Among a group lamenting the worrying state of the world – war in Eastern Europe, carnage on stock markets, inflation driving up cost of living pressures – one group of investor is uttering in despair: “I can’t look at my crypto wallet right now. It’s losing so much!”

The price of Bitcoin fell below USD30,000 in May 2022 and has struggled to make headway since. The last time the price fell this low was July 2021. Later that year it surged towards USD69,000. Now the market has been spooked into a radical reversal for those who have bought into the ‘digital gold’ narrative amid new concerns about the amount of electricity consumed by miners of Bitcoin.

A store of value? A hedge? What is it?

Often used to promote cryptocurrencies, the line argues that Bitcoin can provide a store of value similar to gold. Supposedly negatively correlated to financial markets, Bitcoin and its ilk will help protect the overall value of an investment portfolio in troubled times, or so its backers claim.

And yet, Bitcoin’s slump is coinciding with the sell off on Wall Street and other markets worldwide. Stephen Bartholomeusz wrote in the Sydney Morning Herald.

“The selling points for crypto assets used to be that they weren’t correlated to other assets classes and therefore would provide diversification from conventional holdings of shares and bonds and also provide a hedge against inflation. It turns out none of those previous investor convictions has proven true.”

Others point out that Bitcoin has been behaving more like a speculative tech investment. Research published by The Perth Mint in February 2021 indicated that Bitcoin beat gold for generating speculative returns in a rapid fashion but it was 12 times more volatile than gold.

While Elon Musk, the world’s richest man, may be relatively unconcerned by Bitcoin’s recent performance, everyday investors, inspired by his enthusiasm for the crypto, are clearly feeling the pinch.

I believe it is still too early to claim Bitcoin can replace gold but understand that the media ‘buzz’ created by high-profile investors will keep it front of mind for many. Without so many column inches, the benefits of gold are often more opaque, particularly in the minds of new investors. Given the excessive volatility of cryptos like Bitcoin, it’s a good time for anyone seeking refuge for their money to familiarise themselves with gold’s track record.

Gold is one of the best performing assets this millennium

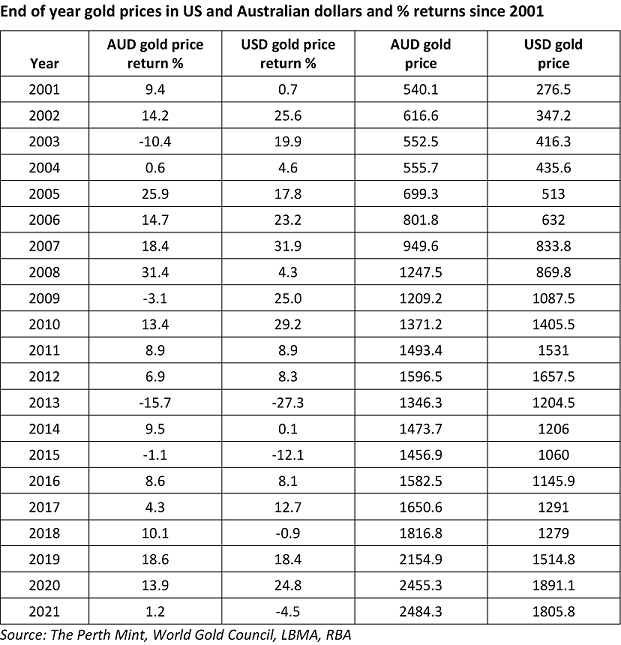

Gold has been one of the best performing asset classes of the current millennium. The table below highlights end of year gold prices in both US dollars and Australian dollars per troy ounce, and the calendar year returns seen across the last 20 years.

Despite the occasional negative calendar year return, long-term investors in gold have been well rewarded, with the price of gold rising by 553% in US dollar and 360% in Australian dollar terms over this period.

Gold’s performance relative to other asset classes

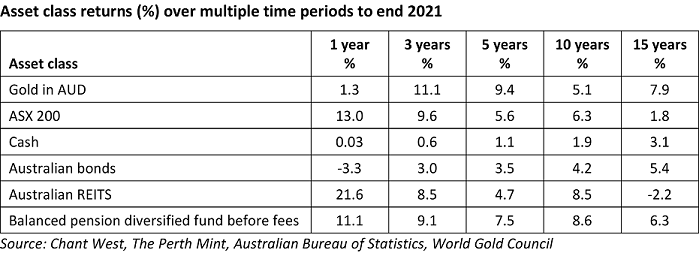

Not only has gold performed well in absolute terms over the last 20 years, but it’s also done so in relative terms, with the precious metal either matching, or in many cases exceeding, the returns generated by other asset classes.

The following table highlights the returns delivered by gold on an annualised rate of return over multiple time periods to the end of 2021, compared to the returns delivered by traditional asset classes, including Australian shares, cash and housing, over the same timeframe.

The last 15 years are a testament to the beneficial role that gold could have played in a diversified portfolio.

Gold is an effective hedge against equity market falls

One of the chief arguments for gold is its ability to act as a hedge against volatility in the stock market. A look back at the performance of gold and the local equity market in Q1 2020 demonstrates this point. The S&P/ASX200 suffered an almost 30% decline in March 2020 as fears over COVID-19 and the measures taken to limit its spread caused a huge decline in economic activity.

Over the same period, the price of gold in Australian dollars rallied more than 20%. The performance of gold during this time was not an anomaly. Instead, it was a continuation of a trend that has been in place for 50 years, with gold typically serving as an excellent hedge against falling equity markets.

Gold is an important diversifier even when equities are rising

Gold’s positive role is not limited to time periods where shares fall sharply.

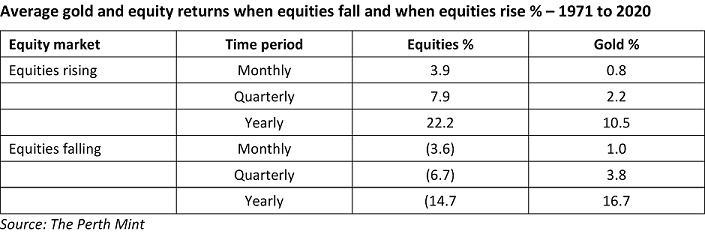

This table, which uses market data from 1971 to 2020 inclusive, reveals the average return for equities and for gold in the months, quarters and years when the equity market has risen, as well as when the equity market has fallen.

Gold is positively correlated to rising equity markets, and negatively correlated to falling equity markets. More precisely, the table tells us that:

- The average gain for equities in the months when equities rose was +3.9%. In the same months, the average return on gold was +0.8%.

- The average loss on equities in the quarters when equities fell was -6.7%. In these same quarters, the average return on gold was +3.8%.

Given all these credentials, investors can secure exposure to the gold price and government-backed physical gold on the listed market, such as Perth Mint's ASX:PMGOLD.

Sawan Tanna is the Treasurer of The Perth Mint, a sponsor of Firstlinks. The information in this article is general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.

Among offerings from The Perth Mint, the ASX-listed PMGOLD enables investors to trade in gold via a stock broking account as they would shares on the ASX. Tracking the price of gold in Australian dollars, PMGOLD holds more than 260,000 troy oz of the precious metal on behalf of investors. With a management fee of 0.15%, making it the lowest cost gold ETF on the ASX, it’s unique in that client metal is fully underpinned by government-backed physical gold that exists within the Mint.

Recently reviewed by Lonsec, one of Australia’s leading research houses, PMGOLD has been awarded its Recommended Rating.