Fixed interest Listed Investment Trusts (LITs) were one of the market’s success stories in 2018 and 2019. Faced with low deposit rates, retail investors placed billions into new trusts, in many cases not knowing much about the underlying assets.

Sub-investment grade bonds and private assets found a way into the portfolios of investors looking for less risk in a frothy equity market. Until the coronavirus hit, these LITs traded well, around their Net Tangible Asset (NTA) values, in contrast to many equity Listed Investment Companies (LICs) trading at heavy discounts.

Retail investors now realise they traded one risk for another, and in the space of a month, the market value of eight fixed interest LITs in the table below has fallen by $1 billion (revalued to 24 March 2020). Some LITs halved in price since their issue date. So severe is the damage, it is unlikely similar transactions are viable, perhaps for years.

The decision to allow financial advisers and brokers to continue to receive stamping fees from fund managers to promote new issues, a practice prohibited for unlisted vehicles, was a mistake.

Examples of price falls in LITs

We have published many warnings about narrow margins in debt and sub investment grade bonds markets, such as in May 2019: “Global high-yield debt markets seem determined to go beyond the stupidity seen in 2006 and 2007.” And this: “History is replete with examples of investors losing their minds and believing the unsustainable is permanent.” An article describing the LIT market published in Firstlinks in November 2019 concluded with a warning from Howard Marks.

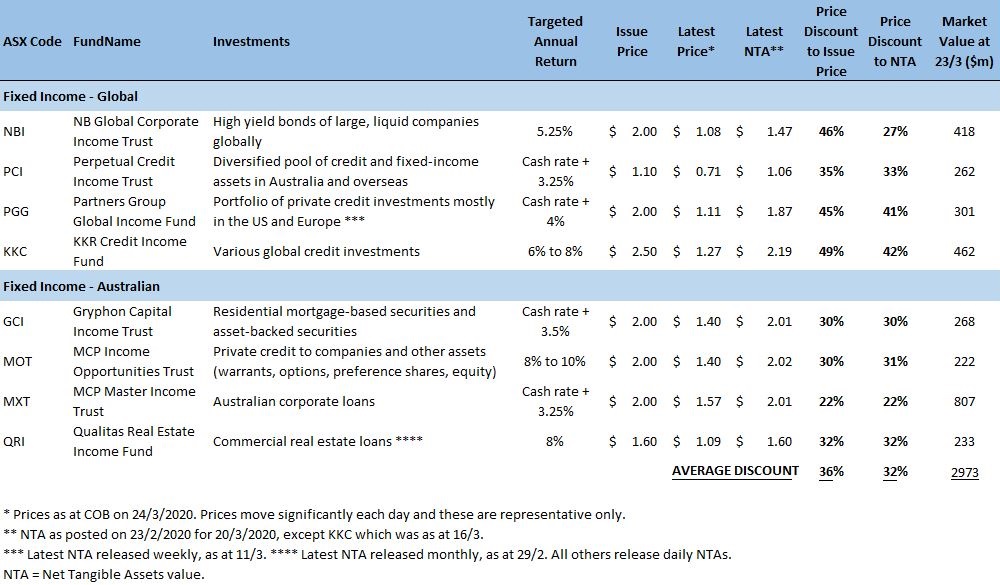

The following table shows recent market prices, NTAs and issue prices of eight leading LITs (this table has been updated many times, as the market is changing each day):

Examples of price deterioration in LITs

The table highlights two major issues.

First, there is a large difference in the extent to which managers are recognising asset value write downs. Two large industry super funds, AustralianSuper and Unisuper, this week marked down their unlisted asset values by up to 10% to increase the accuracy of their unit pricing.

The table shows some ‘Latest NTA’ figures where the asset values have not changed. For example, Qualitas (QRI) makes loans against commercial real estate. It is probably too early for their borrowers to translate the cash flow impact of coronavirus into an inability to service loans, and to know the extent to which companies can access government subsidies. But it is unrealistic to assume no impact. Listed property trusts that own commercial property have fallen in price significantly. Qualitas advised in its latest NTA statement:

“QRI’s loan portfolio as at current date is not materially impacted by the coronavirus and no impairment has been deemed necessary. The Trust also benefits from investing only in commercial real estate loans secured by real property mortgages, thereby delivering on the Trust’s investment objective being to the maximum extent possible providing capital preservation to investors.”

