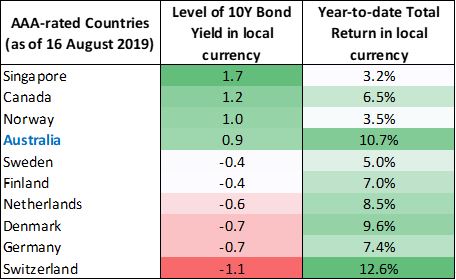

In a world where US$17 trillion of bonds trade at negative yields, Australian government bond yields are still high relative to the rest of world. There are very few AAA-rated countries where government bond yields are higher than in Australia. Year-to-date, some of these bond markets have generated positive returns ranging from 3-12% (as at 16 August 2019), defying any notion that low bond yields imply low returns. Remarkably, the best performing AAA government bond market, Switzerland, is the one with the most negative yields.

The persistence of high debt, low inflation, and bond yields

What’s more striking for Germany, Denmark and Switzerland is that currently the financial market is willing to lend to these AAA countries at negative yields for every single bond outstanding, including the longest German government bond that will mature in 2050 and had its debut on 21 August 2019, and the longest Swiss government bond that will mature in 2064. The bond market’s rally this year goes from strength to strength as many investors look to move into highly-rated fixed income for higher levels of protection in time of higher economic uncertainty.

10 Year Bonds Yields of AAA-rated Countries

Source: Bloomberg and Jamieson Coote Bonds (Total returns are calculated from S&P Singapore Government Bond Index Total Return, Bloomberg Barclays Treasury Total Return of Canada, Norway, Australia, Sweden, Finland, Netherlands, Denmark, Germany, and Swiss Bond Index Domestic Government Total Return). Past performance is not a reliable indicator of future performance.

Negative bond yields have been around for at least five years, ever since the European Central Bank and the Bank of Japan took their policy rates below zero. What drives bond yields even lower this year is that central banks signal their willingness to keep their policy rates low or lower for much longer.

In both Europe and Japan, the central banks believe that negative policy rates and quantitative easing diverted their economies from a deflationary trap, but headline inflation settles near their respective core inflation levels at around 1% in Europe, and 0.5% in Japan. Meanwhile, in Australia, the RBA has cut the official cash rate by 0.5% so far this year, after inflation dropped. In many developed nations, inflation is persistently lower than expectation.

Why is it so hard to generate inflation when central banks are already undertaking unconventional policy?

Inflation usually arises when growth overheats, which the world has not experienced in a long time. There are bigger forces at play outside central banking policy.

First, an aging population leads to lower potential economic growth. Japan and Europe are heading that way.

Second, in the past, accumulation of debt had enabled higher levels of consumption and growth. As debt burdens keep loading up over the years, it can generate less growth than in the past. Lower growth, no overheating, leads to low inflation.

Third, a weak banking system needs time to heal, as in the case of Japan and of the European banks. Hence, central banks have been steering economies on a low, and lower interest rate path to enable a growth friendly level of indebtedness.

How should Australian investors approach this lower-rate world?

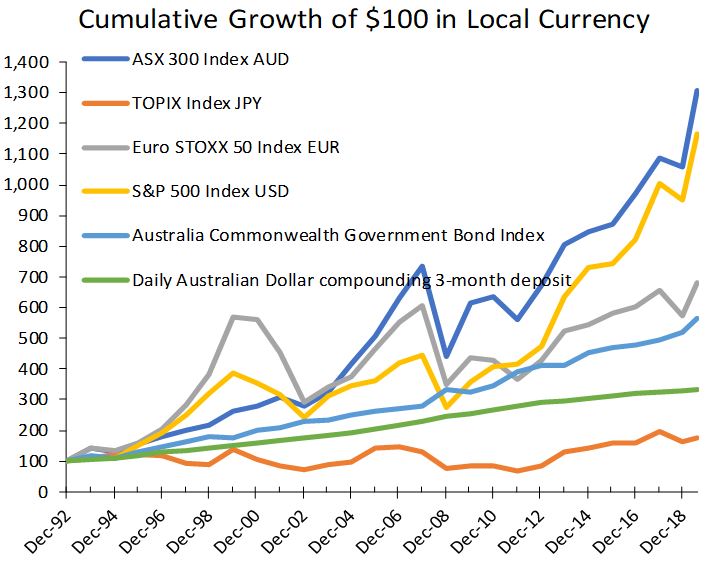

Australia is one lucky country. It has just finished a mining boom and never experienced a severe housing crash, so far. If an individual had invested $100 into the Australian equity market at the end of 1992, reinvested all dividends, and let the power of compounding work its magic, that investor would have done even better than similar investors in the S&P500 Index. However the journey hasn’t been a smooth path, as the GFC destroyed 40% of the accumulated wealth over the previous 16 years. It took almost six years to rebuild the cumulative growth to surpass the pre-crisis level, as seen in the chart below.

Source: Bloomberg and Jamieson Coote Bonds

Not all equity returns derived from offshore markets have performed as well as the S&P 500 Index (yellow line) and the ASX 300 Index (dark blue line). The Euro Stoxx 50 index (grey line) has built up accumulated gains to this level three times in the last 30 years, only to have been destroyed by a whopping 40-50% twice in the past. It took the Euro Stoxx 50 Index eight to 10 years to re-accumulate to the previous levels.

Japanese investors, after their bubble burst in 1989, still barely accrue substantial wealth from investing in their stock market. Australian savers in short-term bank deposits would have accumulated more wealth than an investor in the Japanese equity index, but not as much as if they had invested in Australian government bonds.

Made your money in equities? Store some of it in bonds.

In Australia, we are also lucky to have one of the most liquid AAA-rated government bond markets in the world. An individual or SMSF that invested $100 in Australian Commonwealth Government bonds in 1992, reinvesting all coupon payments, and enabling the power of compounding to work its magic, would have grown its capital five to six times, with a smooth accumulation path (light blue line). This is important for pre-retirees and retirees who seek lower volatility from their investments with steady growth.

Investors have an attachment to the stock market, but how many would tolerate losing 40% of our wealth? There seems to be a large divide between growing wealth and preserving it, or the need for safety. Bonds can also experience some drawdowns, however unlike equity markets, the drawdowns tend not to be as large. As the chart above highlights, investing in Australian government bonds would have preserved your purchasing power, when adjusted for inflation.

Where to seek a less volatile foundation for your portfolio?

Every investor is constantly reminded about the importance of balancing risk and return, but the right level of risk comes down to individual risk tolerances and stages of life. An investor who is 65-years-old may prefer a greater defensive allocation to highly-liquid high-grade bonds over equities, compared to a 30-year-old who has many years to accumulate wealth and ride out the volatility in equity markets.

Let’s hope history does not repeat itself as it did in 2008, as it took six to eight years to stay invested in order to build back that lost wealth.

Kate Samranvedhya is Deputy Chief Investment Officer at Jamieson Coote Bonds Pty Ltd ACN 165 890 282 AFSL 459018 (JCB). JCB is a Global Partner of Channel Capital Pty Ltd ACN 162 591 568 AR No. 001274413, a sponsor of Firstlinks. This information should not be considered advice or a recommendation to investors or potential investors in relation to holding, purchasing or selling particular assets and does not take into account your particular investment objectives, financial situation or needs.

For more articles and papers from Channel Capital, please click here.