As yet another US budget crisis looms in Washington, the US Government may run out of money and be forced to close down. It will not be the first time the US Federal Government has run out of money, unable to borrow more to keep paying its bills. It has happened before - most recently in 1995 and 1996. Scary as this may sound to investors, the impact on markets of recent government shutdowns was different to what many expected.

1980s boom financed by debt

The deep financial, economic and political crises of the 1970s came to a head in 1979. The US Treasury defaulted three times on its Treasury Bills in 1979, when Congress didn’t legislate in time to raise the debt ceiling – like in early August 2011, and at the end of December 2012, and again this month. But these temporary defaults on US government debt became the dawn of a brand new era of growth and prosperity for Americans. We will look at recent US Treasury defaults next week.

Following Ronald Reagan’s landslide victory over Jimmy Carter in the November 1980 elections, Reagan, Volcker, and Thatcher led the macroeconomic revolution in the 1980s, back toward smaller government, lower tax rates, privatisation of industries and deregulation of markets. These reforms brought lower inflation, lower interest rates, lower unemployment rates, a return to economic growth and prosperity.

Or so it seemed.

The US economy may have grown strongly in the 1980s, 1990s and 2000s after the stagflation of the 1970s, but the boom was financed by a massive build-up of budget deficits, trade deficits and debt.

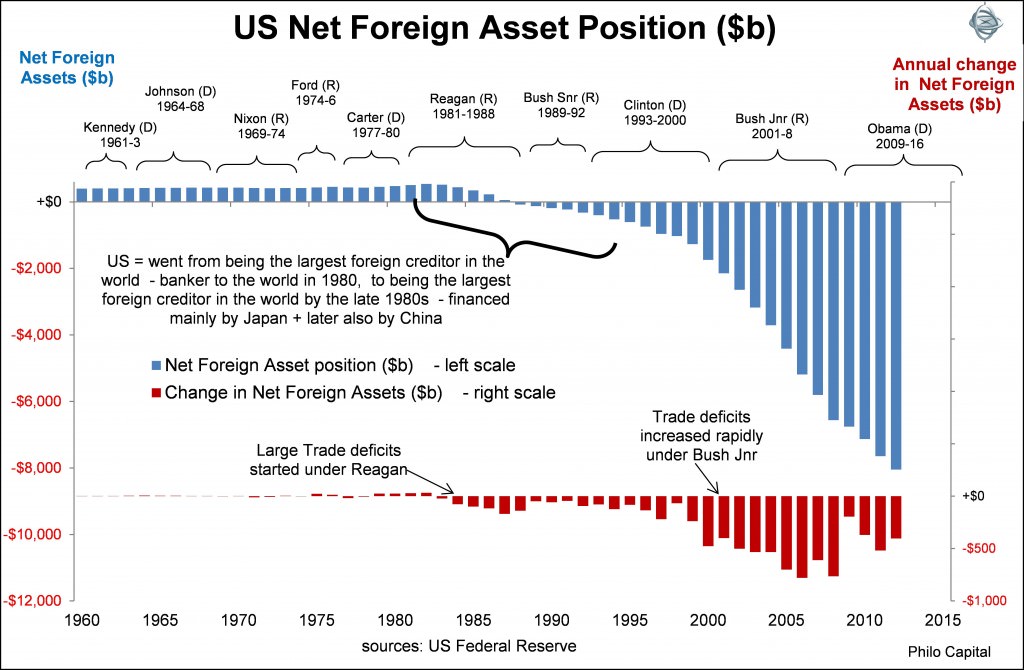

When Reagan came to office in 1981 the US was the biggest creditor nation – it was the banker to the world. By the end of Reagan’s first term it had become a net debtor nation. By the end of his second term the US had become the world’s biggest net debtor and Japan had become the biggest creditor and main banker to America. This is shown in the following chart of the US net foreign asset position.

Trade deficits increased rapidly under Reagan, were lower under Bush Senior and Clinton, but then blew out to record deficits again under Bush Junior. The trade deficits were financed by foreign investors, including a rapid build-up of foreign debt – firstly owed to the Japanese, and during the 2000s, to the Chinese.

Trade deficits increased rapidly under Reagan, were lower under Bush Senior and Clinton, but then blew out to record deficits again under Bush Junior. The trade deficits were financed by foreign investors, including a rapid build-up of foreign debt – firstly owed to the Japanese, and during the 2000s, to the Chinese.

