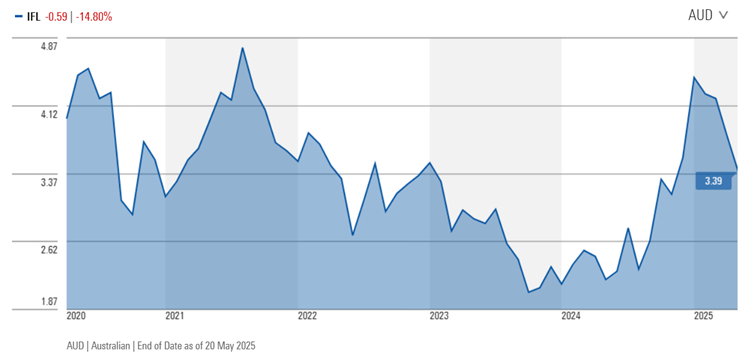

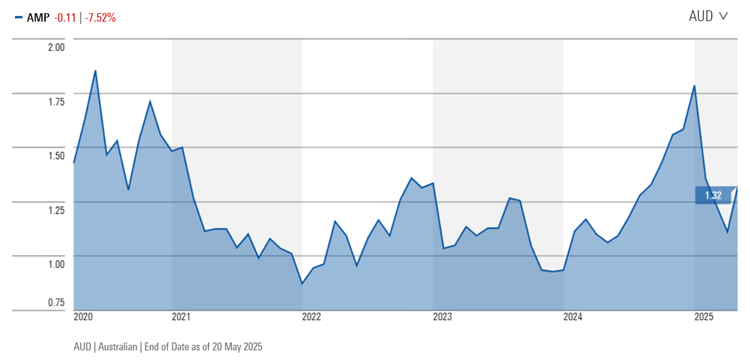

If we broaden the focus, we might equally include Insignia Financial [IFL] and AMP Ltd [AMP]. While not as single-focused as Netwealth and Hub24, both companies compete in the financial platforms sector with valuations that rank equally well below those of the two successful challengers.

Source: Morningstar. As of 20 May 2025.

You already know the outcome from any comparison of returns. Insignia shareholders might be keeping their fingers crossed for a positive outcome in take-over talks between the board and suitor CC Capital.

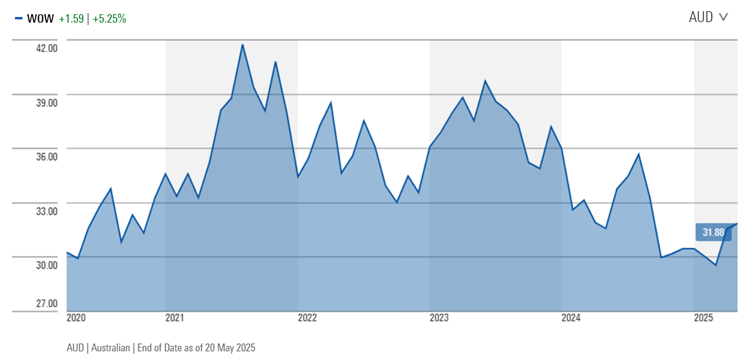

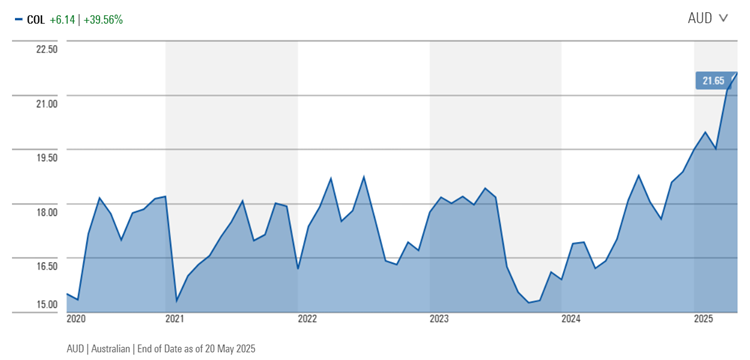

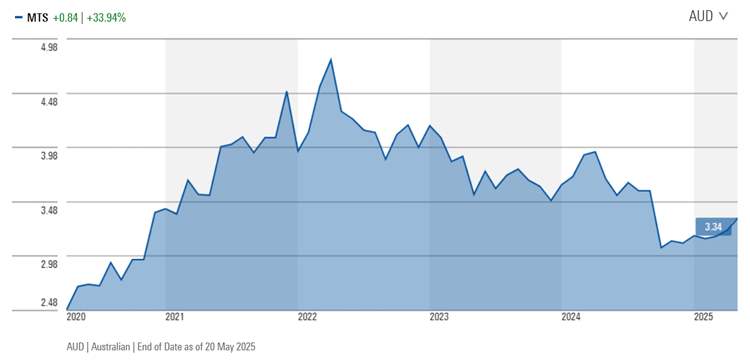

In case anyone wonders, buying the most 'expensive' stock in a given sector is not always a successful strategy. It hasn't worked for supermarket operators where the most expensively priced market leader, Woolworths Group [WOW], has underperformed its smaller and cheaper-priced competitors Coles Group [COL] and Metcash [MTS].