In contrast, Neuberger Berman (NBI) holds bonds which trade in the secondary market. Normally, bonds are preferred for their liquidity, but in this case, the NTA suffers because there is a market price. Ultimately, there is no difference between a loan and a bond of the same company if it ranks equally in the capital structure and the company goes into liquidation. NBI’s NTA has taken punishment because there are liquidity problems in bond markets and prices have been marked down on little volume.

Here is a video from Neuberger Berman explaining the opportunities that such sell offs have created in the past.

Second, the closed-end nature of LICs and LITs has a downside where the only available source of liquidity is an on-market sale, and sellers have panicked. In unlisted managed funds, the manager sells the asset and meets redemption requests at NTA (or its best estimate of NTA). This is far from a perfect structure in that the manager may be forced to sell illiquid assets, but at least there is an effort to calculate an accurate NTA.

While the investor may take some comfort from the fact that the assets of GCI, QRI and MOT have not been marked down, the investor desire to sell has sent every LIT to a significant discount to NTA. Maybe there’s also an assessment that the asset values are unrealistic and the market value is more accurate.

Whichever way you cut it, these investments were promoted as ‘fixed interest’ with diversified portfolios offering regular income and capital protection qualities, and an expectation of much less volatility than equities.

In a similar table with seven of these LITs plus KKC at $925 million published in November 2019, the combined market cap was over $4 billion. This week, it was less than $3 billion, a loss of market value wealth for retail investors of over $1 billion.

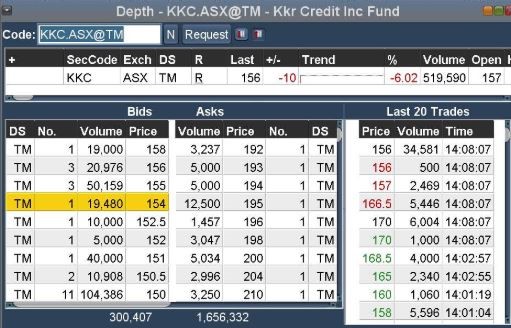

Loss of liquidity and wide spreads: the example of KKC

The KKR Credit Income Fund (KKC) is the best example of the problems the sector is facing. This LIT raised an extraordinary $925 million in a few weeks from retail investors, and the only way such an amount was possible for a relatively unknown name was the motivation of stamping fees. At time of writing, the shares are worth $463 million less than when issued and listed in November 2019, only a few months ago.

The screen shot below shows an additional problem (this shot was taken a few days before the numbers in the table above). KKC is bid at $1.58 and offered at $1.92, a spread of $0.34. No buyers and sellers should transact with such poor liquidity. A buyer must hit the $1.92 price, or a seller the $1.58 price, in order to transact.

Two important lessons here:

- Transact at a specific price rather than ‘at market’. An investor placing an order to buy KKC 'at market' would be filled at $1.92 (and even higher for volume) whereas the previous trade was $1.56. For an investor who thinks KKC represents value after the sell off, it's better to place a buy order at say $1.59, the highest bid in the market, to draw out a seller desperate to exit at any price.

- Review the spread and depth before trading. KKC was illiquid on this day, as shown by the tiny trades between the times of 14.01 and 14.08. A seller could quickly chase the price even lower.

An adviser who put his clients into KKC at issue date told me he thought it was outstanding value, because he believed the portfolio had avoided the more damaged bond sectors of energy and travel. I pointed out to him that over half the investments are rated CCC or below, or unrated, and companies in the US are about to be hit by a recession, regardless of how much Donald Trump spends. KKC has traded down to $1.21, less than half its issue price.

This loss of liquidity is typical of a small LIC with $10 million of assets, but KKC was issued with a value of $925 million!

