The US Government is teetering toward another debt ceiling crisis, and it is useful to remember that failing to make repayments on government debt is not new for the US.

The US Treasury defaulted three times on its treasury bills in 1979, when Congress didn’t legislate in time to raise the debt ceiling. In 1979, they were ‘temporary’ defaults, and they were rectified within a month, but they did shock people who believed that the mighty US government would always pay its debts on time. The default crisis was one of the final nails on the coffin for Jimmy Carter and helped pave the way for the 1980s boom under Ronald Reagan and Paul Volcker.

It is also important to differentiate between the more common shut-down, as discussed here last week, and the more serious debt default, or failing to meet a payment when it is due.

The 1970s - a dark decade for America

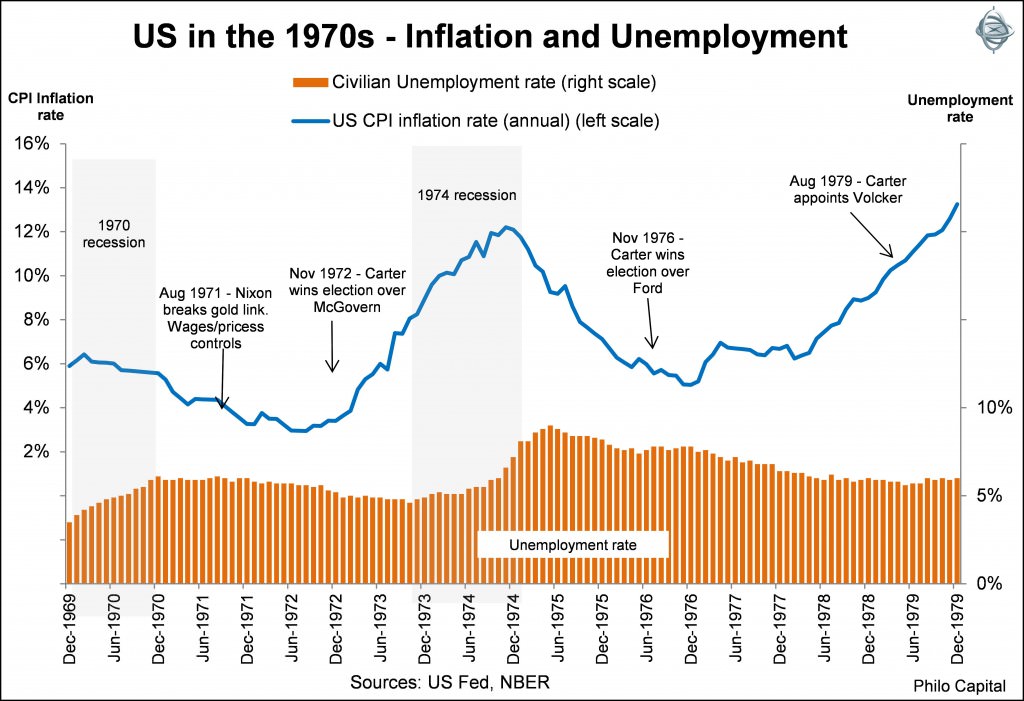

1979 capped off a long dark decade for America. Nearly five decades of Keynesian policies were taking a heavy toll. The first chart below shows the CPI inflation rate and unemployment rate during the 1970s:

Inflation had started rising in the mid-1960s but it was only recognised as a problem in the early 1970s. CPI inflation peaked at more than 12% pa in November 1974, fell to 5% by end 1976, but then accelerated rapidly in 1978, and kept rising above 10% by March 1979.

The unemployment rate rose above 6% in 1971, peaked at 9% in 1975, but was still 6% in 1979 and rising again. This ran against one of the core tenets of Keynesianism, which held that high unemployment should bring down inflation. The 1970s stagflation – stagnant growth together with high inflation – plus high unemployment levels, showed that the Keynesian model was not working. In the 1970 recession unemployment rose but inflation remained high, prompting Nixon to break the gold standard in August 1971 and institute his ‘New Economic Policy’ involving prices and wages controls (supported by Paul Volcker, then under-Secretary of the Treasury).

The peak of Keynesianism in America was October 1978 when Congress passed the Humphrey-Hawkins Full Employment Law, specifically stating that fighting inflation was NOT to take priority over reducing unemployment, even though inflation was already in double digits. It was championed by Nobel Prize winner and Keynesian, James Tobin. Tobin had been the architect of Kennedy’s 1963 tax cut plan which marked the start of the inflationary era. Tobin championed the Keynesian cause and fought against every attempt to fight inflation, even into the 1980s.

