Stock markets are almost as expensive as they have ever been on a range of different measures. The economy is almost as bad as it has ever been on a range of different measures. Take note of the analysts who are contorting themselves trying to reconcile the two and telling you to keep buying. These are probably the same analysts who cheer-led the stock market at the peak of the Dot-Com bubble or just before the GFC.

Last week I wrote that we are being given a rare second chance to sell stocks. This week I’m interested in how much further the virus bubble can run before collapsing.

Will it run for years like the tech boom, or is it more like the 2015 China stock market boom and over in a matter of months?

Defining bubbles

It is important to know what type of bubble we are dealing with as this is not typical. I’ll look at it through the lens of James Montier’s four flavours for context:

- Fad or mania. These are the 'this time it is different' bubbles. The tech-boom, the Japanese bubble, the railroad boom of the 1800s, the South Sea bubble. These are the booms where the excitement over a new paradigm turns irrational. The virus bubble is not one of these.

- Intrinsic. These are bubbles which assume earnings will grow at an unsustainable rate forever. Financial stocks during the US housing bubble, resource stocks during commodity booms are examples. The virus bubble has elements of this as the assumption for many companies that earnings will recover quickly (and in some cases at all) is unrealistic.

- Near rational or greater fool. These are the bubbles where investors don’t believe the intrinsic value but figure there will be a greater fool prepared to bid the asset price higher. The Dutch tulip bubble is the best example. The virus bubble is not one of these.

- Informational. These bubbles see investors not act based on their own information. Instead, they are working on information revealed by others. i.e. stock markets are expensive, but if everyone else is buying, then they must know something I don’t. The virus bubble has elements of this.

What will pop the bubble?

Given the virus bubble is a mix of an intrinsic and an informational bubble, it gives us clues as to what the demise will be.

Informational bubbles end when other investors start selling and everyone stampedes for the exit. So, that is no help on timing.

Intrinsic bubbles end once the irrationality of the earnings is acknowledged. My best guess is a mix of bankruptcies and continued weak earnings will eventually do it. It might take six months. It might take six minutes.

A Biden win in the US election, or even the increased threat of one, has the potential to shock the market into a dose of reality with the spectre of higher taxes and wages eating into profits.

How much bigger can this bubble get?

As long as new money is flowing, the stock market bubble can keep growing.

This bubble does have a higher hurdle. Many bubbles come with increased profits which are reinvested and help to sustain the bubble. The virus bubble is the opposite, it needs new money just to fill the hole that reduced earnings and increased debt are leaving behind. Only after that can it grow.

There are four primary sources bubbles rely on for new money:

1. New investors

Globally there has been a rush of new, generally younger investors into the market. The numbers sound impressive. Robinhood, a popular new US trading platform, has added three million accounts this year. If you take the top four US online brokers, we can find another 3 million accounts in the first quarter alone. Australia, at less than a tenth of the size of the US, in a six week period 280,000 new and reactivated accounts, while UK firms reported up to 300% more new accounts in the first three months. It is a global phenomenon.

But these numbers need context. The tech boom in 2000 was also (in part) driven by new retail accounts, peaking at around 19 million US households with at least one trading account (noting a different definition of accounts) in 2001. That fell to 17 million a few years later where it has remained since.

If we assume 9 million new US accounts this year, and 65% already had a household account, that gives 3 million new households with accounts. That would put household accounts above the Dot-Com boom peak.

Two conclusions: (a) the numbers are significant (b) we have probably seen most of the increase in accounts already.

But has the increase been due to bored workers stuck at home? If so, with sport resuming, we may see retail stock market trading drop away.

2. Increased gearing

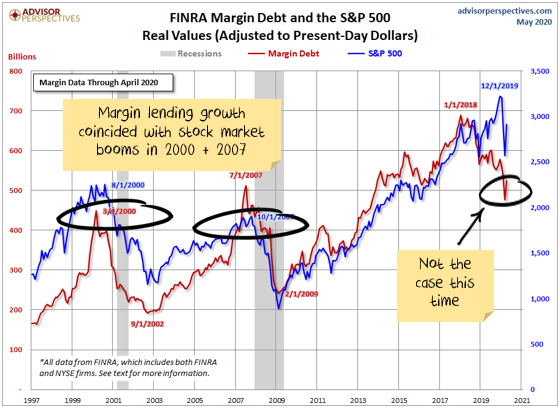

Many booms involve a significant increase in debt to fuel asset price growth. This time around, however, it seems unlikely increased gearing has played a meaningful role in the boom.

3. Derivatives

The other way to obtain leverage is through derivatives which can increase the return and risk by many multiples of the investment. While the investor themselves might not be buying the stock, the market makers who are selling the derivatives need to purchase the shares to hedge against losses.

There has been a lot of additional derivative trading, with total option volumes close to double the five-year average and retail investors heavily involved.

4. Switching asset classes

The final way to get more money into a stock market bubble is to transfer money from other asset classes. This comes in two parts:

a) Central banks

Central banks are encouraging stock investment. By buying government debt, they are hoping to force investors to shuffle up the risk spectrum. Having said that, governments are also issuing massive amounts of debt.

So, to get investors to switch into equities, central banks need to buy more debt than what governments are issuing, otherwise the opposite will happen.

US government debt has increased from about US$23 trillion at the start of the year to about US$25 trillion at the beginning of May.