Problems compounded by poor selling by brokers and advisers

Treasurer Josh Frydenberg is rightly preoccupied saving the nation from coronavirus, but it means he has been distracted from an issue high on the agenda only a couple of months ago. The problem of financial advisers and brokers accepting stamping fees on new LITS and LICs was a hot issue when he wrote to ASIC in January 2020 expressing “my concern that ASIC's analysis revealed some correlation between higher stamping fees and underperforming LICs.”

The market collapse highlights the very issue policymakers should address. Financial advisers and brokers were paid an incentive, or stamping fee, by fund managers to promote new issues to their clients. It’s a conflict between the best interests of the client and the best interests of the adviser, and it has contributed to a destruction of wealth.

Our articles have been critical of the continuing ability to pay stamping fees, including the following in this article:

“Can anyone deny that many brokers and advisers are motivated by the selling fee? Some of the advisers rebate the fee but what about the rest? Was a LIT offered in a particular month the best fixed interest fund available, and so much so, it deserved a billion dollars? That’s a stretch.”

For those wanting more details on stamping fees and poor selling, see the Appendix.

Is this a buying opportunity?

There’s an important difference between believing that:

- These LITs are good investments over the long run, and

- These LIT prices are the lowest we will ever see.

It's more likely that most of the LITs will recover at least some of the loss over time than guessing correctly that this particular moment is the bottom of the market. They might be even better value in a week or a month. Nobody knows where coronavirus is taking us.

On the surface, a fund manager telling us the assets are worth $2 on a LIT trading at $1.40 looks like a bargain, but they do not really know the value of the assets. Let’s face it, thousands of investors were convinced to buy the LIT for $2 and it probably looked good at $1.80, so is $1.40 the floor? No idea. If the fund managers really believe the assets are correctly valued, they should be buying their own stock back.

What should Josh do?

The Treasurer has other priorities, but one day, he will return to the deliberation on stamping fees. If the Liberal Party had refused to listen to the lobbying demanding the exemption from FoFA in 2014, most of these LITs would either not have happened or would have been a fraction of their issue size. Retail investors might have saved a billion dollars.

In any case, the market for new fixed interest LITs is closed for a long time, so you could say the market eventually fixed the fee problem. How efficient it is.

Appendix

A brief recap (ignore this section if you’ve been following the subject)

We have covered the stamping fee issue in detail including criticism of a policy which encourages a conflict of interest and not acting in a client’s best interests. We will not repeat here the points made in these articles:

5 Feb 2020: LIC/LIT stamping fees survey

29 Jan 2020: Survey on attitudes to LIC fees

22 Jan 2020: Three overlooked points on the LIC/LIT fee battle

8 Jan 2020: Authorities reveal disquiet over LIC fees

8 Jan 2020: 1 January is a moment of truth for the wealth industry

18 Dec 2019: Advisers and investors in the dark on LITs and LICs

On 27 January 2020 (seems like a lifetime ago), Josh Frydenberg started a review process when he said:

“The Morrison Government is today announcing that Treasury will undertake a four week targeted public consultation process on the merits of the current stamping fee exemption in relation to listed investment entities.

Stamping fees are an upfront one-off commission paid to financial services licensees for their role in capital raisings associated with the initial public offerings of shares.

Public consultation will allow the Government to make an informed decision on whether to retain, remove or modify the stamping fee exemption in order to ensure that the interests of investors are protected and capital markets remain efficient and globally competitive.”

Firstlinks has made a submission to the enquiry, but to date, there has been no response.

Here’s how the problem arose. The Future of Financial Advice (FoFA) regulations prohibit payments from product manufacturers to financial advisers. However, in 2014, the Coalition granted an exemption from FoFA for financial advisers and brokers to continue to receive commissions in the form of ‘stamping fees’. Under Corporations Regulations 7.7A.12B:

“A monetary benefit is not conflicted remuneration if it is a stamping fee given to facilitate an approved capital raising.”

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor. Prices are constantly changing and numbers quoted in this article were correct at time of writing on 23 March 2020. Fund managers such as Perpetual and Neuberger Berman mentioned in this article are sponsors of Firstlinks.