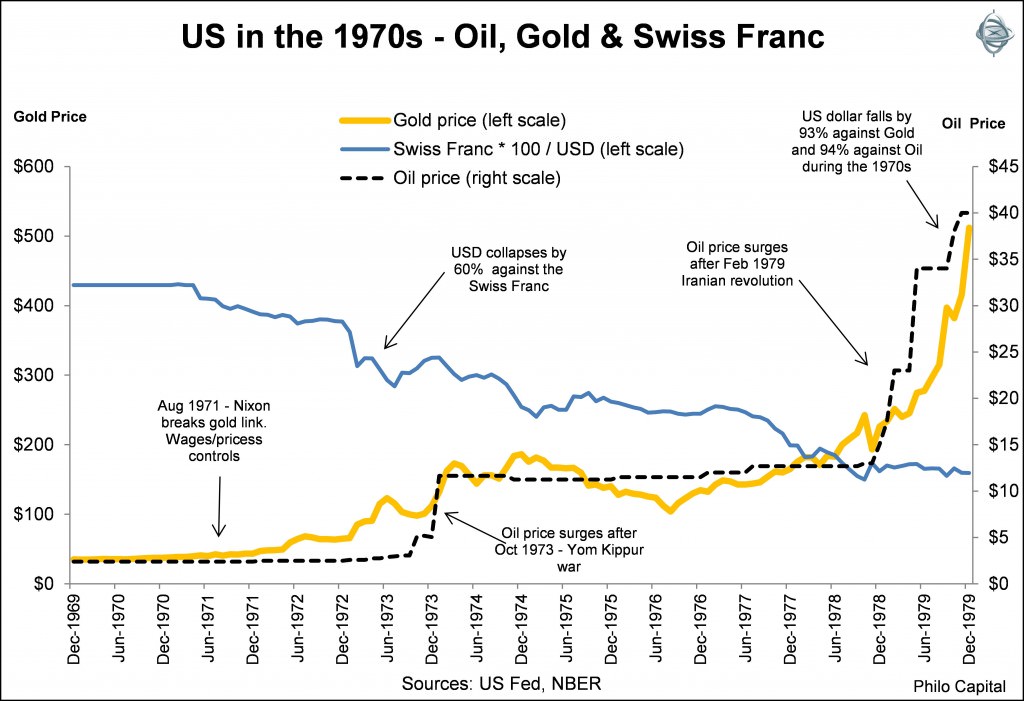

Another feature of the 1970s was oil. Oil prices had gone from $3 per barrel at the start of the 1970s, but prices trebled after the Yom Kippur war in October 1973 and then nearly doubled again from late 1978 to early 1979 following the Iranian revolution.

The once mighty US dollar – the symbol of American dominance in the world – collapsed during the 1970s. By 1979 the dollar had lost half its value against the Deutsche Mark, lost two-thirds of its value against the Swiss Franc, and a third against the yen. The problem was that the lower US dollar was not helping US manufacturers and exporters as it should in theory. The economy was stagnant and the US was starting to lose out to Japan and Germany in quality and efficiency. The Japanese had taken the lead in small cost-effective fuel-efficient cars while Americans were still making giant gas-guzzlers that Americans couldn’t afford to run. Factories were closing down in America’s ‘rust belt’ and new ones were opening up in the new southern ‘sun belt’, financed by Japanese money and run by Japanese management. This came as a rude shock to many Americans troubled by what they saw as the rise of Japan and the loss of American economic dominance and sovereignty.