1995/1996 deficit crisis and government shutdown

Fifteen years of spending and borrowing binges that started under Reagan led to the next crisis: the 1995/1996 government shut-downs. The budget stand-off forced temporary shut-downs of non-essential government services for 28 days across two periods: 14 to 19 November 1995, and again from 16 December 1995 to 6 January 1996.

The crisis was a culmination of the stand-off in the 1990s between the Republican controlled Congress (led by Newt Gingrich) and Democrat President Clinton. Clinton’s 1993 Deficit Reduction Act was opposed by Republicans in Congress, who wanted more cuts to welfare, mainly Medicare.

By pushing the President all the way down to the wire in 1995 and forcing a shut-down of the government, Gingrich was seen by the public as going too far in putting political point-scoring ahead of America’s credit standing in the world. Gingrich’s loss of public support effectively ended his political career.

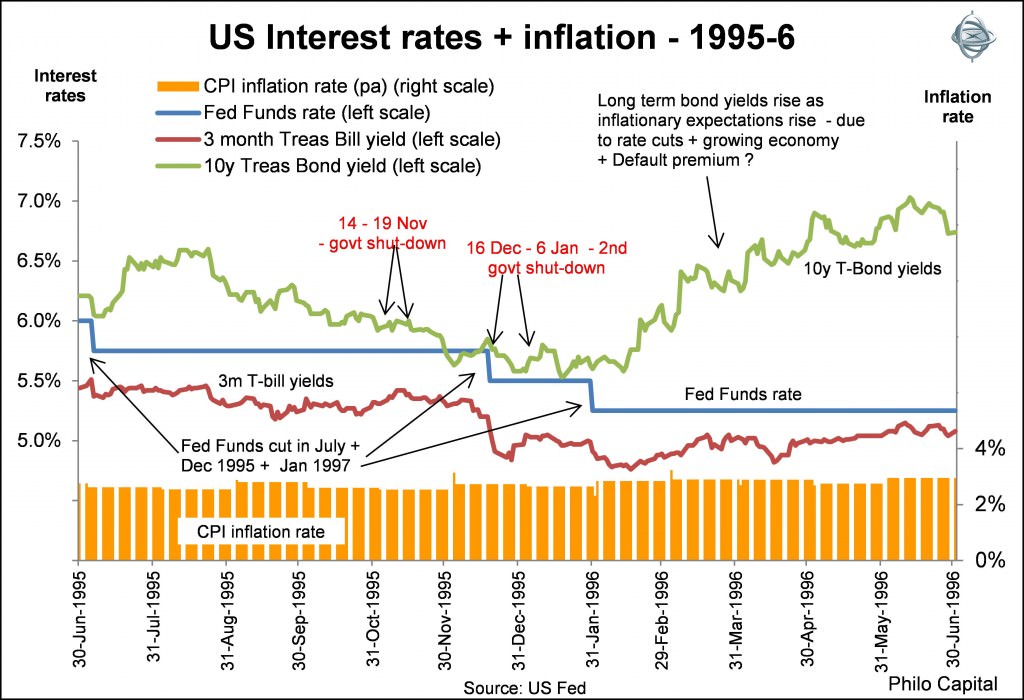

The following chart shows US interest rates and inflation during the 12 months from July 1995 to June 1996.

The Fed reduced the Fed Funds target rate three times from July 1995 and January 1996, following the seven rate hikes between February 1994 (which had triggered the 1994 bond market crisis) and February 1995. Short term rates were drifting down during the second half of 1995 and did not spike upward when the government shut-downs occurred, as might be expected in the event of a cash shortage. Rates stabilised at around 4% during 1996, and the Fed did not cut rates again in that cycle.

Long term bond yields were on the way down following the 1994 rate hikes, but started to rise again from January 1996 following the shut-down crisis. There are several likely reasons for the rises in bond yields. The first is that inflationary expectations were rising – with inflation still running at 3% while the Fed was cutting rates and the economy was also growing relatively strongly.

Second, it is possible that the increase in bond yields also started to factor in a credit default premium since clearly shutting down the government was not a long term solution to the deficit/debt crisis. However a stronger argument is that it reflected higher inflationary expectations as a result of Clinton’s perceived victory over Gingrich in the PR war, meaning there was likely to be less pressure to balance budgets in future and more latitude to keep running expansionary deficits.