Over the same timeframe, the US Federal Reserve assets rose from US$4 trillion to US$7 trillion. US government debt will probably increase by about another US$4 trillion in 2020. So, if the US Federal Reserve does not also increase its balance sheet by $4 trillion, then money will flow into government bonds from other assets. The Fed will also need to increase its balance sheet to cover new corporate debt.

Then, repeat this problem in just about every country globally. Otherwise, money won’t continue to flow into the stock market.

b) Investors

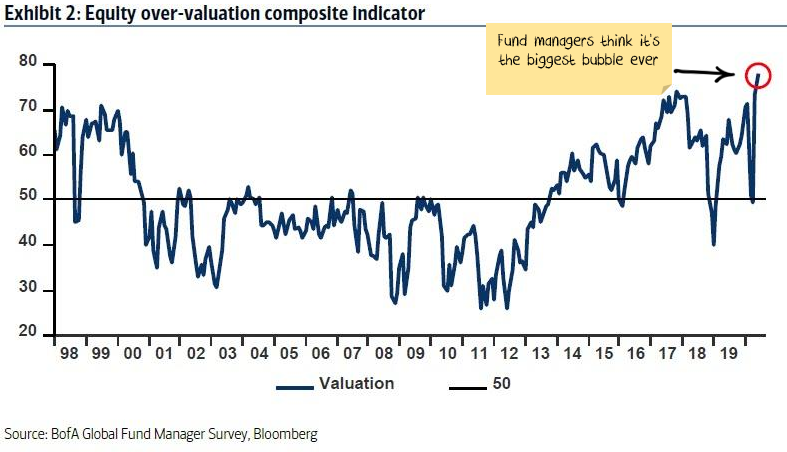

According to the latest Bank of America survey, fund managers agree that the stock market is overvalued:

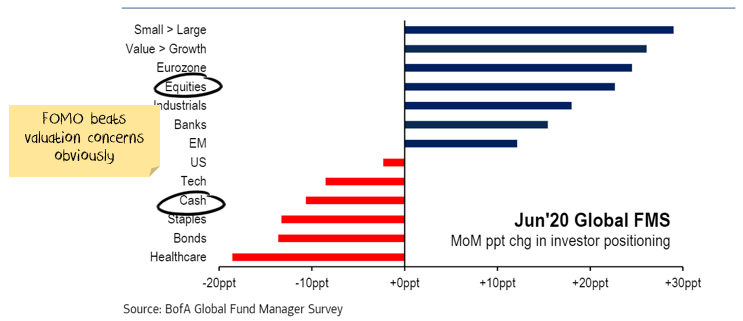

And in April (reported in May), they acted that way, with net sales of equities. But in May, Fear Of Missing Out (FOMO) took over, and they were buying stocks:

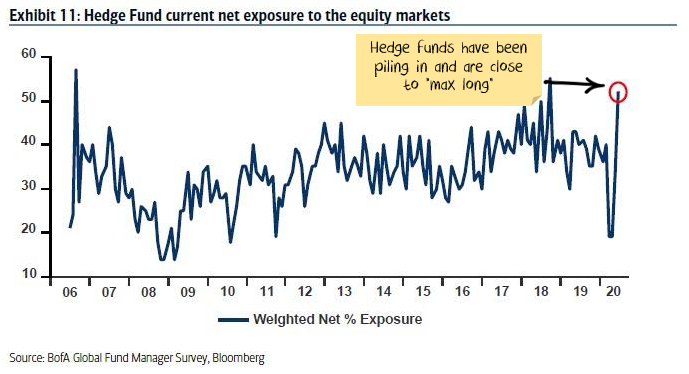

And hedge funds now have one of their highest ever weightings to the stock market, which suggests they are unlikely to buy much more.

Keep in mind that all bubbles are built on a grain of truth. That truth here is that central banks and governments ‘have your back’ and will buy anything and everything to keep the stock market high.

I think central banks will continue to bail out corporate debt markets where they can, but already we are seeing cracks with Hertz and several airlines filing for bankruptcy.

The more significant issue is small and medium businesses which (a) make up 50-70% of most economies (b) don’t have traded debt that central banks can buy.

Where does that leave us?

- There are probably not that many new retail investors to add to the stock market.

- There is scope to increase margin lending but no signs of that occurring.

- Derivative use is already very high, probably can’t grow too much more.

- Hedge funds (in aggregate) are a lot closer to their maximum equity exposure than their minimum. So not much more buying to come there.

- Fund managers (in aggregate) talk a good game about overvaluation but are actually relatively fully invested and so don’t have a lot of scope to buy more equities.

- Central banks are running hard just to keep up with government and corporate bond issuance. It is possible for central banks to do more. They are the bull’s best hope for an extended bubble.

The US tech Dot-Com boom took about two years to play out but was a different type of bubble. The China 2015 Bubble took four months before economic reality sunk in.

I expect the virus bubble will be closer in timeframe to the China bubble than to the Dot-Com bubble. But bubbles often last longer than seems reasonable.

It has been a surprisingly raucous party in share markets, but the hour is late, and the party seems to be dying down. Some partygoers are trying to find more alcohol to keep the party going. They may be successful. Regardless of their success in extending the party, given the amount of alcohol already consumed, investors will feel a lot better in the morning if you leave the party now.

Damien Klassen is Head of Investments at Nucleus Wealth. This article is general information and does not consider the circumstances of any investor.