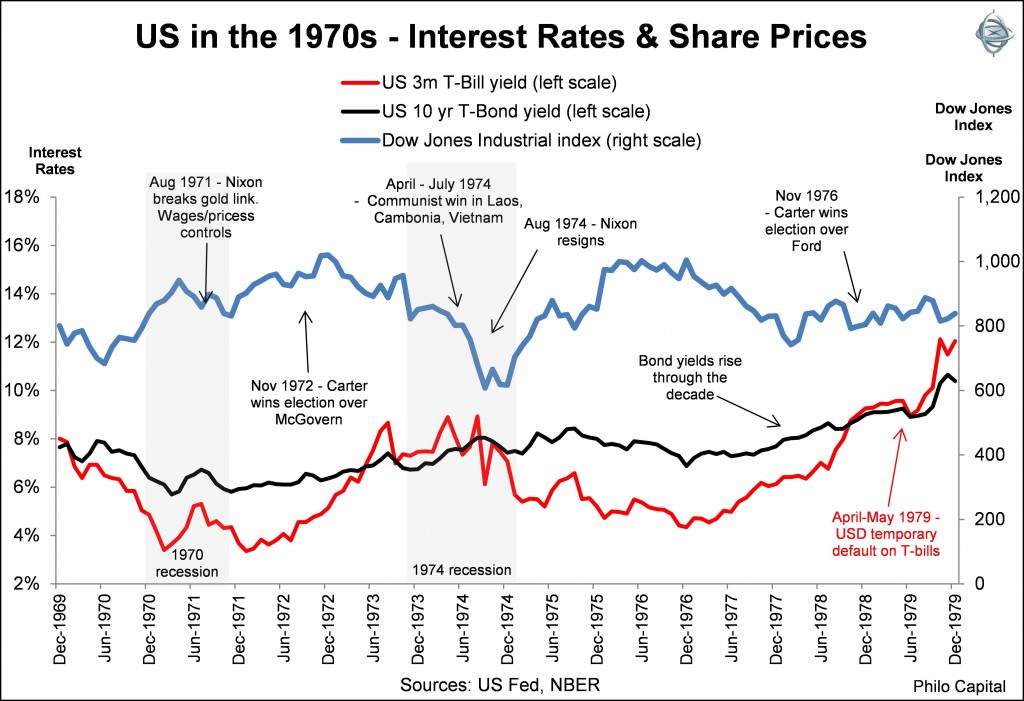

Interest rates were also at crippling levels. By 1979, yields on 10 year Treasury bonds had risen to above 9% for the first time ever in US history, and short term interest rates were back up above their 1974 peaks and heading for 10%.

Shareholders suffered badly in the 1970s. Share prices were no higher in 1979 than they had been 10 years earlier, but in real terms after inflation, prices had fallen by an average of 50% over the decade.

Domestic politics plunged to new depths with the Watergate scandal and Nixon’s impeachment and forced resignation in 1974. In foreign affairs it was also the peak of a bad decade for America. They had lost the enormously expensive and unpopular Vietnam War to the Communists, and in February 1979 the US were also kicked out of Iran when the US-backed Shah of Iran was overthrown by the Ayatollah Khomeini’s Islamists.

Then in February, China was on the march, invading Vietnam over Vietnam’s occupation of the Spratley Islands and its invasion of Cambodia. Meanwhile, with America out of the Middle East, the Soviets were gearing up to march into Afghanistan.

To cap it off on 28 March 1979, there was a nuclear leak at Three Mile Island in Pennsylvania, which put the fear of nuclear fallout into Americans on the densely populated East Coast.

Federal Reserve Chairman Arthur Burns had let inflation run out of control during his eight-year reign, so Jimmy Carter replaced him with Bill Miller in 1978, but Miller just made the situation worse. As a committed Keynesian he opposed interest rate rises, increased money supply to increase inflation and devalued the dollar in an effort to assist US exporters. The US dollar collapsed in 1978 and the US government was forced to borrow from the IMF and start issuing US Treasuries in foreign currencies for the first time. This humiliation caused a crisis in the Carter administration and Carter himself descended into despair and self-doubt.

It seemed that everything that could go wrong for America had gone wrong. This then was the environment in which the 1979 defaults occurred.

The debt ceiling - again

In April of 1979, Congress failed to legislate to reach a deal in time, and the Government hit the debt ceiling. Without the ability to borrow more it had to decide who not to pay. It could ‘close down the government’ and stop paying employees or suppliers, or it could stop paying interest and maturing principal on its debts – Treasury bills, notes and bonds. It chose the latter.

In the 1979 defaults, the US Government didn’t treat all its creditors equally. Most Treasury bills, notes and bonds are held by banks and other financial institutions like insurance companies and pension funds, with a small minority held by individuals. In 1979, the Government chose to repay the main institutional creditors in full, out of fear of triggering a banking crisis, but chose to default on 6,000 individual investors.

On 26 April 1979, the US Treasury defaulted on $41 million of maturing Treasury bills. They were paid 20 days late on Thursday 17 May 1979 after the Government found some money. Then again on 3 May 1979, Treasury defaulted on another $40 million. These were also paid 14 days late. Then again on 10 May 1979, Treasury defaulted on yet another $40 million of maturing T-bills. These were also paid on 17 May.

