Let’s start with a quick physics lesson. The phrase, ‘nature abhors a vacuum’, is based on Aristotle’s observation that there are no real vacuums because nature will fill the space by creating an immediate force due to differences in pressure. ‘Abhor’ means ‘regard with disgust’.

In contrast, fund managers love a market vacuum, especially when it creates an issuing opportunity. If there is demand for a type of investment, fund managers will supply ‘an immediate force’ to fill the gap. In fact, the risk is that as more issuers join the party, there may be an oversupply and the once-vacant space becomes crowded.

The new range of fixed income Listed Investment Trusts

The best example of meeting a new demand or market gap in the last two years is the range of listed fixed interest Listed Investment Trusts (LITs) now available on the ASX. It was not long ago that investors wanting bond exposure were restricted to the unlisted market, which required direct investment with the fund manager through a painful application procedure, or access via a platform with additional fees.

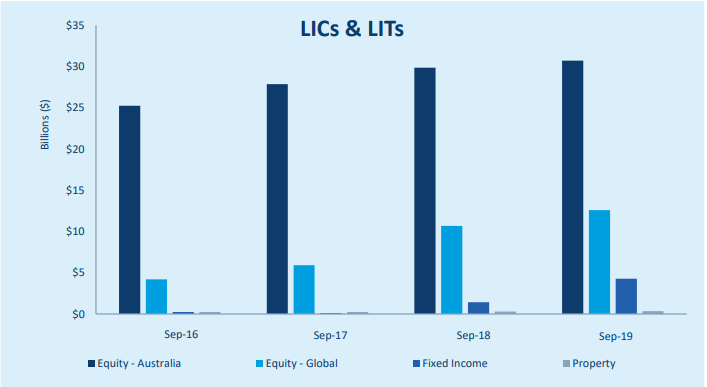

Many investors, and particularly SMSFs, prefer the easier access and administration of buying a fund in the same simple way as buying a share on the exchange. With no extra paperwork, fixed interest funds were suddenly a couple of clicks away, giving instant diversification and another asset class to consider. As the chart below shows, fixed income LITs barely registered in September 2017, and while equities still dominate, fixed income is a healthy $4 billion and soon $5 billion.

Source: ASX Investment Products Report, September 2019

Of course, the reason for the gap in the market was the miserable rates available on term deposits and cash, which once dominated the conservative allocation in a balanced portfolio. For example, SMSFs in pension mode are required to withdraw at least 4% a year, forcing a fund earning 1% to draw down capital. Enter listed fixed interest funds taking greater risk to deliver 4% to 5% or more. With these investments, the perceived security of bonds holds appeal for those who cannot bring themselves to put more into the higher-yielding equities which deliver even more risk.

In fact, in the Listed Investment Company (LIC) space, most equity funds are trading at significant discounts to their Net Tangible Assets (NTA), with many struggling to gain investor support. Meanwhile, the fixed interest LITs are holding their value and in some cases trading at small premiums. To date, the investment experience has been good.

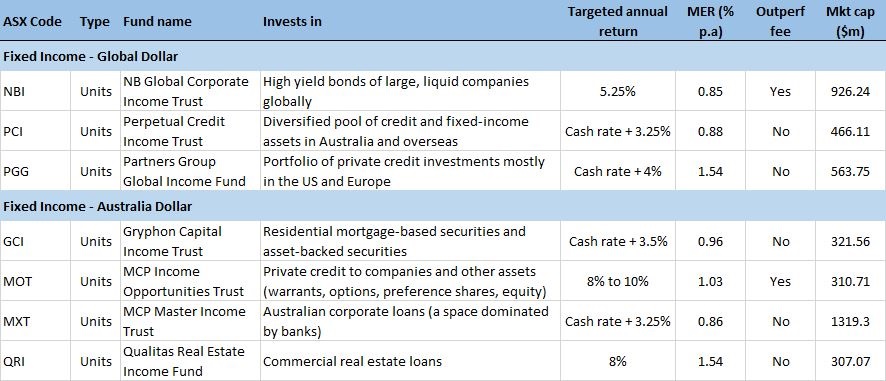

Here is the range of fixed income LITs available on the ASX as at September 2019:

Source: ASX Investment Products Report, September 2019 plus trust reports.

Also listing soon is KKR Credit Income (ASX:KKC) with a global portfolio of company loans. The competitor exchange to the ASX, Chi-X, has launched its first actively-managed fixed income Quoted managed Funds (QMFs) with the ActiveX Kapstream Absolute Return Income (CXA:XKAP) targeting a return of RBA plus 2-3%, and other QMFs will follow.

The high market capitalisation of these funds shows that they have received strong support. Partners Group claims it received bids worth $1.2 billion and it closed early at $550 million, and KKR has raised over $800 million. Neuberger Berman, issuer of NBI, pushed the amount on issue close to $1 billion with a recent issue to existing shareholders.

What do these funds do and what are the risks?

The table above shows the wide range of bonds, debt instruments, loans and asset-backed securities managed by the LITs. However, most retail investors would not be familiar with the types of exposures taken, and it is difficult to assess the differences.

One fact for certain is that if a bank term deposit or government bond paying 1% is the risk-free rate, then a fund paying 3% to 7% more is taking a greater risk. The returns listed in the table are more like manager aspirations, and are certainly not guaranteed.

Although many of the LITs are managed by established global or Australian fixed interest teams, most retail investors have not heard of them, so there is a leap of faith in the long-term credentials. Every fund is different and it takes some serious effort to identify the nuances of the risks.

As a sign of the complexity, here are 10 quick questions to consider:

- Does the fund manager have a long-term track record managing bond, loan and credit risk through different cycles?

- What is the maximum exposure to any one investment?

- Are the investments rated, and if not, what is the due diligence process before the fund manager lends to a company?

- Where does the investment sit in the capital structure? For example, senior secured debt ranks higher than subordinated debt, and some of the funds can invest in mezzanine loans and even distressed debt.

- What is the historical default level of the type of assets bought by the fund?

- How is the performance fee calculated and is it easy to exceed the chosen benchmark and push up fees?

- Is leverage possible by borrowing to lift returns, adding to both performance and risk?

- How will the portfolio be valued, given that many of the assets are privately issued or unlisted, yet the LIT trades on the exchange each business day and issues regular estimates of its Net Tangible Assets.

- Is there any currency exposure in the global LITs?

- Is the LIT trading at a discount or premium to the value of its investments?

At the moment, the fixed interest funds are trading well post-IPO, but as with equity LICs, these are closed-end vehicles where liquidity for a seller comes from the market rather than the fund manager selling assets. This is appealing for preservation of permanent capital but also means the issues can drift into a discount if buyer demand evaporates in difficult market conditions.

This sector of the ASX is young and has not been tested over a full credit cycle. Overall, it is a useful addition to the investment options for a diversified portfolio. Investors should recognise the added risk and potential volatility and not treat these LITs as the same risk as a bank term deposit.

As a final note of caution, consider the words of legendary investor, Howard Marks of Oaktree Capital, in an interview with Bloomberg on 23 October 2019:

“The record amounts of debt and unusually high leverage ratios imply that eventually there will be a bunch of defaults and a bunch of bankruptcies, as there always have been in the three debt crises that I’ve lived through in the last 30 years.”

For completeness, it’s worth noting that a broad range of fixed income Exchange-Traded Funds (ETFs) is also listed on the ASX, attracting strong flows based on their lower fees, but without the potential to deliver the higher returns of most of the funds listed above.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor, and there are no recommendations made here. Investors should seek independent advice if not familiar with the risks. Data is correct as at end of October 2019.