Source: Morningstar. As of 20 May 2025.

In particular for Coles, the outperformance has coincided with a narrowing of the relative valuation gap since Woolworths lost its prior mojo. Equally telling: Endeavour Group [EDV] is also facing serious operational challenges since demerging from Woolworths in mid-2021.

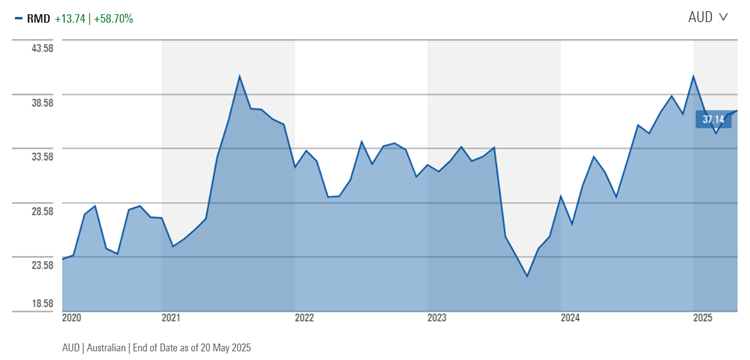

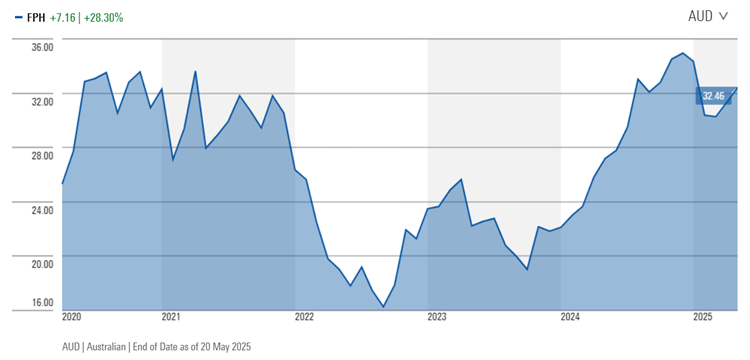

Similar as for the two platform challengers, any differences between ResMed [RMD] and Fisher & Paykel Healthcare [FPH] seem rather subjective. Both companies only compete in certain market segments, so are not 100% comparable, but both have significantly outperformed the broader market and much smaller competitors vying for their own share of sleep and breathing solutions.

Source: Morningstar. As of 20 May 2025.

Both ResMed and Fisher & Paykel Healthcare, similar to Netwealth, Hub24 and most market leaders mentioned earlier, are also consistently trading on above-market average multiples/valuations.

Despite trading on richer valuations, in particular vis a vis direct competitors, it seems to me the list of richer-valued companies that outperform their 'cheaper' priced competitors over prolonged periods of time is much longer than the opposite.

Think also Sonic Healthcare [SHL] versus Healius [HLS] in pathology services, and Treasury Wine Estates [TWE] versus Australian Vintage [AVG] in wine, Medibank Private [MPL] versus nib Holdings [NHF] in private healthcare, Xero [XRO] versus Reckon [RKN] in accountancy software, and versus MYOB pre-delisting, and TechnologyOne [TNE] versus Objective Corp [OCL] in Enterprise Resource software.

This exercise is by no means advocating investors should no longer care about valuations, or forget about buying shares as cheaply as possible, as the share market will still push valuations too high and too low under opposing circumstances, but at the very least there should be questions asked as to why certain companies are more highly valued than others, rather than automatically choosing the more 'attractive' looking option.

To extra-illustrate that point, I have kept the most controversial sector for last: Australian banks.

Some sector analysts have started to anticipate cuts in dividends across the sector, as headwinds will only keep building. Guess which bank is not expected to reduce its payout to shareholders?

It's the local market leader whose valuation and investment return has dwarfed the rest of the sector since the GFC, now 16 years ago.

Rudi Filapek-Vandyck is Editor at the FNArena newsletter, see www.fnarena.com. This article has been prepared for educational purposes and is not meant to be a substitute for tailored financial advice.