Treasury refused investors’ demands to reimburse the $325,000 in lost interest on the late days and so investors were forced to sue the US government in a class action (Claire G. Burton v. United States, US District Court, Central District, California, D 79, 1818LTL (Gx)). Unfortunately the Court threw out the investors’ claim by relying on a 1937 Supreme Court ruling that, “interest does not run upon claims against the Government even though there has been a default in the payment of principal”. (Smyth v. United States, 302 U.S. 329, 1937). It came as a shock for Americans to discover that not only had the Government defaulted on its debts, but there was a decades old judicial precedent establishing that it didn’t legally owe interest when it failed to pay on time!

When the money market opened on Friday 27 April 1979, the day after the first default, T-bill yields spiked up by 50 basis points and this default premium on US T-Bills remained even after the default was rectified the next month. This demonstrates that the US Government has indeed defaulted on its debt (at least temporarily), and that US T-bills are not ‘risk-free’, but are prone to a credit default premium in their pricing.

This was the end for the Carter administration. Carter threw in the towel in his televised ‘malaise’ speech on 15 July 1979, in which he succumbed to the national sense of hopelessness:

“… I realize more than ever that as president I need your help… We are confronted with a moral and a spiritual crisis…..It is a crisis of confidence. It is a crisis that strikes at the very heart and soul and spirit of our national will. We can see this crisis in the growing doubt about the meaning of our own lives and in the loss of a unity of purpose for our nation. The erosion of our confidence in the future is threatening to destroy the social and the political fabric of America”. (http://www.youtube.com/watch?v=KCOd-qWZB_g)

Carter’s admission of defeat and despair marked the nadir for the American post-war prosperity and the end of the grand Keynesian dream that had dominated political and economic thought since Franklin Roosevelt’s election in the depths of the 1930s depression.

Recovery from 1979 crisis

But all was not lost. The dark days of 1979 turned out to be just before the dawn of a new era for America. Jimmy Carter removed Bill Miller after just 18 months as Fed Chairman and installed Paul Volker in his place. Following Volcker’s confirmation on 6 August 1979, he set about immediately to switch Fed policy from Keynesianism to Monetarism, as advocated by Friedrich Hayek, Keynes’ arch rival, and Milton Friedman. Volcker instituted a new policy that clearly elevated the low inflation goal above the low unemployment goal, and focused the policy tools on tight control of the money supply to bring down inflation.

Meanwhile across the Atlantic, the UK had suffered a similarly debilitating and demoralising 1970s – with stagnant growth, high inflation, high unemployment, high interest rates, high tax rates and negative stock market returns and a humiliating IMF bailout. Following the ‘winter of discontent’, a series of bitter industrial disputes and strikes under Labour, British voters elected Margaret Thatcher’s Tories in the 3 May 1979 elections in the largest electoral swing seen in Britain since 1945.

To Carter’s credit, he honoured his promise to let Volcker increase interest rates until he brought down inflation, even though it triggered a deep double-dip recession that began in 1980. The Fed discount rate peaked at 13% in Feb 1980 and T-bill yields peaked at 16% in March when inflation peaked at 14.6%, as the economy dived into recession and the unemployment shot up to double digits.

In conditions like these, and also the Iranian hostage debacle, it is hardly surprising that the November 1980 Presidential election was won by Ronald Reagan in a landslide victory. Volcker, Reagan and Thatcher led the macroeconomic revolution in the 1980s, towards smaller government, lower tax rates, privatisation of industries and deregulation of markets. It resulted in lower inflation, lower interest rates, lower unemployment rates, a return to economic growth, and ultimately victory over communism.

1979 was the turning point and the start of the 1980s which saw the victory of monetarism and market capitalism over state-directed Keynesian, socialism and communism. In China, Deng Xiao Ping turned his back on communism as an economic system and started down the capitalist road, and within a decade the Soviet system and communist eastern bloc had completely collapsed.

Another US default on Treasuries in the coming weeks is not out of the question. It would be a temporary default, like the 1979 episodes, and not a complete rescheduling like Greece. The US has plenty of money, the problem is primarily one of politics, not insolvency. Another default may be enough of a shock to get the parties together to work on real solutions. It may provide the catalyst for the next era of growth and prosperity, as happened in 1979.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director and adviser to Third Link Growth Fund.