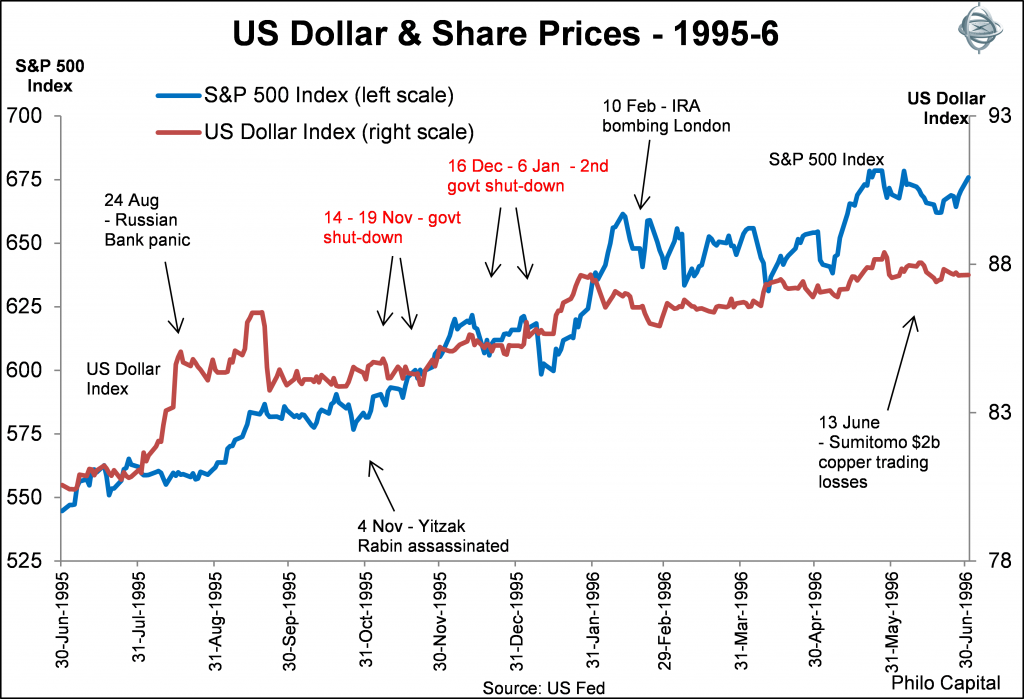

The next chart shows the US dollar index (trade weighted basket) and the S&P 500 index over the same period.

The US dollar surged during the Russian bank crisis in August 1995 and then kept strengthening during the budget stand-off and even during the government shutdowns. Far from panicking in the crisis, investors kept buying US dollars and US shares. Over the 12 month period the US dollar gained 10% and the S&P 500 index put on a decidedly bullish 20%.

President Obama and the Republicans in Congress today are keen to not repeat the errors of gamesmanship in the 1995/1996 shut-down crisis. Painful as the shut-downs were at the time for staff and suppliers, markets ignored them and kept on booming. However the crisis did act as shock therapy for the President and Congress and it stunned both sides into constructive dialogue and action.

As a result, a compromise balanced budget bill was passed in August 1997, aimed at balancing the budget by 2002. In fact the goal was achieved earlier than expected, thanks to the booming dot-com economy that delivered better than expected tax revenues and lower than expected welfare costs.

To this day, Republicans and Democrats both claim credit for the 1998-2000 surpluses, and they are both partially correct – it was the bi-partisan co-operation that was forged by the shock therapy of the shut-down crisis that produced the result.

Clinton is the only President since Nixon (Republican) in 1973 to achieve a budget surplus. Not only that, there were three surplus years in a row – 1998, 1999 and 2000 - a feat not seen since the Kennedy/Johnson (Democrat) surpluses of the early-mid 1960s.

To sum up, the government shutdown crisis of 1995 and 1996 was shrugged off by markets and served as shock therapy that forced both parties to the negotiating table to come up with bi-partisan action that resulted in a rapid return to surplus. Bi-partisan action is what is sorely needed in Washington to solve the current crisis, but it has largely disappeared during the Obama administration.

Perhaps a government shutdown or debt default will provide the necessary catalyst once again as it did in the past.

Ashley Owen is Joint Chief Executive Officer of Philo Capital Advisers and a director and adviser to Third Link Growth Fund.